Check out our app!

Explore more features on mobile.

Rural America’s Population Decline: How It’s Reshaping Real Estate Investment

The latest U.S. Census Bureau data reveals a significant demographic shift: rural America is experiencing an unprecedented population decline as residents flee to metropolitan areas seeking better opportunities. This migration is reshaping local real estate markets, creating both challenges for rural property owners and opportunities for strategic investors. In this comprehensive guide, we analyze the latest data, explore market trends, and provide actionable investment strategies using our unique Builds and Buys approach.

[Image: Rural America’s Shrinking Population Impact on Real Estate]

1. The Rural Exodus: Latest Census Data Analysis

The most recent U.S. Census Bureau statistics paint a stark picture of rural America’s population challenges. Out of the top 10 counties experiencing population decline nationally, five are located in Mississippi, with similar patterns emerging across Georgia, Alabama, and Oregon.

Yazoo County, Mississippi, has seen its population drop by 6.4% between July 2023 and 2024 alone. Even more dramatically, neighboring Sunflower County—once a thriving center of the Delta’s cotton industry—has lost 10.8% of its residents since 2020. This accelerating trend represents a significant shift in America’s demographic landscape with profound implications for real estate markets.

While domestic outmigration is the primary factor, immigration has helped slow the decline in some regions. Without immigration, 452 U.S. counties would have lost population in the past year, and in 822 counties, immigration has softened the overall rate of decline.

2. Market Trends: Impact on Rural Property Values

The mass exodus from rural counties has created a clear pattern in local real estate markets: decreasing demand leading to falling property values, extended listing times, and reduced investment returns. Let’s examine the market metrics:

| County | Population Change | Median List Price | Days on Market |

|---|---|---|---|

| Yazoo County, MS | -6.4% (2023-2024) | $171,156 | 124 |

| Sunflower County, MS | -10.8% (2020-2024) | $165,000 | 93 |

| Mitchell County, GA | -2.2% (2023-2024) | $248,425 | 102 |

| Dawson County, GA (Growth) | +3.8% (2023-2024) | $605,794 | 65 |

| Kaufman County, TX (Growth) | +4.2% (2023-2024) | $352,500 | 58 |

The contrast is stark: while rural counties with declining populations show lower median list prices and significantly longer market times (often 90+ days), growing counties like Dawson and Kaufman demonstrate stronger property values and quicker sales.

Local real estate professionals report that many properties in declining areas aren’t even being sold but rather inherited and converted to rentals, as owners who have moved away maintain ties to their ancestral properties without intending to return.

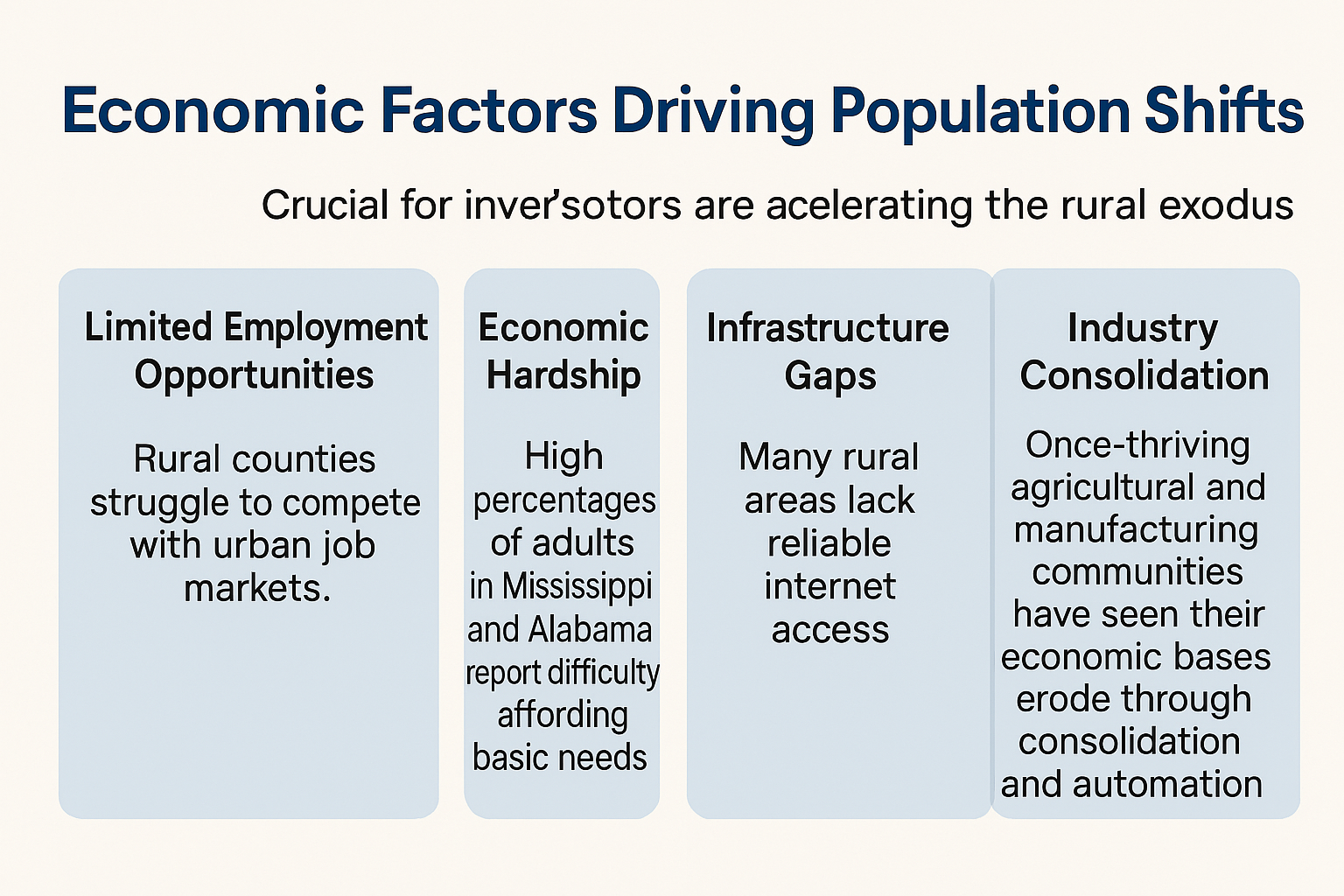

3. Economic Factors Driving Population Shifts

Understanding the economic forces behind this demographic shift is crucial for investors. Multiple interconnected factors are accelerating the rural exodus:

- Limited Employment Opportunities: Rural counties struggle to compete with urban job markets. In areas like Yazoo and Sunflower Counties, unemployment rates reached 5.6% by late 2024, significantly higher than the national average.

- Economic Hardship: According to the Census Bureau’s Household Pulse Survey, Mississippi (49.5%) and Alabama (45.5%) have the highest percentages of adults reporting difficulty affording basic needs. This economic pressure drives migration to areas with better opportunities.

- Infrastructure Gaps: The USDA identifies reliable internet access as a key driver for remote work and new business creation. Many rural areas still lack the digital infrastructure needed for modern economic participation.

- Industry Consolidation: Once-thriving agricultural and manufacturing communities have seen their economic bases erode through consolidation and automation, eliminating jobs that once supported middle-class households.

[Image: Economic Factors Driving Rural Population Decline]

4. Rural vs. Urban Markets: Comparative Analysis

The dichotomy between shrinking rural markets and growing urban/suburban areas creates distinct investment landscapes. Our analysis reveals several critical contrasts:

| Metric | Declining Rural Markets | Growing Urban/Suburban Markets |

|---|---|---|

| Initial Investment Cost | Lower (Often 30-50% below national median) | Higher (Often 20-40% above national median) |

| Annual Appreciation | Low or Negative (-2% to +1%) | Moderate to High (+4% to +8%) |

| Rental Yield Potential | Moderate to High (7-12%) | Low to Moderate (3-6%) |

| Vacancy Risk | High (15-25%) | Low (3-8%) |

| Liquidity | Low (90+ days on market) | High (30-60 days on market) |

| Exit Strategy Complexity | High | Low |

While rural properties offer lower entry costs and potentially higher rental yields, they come with significant risks, including limited appreciation, higher vacancy rates, and reduced liquidity. Urban and growing suburban markets present the inverse: higher entry costs but stronger appreciation potential and easier exit strategies.

The data reveals a key insight: investors can find value in both markets, but their strategies must align with fundamentally different risk-reward profiles.

5. Investment Strategies: Finding Opportunity Amid Decline

Despite the challenges, strategic investors can find opportunities in both declining rural markets and growing urban centers. Here are market-specific approaches:

Rural Market Investment Strategies

- Cash Flow Focus: Rural properties often offer higher cap rates (7-12%) compared to urban markets. With lower acquisition costs, investors can achieve positive cash flow even with higher vacancy rates.

- Value-Add Renovations: In markets with low property values but stable rental demand, strategic renovations can significantly boost rental income. Focus on essential improvements rather than luxury upgrades.

- Agricultural Land Banking: Land in declining counties can be acquired at discounted prices for agricultural leasing or long-term appreciation as urban areas eventually expand.

- Remote Worker Housing: Counties with declining populations but improving broadband infrastructure may attract remote workers seeking affordable living with digital connectivity.

Growth Market Investment Strategies

- Suburban Corridor Focus: Identify growth corridors between major employment centers, such as between Jackson, MS, and Memphis, TN, where infrastructure investments are creating new opportunities.

- Technology Hub Proximity: Properties near new technology centers (like Madison County, MS with its growing Amazon Web Services campus) offer strong appreciation potential.

- Migration Pattern Analysis: Track where rural residents are relocating and invest in those emerging neighborhoods before prices fully reflect the population influx.

[Image: Rural vs. Urban Investment Strategy Matrix]

6. Step-by-Step Guidance: Builds, Buys & Invest Approach

At Builds and Buys, we offer a structured framework for navigating these complex demographic shifts:

Step-by-Step Builds: Rural Property Optimization

- Infrastructure Assessment: Prioritize properties with access to reliable broadband, clean water, and stable electrical service.

- Efficiency Renovations: Focus on energy-efficient upgrades that reduce operating costs in areas with thin rental margins.

- Multi-Use Conversions: Convert single-use properties to multi-use spaces that can serve shifting market needs.

- Remote Work Amenities: Incorporate dedicated office spaces and high-speed internet connectivity to attract digital nomads and remote workers.

Step-by-Step Buys: Strategic Acquisition

- Demographic Trend Analysis: Use census data to identify counties where population decline is slowing or reversing.

- Economic Driver Mapping: Research areas receiving infrastructure investments or attracting new businesses.

- Revitalization Zone Targeting: Look for properties in designated opportunity zones or revitalization districts.

- Migration Pattern Tracking: Follow where rural residents are relocating to identify emerging hot spots.

Step-by-Step Invest: Financial Optimization

- Cash Flow Modeling: Develop realistic pro formas that account for higher vacancy rates in declining markets.

- Risk-Adjusted Return Calculation: Compare investments across markets using risk-adjusted metrics.

- Portfolio Diversification: Balance high-risk rural investments with more stable urban properties.

- Exit Strategy Planning: Develop multiple exit options for rural investments where liquidity may be limited.

Expert Insight: Case Study

“We’ve seen success with investors who purchased properties in Sunflower County at $65,000, invested $30,000 in renovations focused on energy efficiency and remote work amenities, and now command rents that yield a 9.7% cap rate. The key was targeting the property to remote workers from high-cost areas who can work from anywhere.”

— Reginald Wells, The Agency Haus LLC

7. Future Outlook: Revitalization Efforts & Growth Potential

While current trends show continuing rural population decline, several factors could help stabilize or even reverse this pattern in select areas:

- Broadband Expansion: The USDA identifies reliable internet as a key driver for remote work and new business creation in rural areas. Federal infrastructure investments are bringing high-speed connectivity to previously underserved regions.

- Regional Collaboration: As Professor John J Green from the Southern Rural Development Center notes, “Places seeking to stabilize population loss through local development efforts are directing attention to issues that have a more direct impact… For rural communities, this necessitates multicommunity and regional collaboration.”

- Remote Work Revolution: The post-pandemic normalization of remote work enables residents to enjoy rural living while maintaining urban-level incomes.

- Green Energy Development: Rural areas are seeing increased investment in renewable energy projects, creating new job opportunities and economic activity.

- Immigration Benefits: Data shows that immigration has helped slow population decline in 822 counties. Areas welcoming new immigrants may find population stabilization more achievable.

For real estate investors, the key is identifying which rural areas have the foundation for potential revitalization—those with strategic infrastructure investments, regional cooperation initiatives, and diversifying economic opportunities.

Explore our in-depth resources to master demographic-driven investment strategies. Learn how to identify opportunities in both declining rural markets and growing urban centers.

Rural America’s population decline presents unique challenges and opportunities for real estate investors. By understanding the demographic trends, economic factors, and market dynamics, investors can develop strategies that align with each market’s distinctive risk-reward profile. Whether focusing on cash flow in rural areas or appreciation in growing urban centers, our Step-by-Step Builds, Buys, and Invest approach provides the framework for making data-driven investment decisions.

For more actionable advice on navigating demographic shifts in real estate, check out our comprehensive guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.