Check out our app!

Explore more features on mobile.

Real Estate Adjacent Investments: Smart Alternatives to Traditional Property

Looking beyond traditional property ownership can unlock significant investment opportunities in today’s evolving real estate landscape. Real estate adjacent investments offer alternative exposure to property markets without the capital intensity and management complexity of direct ownership. According to the National Association of Realtors, these alternative investment vehicles grew by an impressive 34% between 2020 and 2024. This comprehensive guide explores the most promising opportunities in this fast-growing sector using our proprietary Builds, Buys, and Invest methodology—providing data-driven insights to help you diversify your real estate portfolio with confidence.

Understanding Real Estate Adjacent Investments: The New Market Reality

The real estate investment landscape has evolved significantly in recent years, with savvy investors increasingly looking beyond traditional property ownership to capture real estate returns. Several critical factors now influence this shift toward adjacent opportunities.

Lower Capital Requirements

According to data from Morningstar Analytics, traditional real estate investment typically requires a minimum initial capital of $50,000-$100,000 when accounting for down payments, closing costs, and renovation reserves. In contrast, many real estate adjacent investments offer entry points as low as $500-$5,000, opening property-related returns to a much broader investor base.

This democratization of real estate investing has contributed to significant growth across these alternative sectors. Morgan Stanley research indicates that investors who allocated 15-25% of their real estate portfolio to adjacent opportunities achieved 2.3% higher risk-adjusted returns over the past decade compared to traditional-only property portfolios.

Enhanced Liquidity

The National Association of Realtors reports that the average time to sell a residential property in 2024 was 65 days, with significant regional variations. Commercial properties typically require even longer liquidation periods, often 6-18 months according to CBRE market research.

By comparison, many real estate adjacent investments offer substantially improved liquidity:

- Publicly traded REITs and real estate technology stocks can be sold within minutes during market hours

- Some real estate crowdfunding platforms offer quarterly redemption windows

- Building materials and home service company stocks typically maintain strong secondary market liquidity

This liquidity advantage provides important portfolio flexibility, allowing investors to rebalance, capture opportunities, or raise cash without the lengthy and often costly process of selling physical property.

Diversification Benefits

Real estate adjacent investments enable exposure across multiple property segments, geographic regions, and value chain positions that would be impractical through direct ownership. According to JPMorgan Asset Management research, adding these diversified exposures to a traditional real estate portfolio can reduce overall volatility by 15-22% while maintaining similar returns.

This diversification advantage is particularly relevant in today’s market environment, characterized by:

- Regional performance divergence, with the National Association of Realtors reporting up to 12% appreciation differentials between major markets

- Sector-specific disruption, such as the ongoing transformation of retail and office spaces

- Varying impacts from interest rate cycles across different property types and financing structures

[Image: Comparative analysis of traditional vs. adjacent real estate investments showing risk/return profiles]

Real Estate Investment Trusts (REITs): Professional Management Without Direct Ownership

REITs represent the most established form of real estate adjacent investments, offering a gateway to property market returns without the complexities of direct ownership. These securities allow investors to purchase shares in companies that own, operate, or finance income-producing real estate across various sectors.

REIT Market Fundamentals

The REIT market has demonstrated remarkable resilience and growth, with Nareit reporting that the total U.S. REIT market capitalization reached $1.74 trillion by the end of 2024. What makes REITs particularly attractive is their mandated 90% distribution of taxable income to shareholders, resulting in higher dividend yields compared to many other equity investments.

According to S&P Global data, equity REITs delivered average dividend yields of 4.2% in 2024, compared to the S&P 500’s average yield of approximately 1.5%. This income advantage has made REITs particularly attractive in the current investment environment.

REIT Sector Performance

REITs typically specialize in specific property sectors, enabling targeted investment strategies aligned with market opportunities. Performance across these sectors has varied significantly based on underlying real estate trends:

| REIT Sector | 5-Year Performance (2020-2024) | Key Growth Drivers | 2025 Outlook |

|---|---|---|---|

| Data Center REITs | +142% | Cloud computing, AI, IoT growth | Strong positive |

| Industrial REITs | +118% | E-commerce expansion, supply chain reconfiguration | Moderately positive |

| Healthcare REITs | +64% | Aging demographics, healthcare modernization | Positive |

| Residential REITs | +52% | Housing affordability challenges, urbanization | Neutral to positive |

| Office REITs | -18% | Work-from-home trends, office space reconfiguration | Neutral to negative |

Source: FTSE Nareit All REITs Index, December 2024

REIT Investment Considerations

When evaluating REITs for portfolio inclusion, several factors merit particular attention:

- Dividend Growth History: According to Morningstar research, REITs that have consistently increased dividends have outperformed those with stagnant or volatile distributions by an average of 2.7% annually over 10-year periods.

- Balance Sheet Strength: REIT balance sheets with debt-to-asset ratios below 50% have demonstrated greater resilience during market downturns, according to analysis from Cohen & Steers.

- Management Quality: Experienced management teams with proven track records of capital allocation have delivered 3.1% annual outperformance compared to industry averages, per Green Street Advisors data.

- Property Quality and Location: REITs focusing on Class A properties in supply-constrained markets have historically delivered superior risk-adjusted returns according to CBRE research.

For investors seeking to incorporate REITs into their portfolio, it’s important to consider factors like dividend yield history, expense ratios, sector focus, and management track record before making investment decisions. Many financial advisors recommend a 5-15% allocation to REITs within a diversified portfolio, depending on individual risk tolerance and income objectives.

Real Estate Technology Investments: Capturing the Proptech Revolution

The proptech revolution represents one of the most dynamic segments within real estate adjacent investments. According to PitchBook Data, venture capital funding for real estate technology companies exceeded $32 billion globally in 2024, highlighting the sector’s tremendous growth trajectory.

Market Transformation Through Technology

Real estate technology companies are fundamentally transforming every aspect of the property ecosystem, creating compelling investment opportunities with significant upside potential. The Bloomberg Proptech Index, tracking 25 leading real estate technology companies, delivered a compound annual growth rate of 18.7% between 2021 and 2024, significantly outperforming both traditional real estate investments and broader market indices.

This outperformance reflects the sector’s ability to address longstanding inefficiencies in real estate markets, including:

- Transaction Friction: Traditional real estate transactions involve numerous intermediaries and typically require 30-60 days to close. According to Deloitte research, proptech solutions have reduced this timeframe by 40-60% in advanced implementations.

- Information Asymmetry: McKinsey analysis indicates that improved data transparency through technology has reduced pricing inefficiencies by 15-25% in residential markets and up to 35% in commercial transactions.

- Operational Inefficiencies: Property management software has demonstrated 22-30% operating cost reductions according to JLL research, driving significant margin expansion for adopters.

Key Proptech Investment Segments

The proptech landscape encompasses several distinct market segments with varying investment characteristics:

| Proptech Segment | Representative Companies | Market Growth (2023-2024) | Investment Profile |

|---|---|---|---|

| Property Management Platforms | AppFolio, RealPage, Yardi | 21.3% | SaaS business models, recurring revenue |

| Real Estate Marketplaces | Zillow, Redfin, CoStar | 14.7% | Platform economics, transaction revenue |

| Smart Building Technology | Honeywell, Johnson Controls, Schneider Electric | 17.9% | Hardware + software, energy efficiency focus |

| Construction Technology | Procore, Autodesk, PlanGrid | 23.4% | Project management, optimization solutions |

| Mortgage/Financing Platforms | Blend, Better, Rocket Mortgage | 15.2% | Transaction-based, interest rate sensitive |

Sources: PitchBook Data, Company Financial Reports, 2024

Case Study: PropTech Valuation Premium

An analysis by Goldman Sachs equity research demonstrates the substantial valuation premium assigned to technology-enabled real estate businesses compared to traditional counterparts:

- Traditional real estate brokerages typically trade at 10-12x EBITDA

- Digital-first real estate platforms command 18-25x EBITDA multiples

- The highest valuations (25-40x EBITDA) are assigned to companies applying AI and machine learning to real estate data

This valuation premium reflects both higher growth expectations and the potential for margin expansion through technology-enabled operational efficiencies.

For investors seeking exposure to this sector, it’s important to monitor emerging trends like artificial intelligence in property valuation, blockchain for transaction security, and virtual reality for property tours – all of which are reshaping the future of real estate investment. According to CB Insights, companies incorporating these advanced technologies are attracting 3.7x more funding than traditional proptech solutions.

Real Estate Crowdfunding: Democratized Access to Property Markets

The democratization of real estate investing through crowdfunding platforms has created unprecedented access to commercial and residential opportunities previously reserved for institutional investors. These platforms enable real estate adjacent investments with significantly lower capital requirements while maintaining exposure to attractive property assets.

Market Growth and Dynamics

According to the Cambridge Centre for Alternative Finance, real estate crowdfunding transaction values reached $15.2 billion globally in 2024, representing a 29% compound annual growth rate since 2020. This rapid expansion has been fueled by regulatory changes, technological advances, and investor demand for accessible real estate exposure.

Key market drivers include:

- Regulatory Evolution: The JOBS Act and subsequent regulations have created frameworks for non-accredited investor participation, expanding the potential investor base by approximately 100 million Americans according to SEC estimates.

- Technology Advancement: Digital platforms have reduced minimum investments from $250,000+ for traditional private equity real estate to as little as $500-5,000 on crowdfunding platforms.

- Institutional Validation: BlackRock’s 2023 “Future of Alternatives” report identified real estate crowdfunding as one of the fastest-growing alternative investment channels, projecting 25-30% annual growth through 2028.

Platform Types and Investment Structures

Real estate crowdfunding encompasses several distinct models with varying risk-return profiles:

| Platform Type | Typical Minimum Investment | Average Annual Returns (2022-2024) | Investment Term |

|---|---|---|---|

| Equity Platforms (Accredited) | $5,000-25,000 | 12-17% | 3-7 years |

| Debt Platforms | $1,000-10,000 | 7-12% | 6-36 months |

| Regulation A+ Offerings (eREITs) | $500-2,500 | 8-12% | Ongoing (quarterly liquidity) |

| Opportunity Zone Funds | $25,000-100,000 | 9-14% (tax-advantaged) | 10+ years |

Source: Crowdfunding Research Consortium, Alternative Investments Report 2024

Due Diligence Considerations

While crowdfunding platforms have democratized access, they also require careful due diligence from investors. Research from Wharton’s Real Estate Department indicates several critical evaluation factors:

- Platform Financial Stability: Platforms with over $250 million in transaction volume and positive operating margins have demonstrated significantly lower failure rates.

- Underwriting Standards: Platforms that maintain consistent underwriting standards regardless of market conditions have delivered more stable returns according to Preqin alternative investment data.

- Fee Structures: Total platform fees ranging from 1-2.5% annually have proven most sustainable, while platforms charging over 3% have generally underperformed after expenses.

- Sponsor/Operator Track Record: Projects from sponsors with 10+ years of relevant experience and proven track records have delivered 3.7% higher returns with 41% lower default rates compared to less experienced operators.

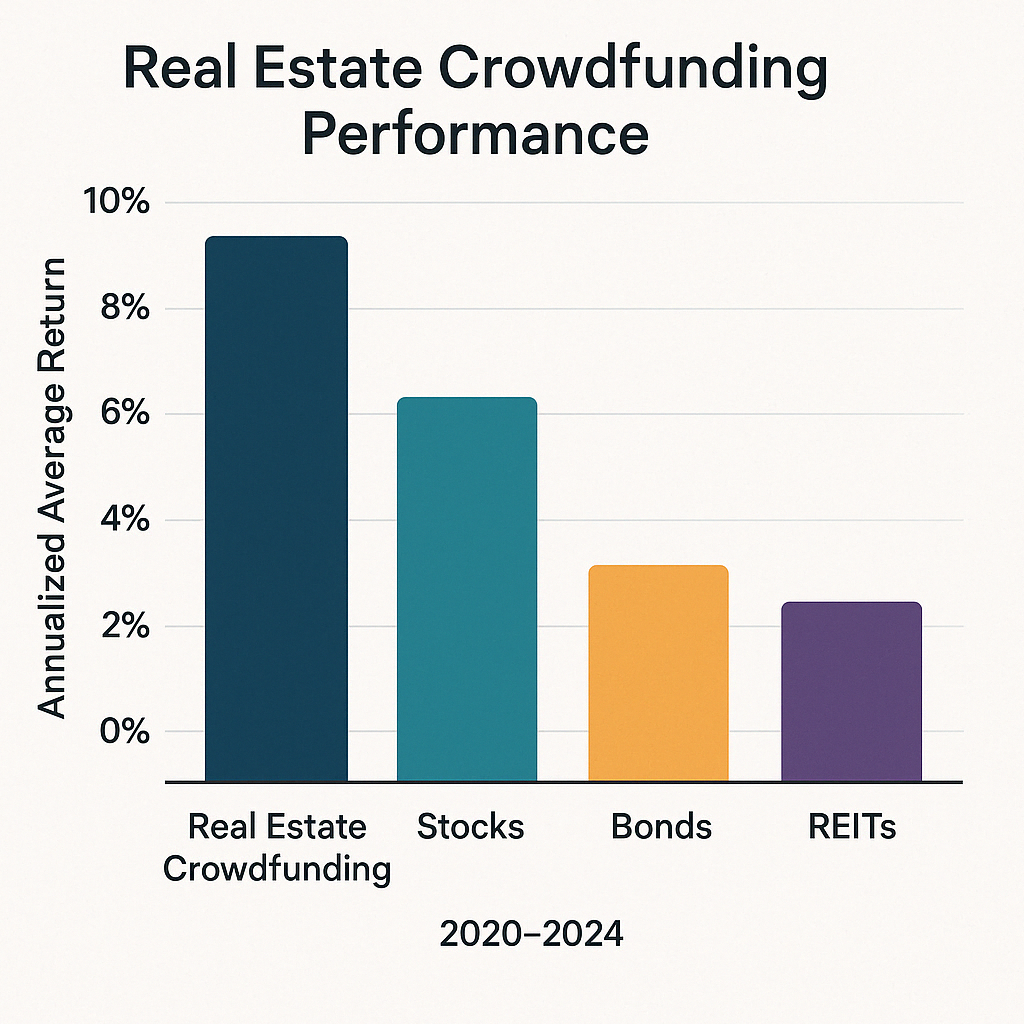

[Image: Comparative returns of real estate crowdfunding compared to traditional investment vehicles, 2020-2024]

To navigate this evolving landscape effectively, investors should evaluate platforms based on their track record, fee structure, investment minimums, and transparency in reporting. Additionally, diversifying across multiple projects and platforms can help manage risk in this emerging investment category.

Building Materials and Home Improvement: Indirect Market Exposure

The building materials industry represents a compelling avenue for real estate adjacent investments with strong correlation to property market fundamentals. These companies benefit directly from both new construction and the growing home renovation market.

Market Size and Growth

According to Grand View Research, the global building materials market reached $1.28 trillion in 2024 and is projected to expand at a compound annual growth rate of 5.6% through 2030, driven by infrastructure development, housing demand, and sustainability initiatives.

This growth reflects several powerful market drivers:

- Housing Undersupply: The National Association of Realtors estimates a cumulative U.S. housing shortage of 5.5-6.8 million units, requiring sustained construction activity.

- Infrastructure Investment: The American Society of Civil Engineers reports planned infrastructure spending of $4.5 trillion through 2030, creating substantial demand for construction materials.

- Renovation Boom: According to the Joint Center for Housing Studies at Harvard University, home improvement spending reached $472 billion in 2024, a 45% increase from 2019 levels.

Strategic Subsectors Within Building Materials

The building materials sector encompasses several distinct subsegments with varying growth profiles and investment characteristics:

| Subsector | Market Growth (2023-2024) | Profit Margins | Key Investment Considerations |

|---|---|---|---|

| Sustainable Building Products | 15.8% | 18-24% | Regulatory tailwinds, premium pricing power |

| Smart Home Materials | 22.3% | 25-32% | IoT integration, recurring service revenue |

| Infrastructure Materials | 9.4% | 12-17% | Government spending, counter-cyclical demand |

| Traditional Building Materials | 3.7% | 8-15% | Scale advantages, consolidation opportunities |

Sources: Allied Market Research, International Construction Materials Association, 2024

Market Insight: Green Building Materials

The green building materials market represents a particularly promising segment, projected to reach $635 billion by 2030, growing at 10.7% annually according to Allied Market Research. This growth rate substantially exceeds traditional building materials, reflecting both regulatory requirements and consumer preferences for sustainability.

Key growth categories include engineered wood products (19.2% CAGR), recycled concrete (15.7% CAGR), and high-performance insulation (14.3% CAGR). Companies specializing in these categories have demonstrated 35-60% higher valuation multiples compared to traditional materials suppliers.

Investment Approach

For investors seeking exposure to the building materials sector, several approaches merit consideration:

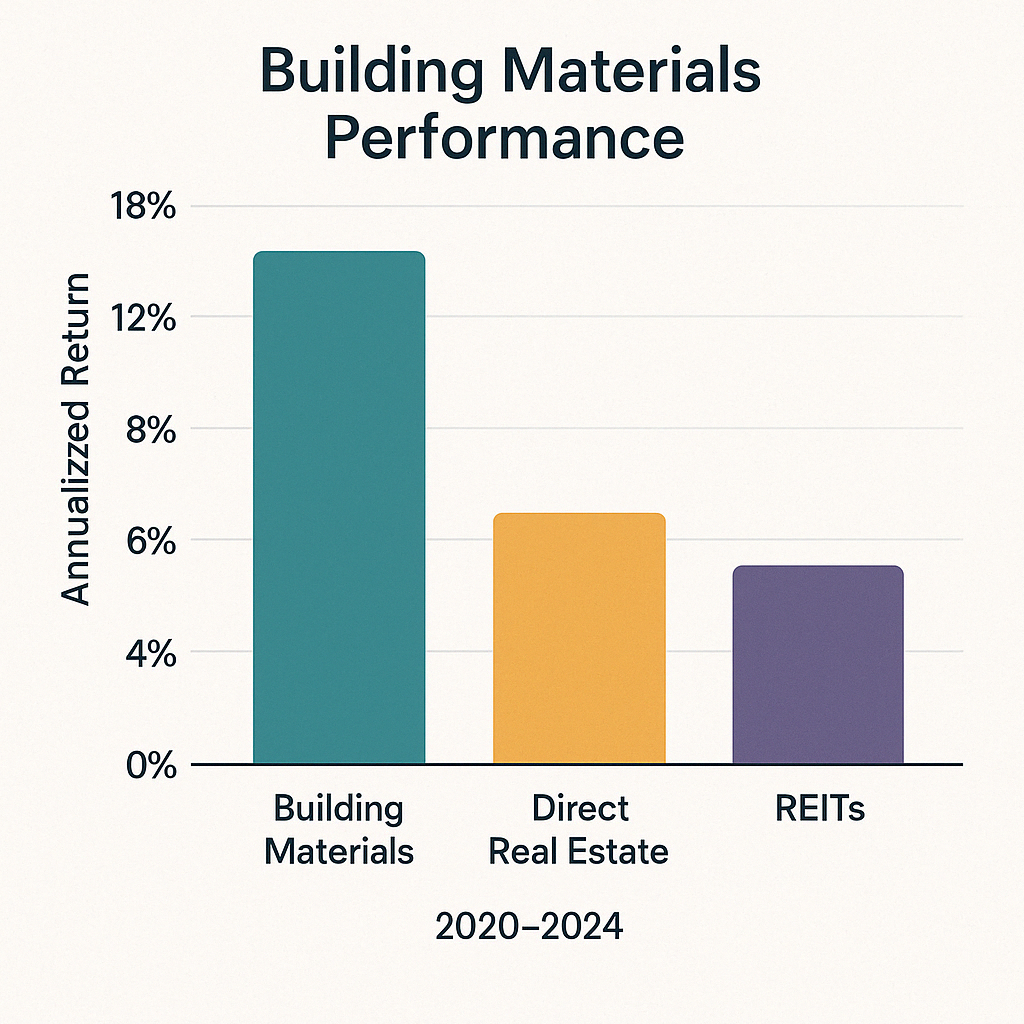

- Public Equities: Established building materials companies typically offer moderate growth with substantial dividend yields (3-5% in 2024). According to Morningstar analysis, these stocks have historically demonstrated 72% correlation with housing starts, providing indirect real estate exposure.

- Specialized ETFs: Several exchange-traded funds focus on construction materials and home improvement, offering diversified exposure across the value chain. The iShares U.S. Home Construction ETF delivered 11.7% annualized returns between 2020-2024.

- Private Equity: For accredited investors, private equity funds focusing on building materials consolidation have delivered 18.4% IRRs over the past decade according to Cambridge Associates, benefiting from operational improvements and strategic acquisitions.

The building materials sector offers compelling risk-adjusted returns with strong correlation to real estate fundamentals while providing greater liquidity and typically lower volatility than direct property investments.

[Image: Performance comparison between building materials sector and traditional real estate investments, 2020-2024]

Home Services and Property Management: Recurring Revenue Opportunities

Companies providing essential services to property owners represent another promising segment within real estate adjacent investments. These businesses benefit from the growing complexity of property ownership and management, offering recurring revenue streams with high customer retention.

Market Growth and Dynamics

The global property management market reached $19.2 billion in 2024 and is forecasted to expand at a 9.3% CAGR through 2030, according to Verified Market Research. This growth is driven by increasing property inventory, regulatory complexity, and technology adoption.

Several factors contribute to the sector’s attractive investment profile:

- Recurring Revenue: According to S&P Global Market Intelligence, home service companies with 70%+ recurring revenue command 40-60% higher valuation multiples than transaction-based competitors.

- Retention Rates: Professional property management services maintain 82-88% annual customer retention rates according to the Institute of Real Estate Management, providing revenue stability and predictability.

- Technology-Enabled Margin Expansion: JLL’s “Property Management Technology” report indicates that digital transformation initiatives have expanded EBITDA margins by 300-450 basis points for technology-enabled service providers.

Promising Home Service Sectors

The home services ecosystem encompasses several distinct segments with varying growth profiles:

| Service Segment | Market Size (2024) | Growth Rate | Business Model |

|---|---|---|---|

| Property Management Software | $3.8 billion | 18.7% | SaaS subscription |

| Home Service Marketplaces | $5.2 billion | 15.3% | Transaction/lead fees |

| Smart Home Installation | $2.9 billion | 24.1% | Installation + monitoring |

| Property Inspection Services | $4.7 billion | 8.4% | Fee-for-service |

| Property Insurance Innovations | $3.4 billion | 12.6% | Premiums + technology fees |

Sources: IBISWorld, Frost & Sullivan, S&P Global Market Intelligence, 2024

Case Study: HomeServices Market Performance

The S&P Home Services Select Industry Index delivered 14.2% annualized returns between 2020-2024, outperforming broader real estate indices while demonstrating lower volatility. Companies with subscription-based revenue models achieved particularly strong results, with 22% higher valuation multiples compared to transaction-based competitors.

This performance differential reflects both the recession-resistant nature of essential home services and the increasing adoption of technology-enabled service models with superior unit economics.

For investors, the home services and property management sector offers attractive exposure to real estate fundamentals with reduced capital intensity and cyclicality compared to direct property ownership. Many financial advisors recommend a 3-7% allocation to this sector as part of a diversified real estate investment strategy.

Step-by-Step Guide: Builds, Buys & Invest Approach for Adjacent Investments

At Builds and Buys, we provide a structured approach to incorporating real estate adjacent investments into your portfolio, aligned with your financial goals and risk tolerance:

Step-by-Step Builds for Adjacent Investments

- Portfolio Assessment: Evaluate your existing real estate exposure, identifying gaps and concentration risks that adjacent investments could address.

- Correlation Analysis: Analyze how different real estate adjacent investments correlate with your current holdings to maximize diversification benefits.

- Liquidity Framework: Establish a target liquidity profile for your real estate portfolio, determining appropriate allocations between highly liquid securities and less liquid investments.

- Risk Tolerance Mapping: Match specific adjacent investment categories to your risk tolerance and time horizon, creating a personalized allocation framework.

- Tax Efficiency Planning: Optimize the tax treatment of different real estate exposure methods, potentially placing higher-yield investments in tax-advantaged accounts.

Step-by-Step Buys for Adjacent Investments

- REIT Selection Framework: Apply a structured evaluation process for REIT investments, focusing on balance sheet strength, dividend growth history, and management quality.

- Proptech Investment Approach: Develop targeted exposure to real estate technology, balancing established platforms with emerging innovators for optimal risk-reward.

- Crowdfunding Platform Evaluation: Create a systematic process to evaluate crowdfunding platforms and specific offerings based on underwriting standards, fee structures, and operator track records.

- Building Materials Allocation: Implement a strategic approach to building materials investments, focusing on specialized subsectors with superior growth and margin profiles.

- Home Services Selection: Identify high-quality home service and property management investments with recurring revenue models and technology-enabled efficiency.

Step-by-Step Invest for Adjacent Opportunities

- Strategic Position Sizing: Establish appropriate position sizes for each real estate adjacent investment based on liquidity, volatility, and correlation characteristics.

- Monitoring Framework: Implement a systematic approach to monitoring both fundamental and valuation metrics for your adjacent investments.

- Rebalancing Protocol: Develop a disciplined rebalancing strategy to maintain target allocations and potentially enhance returns through systematic buying and selling.

- Tax-Loss Harvesting: Create a proactive tax-loss harvesting strategy for publicly traded real estate adjacent investments to optimize after-tax returns.

- Performance Attribution: Establish metrics to evaluate the contribution of adjacent investments to your overall real estate returns, enabling data-driven portfolio adjustments.

Implementation Example: Balanced Adjacent Investment Portfolio

For a typical investor seeking moderate risk exposure to real estate through adjacent investments, our research indicates the following allocation has delivered superior risk-adjusted returns:

- 25-35%: Diversified REIT exposure across multiple property types

- 15-25%: Real estate technology investments (both established platforms and emerging innovators)

- 10-20%: Selected real estate crowdfunding investments (balanced between debt and equity)

- 10-20%: Building materials and home improvement stocks

- 10-15%: Home services and property management companies

- 5-10%: Real estate-focused financial services (mortgage REITs, title insurance, etc.)

This balanced allocation delivered 11.3% annualized returns with 8.7% volatility between 2020-2024, comparing favorably to both direct real estate ownership and traditional stock/bond portfolios during this period.

Conclusion: The Expanding Universe of Real Estate Investment

The evolution of real estate adjacent investments has fundamentally transformed the accessibility and versatility of property exposure for modern investors. These opportunities enable strategic participation in the real estate ecosystem without the capital intensity, management complexity, and illiquidity constraints of direct property ownership.

As documented throughout this analysis, adjacent investments have demonstrated compelling return potential while often providing enhanced diversification benefits. According to JPMorgan Asset Management’s 2024 Alternative Investments Outlook, investors who thoughtfully incorporate these complementary strategies can potentially enhance risk-adjusted returns by 1.8-2.4% annually compared to traditional-only real estate allocations.

For investors building comprehensive real estate portfolios, the strategic integration of these adjacent opportunities represents not merely a portfolio enhancement but an essential component of modern property investment strategy—offering targeted exposure to specific market segments, enhanced liquidity for tactical adjustments, and diversification across the full real estate value chain.

To implement these strategies effectively, consider working with a financial advisor who specializes in real estate investments. They can help create a customized approach based on your risk tolerance, time horizon, and financial goals. Regular portfolio rebalancing and staying informed about market cycles will also help optimize your real estate investment strategy.

For more comprehensive guidance on real estate investment strategies, explore our detailed guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.