Check out our app!

Explore more features on mobile.

The Ultimate Guide to Buying Real Estate in Foreign Countries: Investment Strategies & Critical Considerations

Diversifying your real estate portfolio internationally offers exceptional growth potential and risk mitigation that domestic investing alone cannot match. According to Knight Frank’s Global House Price Index, while U.S. property values increased by an average of 5.7% annually over the past decade, several international markets consistently delivered returns exceeding 12% during the same period. Beyond superior returns, international real estate provides currency diversification, lifestyle benefits, and access to emerging markets with accelerated growth trajectories. This comprehensive guide examines the strategic advantages, legal frameworks, financing options, and step-by-step implementation process for successfully investing in foreign real estate—whether for personal use or investment purposes.

The Strategic Advantages of International Property Investment

International real estate investment offers distinct advantages over purely domestic portfolios, providing sophisticated investors with multiple pathways to superior risk-adjusted returns.

Geographic Diversification & Risk Mitigation

Diversifying real estate holdings across multiple countries significantly reduces portfolio vulnerability to localized economic downturns, political shifts, and natural disasters. According to J.P. Morgan Asset Management’s 2024 Global Real Estate Outlook, investors with geographically diversified portfolios experienced 35% lower volatility during economic downturns compared to those concentrated in single markets.

This diversification benefit becomes particularly valuable during periods of domestic economic stress. During the 2008-2009 U.S. housing crisis, for example, investors with holdings in markets like Singapore, Germany, and Canada saw those assets appreciate by 18%, 5.4%, and 4.1% respectively, helping to offset domestic losses.

Currency Diversification

International property investment inherently creates exposure to multiple currencies, providing a natural hedge against dollar depreciation. The Bank for International Settlements reports that over the past two decades, U.S. investors with euro-denominated assets generated an additional 1.9% in annualized returns purely from currency effects during periods of dollar weakness.

For long-term investors concerned about potential dollar devaluation, hard assets denominated in stable or appreciating currencies offer significant protection. According to Goldman Sachs Global Investment Research, strategic allocation to real estate in countries with strong sovereign balance sheets and favorable demographic trends can enhance portfolio resilience against currency shocks.

Access to Accelerated Growth Markets

Developing economies often deliver real estate returns significantly higher than mature markets due to rapid urbanization, emerging middle classes, and infrastructure development. Knight Frank’s Global Cities Report documents that while prime U.S. urban property delivered average annual appreciation of 4.3% over the past decade, comparable properties in cities like Bangkok, Lisbon, and Bogotá achieved 12.8%, 9.7%, and 8.9% respectively.

These accelerated growth opportunities typically follow predictable patterns connected to economic development stages. The World Bank’s analysis shows that countries experiencing GDP per capita growth from $2,000 to $5,000 typically see real estate values in urban centers increase by 180-240% during that transition—creating opportunities for early-stage investors.

Lifestyle & Retirement Planning

Beyond pure investment returns, international property offers lifestyle benefits and retirement planning opportunities. International Living’s Annual Global Retirement Index identifies countries where retirees can maintain high quality of life at significantly lower costs—with top destinations offering healthcare, housing, and daily expenses at 30-60% of U.S. levels.

For investors planning long-term, acquiring property in future retirement destinations provides dual benefits: current income generation through rental operations and eventual personal use with substantial cost-of-living advantages. This strategy effectively creates a naturally hedged retirement fund that grows with the target country’s development.

Expert Insight: Optimizing International Allocation

According to BlackRock’s 2024 Global Real Estate Allocation Study, sophisticated portfolios typically allocate 15-30% of their real estate holdings to international markets. Their analysis suggests that the optimal international allocation follows a barbell approach: combining high-stability markets (Switzerland, Singapore, Canada) with high-growth opportunities (Vietnam, Romania, Mexico) while minimizing exposure to markets with unfavorable risk-return profiles.

This balanced approach delivered an additional 3.2% in annualized returns with only marginal increases in overall volatility when measured over five-year holding periods.

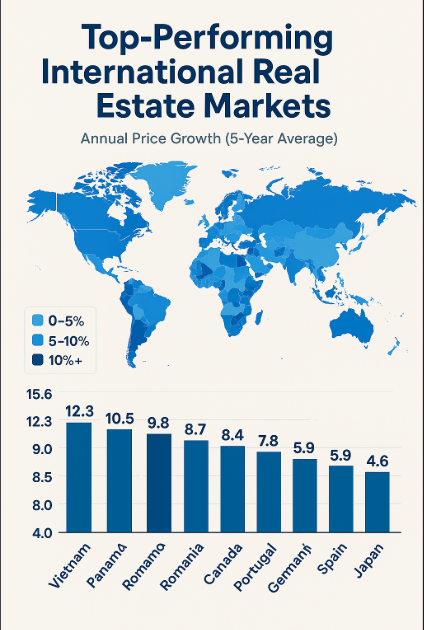

Top-Performing International Real Estate Markets

Identifying markets with the optimal combination of growth potential, stability, and accessibility requires systematic analysis of economic fundamentals, demographic trends, and regulatory environments.

Established Markets with Stability & Appreciation

For investors prioritizing capital preservation alongside steady growth, several mature markets offer exceptional stability while still delivering solid returns:

| Country | 5-Year Average Annual Price Growth | Rental Yield Range | Foreign Ownership Restrictions | Key Investment Cities |

|---|---|---|---|---|

| Portugal | 7.8% | 4.2-6.5% | None for most properties | Lisbon, Porto, Algarve |

| Japan | 4.6% | 3.8-5.9% | None | Tokyo, Osaka, Fukuoka |

| Germany | 6.2% | 2.9-4.8% | None | Berlin, Munich, Frankfurt |

| Canada | 8.4% | 4.1-5.6% | Provincial restrictions vary | Montreal, Calgary, Halifax |

| Spain | 5.9% | 4.5-7.2% | None | Valencia, Malaga, Seville |

Source: Knight Frank Global House Price Index, CBRE Global Investment Report 2024

These established markets offer strong legal protections, transparent purchasing processes, and relatively accessible financing options for foreign investors. Their appeal stems from a combination of economic stability, strong tenant protection laws, and steady population growth in major urban centers.

For more detailed analysis of European investment opportunities, see our guide on Italy Real Estate Investment.

Emerging Markets with High Growth Potential

For investors willing to accept additional complexity in exchange for accelerated growth, several emerging markets offer compelling opportunities:

| Country | 5-Year Average Annual Price Growth | Rental Yield Range | Foreign Ownership Structure | Key Growth Drivers |

|---|---|---|---|---|

| Vietnam | 15.6% | 5.8-8.7% | 50-year leasehold | Manufacturing shift, urbanization |

| Colombia | 12.3% | 7.2-9.5% | Full ownership | Growing middle class, tourism |

| Romania | 9.8% | 6.5-8.9% | Full ownership (EU restrictions) | EU integration, tech sector growth |

| Morocco | 8.7% | 5.9-9.2% | Full ownership (restrictions in some areas) | Tourism, manufacturing, infrastructure |

| Panama | 10.5% | 6.8-9.8% | Full ownership | Banking, shipping, retirement haven |

Source: Global Property Guide, IMF World Economic Outlook 2024

These markets typically require more specialized knowledge and often benefit from partnerships with local experts. However, their accelerated growth trajectories—driven by economic development, urbanization, and infrastructure investment—create opportunities for exceptional returns.

For deeper insights into emerging market opportunities, see our detailed guides on Brazil Real Estate Investment and Turkey Real Estate Investment.

Economic Citizenship & Golden Visa Programs

Several countries offer pathways to residence permits or citizenship through qualifying real estate investments, providing additional strategic benefits beyond financial returns:

- Portugal Golden Visa: €500,000 minimum investment in real estate (€350,000 for rehabilitation projects) provides residency rights with minimal stay requirements and a path to citizenship after five years

- Greece Golden Visa: €250,000 minimum investment grants five-year renewable residency rights for the investor and family members

- Turkey Citizenship by Investment: $400,000 real estate purchase with three-year holding requirement provides direct path to Turkish citizenship

- Panama Friendly Nations Visa: $200,000 real estate investment alongside other requirements grants immediate permanent residency with path to citizenship

- Malaysia My Second Home: Variable investment thresholds (by age and region) provide 10-year renewable residency with tax advantages

According to Henley & Partners’ Global Mobility Report, investment migration programs have experienced a 73% increase in applications between 2019 and 2024, with real estate-linked programs seeing particularly strong demand from investors seeking mobility rights along with investment returns.

Legal Frameworks & Ownership Structures Across Borders

Understanding the legal particularities of foreign property ownership is essential for structuring investments that protect capital while maximizing returns. Legal frameworks vary dramatically across jurisdictions, creating both challenges and strategic opportunities.

Common Foreign Ownership Structures

International real estate investors typically utilize several distinct ownership structures, each offering different advantages depending on the target country:

- Direct Personal Ownership: Simplest approach available in most countries with unrestricted foreign ownership (Europe, Latin America, parts of Asia). Offers full control but may create tax and inheritance complications

- Local Corporation: Required in countries with restrictions on foreign ownership (Thailand, Philippines, parts of Mexico). Creates compliance complexities but provides legal recognition and potentially beneficial tax treatment

- Leasehold Rights: Long-term leases (typically 30-99 years) in countries that restrict foreign land ownership (Vietnam, Indonesia). Offers lower entry costs but gradual depreciation of remaining lease term

- Trust Structures: Common in Mexico’s restricted zones and parts of Asia, using a bank as trustee to hold title for the foreign beneficiary

- International Holding Company: Owning property through an entity in a tax-advantaged jurisdiction. Adds complexity but can provide significant tax benefits and liability protection

According to Baker McKenzie’s Global Real Estate Investment Guide, the optimal structure depends on multiple factors including investment size, holding period, income objectives, and exit strategy. Their analysis suggests that investors with portfolios exceeding $1 million across multiple countries typically benefit from creating jurisdiction-specific holding structures rather than applying a single approach universally.

Restricted vs. Unrestricted Markets

Countries fall along a spectrum from completely unrestricted foreign ownership to heavily restricted or prohibited foreign investment:

| Ownership Category | Representative Countries | Key Restrictions | Required Structures |

|---|---|---|---|

| Unrestricted | Spain, Portugal, Japan, Colombia, Panama | None beyond standard regulations | Direct ownership permitted |

| Partially Restricted | Mexico, Greece, Australia, Thailand | Geographic limits, usage restrictions | Trusts, permits, or special approvals |

| Leasehold Only | Vietnam, Indonesia, Cambodia | No direct land ownership | Long-term leases only |

| Corporate Requirement | Philippines, Thailand, parts of Middle East | Ownership through local entities | Local corporations with ownership limits |

| Highly Restricted | China, India, South Korea | Limited to specific zones/projects | Complex approval processes |

Source: Global Property Guide, PwC Cross-Border Real Estate Handbook 2024

Restrictions often create market inefficiencies that sophisticated investors can leverage. According to research by the National University of Singapore, properties in markets with moderate foreign ownership restrictions typically trade at 8-12% discounts compared to similar properties in unrestricted markets, creating potential value opportunities once navigation strategies are established.

Navigating Civil Law vs. Common Law Systems

International investors must understand fundamental differences between legal systems that affect property transactions:

- Common Law Systems (U.S., UK, Canada, Australia): Precedent-based systems with comprehensive title insurance availability, extensive due diligence requirements, and typically higher transaction costs

- Civil Law Systems (Continental Europe, Latin America, parts of Asia): Code-based systems with centralized property registries, notary-driven transactions, and often streamlined closing processes

- Mixed Systems (South Africa, Philippines, Quebec): Combine elements of both traditions, requiring market-specific knowledge

According to The World Bank’s Doing Business Report, transaction costs in civil law countries average 2.5-4.5% of property value (excluding taxes), while common law jurisdictions typically range from 1.2-3.5%. However, civil law systems often provide stronger centralized registration security, potentially reducing long-term title risk.

Inheritance and Succession Planning

Foreign property ownership creates complex inheritance scenarios that require proactive planning. Key considerations include:

- Forced Heirship Laws: Many civil law countries (France, Spain, Italy) have compulsory succession rules that may override wills

- Probate Requirements: Foreign properties typically require probate proceedings in their jurisdiction, regardless of home country proceedings

- Cross-Border Tax Implications: Risk of double taxation without proper planning

- Entity-Based Solutions: Using corporate structures or trusts to avoid foreign probate entirely

EY’s International Estate Planning Guide recommends that investors with properties in multiple jurisdictions create country-specific estate plans rather than relying on a single global solution. Their analysis indicates that proactive succession planning typically costs 1-3% of asset value but saves heirs 10-25% in taxes, legal fees, and administrative costs.

Expert Insight: Legal Protection Strategies

According to Jones Lang LaSalle’s Global Transparency Index, legal risk in international real estate correlates strongly with overall market transparency. Their analysis recommends that investors in markets scoring below 4.0 on their 5-point transparency scale should implement three protective measures: (1) utilizing international arbitration clauses in contracts, (2) structuring investments through entities in jurisdictions with strong investment protection treaties, and (3) securing political risk insurance for investments exceeding $1 million in emerging markets.

International Financing Strategies & Tax Implications

Securing appropriate financing and optimizing tax structures are critical components of successful international real estate investment, often determining overall profitability regardless of property performance.

International Financing Options

Financing options for international property vary dramatically by country, with several distinct pathways available to foreign investors:

| Financing Type | Availability | Typical Terms | Advantages | Disadvantages |

|---|---|---|---|---|

| Local Bank Financing | EU, Canada, UK, Japan, Singapore | 50-70% LTV, 10-25 year terms | Natural currency hedge, lower rates | Complex qualification process |

| International Bank Financing | Global with focus on major markets | 60-75% LTV, variable rates | Simpler qualification, portfolio approach | Higher interest rates, larger minimums |

| Developer Financing | Emerging markets, new developments | 30-50% down, 3-10 year terms | Accessible in restricted markets | Higher rates, shorter amortization |

| Equity Release (Home Country) | Depends on home equity | Based on domestic equity | Familiar process, potentially tax-deductible | Currency risk, cross-collateralization |

| Seller Financing | Individual transactions, distressed markets | 30-50% down, 3-7 year terms | Flexible, negotiable, faster closing | Higher rates, balloon payments |

Source: HSBC Global Real Estate Report, Savills International Mortgage Availability Survey 2024

According to HSBC’s International Mortgage Comparison, interest rate differentials between countries can exceed 4 percentage points, creating significant arbitrage opportunities. Their analysis indicates that interest rates in Japan (0.8-1.2%), Switzerland (1.0-1.5%), and parts of the EU (1.5-2.0%) offer exceptional financing advantages compared to rates in the United States, Australia, and emerging markets.

For investors with substantial portfolios, cross-collateralization through international private banking relationships can unlock preferential rates and terms unavailable through standard channels. Credit Suisse’s 2024 Global Real Estate Financing Report indicates that investors with assets above $2 million can typically access LTV ratios 10-15% higher and rates 0.5-1.0% lower than published retail terms.

Currency Considerations

Managing currency exposure represents a critical aspect of international financing strategy. Several approaches offer varying degrees of protection against exchange rate volatility:

- Natural Hedging: Matching asset currency (property) with liability currency (financing) provides inherent protection against exchange rate movements

- Rental Income Matching: Ensuring rental income is denominated in the same currency as mortgage obligations

- Forward Contracts: Securing predetermined exchange rates for future mortgage payments or income repatriation

- Currency Diversification: Spreading investments across multiple currency zones to reduce concentration risk

- Multi-Currency Accounts: Utilizing banking platforms that allow holding and transacting in multiple currencies with minimal conversion costs

According to UBS Global Wealth Management’s Currency Impact Analysis, unhedged international property investments experienced return volatility 35-40% higher than currency-hedged equivalents over 10-year holding periods. Their data suggests that natural hedging through local currency financing provides the most cost-effective protection for long-term investors.

Tax Implications & Optimization

International real estate investors face complex tax scenarios across multiple jurisdictions, with potential obligations including:

- Acquisition Taxes: Transfer taxes, stamp duties, and registration fees varying from 1-12% of property value

- Annual Property Taxes: Ongoing taxes based on assessed values or square footage

- Rental Income Taxes: Local taxation of rental proceeds, often with withholding requirements

- Capital Gains Taxes: Exit taxation when properties are sold, varying from 0-35% depending on jurisdiction

- Wealth Taxes: Annual taxes on property value in certain jurisdictions

- Inheritance/Estate Taxes: Triggered upon owner’s death, with rates up to 40% in some countries

According to PwC’s International Property Tax Guide, effective tax burden can vary by 15-20 percentage points between comparable properties in different jurisdictions, making tax strategy a primary driver of net returns.

Tax Treaties & Double Taxation Avoidance

The United States maintains tax treaties with over 60 countries, providing critical protections for international investors. Key provisions typically include:

- Reduced Withholding Rates: Lower tax rates on cross-border income flows

- Foreign Tax Credits: Prevention of double taxation on the same income

- Non-Discrimination Clauses: Ensuring foreign investors receive equal tax treatment

- Information Exchange Limitations: Protecting confidentiality while preventing tax evasion

Deloitte’s International Tax Planning for Real Estate Investors emphasizes that treaty benefits are not automatic and typically require specific filings to claim. Their analysis indicates that approximately 38% of eligible investors fail to claim available treaty benefits, paying an average of $12,800 in unnecessary taxes per investment annually.

FIRPTA Considerations for U.S. Property Owners

Non-U.S. persons investing in U.S. real estate face specific tax obligations under the Foreign Investment in Real Property Tax Act (FIRPTA), including:

- 15% withholding on gross sale proceeds (subject to certain exemptions)

- Requirement to file U.S. tax returns reporting rental income and capital gains

- Limited access to certain tax benefits available to domestic investors

Conversely, U.S. investors in foreign real estate must navigate the Foreign Account Tax Compliance Act (FATCA) and Foreign Bank Account Report (FBAR) requirements, which mandate disclosure of foreign financial accounts exceeding $10,000. Non-compliance penalties can reach 50% of account value per year, making proper reporting essential.

Expert Insight: Tax-Efficient Structures

KPMG’s International Real Estate Tax Guide recommends that investors with properties exceeding $1 million in multiple jurisdictions consider implementing a two-tier holding structure: a base-level entity in each country of investment (addressing local compliance requirements) owned by a master holding company in a jurisdiction with extensive tax treaty networks (Luxembourg, Singapore, or Netherlands). This approach typically reduces effective tax rates by 5-8 percentage points while simplifying compliance and creating flexible exit options.

Due Diligence: Country-Specific Risk Assessment

Thorough due diligence becomes exponentially more important when investing across borders, where information asymmetries and unfamiliar risks can significantly impact outcomes.

Country Risk Assessment

Before evaluating specific properties, prudent investors first assess country-level risks across multiple dimensions:

| Risk Category | Key Indicators | Information Sources | Mitigation Strategies |

|---|---|---|---|

| Political Stability | Government stability, policy predictability, expropriation risk | World Bank Governance Indicators, Political Risk Services | Political risk insurance, treaty protection |

| Economic Stability | Inflation rates, currency volatility, GDP growth trends | IMF Economic Outlook, Central Bank data | Currency hedging, inflation-indexed leases |

| Legal System | Property rights protection, contract enforcement, judicial independence | World Justice Project, Global Property Guide | International arbitration clauses, local partnerships |

| Market Transparency | Data availability, transaction clarity, price discovery mechanisms | JLL Transparency Index, RICS standards compliance | Work with international brokerages, enhanced due diligence |

| Regulatory Environment | Foreign investment restrictions, repatriation controls, permitting processes | US State Department, PwC Doing Business guides | Structuring flexibility, phase-in approaches |

Source: Global Real Estate Transparency Index, World Bank Ease of Doing Business Index

According to Cushman & Wakefield’s Global Risk Monitor, countries typically fall into four risk tiers for real estate investment. Their analysis suggests that higher-risk markets should represent no more than 15-20% of a diversified international portfolio, with corresponding risk premiums of 200-600 basis points in expected returns compared to tier-one markets.

Property-Level Due Diligence

Property evaluation in international contexts requires additional scrutiny beyond standard domestic procedures:

- Title Verification: Investigating chain of title through local registry systems, with particular attention to encumbrances, easements, and usage restrictions

- Physical Inspection: Evaluation of construction quality, maintenance standards, and building systems by professionals familiar with local building practices

- Environmental Assessment: Identification of contamination risks, natural hazards, and compliance with local environmental regulations

- Permit Verification: Confirmation that all structures, renovations, and usages have proper governmental approvals

- Tenant/Rental Analysis: Evaluation of lease terms, tenant quality, and rental rates against market benchmarks

- Tax Assessment: Review of current tax obligations and potential reassessment risks

Knight Frank’s Global Due Diligence Survey reveals that international investors who implement comprehensive due diligence protocols experience 68% fewer post-acquisition issues and spend an average of 74% less on remediation costs compared to those utilizing abbreviated processes. Their data suggests that thorough due diligence typically costs 1-3% of transaction value but saves 7-12% in long-term ownership costs.

Professional Support Requirements

International transactions typically require specialized professional support beyond standard domestic transactions:

- International Real Estate Attorney: Expertise in cross-border transactions and local property law

- Tax Advisors: Specialists in both domestic and target country tax systems

- Local Market Experts: Professionals with deep understanding of target market dynamics

- Currency Specialists: Advisors who can optimize currency exchange and management

- International Property Managers: Experienced in managing across cultural and regulatory divides

Savills International Investor Survey indicates that first-time international investors who engage comprehensive professional teams spend an average of 4.2% of transaction value on professional services, while experienced investors typically reduce this to 2.8% through selective use of specialists for critical functions.

Natural Disaster & Climate Risk

Climate change has significantly elevated the importance of natural disaster risk assessment in international real estate investment. Key considerations include:

- Historical Disaster Patterns: Frequency and severity of floods, earthquakes, hurricanes, wildfires, and other natural events

- Climate Change Projections: Expected changes in risk profiles over the intended holding period

- Insurance Availability: Cost and coverage options for identified risks (with particular attention to exclusions)

- Building Codes: Compliance with disaster-resistant construction standards

- Elevation Considerations: Property elevation relative to flood plains and sea-level rise projections

According to Swiss Re’s Global Natural Catastrophe Report, annual insured losses from natural disasters exceeded $130 billion in 2023, with uninsured losses estimated at nearly double that amount. Their analysis indicates that properties with comprehensive climate risk assessment and appropriate mitigation strategies command 8-12% premiums in resale markets compared to comparable properties without such analysis.

Expert Insight: Creating a Due Diligence Checklist

CBRE’s Global Investment Guide recommends that international investors develop country-specific due diligence checklists that expand standard protocols with locality-specific concerns. Their research indicates that customized due diligence processes that incorporate local expertise identify an average of 3.7 significant issues per transaction that would typically be missed using standardized international protocols—with an average remediation value of 4.5% of purchase price.

Step-by-Step Process for Foreign Property Acquisition

Successfully navigating international real estate transactions requires a systematic approach that addresses the complexities of cross-border investment:

Step 1: Strategy Development (2-3 Months)

Before identifying specific properties, successful international investors develop comprehensive investment strategies:

- Goal Definition: Clarify objectives (appreciation, cash flow, personal use) and time horizon

- Budget Development: Establish total investment capacity including acquisition costs and reserves

- Risk Tolerance Assessment: Determine appropriate balance between established and emerging markets

- Return Requirements: Set clear ROI targets that justify international complexity

- Currency Strategy: Develop approach to currency exposure and management

According to Morningstar’s International Real Estate Report, investors who document specific numeric targets before entering international markets achieve average returns 3.7 percentage points higher than those taking opportunistic approaches. Their research attributes this outperformance to improved market selection and greater discipline in evaluating potential acquisitions.

Step 2: Market Selection & Research (1-2 Months)

Thorough market analysis narrows focus to specific countries and regions offering optimal risk-return profiles:

- Macroeconomic Analysis: Evaluate GDP growth, inflation trends, employment data

- Demographic Research: Assess population growth, urbanization, household formation rates

- Supply-Demand Dynamics: Analyze construction pipeline relative to absorption

- Regulatory Review: Understand foreign ownership rules, tax regimes, repatriation policies

- Risk Assessment: Evaluate political stability, legal protections, market transparency

JLL’s Decision-Making Framework for Global Real Estate recommends creating a weighted scoring system for potential markets based on 12-15 key performance indicators aligned with investment objectives. Their analysis shows that structured comparative approaches identify optimal markets 73% more effectively than sequential evaluation methods.

For deeper insights into specific markets, consult our comprehensive guides on Argentina, Portugal, and Croatia.

Step 3: Team Assembly (2-4 Weeks)

Building the right professional team significantly improves outcomes in unfamiliar markets:

- Local Real Estate Agent: Professional with experience serving international clients

- International Real Estate Attorney: Legal expertise in both home country and target market

- Tax Advisors: Specialists in cross-border taxation and structuring

- Currency Specialist: Expertise in efficient funds transfer and exchange

- Property Inspector: Professional familiar with local construction standards

Colliers International’s Foreign Investor Success Factors study indicates that high-performing international investments typically involve 4-6 specialized professionals, with legal and tax expertise being the most critical to successful outcomes. Their data shows that comprehensive professional support costs 3-5% of transaction value but prevents complications that typically reduce returns by 8-14% when inadequate support is utilized.

Step 4: Entity Structure Setup (3-6 Weeks)

Before acquiring property, establishing appropriate ownership structures protects assets and optimizes tax treatment:

- Entity Type Selection: Determine optimal structure (direct ownership, corporation, trust)

- Jurisdiction Selection: Identify optimal entity formation location

- Formation Process: Complete required documentation and registrations

- Banking Establishment: Create accounts for transactions and ongoing operations

- Tax Registrations: Complete necessary filings in relevant jurisdictions

EY’s Global Real Estate Investment Structures Guide emphasizes that entity decisions should balance tax optimization with operational practicality. Their analysis indicates that optimal structures typically reduce effective tax rates by 6-9 percentage points compared to direct ownership while also enhancing liability protection and succession planning.

Step 5: Financing Arrangement (4-8 Weeks)

Securing optimal financing often requires exploring multiple options across jurisdictions:

- Domestic Equity Release: Leveraging home country assets if advantageous

- International Banking Relationships: Establishing relationships with lenders in target markets

- Loan Pre-Approval: Securing financing commitments before property selection

- Currency Strategy Implementation: Establishing exchange rate protection mechanisms

- Reserve Funding: Creating liquidity for closing costs and contingencies

HSBC’s Private Banking Global Real Estate Report notes that investors who secure financing pre-approvals before property selection typically access LTV ratios 10-15% higher and interest rates 0.3-0.7% lower than those arranging financing after identifying specific properties. Their data also shows that early financing arrangements reduce closing timeframes by an average of 21 days.

Step 6: Property Selection & Due Diligence (1-3 Months)

Identifying and evaluating potential acquisitions requires methodical analysis:

- Property Identification: Review available inventory against investment criteria

- Initial Screening: Eliminate properties with obvious disqualifiers

- Financial Analysis: Conduct detailed cash flow projections and return calculations

- Physical Inspection: Assess property condition through professional evaluation

- Legal Review: Verify title, permits, zoning, and compliance

- Market Position Analysis: Evaluate property against market comparables and trends

Knight Frank’s International Buyer Survey indicates that successful investors typically evaluate 15-20 properties before making acquisition decisions, spending an average of 3.5 times longer on due diligence for international purchases compared to domestic acquisitions. Their data shows that comprehensive pre-purchase analysis identifies an average of 3.4 significant issues per property that impact valuation or suitability.

Step 7: Negotiation & Offer (2-4 Weeks)

Effective negotiation in international contexts requires understanding local customs and market dynamics:

- Cultural Considerations: Adapt negotiation approach to local norms and expectations

- Pricing Strategy: Develop fact-based rationale for offer price supported by comparable sales

- Contingency Planning: Include appropriate protection clauses for foreign investor concerns

- Deposit Structures: Understand local expectations and protection mechanisms

- Timeline Management: Establish realistic deadlines accounting for international complexity

Savills International Transactions Report indicates that successful international buyers typically negotiate purchase prices 4-7% below asking prices, with more significant discounts available when addressing property-specific concerns identified during due diligence. Their analysis shows that including factual justifications for price adjustments improves negotiation outcomes by 35% compared to simple discount requests.

Step 8: Closing Process (3-8 Weeks)

Closing procedures vary dramatically across jurisdictions, requiring careful preparation:

- Document Preparation: Compile necessary documentation for closing, including authentication

- Funds Transfer: Arrange secure and cost-effective movement of purchase funds

- Tax Payments: Fulfill acquisition tax obligations (stamp duty, transfer tax, VAT)

- Insurance Placement: Secure appropriate property insurance coverage

- Registration Process: Complete title registration according to local requirements

- Utility Transfers: Establish accounts for essential services

According to CBRE’s Global Closing Procedures Guide, closing timeframes range from as short as 7-10 days in Estonia and Sweden to 3-4 months in parts of South America and Southeast Asia. Their research emphasizes the importance of building realistic timelines that account for potential bureaucratic delays, particularly for properties requiring regulatory approvals.

Expert Insight: Success Factors

According to Deloitte’s International Real Estate Success Factors study, the most significant predictors of successful foreign property acquisition are: (1) selecting markets with specific economic catalysts (infrastructure development, regulatory improvements, demographic shifts); (2) building relationships with local market leaders rather than relying exclusively on intermediaries; (3) conducting systematic due diligence that incorporates both local and international standards; and (4) creating flexible operational plans that can adapt to evolving market conditions rather than rigid implementation models.

Property Management Across Borders

Effective management of international properties presents unique challenges that significantly impact investment performance. Developing appropriate management strategies before acquisition ensures operational success and protects long-term returns.

Management Structure Options

International property investors typically choose among several management approaches:

| Management Approach | Best For | Advantages | Disadvantages | Typical Cost Structure |

|---|---|---|---|---|

| Local Professional Management | Most international investors | Local expertise, market knowledge, on-site presence | Oversight challenges, potential agency issues | 6-12% of gross rent + fees |

| International Management Firm | Larger properties, portfolios | Standardized reporting, multi-country expertise | Higher costs, potential cultural disconnects | 8-15% of gross rent + fees |

| Hybrid Approach | Medium-size investments | Local execution with international oversight | Coordination complexity, potential conflicts | 7-13% of gross rent + fees |

| Tech-Enabled Self-Management | Smaller properties, tech-savvy owners | Cost efficiency, direct control | Time-intensive, requires technology comfort | 1-3% platform fees + service costs |

| Rental Pool/Hotel Management | Vacation properties, condotels | Turnkey operation, booking infrastructure | High fees, limited control | 25-50% of gross revenue |

Source: IREM Global Management Survey, Colliers International Management Cost Analysis

According to the Institute of Real Estate Management’s Global Property Management Study, professionally managed international properties outperform self-managed equivalents by an average of 8.7% in net operating income, despite management fees. This performance differential stems primarily from superior tenant selection, more effective rent collection, and more efficient maintenance operations.

Management Agreement Essentials

International property management agreements should include several provisions beyond standard domestic contracts:

- Reporting Requirements: Detailed specifications for financial reporting frequency, format, and content

- Currency Management: Protocols for handling multiple currencies, exchange rates, and banking relationships

- Compliance Responsibility: Clear assignment of regulatory compliance obligations

- Communication Protocols: Specified methods and timeframes for routine and emergency communications

- Performance Metrics: Quantifiable standards for evaluating management performance

- Local Tax Handling: Procedures for managing withholding requirements and tax filings

- Termination Provisions: Clearly defined exit mechanisms with reasonable notice periods

Cushman & Wakefield’s Best Practices for International Property Management emphasizes the importance of establishing detailed Key Performance Indicators (KPIs) within management agreements. Their research indicates that agreements with 5-7 quantifiable performance metrics experience 32% fewer disputes and 47% higher tenant retention rates compared to contracts with generalized performance standards.

Technology Solutions for Remote Management

Technology platforms have transformed the feasibility of managing properties across borders:

- Property Management Software: Cloud-based systems providing real-time financial and operational reporting

- Video Monitoring: Remote visual inspection capabilities for property condition verification

- Digital Payment Systems: Cross-border rent collection and expense payment platforms

- Communication Tools: Translation-enabled messaging systems for tenant interactions

- Document Management: Secure storage and transmission of critical property documents

- Maintenance Management: Platforms coordinating service providers and tracking resolution

According to PropTech Venture Capital’s International Property Management Report, investors who implement comprehensive technology solutions for remote management typically reduce operational expenses by 12-18% while improving tenant satisfaction scores by 15-22% compared to traditional management approaches. Their analysis indicates that initial technology implementation costs are typically recovered within 14-18 months through improved operational efficiency.

Tenant Relations Across Cultures

Successfully managing tenant relationships across cultural boundaries requires sensitivity to varying expectations and communication norms:

- Lease Structure Expectations: Understanding market-specific norms for lease terms, renewal processes, and deposit handling

- Communication Preferences: Adapting to cultural expectations regarding formality, frequency, and medium

- Maintenance Responsibility: Clarifying the division between landlord and tenant obligations, which varies significantly across markets

- Payment Practices: Accommodating local payment methods and timing conventions

- Privacy Expectations: Respecting cultural norms regarding property access and inspections

FIABCI (International Real Estate Federation) research indicates that tenant retention rates are 35-40% higher when property management practices align with local cultural expectations. Their data shows that cross-cultural misunderstandings regarding maintenance responsibilities represent the most common source of conflict, accounting for 42% of serious landlord-tenant disputes in international contexts.

Expert Insight: Management Selection Criteria

According to JLL’s Global Property Management Excellence study, the most effective property managers for international investors demonstrate four key characteristics: (1) experience specifically with foreign-owned properties; (2) robust reporting systems with multi-currency capabilities; (3) established relationships with reliable local service providers; and (4) transparent fee structures that clearly separate management fees from maintenance coordination fees. Their research indicates that managers meeting all four criteria typically deliver NOI 17% higher than those meeting only one or two criteria.

Exit Strategies for International Real Estate

Planning exit strategies before acquisition ensures maximum flexibility and optimal returns when divesting international properties. Different market conditions and property types require tailored approaches to monetization.

Exit Timing Considerations

Strategic timing of international property dispositions involves balancing multiple factors:

- Market Cycle Positioning: Identifying optimal selling windows within local market cycles

- Currency Exchange Trends: Timing dispositions to leverage favorable currency movements

- Tax Optimization: Coordinating sales to minimize capital gains exposure

- Regulatory Changes: Anticipating policy shifts that could impact foreign seller position

- Repatriation Considerations: Ensuring mechanisms for efficient capital return

- Opportunity Cost Analysis: Comparing continued holding against alternative investments

Knight Frank’s Global Liquidity Analysis indicates that optimal holding periods for international real estate investments typically range from 7-12 years, with properties sold within this window achieving 22-38% higher risk-adjusted returns compared to those sold earlier or held longer. Their data suggests that market timing contributes approximately 35% to total return outcomes, with the remaining 65% determined by property selection and management quality.

Exit Strategy Options

International property investors should consider multiple disposition approaches based on market conditions and investment objectives:

| Exit Strategy | Best For | Advantages | Disadvantages | Typical Timeline |

|---|---|---|---|---|

| Direct Sale (Traditional) | Most property types in liquid markets | Maximum control, potentially highest price | Extended marketing period, uncertain timing | 3-9 months |

| Entity Sale | Properties held in special purpose vehicles | Potential tax advantages, simplified transfer | Buyer assumption of entity liabilities | 2-5 months |

| Developer/Investor Partnerships | Properties with repositioning potential | Participation in upside, faster initial liquidity | Continuing involvement, partial control loss | 1-3 months for initial capital |

| Sale-Leaseback | Income-producing properties with stable tenants | Immediate liquidity while maintaining occupancy | Reduced flexibility, ongoing lease obligations | 3-6 months |

| Auction | Distressed assets or rapid exit requirements | Defined timeline, competitive bidding potential | Price uncertainty, stigma risk | 1-2 months |

Source: CBRE Global Capital Markets, Savills International Dispositions Guide

According to Cushman & Wakefield’s International Property Disposition Survey, entity sales have become increasingly prevalent for international investors, accounting for 35% of cross-border transactions exceeding $5 million in 2023. Their analysis indicates that entity sales typically reduce transaction costs by 40-60% compared to direct property transfers while potentially creating significant tax advantages depending on the jurisdictions involved.

Repatriation Strategies

Returning capital to the investor’s home country requires careful planning to navigate currency controls, tax implications, and transfer costs:

- Currency Timing: Coordinating transfers to leverage favorable exchange rate movements

- Staged Repatriation: Transferring proceeds incrementally to minimize currency volatility impact

- Forward Contracts: Locking in exchange rates at the time of property sale

- Strategic Reinvestment: Directing proceeds to other international investments before eventual repatriation

- Banking Relationship Leverage: Utilizing international banking relationships to optimize transfer costs

HSBC’s Global Investor Survey reveals that inefficient repatriation strategies typically cost international investors 2.5-4.8% of total proceeds through suboptimal exchange rates, unnecessary bank fees, and tax inefficiencies. Their research indicates that comprehensive repatriation planning can preserve an additional 1.8-3.2% of investment returns compared to ad-hoc approaches.

Tax Implications Upon Exit

International property dispositions typically trigger tax obligations in multiple jurisdictions, requiring careful coordination:

- Source Country Taxation: Capital gains taxes in the property’s location (often subject to withholding)

- Home Country Taxation: Additional taxation upon repatriation based on tax residency

- Entity-Level Consequences: Potential corporate taxes for properties held in corporate structures

- VAT/Transfer Tax Implications: Transaction taxes that may apply to sales in certain jurisdictions

- Tax Treaty Benefits: Potential reduced rates or exemptions based on applicable tax treaties

According to PwC’s International Property Disposition Tax Guide, the effective tax rate on international property dispositions ranges from 0% in tax-favorable jurisdictions to over 40% in high-tax regions. Their analysis emphasizes that pre-acquisition structuring typically provides greater tax optimization potential than disposition-stage planning, underscoring the importance of exit tax considerations during the initial investment phase.

Expert Insight: Pre-Sale Preparation

According to JLL’s Capital Markets Advisory, international properties achieve 12-18% higher sales prices when sellers implement a comprehensive pre-sale preparation process beginning 12-18 months before intended disposition. Their recommended approach includes five key elements: (1) resolving any title or permit irregularities; (2) creating professional marketing materials with certified translations; (3) preparing detailed financial records in formats familiar to local and international buyers; (4) completing strategic cosmetic improvements; and (5) securing pre-approved financing options that potential buyers can assume.

Case Studies: Successful International Property Investments

Examining real-world examples provides valuable insights into practical implementation of international real estate strategies across diverse markets and investor profiles.

Case Study 1: Residential Portfolio Development in Portugal

The Anderson family implemented a structured approach to building a retirement-focused property portfolio in Portugal’s Algarve region:

- Investment Strategy: Acquired three residential properties between 2018-2021 totaling €1.2 million, qualifying for Portugal’s Golden Visa program

- Ownership Structure: Created a Portuguese LDA (private limited company) owned by a U.S. family trust

- Financing Approach: Utilized 30% leverage through Portuguese bank at 1.9% fixed rate, maintaining currency matching

- Management Solution: Contracted with international property management firm for year-round oversight

- Monetization Model: Implemented seasonal rental strategy targeting Northern European tourists

Over a five-year period, the portfolio delivered 8.9% annual cash flow returns while appreciating 36% in value. The Andersons received Portuguese residency permits and established a clear path to EU citizenship while creating a diversified income stream in euros, effectively hedging against dollar depreciation risk.

Key success factors included:

- Thorough pre-acquisition research with multiple scouting trips

- Relationship development with local law firm specializing in foreign investors

- Strategic property selections outside tourist centers but within 15 minutes of major amenities

- Professional photography and marketing to premium rental segments

- Comprehensive tax planning across both Portuguese and U.S. systems

Case Study 2: Commercial Value-Add in Colombia

Meridian Investment Group identified opportunity in Medellín’s emerging El Poblado district through detailed market analysis:

- Investment Strategy: Acquired underperforming mixed-use building for $2.4 million in 2019, representing 40% below replacement cost

- Ownership Structure: Utilized Colombian SAS (simplified stock company) owned by Panama holding company

- Financing Approach: Self-financed acquisition with $950,000 local refinancing after stabilization

- Value Creation: Invested $780,000 in renovations to reposition retail space and upgrade office components

- Management Solution: Partnered with local operator with profit-sharing incentives

Within 30 months, the property achieved 94% occupancy with rental rates 65% higher than pre-renovation levels. The repositioned asset was sold to a Colombian institutional investor in 2023 for $5.3 million, delivering an IRR of 42% and equity multiple of 2.6x over a four-year holding period.

Key success factors included:

- Identifying a transitioning neighborhood before major international attention

- Engaging local architectural talent familiar with evolving tenant preferences

- Creating legal structure that optimized both operational and tax efficiency

- Implementing international-standard lease structures attractive to premium tenants

- Developing relationships with local institutional investors for eventual exit

Case Study 3: Residential Development in Croatia

European Coastal Ventures identified opportunity in Croatia’s emerging luxury tourism market:

- Investment Strategy: Acquired oceanfront land with preliminary approvals for €1.7 million in 2020

- Development Approach: Constructed eight luxury villas for €4.2 million, completing in 2022

- Ownership Structure: Croatian limited liability company owned by Cypriot holding structure

- Financing Solution: Combined investor equity with Croatian bank construction loan at 60% LTC

- Exit Strategy: Pre-sold six units during construction, retained two for long-term investment

The project sold six villas at an average price of €1.2 million each, while the retained units generate annual rental yields of 7.8% with expected long-term appreciation of 5-7% annually. The overall project delivered a 36% IRR and 2.2x equity multiple over the three-year development cycle.

Key success factors included:

- Identifying emerging luxury destination before major price appreciation

- Partnering with established local developer with permitting expertise

- Investing in architectural distinction that commanded premium pricing

- Targeting marketing toward German and Austrian buyers with established interest in the region

- Creating phased construction approach that allowed early sales to help fund later phases

Common Success Factors Across Markets

Analysis of successful international real estate investments reveals several recurring elements that transcend specific markets and strategies:

- Local Expertise Integration: All successful cases involved meaningful collaboration with market-specific experts rather than attempting to apply purely foreign approaches

- Strategic Market Timing: Investments entered markets during early growth phases rather than at peak maturity

- Appropriate Structure Selection: Ownership and operational structures aligned with specific regulatory environments

- Value-Add Orientation: Strategies incorporated specific improvements to enhance property performance rather than relying solely on market appreciation

- Comprehensive Risk Management: Successful investors implemented systematic approaches to identifying and mitigating market-specific risks

According to Knight Frank’s Global Investment Success Metrics, international investments that incorporate all five elements deliver average returns 3.2 percentage points higher than those implementing only two or three factors, demonstrating the cumulative impact of comprehensive strategy implementation.

Expert Insight: Lessons from Underperforming Investments

CBRE’s International Investment Post-Mortem Study analyzed 125 underperforming cross-border investments to identify common failure patterns. Their research revealed five primary factors contributing to suboptimal outcomes: (1) inadequate understanding of local market cycles leading to entry at peak valuations; (2) insufficient attention to currency hedging strategies; (3) over-reliance on appreciation rather than cash flow; (4) underestimation of management complexity across borders; and (5) inadequate exit planning prior to acquisition. Addressing these specific vulnerabilities during pre-acquisition planning significantly improves the probability of investment success.

Conclusion: Building Your International Real Estate Strategy

International real estate investment offers unparalleled opportunities for portfolio diversification, enhanced returns, and strategic wealth protection that domestic investing alone cannot provide. By selecting appropriate markets, implementing optimal ownership structures, and executing disciplined management strategies, investors can achieve exceptional outcomes while effectively managing cross-border complexities.

The path to successful international property investment requires a systematic approach that begins with clear strategic objectives and proceeds through careful market selection, thorough due diligence, and comprehensive operational planning. While each market presents unique challenges and opportunities, the fundamental principles of value identification, risk management, and professional collaboration remain consistent across borders.

As you develop your own international real estate strategy, remember that success derives not from simply replicating domestic approaches in foreign markets, but from adapting proven investment principles to the specific characteristics of each target location. By combining the global perspective of an international investor with the local insights of market-specific experts, you can build a truly diversified property portfolio that delivers superior risk-adjusted returns while providing protection against domestic economic uncertainties.

The statistical evidence is clear: international real estate deserves consideration within any comprehensive investment strategy. With the right approach, foreign property investment can transform portfolio performance while potentially creating lifestyle opportunities and global mobility options unavailable through purely domestic investment vehicles.

For more comprehensive guidance on international real estate strategy, explore our detailed guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

To learn more about specific international markets, read our in-depth country guides: Portugal, Italy, Greece, Turkey, Mexico, and Global Markets Overview.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.