Good, Bad and No Credit, Is it possible?: Your Complete Guide to Securing Real Estate in 2025

The dream of homeownership remains powerful, yet many potential buyers believe their credit challenges have placed this dream permanently out of reach. According to the Federal Reserve Bank of New York, approximately 30% of Americans have a credit score below 670—traditionally considered the threshold for “good” credit. However, buying real estate with bad credit or limited credit history is absolutely possible in today’s evolving mortgage landscape. This comprehensive guide examines the realistic pathways, specialized loan programs, and strategic approaches that can transform credit challenges into homeownership opportunities, providing concrete steps for those who thought they had to remain indefinitely on the sidelines of real estate ownership.

Understanding the Credit Spectrum in Real Estate

Contrary to popular belief, there is no universal credit score cutoff that absolutely prevents mortgage approval. The mortgage lending landscape operates on a spectrum, with different loan products designed for various credit profiles.

Common Credit Score Ranges and Their Mortgage Implications

| Credit Score Range | Classification | Available Mortgage Options | Typical Interest Rate Premium |

|---|---|---|---|

| 760-850 | Excellent | All conventional and government programs | Base rate (0%) |

| 700-759 | Very Good | All conventional and government programs | 0.25-0.5% |

| 670-699 | Good | Most conventional and all government programs | 0.5-0.75% |

| 620-669 | Fair | Some conventional, all government programs | 0.75-1.5% |

| 580-619 | Poor | FHA, VA, non-QM options | 1.5-3.0% |

| 500-579 | Very Poor | FHA with higher down payment, specialized non-QM | 3.0-5.0% |

| Below 500 | Severely Impaired | Alternative financing (seller financing, hard money) | 5.0%+ or private terms |

Source: Mortgage Bankers Association, FICO Score Distribution Report 2025

Beyond the Score: What Lenders Actually Consider

Credit scores provide an initial screening mechanism, but savvy mortgage professionals evaluate the complete credit profile rather than fixating solely on the numerical score. According to research from the Urban Institute’s Housing Finance Policy Center, several factors beyond the score significantly impact mortgage approvals:

- Credit Trajectory: Upward movement in credit scores over the past 12-24 months can offset a currently lower score

- Derogatory Context: Medical collections are viewed less negatively than consumer debt delinquencies

- Timing of Events: Recent negatives impact more heavily than older issues

- Extenuating Circumstances: One-time events (job loss, divorce, medical crisis) vs. pattern of mismanagement

- Compensating Strengths: Strong income, substantial down payment, or significant reserves

The Urban Institute’s research found that approximately 42% of borrowers with credit scores below 620 who demonstrated compensating factors successfully obtained mortgage financing in 2024, highlighting that the full credit story matters more than the headline number.

The Post-Pandemic Credit Flexibility

The economic disruptions of the pandemic era have prompted significant adjustments in how credit is evaluated for mortgage purposes. The Federal Housing Finance Agency (FHFA) reported that Fannie Mae and Freddie Mac have implemented more nuanced credit assessment models that give greater weight to:

- Rental payment history (even when not previously reported to credit bureaus)

- Utility and telecom payment consistency

- Banking data showing responsible cash flow management

- Reduced impact of pandemic-era financial hardships

These changes recognize that traditional credit scoring models may not adequately reflect true creditworthiness for many prospective homebuyers, particularly those disproportionately affected by pandemic disruptions or those with limited traditional credit history.

For a more detailed analysis of market trends impacting credit requirements, read our coverage of Top 10 Real Estate Trends You Can’t Afford to Ignore in 2025.

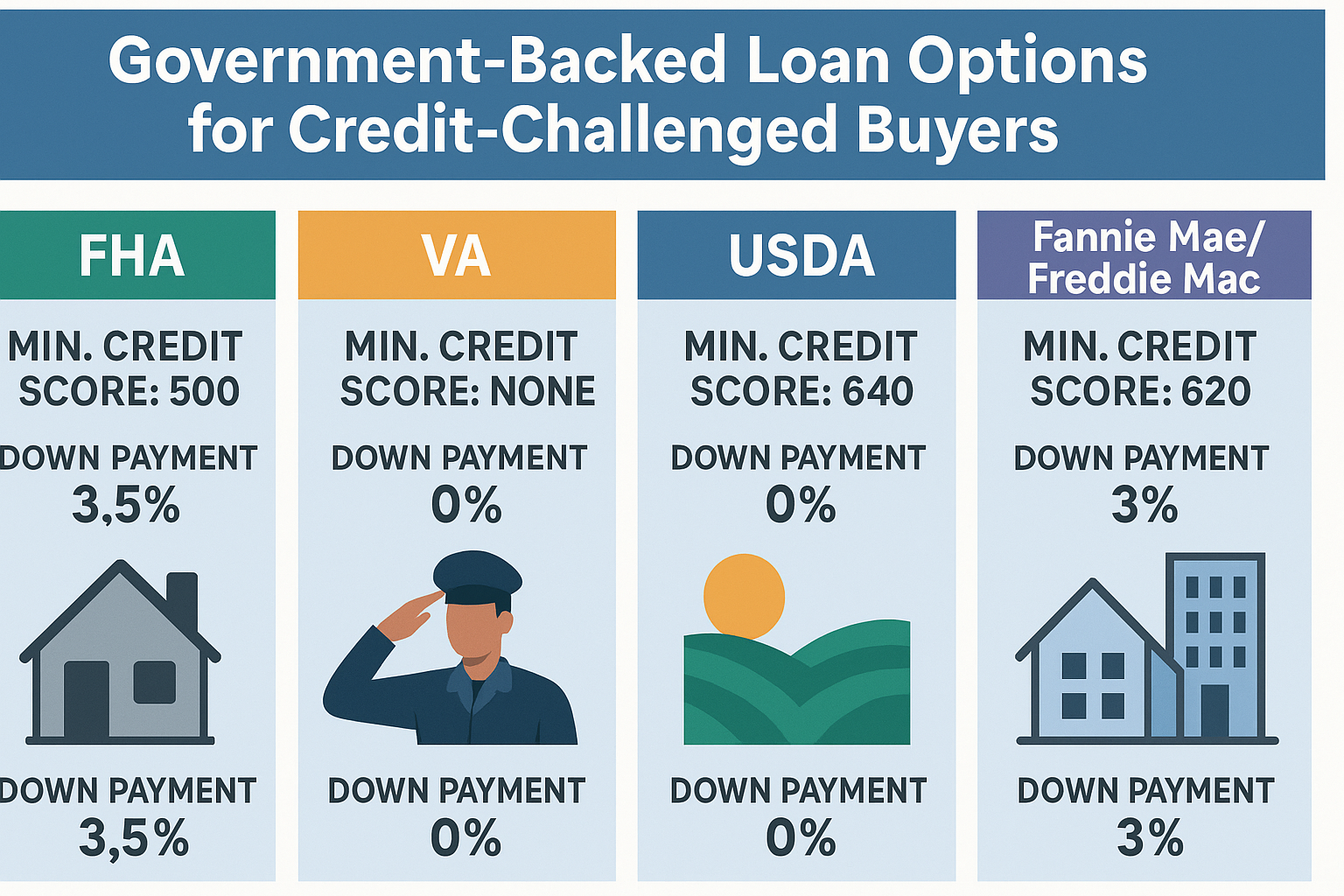

Government-Backed Loan Options for Credit-Challenged Buyers

Government-sponsored mortgage programs offer the most accessible pathways to homeownership for those with credit challenges. These programs are specifically designed to expand access to mortgage financing by providing insurance or guarantees that reduce lender risk.

FHA Loans: The Credit-Challenged Buyer’s Primary Option

The Federal Housing Administration (FHA) loan program remains the cornerstone solution for credit-impaired borrowers. According to the Department of Housing and Urban Development (HUD), FHA loans offer several critical advantages:

- Minimum Credit Score: Technically 500, though most lenders impose overlays requiring 580+

- Down Payment Requirements:

- 3.5% down with credit scores of 580 or higher

- 10% down with credit scores between 500-579

- Manual Underwriting: Available for borrowers with limited credit histories or extenuating circumstances

- Post-Bankruptcy Access: Eligible 2 years after Chapter 7 discharge or 1 year with extenuating circumstances

- Post-Foreclosure Access: Eligible 3 years after foreclosure or deed-in-lieu

In 2024, FHA loans represented approximately 23% of all purchase mortgages, with an average credit score of 668—significantly below the 738 average for conventional loans. The program’s flexibility makes it particularly valuable for first-time homebuyers with limited credit history or those rebuilding after financial setbacks.

Expert Insight: FHA Loan Optimization

While FHA loans accept lower credit scores, strategic credit improvement can dramatically affect costs. According to data from HUD, a borrower with a 580 credit score will pay approximately 1.75% more in interest compared to a borrower with a 640 score. For a $300,000 loan, this represents over $90,000 in additional interest over 30 years. Even modest credit improvement efforts prior to application can yield substantial long-term savings.

VA Loans: Unmatched Flexibility for Veterans

For those with eligible military service, VA loans provide exceptional terms even with credit challenges. The Department of Veterans Affairs does not impose a minimum credit score requirement, though most VA lenders typically look for scores of 580-620.

Key advantages of VA loans for credit-challenged veterans include:

- No down payment requirement regardless of credit score

- No private mortgage insurance

- More flexible DTI (debt-to-income) ratios

- Earlier access after bankruptcy (2 years for Chapter 7, 1 year for Chapter 13)

- Streamlined refinancing options to capture lower rates as credit improves

VA data indicates that VA borrowers have lower default rates than FHA and even conventional borrowers, despite having lower average credit scores. This performance has helped maintain lender confidence in the program, ensuring continued accessibility for veterans with credit challenges.

USDA Loans: Rural Opportunities with Flexible Credit

The USDA Rural Development Guaranteed Housing Loan Program offers another pathway for credit-challenged buyers willing to purchase in eligible rural and suburban areas. The program features:

- 100% financing (no down payment required)

- Minimum credit score of 640 for streamlined processing

- Manual underwriting available for scores below 640

- Consideration of alternative credit data for limited credit histories

- Income limitations (must be below 115% of area median income)

USDA eligibility maps include many suburban communities on the outskirts of metropolitan areas, making this program more widely available than many buyers realize. According to the USDA, over 97% of U.S. land area is eligible for these loans, covering approximately 34% of the U.S. population.

Fannie Mae and Freddie Mac HomeReady/Home Possible

While conventionally backed, these specialized programs offer more flexible terms for credit-challenged buyers:

- 3% down payment options

- Minimum credit scores of 620 (some lenders may require higher)

- Consideration of non-traditional credit sources

- Reduced mortgage insurance costs compared to FHA

- Income limits typically set at 80% of area median income

These programs are particularly valuable for borrowers with thin credit files but strong payment history on rent and utilities, as they can utilize Fannie Mae’s newer credit evaluation tools that incorporate these non-traditional data points.

For more specific strategies tailored to first-time homebuyers with credit challenges, don’t miss our detailed guide: First-Time Homebuyer’s Blueprint: 8 Critical Steps That Experts Don’t Tell You.

Alternative Financing Strategies Beyond Traditional Mortgages

When conventional and government-backed mortgage options remain inaccessible due to severe credit challenges, alternative financing approaches can create viable pathways to homeownership:

Non-Qualified Mortgage (Non-QM) Loans

The non-QM sector has expanded significantly, with loan originations increasing 22% in 2024 according to CoreLogic. These loans are designed specifically for borrowers who fall outside conventional and government lending guidelines:

- Asset-Based Qualification: Qualify based on bank statements or asset levels rather than traditional income documentation

- Recent Credit Events: Programs specifically for borrowers 1 day out of foreclosure, bankruptcy, or short sale

- Foreign Nationals: Options for those without U.S. credit history

- Interest-Only Options: Lower initial payments to improve qualification

Non-QM loans typically carry higher interest rates (2-4% above conventional rates) and larger down payment requirements (often 15-25%), but they can provide immediate homeownership access while working toward credit improvement for eventual refinancing into conventional products.

Seller Financing Arrangements

Direct financing from property sellers offers significant flexibility for credit-challenged buyers. National Association of Realtors data indicates that approximately 8% of home sales in 2024 involved some form of seller financing, with higher concentrations in rural areas and lower-priced markets.

Common seller financing structures include:

- Land Contracts/Contracts for Deed: Buyer makes payments directly to seller, with title transferring upon completion

- Owner Financing with Mortgage: Seller acts as the bank, providing a mortgage with negotiated terms

- Lease-Option Agreements: Combination of rental agreement with future purchase option, with rent credits applied to down payment

- Wrap-Around Mortgages: Seller maintains existing mortgage while providing new financing to buyer

Successful seller financing requires careful structuring with proper legal documentation. Key considerations include interest rates (typically 2-5% above market rates), term length (often 3-7 years with balloon payment), down payment requirements (generally 10-20%), and clear default provisions.

Co-Borrower and Co-Signer Strategies

Leveraging stronger credit profiles through co-borrowing arrangements can create immediate homeownership access. According to Freddie Mac research, 28% of first-time homebuyers in 2024 utilized some form of co-borrowing arrangement.

The primary co-borrowing structures include:

- Non-Occupant Co-Borrowers: Parents or family members co-sign but don’t live in the property

- Occupant Co-Borrowers: Multiple residents combine income and credit profiles

- Blended Credit Underwriting: Some loan programs average credit scores rather than using the lowest score

The optimal approach to co-borrowing depends on whether the primary need is credit enhancement, income supplementation, or both. FHA loans offer particularly flexible terms for family co-borrowers, while Fannie Mae’s HomeReady program accommodates non-occupant co-borrowers for low-to-moderate income applicants.

Portfolio Lending from Community Banks and Credit Unions

Smaller financial institutions that retain mortgages in their own portfolios often exercise greater flexibility with credit requirements. The Independent Community Bankers of America reports that member institutions held approximately $475 billion in portfolio mortgages in 2024, many extended to borrowers who did not meet secondary market requirements.

Advantages of pursuing portfolio lending include:

- Manual underwriting with personalized evaluation

- Consideration of relationship factors (existing accounts, community ties)

- Flexible terms not constrained by secondary market requirements

- Direct decision-making without multiple approval layers

These institutions typically require stronger compensating factors such as larger down payments (15-25%), substantial cash reserves (6+ months), or strong income relative to the loan amount. The relationship-based approach often works best for borrowers with a compelling story behind their credit challenges.

To understand the full range of homeownership costs beyond mortgage qualification, review our comprehensive breakdown: Homeowner Expenses: The Complete Guide to Budgeting Beyond Your Mortgage.

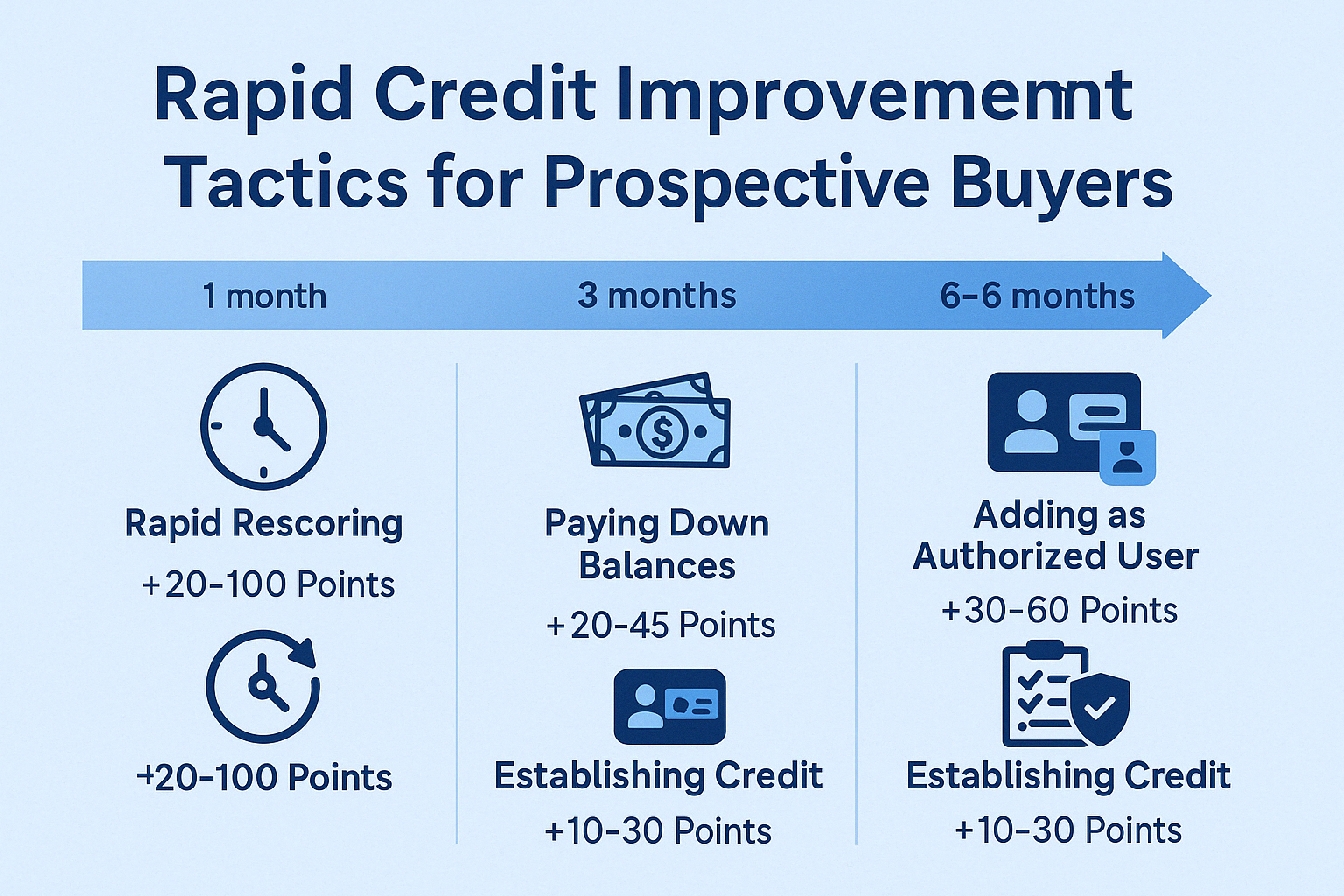

Rapid Credit Improvement Tactics for Prospective Buyers

Strategic credit improvement efforts can significantly expand mortgage options in as little as 3-6 months. According to credit industry research, focused intervention can improve scores by 40-100 points within this timeframe, potentially transforming lending eligibility and terms.

High-Impact Credit Interventions

Consumer credit data analysis reveals that certain actions deliver disproportionate score improvements in shorter timeframes:

| Intervention | Potential Point Improvement | Typical Timeframe | Implementation Approach |

|---|---|---|---|

| Rapid Rescoring | 20-100+ | 3-7 days | Mortgage lender-initiated expedited updates |

| Credit Utilization Reduction | 20-45 | 1-30 days | Pay down revolving balances below 30% |

| Authorized User Addition | 30-60 | 30-60 days | Added to established account with perfect history |

| Collections Resolution | 15-75 | 30-90 days | Pay-for-delete negotiations with creditors |

| Error Disputes | 25-100+ | 30-45 days | Formal disputes of inaccurate derogatory items |

| New Positive Trade Line | 10-30 | 60-90 days | Secured credit card with perfect payment history |

Source: Analysis of consumer credit data from Experian, TransUnion, and Equifax

Rapid Rescoring: The Mortgage Applicant’s Secret Weapon

For homebuyers already in the mortgage application process, rapid rescoring offers a powerful intervention that can deliver score improvements in days rather than months. This lender-initiated service expedites updates to credit reports outside the normal monthly reporting cycle.

According to the National Credit Reporting Association, successful rapid rescoring typically involves:

- Paying down credit card balances to below 30% utilization

- Providing verification of debt payoffs not yet reflected in reports

- Submitting proof of incorrect reporting with supporting documentation

- Addressing authorized user updates that can be expedited

Rapid rescoring typically costs $25-100 per tradeline updated and is arranged through the mortgage lender rather than directly by consumers. The service can improve scores by 20-100+ points within a week when properly implemented with appropriate documentation.

Strategic Debt Paydown Sequencing

For borrowers with limited funds to address multiple debts, strategic paydown sequencing maximizes credit score improvement. FICO scoring models weight utilization most heavily for revolving accounts with balances near their limits.

Analysis from credit optimization services indicates the following prioritization typically yields the greatest score improvement:

- Revolving accounts over 70% of limit (especially those reporting within 7 days)

- Accounts with balances just above threshold multiples of $500 or $1,000

- Recently delinquent accounts that can be brought current

- Collection accounts under two years old (negotiating pay-for-delete arrangements)

- Maxed out accounts, even if relatively small balances

This sequencing approach can improve scores 15-40 points with the same financial outlay that might yield only 5-10 points if applied to different accounts.

Expert Insight: Authorized User Strategy

When implemented correctly, becoming an authorized user on a family member’s established credit card can raise credit scores by 30-60 points within one billing cycle. For maximum impact, the primary account should have perfect payment history, be open for 5+ years, have a high credit limit, and maintain low utilization (under 10%). Cards from major banks that report authorized user activity to all three bureaus deliver the strongest results.

Leveraging Alternative Credit Data

For buyers with limited traditional credit or those working to rebuild after setbacks, actively establishing positive alternative credit data can strengthen mortgage applications. Multiple loan programs now consider non-traditional credit sources:

- Rent Reporting Services: Platforms like Rental Kharma and RentTrack report rental payments to credit bureaus

- Utility and Telecom Reporting: Services that report consistent utility payments

- Experian Boost: Free service that adds utility and subscription payments to Experian reports

- Self-Reporting with Verification: Documented 12-month payment histories for non-reporting accounts

According to a recent TransUnion study, consumers who add rental payments to their credit files see an average score increase of 16 points, with first-time homebuyers experiencing gains of up to 26 points. The impact is particularly significant for those with limited credit histories or rebuilding credit after negative events.

For more strategies to improve your financial position for homeownership, see our detailed article: Your Journey for a Successful Home Purchase: A Strategic Roadmap for Today’s Buyers.

Compensating Factors That Can Overcome Credit Limitations

Mortgage underwriting considers the complete borrower profile, not just credit scores. Strong compensating factors can offset credit weaknesses, particularly in manually underwritten loans.

Down Payment Power: The Ultimate Compensator

Higher down payments significantly mitigate lender risk and can overcome substantial credit limitations. Mortgage industry data consistently shows that default probability decreases as down payment percentage increases, regardless of credit score band.

The down payment impact varies by loan type:

- FHA Loans: 10% down payment reduces mortgage insurance premiums and can qualify borrowers with scores as low as 500

- Conventional Loans: 20-25% down payment can secure approval with scores 30-40 points below standard minimums

- Portfolio Loans: 25-30% down payment can overcome significant credit issues including recent bankruptcy or foreclosure

According to Urban Institute research, a borrower with a 620 credit score making a 20% down payment presents lower default risk than a borrower with a 720 score making a 3.5% down payment, highlighting the powerful compensating effect of equity position.

Financial Reserves: Demonstrating Payment Capacity

Substantial cash reserves after closing demonstrate financial stability and reduce perceived risk. Fannie Mae underwriting guidelines indicate that each month of reserves (defined as liquid assets divided by total monthly housing payment) can offset 5-10 points of credit score deficiency.

Effective reserve documentation strategies include:

- Seasoning funds in accounts for 2+ months prior to application

- Properly documenting gift funds with clear paper trails

- Including retirement accounts (typically counted at 60-70% of value)

- Maintaining reserves separate from down payment funds

Lenders typically require 2-6 months of reserves for conventional loans with borderline credit, while portfolio lenders may require 6-12 months for credit-challenged borrowers. The impact is most significant when combined with other compensating factors.

Income Stability and Strength

Strong, stable income relative to the proposed housing payment creates significant underwriting flexibility. Mortgage industry statistics consistently show that debt-to-income (DTI) ratio is a stronger predictor of default than credit score in many cases.

Optimal income metrics to overcome credit challenges include:

- Housing Ratio: Housing costs below 28% of gross income (front-end DTI)

- Total Debt Ratio: All debt payments below 36% of gross income (back-end DTI)

- Residual Income: Substantial cash flow remaining after all expenses (particularly important for VA loans)

- Employment Stability: 2+ years in same field with steady or increasing income

According to mortgage performance data from the Mortgage Bankers Association, borrowers with DTI ratios below 36% show default rates 62% lower than those with ratios above the 43% Qualified Mortgage threshold, even when controlling for credit score bands.

Property Characteristics as Risk Mitigators

Specific property characteristics can positively influence underwriting decisions for credit-challenged borrowers. Lenders recognize that certain property traits correlate with lower default probability regardless of borrower credit profile.

Favorable property factors include:

- Strong Appraisal: Conservative loan-to-value ratio with no appraisal conditions

- Primary Residence: Owner-occupied properties experience dramatically lower default rates than investments

- Property Condition: Turnkey properties with minimal required repairs or maintenance

- Location Quality: Properties in stable or appreciating markets with low foreclosure rates

- Energy Efficiency: Features that reduce ongoing utility costs improve debt service capacity

Data from Freddie Mac’s loan performance studies indicates that these property factors can reduce default probability by 15-30% across all credit score bands, creating flexibility for underwriters to approve marginally qualified applicants.

For insights on evaluating property quality, see our guide: Hire a Licensed Contractor or Lose Thousands of Dollars on Shoddy Repairs.

| Compensating Factor | Weak Impact | Moderate Impact | Strong Impact |

|---|---|---|---|

| Down Payment | 5-10% | 15-20% | 25%+ |

| Financial Reserves | 3-6 months | 6-12 months | 12+ months |

| Housing Ratio | 33-36% | 28-32% | Below 28% |

| Total Debt Ratio | 41-43% | 37-40% | Below 36% |

| Job Stability | 1-2 years | 2-5 years | 5+ years |

| Payment History | Recent improvements | 12+ months perfect | 24+ months perfect |

Step-by-Step Action Plan for Credit-Challenged Buyers

Successfully navigating the homebuying process with credit challenges requires a strategic, methodical approach. This comprehensive action plan provides a framework for moving from credit limitations to homeownership.

Phase 1: Baseline Assessment (1-2 Weeks)

-

Obtain complete credit reports from all three bureaus

- Access free reports from annualcreditreport.com

- Purchase FICO mortgage scores (not free educational scores)

- Document all discrepancies between bureaus

-

Conduct thorough credit analysis

- Identify all derogatory items with corresponding dates

- Calculate current utilization percentages for all revolving accounts

- Document age of oldest accounts and average account age

- Identify recent credit inquiries and new accounts

-

Organize financial documentation

- Last two years of tax returns and W-2s/1099s

- Recent pay stubs covering 30 days

- Bank statements for all accounts (2-3 months)

- Documentation of any special circumstances affecting credit

-

Calculate key financial ratios

- Front-end and back-end debt-to-income ratios

- Available down payment as percentage of target price

- Liquid reserves in months of projected housing payment

Phase 2: Credit Optimization (1-6 Months)

-

Address immediate credit issues

- Dispute inaccurate derogatory information

- Pay down revolving balances to below 30% utilization

- Resolve small collection accounts with pay-for-delete letters

- Avoid new credit applications and account closures

-

Implement credit building strategies

- Become authorized user on established accounts if beneficial

- Establish secured credit card if lacking revolving accounts

- Enroll in alternative credit reporting services

- Create perfect payment history for all active accounts

-

Strengthen compensating factors

- Increase savings for larger down payment

- Build additional reserves beyond down payment

- Address income stability or documentation issues

- Reduce non-housing debt obligations where possible

-

Document credit improvement journey

- Maintain records of all payoffs and settlements

- Document all dispute correspondence and outcomes

- Create letter of explanation for past credit issues

- Compile evidence of compensating strengths

Phase 3: Lender Selection and Pre-Approval (2-4 Weeks)

-

Research specialized lenders

- Identify FHA-approved lenders with manual underwriting capability

- Explore community banks and credit unions with portfolio lending

- Consider mortgage brokers specializing in non-prime lending

- Review lender overlays (additional requirements beyond program minimums)

-

Conduct informational interviews

- Discuss specific credit situation without formal application

- Identify most appropriate loan programs

- Understand required compensating factors

- Obtain realistic rate and cost expectations

-

Submit formal applications to multiple lenders

- Cluster applications within 14-day period to count as single credit inquiry

- Include comprehensive letter of explanation

- Provide complete documentation package upfront

- Request detailed loan estimates for comparison

-

Evaluate pre-approval options

- Compare interest rates, terms, and total closing costs

- Assess timeline for closing and contingency requirements

- Understand property restrictions or requirements

- Confirm maximum purchase price and geographic limitations

Phase 4: Property Selection and Acquisition (1-3 Months)

-

Align property search with lending parameters

- Focus on properties that meet program requirements

- Prioritize properties requiring minimal repairs if using FHA/VA

- Consider school districts and neighborhood stability for future value

- Evaluate property for long-term affordability (maintenance, utilities, etc.)

-

Structure offers to enhance acceptance

- Provide strong pre-approval letter from lender

- Consider larger earnest money deposit

- Offer flexible closing timeline if helpful to seller

- Limit contingencies to those absolutely necessary

-

Navigate inspections strategically

- Schedule comprehensive inspection upfront

- Focus repair requests on lender-required items

- Consider requesting closing credits instead of repairs where possible

- Address potential appraisal issues proactively

-

Manage the closing process meticulously

- Maintain perfect payment history during processing

- Avoid any new debt or credit applications

- Respond immediately to all lender documentation requests

- Verify closing figures in advance with detailed review

Expert Insight: First-Time Homebuyer Programs

First-time homebuyer status can provide additional advantages for credit-challenged buyers. Most states offer down payment assistance programs with income-based eligibility rather than strict credit requirements. For example, the average state housing finance agency provides between $5,000-$15,000 in assistance, often with more flexible credit guidelines than conventional lenders. When combined with FHA financing, these programs can reduce initial investment requirements to as little as $500-1,000 out of pocket while accepting credit scores as low as 620 and sometimes lower.

For a more detailed breakdown of the home purchase process, review our comprehensive article: First-Time Homebuyer’s Blueprint: 8 Critical Steps That Experts Don’t Tell You.

Success Stories: Real Buyers Who Overcame Credit Obstacles

Examining real-world examples provides valuable insights into effective strategies and realistic timelines for overcoming credit challenges in today’s market.

Case Study 1: Post-Bankruptcy Homeownership

Michael and Jennifer experienced a Chapter 7 bankruptcy discharge in 2023 following medical bills that overwhelmed their finances. Their credit scores dropped to the 530-550 range following the bankruptcy.

Their successful strategy included:

- Immediate Rebuilding: Secured two credit cards within months of discharge and maintained perfect payment history

- Savings Focus: Accumulated 15% down payment over 18 months while establishing rental payment history

- Alternative Credit: Documented 12 months of perfect payment history on utilities and car insurance

- Lender Selection: Worked with portfolio lender specializing in recent bankruptcy cases

Outcome: 24 months after bankruptcy discharge, they purchased a $275,000 home with a 15% down payment at 7.75% interest (approximately 2% above conventional rates), with opportunity to refinance after established 12-month perfect payment history on the mortgage.

Case Study 2: First-Time Buyer with Limited Credit

Sarah, a 29-year-old first-time buyer, had avoided credit cards and loans, resulting in a “thin file” with scores ranging from 580-610 despite no negative items.

Her successful approach included:

- Credit Building: Became authorized user on parent’s 12-year-old credit card with perfect history

- Alternative Documentation: Enrolled in Experian Boost and rent reporting service

- Income Strength: Demonstrated two years of increasing income in same profession

- Down Payment Assistance: Qualified for state housing finance agency program for first-time buyers

Outcome: Within 4 months, her credit scores improved to 640-660, allowing FHA loan approval with 3.5% down payment plus $10,000 in down payment assistance, reducing out-of-pocket costs to approximately $3,500 for a $230,000 condo purchase.

Case Study 3: Self-Employed With Recent Credit Challenges

Robert, a self-employed contractor, faced credit score drops to the 560-580 range following late payments during a business slowdown in 2023.

His effective strategy included:

- Rapid Rescoring: Paid down credit cards from 85% to under 20% utilization

- Income Documentation: Worked with accountant to document increasing business income

- Compensating Factors: Accumulated 6 months of reserves beyond 20% down payment

- Property Selection: Focused on turn-key home requiring no repairs or improvements

Outcome: Secured a non-QM loan with 20% down payment at 8.25% interest for $325,000 property, with option to refinance after 12 months of timely payments and continued credit improvement. The enhanced application incorporated business bank statements rather than tax returns for income qualification.

Common Success Factors

Analysis of successful credit-challenged homebuyers reveals several consistent patterns:

- Strategic Preparation: Most successful buyers spent 3-12 months in deliberate preparation before formal mortgage application

- Multiple Compensating Factors: Successful applications typically featured 2-3 strong compensating elements rather than relying on a single factor

- Specialized Lender Relationships: Working with lenders experienced in credit challenges rather than mass-market institutions

- Down Payment Prioritization: Accumulating larger down payments consistently improved approval odds and terms

- Documentation Excellence: Providing comprehensive explanations and supporting documentation for all credit issues

These case studies demonstrate that with proper preparation, strategic approach, and appropriately matched lending sources, homeownership remains accessible despite significant credit challenges. In each case, the buyers accepted initial terms that reflected their credit situation while positioning themselves for future refinancing as their credit profiles strengthened.

Conclusion: Your Pathway to Homeownership Despite Credit Challenges

The journey to homeownership with credit challenges requires patience, strategic planning, and specialized knowledge—but it remains entirely achievable in today’s lending environment. As demonstrated through market data, program analysis, and real-world success stories, credit limitations represent hurdles rather than roadblocks on the path to property ownership.

The key insights for credit-challenged prospective homebuyers include:

- Multiple Viable Pathways: Government-backed, non-QM, and portfolio lending options create multiple routes to approval

- Credit Score Improvements: Strategic interventions can deliver meaningful score increases in as little as 1-6 months

- Compensating Strength: Down payment, reserves, and income strength can significantly offset credit weaknesses

- Specialized Expertise: Working with professionals experienced in credit-challenged lending maximizes success probability

- Long-Term Perspective: Initial financing terms can be improved through refinancing after establishing mortgage payment history

By implementing the strategies outlined in this guide, prospective buyers can systematically address credit limitations while positioning themselves for successful mortgage approval. The current lending environment, with its expanded range of program options and increasing adoption of alternative credit evaluation methods, offers more opportunities for credit-challenged buyers than at any point in the past decade.

Remember that homeownership represents a long-term investment, and the terms of initial financing represent just the first phase of that journey. Many successful homeowners began with credit-challenged purchases before establishing perfect mortgage payment history that opened doors to improved financing options. With proper preparation, realistic expectations, and strategic approach, your real estate ownership goals remain within reach regardless of your current credit situation.

To continue your homebuying education, explore our detailed guides on Step-by-Step Buys and Step-by-Step Invest for additional insights on navigating the real estate market successfully.

For more specific strategies on evaluating property investment potential, read our comprehensive analysis: Is Real Estate a Good Investment? A Complete 2025 Analysis.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.