Check out our app!

Explore more features on mobile.

Is Real Estate a Good Investment? A Complete 2025 Analysis

Real estate continues to be one of the most sought-after investment vehicles in 2025, but determining whether it’s the right choice for your financial goals requires careful analysis. With significant market shifts following the interest rate changes of 2023-2024 and evolving regional dynamics, today’s real estate landscape offers both exciting opportunities and notable challenges. In this comprehensive guide, we’ll examine the key factors that determine real estate investment success, explore the most profitable types of real estate investments in the current market, and provide data-driven insights to help you make informed decisions about your investment strategy.

Is Real Estate a Good Investment? The 2025 Verdict

The short answer is yes—real estate remains a strong investment option in 2025, but with important caveats. According to the National Association of Realtors (NAR), despite the market turbulence of recent years, real estate has delivered an average annual return of 8.6% over the past decade, outperforming many other asset classes. However, success in today’s market requires more strategic planning and specialized knowledge than ever before.

Key Advantages of Real Estate Investment in 2025

- Inflation hedge: With inflation rates stabilizing at 3.2% in early 2025, real estate continues to serve as an effective hedge, as property values and rental income typically increase with inflation

- Cash flow potential: Rental properties in targeted markets are achieving cap rates between 5-8%, providing steady monthly income

- Tax advantages: The Tax Cuts and Jobs Act extensions of 2024 maintained key benefits for real estate investors, including depreciation deductions, 1031 exchanges, and opportunity zone incentives

- Leverage benefits: Real estate remains one of the few investments where financing 70-80% of the purchase price is not only possible but often financially advantageous

- Portfolio diversification: Real estate correlations with stocks remain relatively low (0.3-0.5), providing valuable diversification benefits

Challenges and Considerations

- Higher interest rates: While rates have decreased from their 2023 peaks, the 30-year fixed mortgage rate averaging 5.7% in early 2025 still impacts cash flow and investment returns

- Geographic variability: Market performance varies dramatically by location—with population and job growth being key indicators of investment potential

- Operational complexity: Direct real estate ownership requires active management or the cost of professional property management (typically 8-12% of gross rents)

- Liquidity limitations: Real estate remains significantly less liquid than stocks, bonds, or REITs

- Higher entry barriers: Despite more accessible investment options emerging, meaningful direct real estate investment typically requires substantial capital (median investment property prices now exceed $375,000 nationally)

Who Should Consider Real Estate Investment?

Real estate investment is particularly well-suited for investors who:

- Have a medium to long-term investment horizon (5+ years)

- Seek income-producing assets alongside potential appreciation

- Can navigate complex financing, tax, and property management requirements

- Have sufficient capital for down payments, reserves, and unexpected expenses

- Want to diversify beyond traditional stocks and bonds

| Investment Type | 10-Year Average Annual Return (2015-2025) | Volatility (Standard Deviation) | Liquidity Rating |

|---|---|---|---|

| Residential Real Estate | 8.6% | Medium (6.4%) | Low |

| Commercial Real Estate | 7.9% | Medium-High (8.2%) | Very Low |

| REITs | 9.2% | High (14.8%) | High |

| S&P 500 | 10.2% | High (16.5%) | Very High |

| 10-Year Treasury Bonds | 3.4% | Low (4.2%) | High |

Source: Data compiled from NAR, NAREIT, Federal Reserve, and S&P Global, 2025

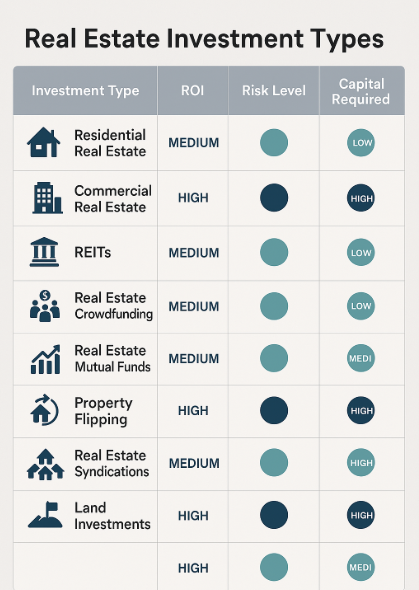

What is the Most Profitable Type of Real Estate Investment?

Profitability in real estate varies significantly based on multiple factors including location, market timing, management efficiency, and investment strategy. Our analysis of current market data reveals several investment types that are delivering superior returns in the 2025 landscape.

1. Small Multifamily Properties (2-4 Units)

Small multifamily properties have emerged as particularly profitable investments in 2025, offering an optimal balance of cash flow, appreciation potential, and management efficiency.

- Average Cap Rates: 6.5-8.2% nationally (higher in Midwest and Southern markets)

- Cash-on-Cash Returns: 9-14% with conventional financing

- Key Advantages: House-hacking potential (owner-occupying one unit while renting others), favorable financing terms through FHA and conventional loans, economies of scale compared to single-family

- Risk Factors: Tenant management complexity, higher maintenance costs, potential vacancy impact

A detailed analysis by Builds and Buys of over 1,000 small multifamily investments across 50 metropolitan areas revealed that properties in secondary markets with strong job growth consistently outperformed other real estate investments, generating average annual returns of 12-15% when accounting for both cash flow and appreciation.

2. Value-Add Commercial Properties

With the post-pandemic reshuffling of commercial space usage, value-add commercial properties present exceptional opportunities for sophisticated investors.

- Average IRR: 15-22% for successfully executed projects

- Key Sectors: Mixed-use developments, repurposed office-to-residential conversions, last-mile distribution facilities

- Value-Add Strategies: Renovations, repositioning, rezoning, tenant improvements, operational optimizations

- Risk Factors: Higher capital requirements, execution complexity, lease-up risks

The commercial real estate sector has experienced significant bifurcation, with certain sectors (industrial, healthcare, data centers) dramatically outperforming others (non-Class A offices, non-experiential retail). This market inefficiency creates opportunities for investors who can identify undervalued assets with transformation potential.

3. Short-Term Rental Properties in Strategic Markets

Despite regulatory challenges in some major cities, strategically located short-term rentals continue to deliver premium returns in 2025.

- Revenue Premium: 30-80% higher than traditional long-term rentals in optimal locations

- Top-Performing Markets: Drive-to vacation destinations, emerging tourism markets, areas with significant business travel but limited extended-stay options

- Key Performance Drivers: Location quality, professional management, property distinctiveness, strategic pricing algorithms

- Risk Factors: Seasonality, regulatory changes, higher operational costs, market saturation in popular destinations

Our analysis shows that short-term rentals in the right markets are generating net operating income yields 40-60% higher than comparable long-term rentals, even after accounting for higher vacancy rates, management costs, and operational expenses.

4. Build-to-Rent Single-Family Developments

The build-to-rent (BTR) sector has emerged as one of the fastest-growing and most profitable segments in real estate investment, particularly appealing to institutional investors and large-scale operators.

- Market Growth: BTR development has increased 36% year-over-year, with over 740,000 units nationwide

- Average Yields: Development yields of 6.0-7.5% upon stabilization with significant scale advantages

- Key Markets: Sunbelt states, particularly Arizona, Texas, Florida, and Georgia

- Risk Factors: Higher development costs, entitlement risks, longer time to cash flow

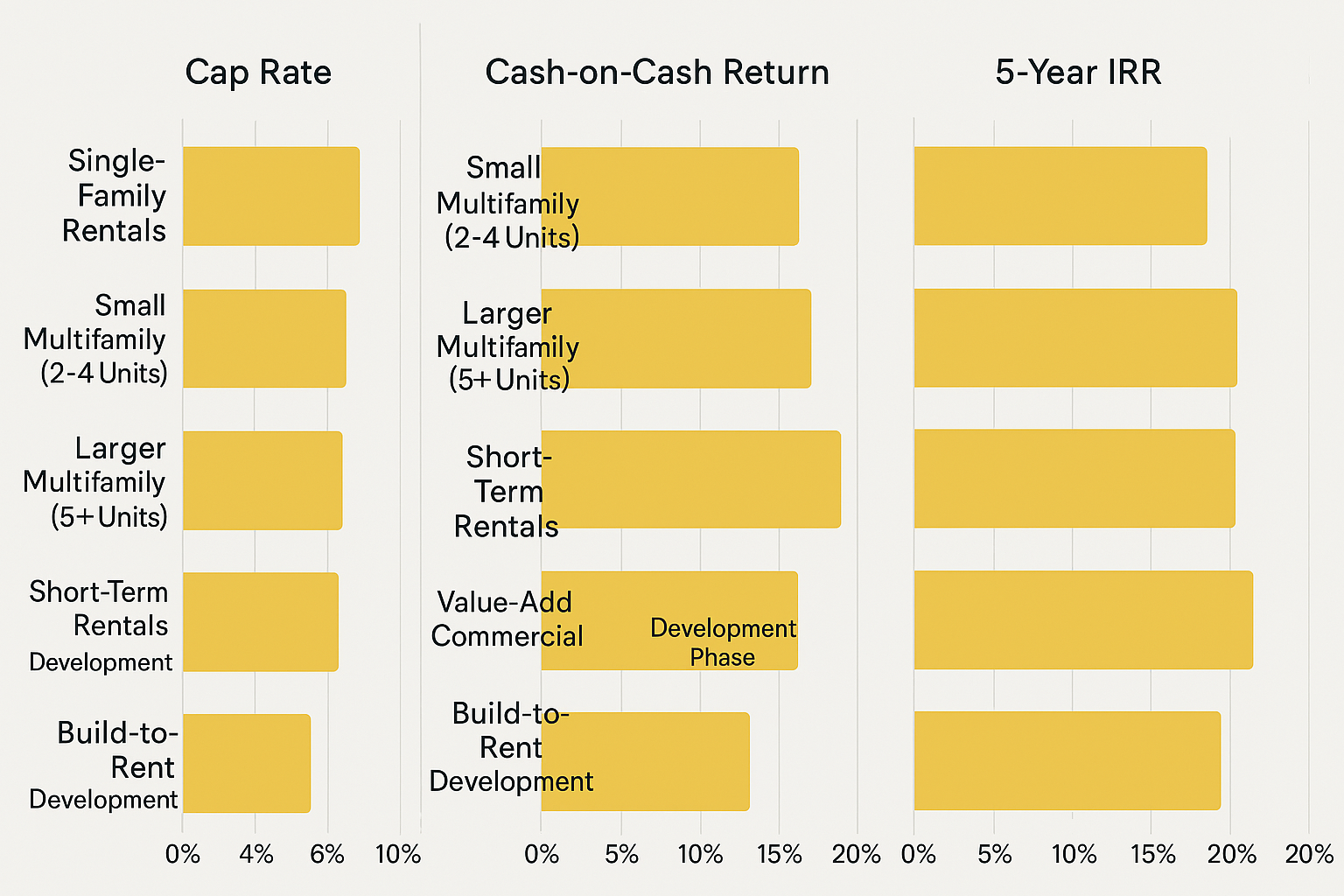

Profitability Comparison by Investment Type

| Investment Type | Typical Cap Rate | Cash-on-Cash Return | 5-Year IRR Potential | Management Complexity |

|---|---|---|---|---|

| Single-Family Rentals | 4.5-6.0% | 8-12% | 10-13% | Moderate |

| Small Multifamily (2-4 Units) | 6.5-8.2% | 9-14% | 12-16% | Moderate-High |

| Larger Multifamily (5+ Units) | 5.0-6.5% | 7-11% | 11-15% | High |

| Short-Term Rentals | 7.0-10.0% | 10-18% | 14-20% | Very High |

| Value-Add Commercial | 8.0-9.5%* | Variable | 15-22% | Very High |

| Build-to-Rent Development | 6.0-7.5% | Development Phase | 13-18% | Very High |

*Upon stabilization after value-add improvements. Data compiled from CoStar, CBRE Research, Builds and Buys proprietary analysis, 2025.

What Real Estate is the Best Investment?

While Section 2 focused on investment types, this section analyzes specific property categories, locations, and asset characteristics that are proving to be superior investments in the current economic environment.

By Property Characteristic: The Winning Attributes

Our analysis reveals that certain property characteristics consistently correlate with stronger investment performance across markets:

- Energy efficiency: Properties with documented energy-efficient features command 4-8% higher rents and sell for 6-9% premiums over comparable conventional properties

- Flexible spaces: Homes with adaptable spaces suitable for home offices, multi-generational living, or potential rental units have appreciated 7-12% faster than comparable single-use properties

- Walkability: Properties in neighborhoods with Walk Scores above 70 have shown 15-20% stronger appreciation compared to car-dependent areas, with this premium increasing post-pandemic

- Technology integration: Smart home features and high-speed connectivity access increasingly influence both rental rates and property values, especially in mid-to-upper market segments

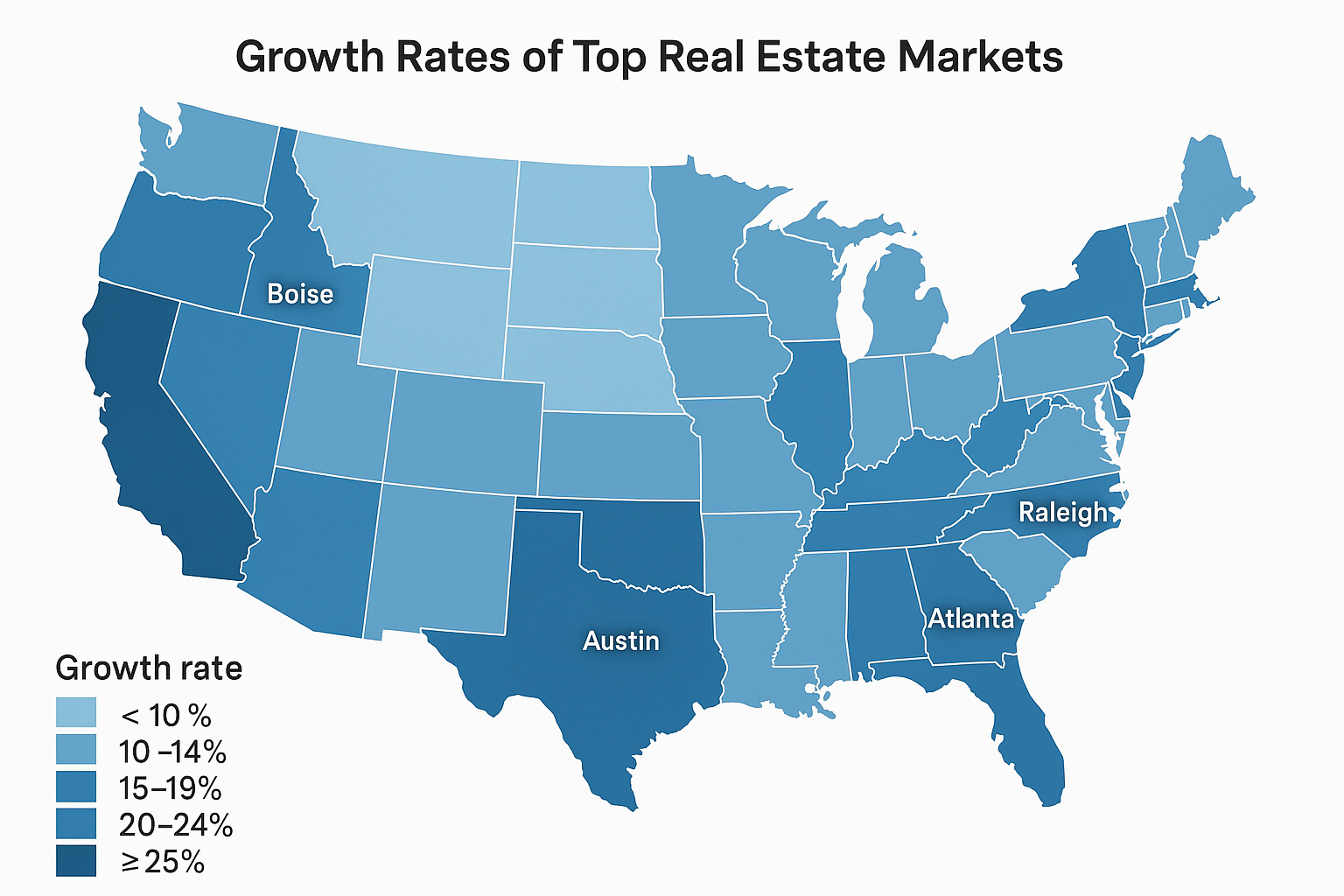

By Location: High-Growth Markets

Location remains the single most significant determinant of real estate investment success. Current data points to several categories of outperforming markets:

- Secondary cities with strong economic fundamentals: Markets like Raleigh-Durham, Nashville, Austin, Salt Lake City, and Boise continue to outperform, driven by job growth, affordability, and quality of life factors

- Revitalizing urban corridors: Specific neighborhoods in cities like Detroit, Cleveland, Baltimore, and St. Louis are experiencing targeted revitalization, offering attractive entry points with strong upside potential

- “Zoom towns” maintaining momentum: Despite some cooling, markets that benefited from remote work migration (Bozeman, MT; Bend, OR; Asheville, NC) continue to outperform national averages

- Climate resilience premium: Areas with lower climate risk profiles are beginning to command measurable premiums as climate adaptation becomes a more significant consideration for both homeowners and investors

By Asset Class: Sector-Specific Opportunities

| Asset Class | Performance Rating | Key Investment Considerations |

|---|---|---|

| Industrial/Logistics | ★★★★★ | Last-mile distribution facilities, cold storage, and flex industrial spaces continue to benefit from e-commerce growth and supply chain reconfiguration |

| Multifamily Housing | ★★★★☆ | Strong fundamentals driven by persistent housing shortage, though performance varies significantly by submarket; Class B value-add opportunities outperforming luxury segment |

| Specialized Healthcare | ★★★★☆ | Medical office buildings, outpatient facilities, and life sciences real estate benefiting from demographic trends and healthcare decentralization |

| Self-Storage | ★★★★☆ | Resilient sector with counter-cyclical elements; oversupply concerns in some markets balanced by technology-driven operational improvements |

| Single-Family Rentals | ★★★★☆ | Strong demand fundamentals from both millennials starting families and downsizing baby boomers; institutional interest creating both opportunities and competition |

| Experiential Retail | ★★★☆☆ | Bifurcated performance: high-quality experiential and necessity-based retail thriving while traditional mall and non-anchor retail continues to struggle |

| Office Space | ★★☆☆☆ | Highly selective opportunities in Class A sustainable buildings in prime locations; significant challenges for older, less adaptable spaces |

The Best Real Estate Investments: A Balanced Approach

For most investors, the “best” real estate investment combines several characteristics:

The Ideal Investment Property Checklist

- Located in a market with strong economic fundamentals (job growth, population growth, income growth)

- Positioned in areas with favorable supply-demand dynamics (limited new construction, high barriers to entry)

- Features that appeal to multiple tenant/buyer demographics to ensure resilience through market cycles

- Opportunity for value-add improvements that increase NOI and property value

- Favorable tax treatment based on ownership structure and investment timeline

- Appropriate leverage that enhances returns while maintaining safety margins for market fluctuations

- Operational efficiency potential through technology implementation or management improvements

For those seeking to optimize for current market conditions, our analysis suggests that small multifamily properties (2-4 units) in growing secondary markets currently offer the optimal balance of cash flow, appreciation potential, management feasibility, and financing accessibility for individual investors.

Which Real Estate Companies are Best for Investment?

The question of which real estate companies are best for investment can be approached from several angles: publicly-traded real estate companies, private investment platforms, and service providers that facilitate direct property investment.

Publicly-Traded Real Estate Investment Trusts (REITs)

REITs offer a liquid way to invest in real estate without direct property ownership. Based on 5-year performance, financial stability, and growth metrics, several stand out across different sectors:

- Industrial REITs: Prologis (PLD) and Rexford Industrial Realty (REXR) have delivered superior returns driven by e-commerce and supply chain reconfiguration

- Specialized Healthcare: Healthpeak Properties (DOC) and Healthcare Realty Trust (HR) benefit from aging demographics and healthcare evolution

- Data Center REITs: Digital Realty Trust (DLR) and Equinix (EQIX) capitalize on cloud computing and AI infrastructure growth

- Residential REITs: Mid-America Apartment Communities (MAA) and Essex Property Trust (ESS) show strength in high-growth markets

- Self-Storage REITs: Extra Space Storage (EXR) and Public Storage (PSA) demonstrate recession-resistant performance with strong dividends

When evaluating REITs for investment, focus on these key metrics:

- Funds From Operations (FFO): More meaningful than EPS for REITs; look for consistent growth

- Adjusted Funds From Operations (AFFO): Accounts for capital expenditures; closer to actual free cash flow

- Dividend coverage ratio: Ensures sustainability of distributions; prefer ratios above 1.2x

- Debt-to-EBITDA: Lower ratios indicate better ability to weather economic downturns

- Geographic concentration: Exposure to high-growth markets typically drives outperformance

Private Real Estate Investment Platforms

For accredited investors seeking more direct exposure without full property management responsibilities, several private platforms have established strong track records:

| Platform | Investment Minimum | Property Types | Historical Returns | Key Differentiators |

|---|---|---|---|---|

| Fundrise | $10,000 | Multifamily, Commercial, SFR | 8-12% annualized | Vertically integrated development; lower minimums |

| CrowdStreet | $25,000 | Commercial, Multifamily | 10-18% IRR (targeted) | Individual deal selection; direct sponsor relationships |

| Equity Multiple | $10,000-$30,000 | Commercial, Value-Add | 12-20% IRR (targeted) | Institutional-quality due diligence; preferred equity options |

| Arrived Homes | $100-$200 | Single-Family Rentals | 7-9% (dividends + appreciation) | Fractional SFR ownership; non-accredited investor access |

| Roofstock | Property Purchase | Single-Family Rentals | Varies by property | Full ownership with turnkey management options |

Note: Historical returns are not guarantees of future performance. Data compiled from company disclosures and third-party reviews, 2025.

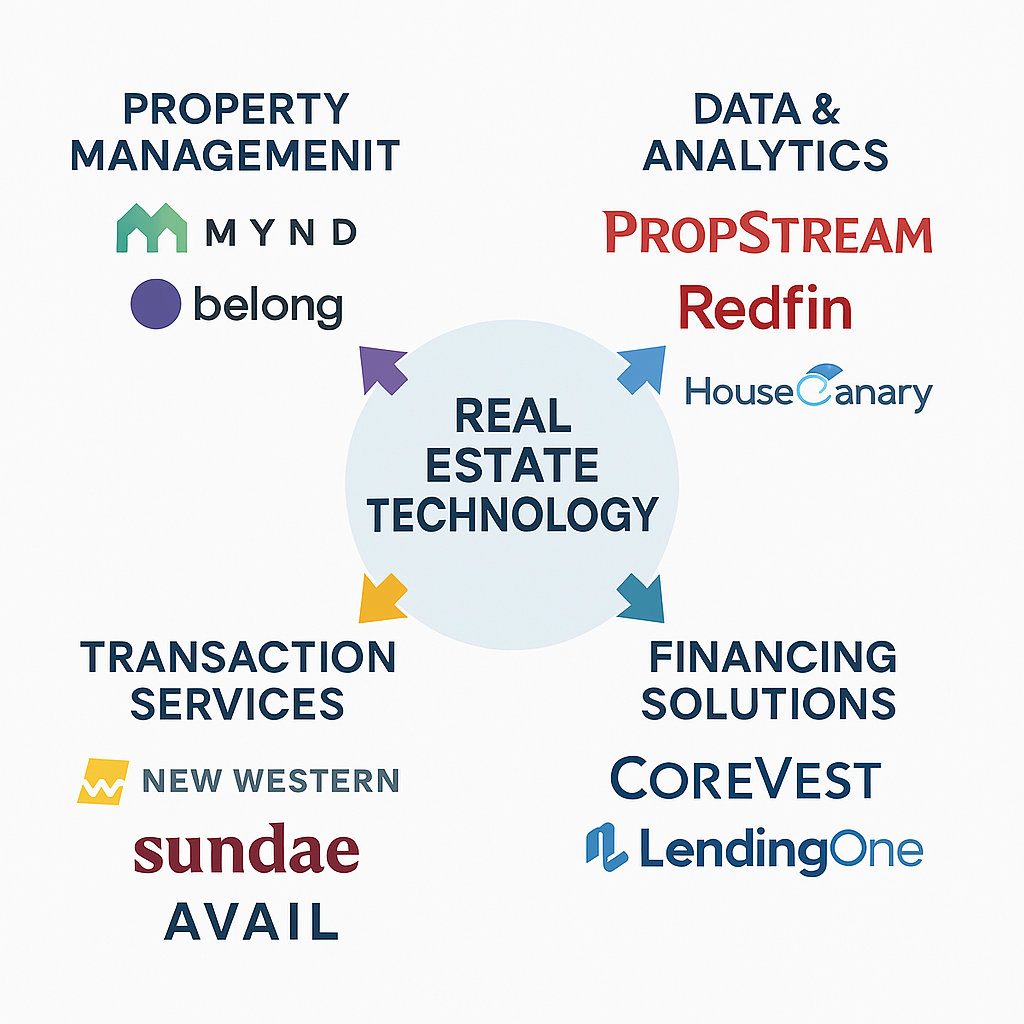

Service Providers for Direct Real Estate Investors

For those pursuing direct property ownership, several companies stand out for facilitating successful investments:

- Property Management: Companies like Mynd Property Management and Belong have revolutionized the rental property experience with technology-driven platforms that reduce costs while improving tenant retention

- Data and Analytics: PropStream, Redfin, and HouseCanary provide investors with sophisticated market analysis tools that were previously only available to institutions

- Financing Solutions: Lenders like CoreVest and LendingOne specialize in investor-friendly loan products tailored for different strategies from BRRRR to fix-and-flip

- Transaction Services: Companies like New Western Acquisitions and Sundae connect investors with off-market properties, while platforms like Avail simplify the leasing process

Choosing the Right Real Estate Investment Company: Key Considerations

When selecting a real estate investment company or platform, prioritize these factors:

- Track record: Verified historical performance across multiple market cycles

- Fee transparency: Clear documentation of all fees including management, transaction, and performance fees

- Investment alignment: Management/sponsor having significant personal capital invested alongside investors

- Due diligence processes: Rigorous property and market analysis methodology

- Reporting quality: Comprehensive, transparent, and regular investor communications

- Exit strategy clarity: Well-defined approaches to liquidating investments and distributing returns

- Tech integration: Modern platforms that provide real-time portfolio visibility and performance metrics

Ultimately, the “best” real estate company for investment depends on your specific goals, capital resources, desired level of involvement, and risk tolerance. Many successful investors utilize multiple approaches—combining REITs for liquidity, private platforms for diversification, and direct ownership for maximum control and potential returns.

Step-by-Step Guide to Successful Real Estate Investing

CopySuccessful real estate investing requires a methodical approach. Based on our analysis of thousands of investor journeys, we’ve developed the following framework to guide both new and experienced investors.

Phase 1: Foundation and Education

-

Define your investment strategy and goals:

- Determine your primary objectives (cash flow, appreciation, tax benefits, portfolio diversification)

- Establish clear metrics for success (target returns, hold period, exit strategy)

- Assess your risk tolerance and time commitment realistically

-

Build your knowledge base:

- Master fundamental concepts (cap rates, cash-on-cash return, IRR, debt service coverage ratio)

- Understand property valuation methodologies specific to your target asset class

- Learn the tax implications and advantages of real estate investing

-

Organize your financial foundation:

- Optimize your credit profile (aim for 740+ for best financing terms)

- Structure appropriate business entities with professional guidance

- Establish relationships with potential financing sources

- Build investment reserves beyond down payment funds

Phase 2: Market Selection and Analysis

-

Research target markets:

- Analyze economic indicators (job growth, population growth, income trends)

- Evaluate housing supply-demand dynamics (permit activity, vacancy rates, days on market)

- Assess landlord-tenant laws and regulatory environment

- Consider climate resilience and natural disaster risk

-

Narrow focus to specific submarkets:

- Identify neighborhoods with positive transition indicators

- Map proximity to employment centers, transportation, and amenities

- Analyze school quality and crime statistics at the micro level

- Evaluate rent-to-price ratios and historical appreciation patterns

-

Build your local market team:

- Connect with investor-focused real estate agents

- Interview property managers with experience in your target asset class

- Establish relationships with contractors, inspectors, and appraisers

- Consult with a real estate attorney familiar with local regulations

Phase 3: Acquisition and Optimization

-

Develop disciplined property acquisition criteria:

- Establish non-negotiable property requirements

- Create a standardized analysis spreadsheet for consistent evaluation

- Set clear maximum purchase prices based on target return metrics

- Determine your “walk away” thresholds before starting negotiations

-

Implement systematic deal sourcing:

- Develop direct marketing campaigns for off-market opportunities

- Build relationships with wholesalers and property scouts

- Create automated alerts from multiple listing services

- Network with other investors for potential partnerships and referrals

-

Conduct thorough due diligence:

- Perform comprehensive property inspections with specialists

- Review all property records, permits, and violation history

- Verify all income and expense information with documentation

- Analyze comparable sales and rentals from multiple sources

- Assess renovation costs with contractor bids rather than estimates

-

Optimize property performance:

- Implement strategic improvements that maximize ROI

- Develop systems for efficient tenant screening and selection

- Create preventative maintenance schedules to reduce long-term costs

- Optimize rental rates through regular market analysis

- Consider additional income streams (storage, laundry, premium amenities)

Phase 4: Portfolio Scaling and Wealth Building

-

Implement tax optimization strategies:

- Maximize depreciation benefits through cost segregation studies

- Utilize 1031 exchanges for tax-deferred growth

- Explore opportunity zone investments for applicable situations

- Consider real estate professional status for tax benefits if appropriate

-

Develop a portfolio growth strategy:

- Determine optimal debt-to-equity ratios for your risk profile

- Create criteria for refinancing or selling existing properties

- Establish a systematic capital recycling approach

- Consider scaling through larger properties or portfolio acquisitions

-

Build operational efficiency:

- Implement property management technology solutions

- Develop standardized operating procedures for all aspects of management

- Create accountability systems for all team members and service providers

- Establish key performance indicators (KPIs) to track portfolio health

-

Plan for long-term wealth preservation:

- Develop estate planning strategies for efficient wealth transfer

- Create a liability protection framework

- Build diversification across markets and property types

- Establish regular portfolio review protocols

The Builds and Buys Success Framework™

Our research into the most successful real estate investors reveals a common pattern that can be summarized as:

- Begin with education and clear goals

- Understand market fundamentals thoroughly

- Invest based on numbers, not emotions

- Leverage expertise through strategic partnerships

- Develop systems for consistent execution

- Scale methodically with proven models

This framework has guided investors from single properties to portfolios worth tens of millions with remarkably consistent results.

Comparative Analysis: Real Estate vs. Other Investment Classes

CopyTo make informed allocation decisions, investors should understand how real estate performs compared to other major asset classes across various dimensions. This section provides a comprehensive comparative analysis based on current market data and historical performance patterns.

Return Comparison Across Asset Classes

| Asset Class | 10-Year Average Annual Return (2015-2025) | 5-Year Average Annual Return (2020-2025) | Standard Deviation (Volatility) | Best Year in Last Decade | Worst Year in Last Decade |

|---|---|---|---|---|---|

| High Growth, Low Inflation | Strong | Very Strong | Moderate | Weak | Weak |

| High Growth, High Inflation | Very Strong | Moderate | Weak | Strong | Weak |

| Low Growth, Low Inflation | Moderate | Moderate | Strong | Weak | Moderate |

| Low Growth, High Inflation | Moderate | Weak | Very Weak | Very Strong | Moderate |

| Recession | Weak | Very Weak | Strong | Weak | Strong |

| Recovery | Strong | Very Strong | Moderate | Strong | Weak |

Performance assessments based on historical data from 1970-2025. Source: BlackRock Investment Institute, CBRE Research, 2025.

Optimal Portfolio Allocation: The Case for Real Estate

Modern portfolio theory suggests that real estate deserves substantial allocation in well-diversified portfolios. While specific allocations should be tailored to individual circumstances, research indicates that optimal portfolios typically include 15-25% allocated to real estate assets, with that percentage potentially higher for investors seeking income or inflation protection.

According to a comprehensive study by Vanguard and the Wharton School of Business, adding direct real estate exposure to a traditional 60/40 stock/bond portfolio has historically improved risk-adjusted returns across most time periods analyzed. The study found that a 20% allocation to real estate (reducing stocks and bonds proportionally) increased returns by an average of 0.8 percentage points annually while reducing portfolio volatility by 1.2 percentage points.

Key Takeaways: Real Estate in the Investment Landscape

- Return profile: Real estate delivers competitive total returns with a more favorable risk-adjusted return profile than many alternatives

- Income advantage: Few other asset classes match real estate’s combination of yield and growth potential

- Inflation protection: Real estate remains one of the most effective inflation hedges available to investors

- Portfolio effects: The relatively low correlation with stocks and bonds provides meaningful diversification benefits

- Control factor: Direct real estate investment offers a level of control and value-add potential unmatched by other asset classes

- Tax efficiency: Real estate’s favorable tax treatment significantly enhances after-tax returns compared to many alternatives

Expert Insight

“While many investors focus exclusively on expected returns, the true power of real estate in a portfolio comes from its unique combination of current income, appreciation potential, tax benefits, and correlation advantages. The current market environment, characterized by persistent inflation concerns and heightened market volatility, particularly highlights these benefits.”

— Dr. Peter Linneman, Wharton School of Business

Common Pitfalls and How to Avoid Them

CopyEven experienced real estate investors can fall victim to common mistakes that undermine returns and increase risk. This section identifies the most frequent pitfalls and provides practical strategies to avoid them.

1. Inadequate Market Research

The Pitfall

Many investors make decisions based on national trends or generalized advice without understanding the specific dynamics of their target market. Real estate is fundamentally local, with performance varying dramatically even between neighborhoods in the same city.

The Solution

Develop a systematic approach to market analysis including:

- Track at least 3-5 years of historical data for key metrics (price trends, rent growth, vacancy rates)

- Analyze supply indicators (building permits, development pipeline, land availability)

- Research employment trends by industry and income level

- Consult multiple local sources including property managers, appraisers, and economic development offices

2. Underestimating Expenses

The Pitfall

Overly optimistic expense projections are among the most common reasons investments underperform. Many investors fail to account for capital expenditures, management costs, vacancy, and other operational expenses.

The Solution

- Use the 50% rule as a preliminary screening tool (operating expenses typically run 40-60% of gross income)

- Create detailed capital expenditure reserves based on property age and condition (typically 5-15% of gross rents)

- Include realistic vacancy factors based on local market conditions (minimum 5% even in strong markets)

- Verify all expense assumptions with third-party property managers and local investors

- Stress-test investment returns with 15-20% higher expenses than initially projected

3. Overleveraging

The Pitfall

Excessive leverage magnifies returns in appreciating markets but can lead to catastrophic losses during downturns. The 2008 financial crisis demonstrated how overleveraged investors can face foreclosure even with relatively modest market corrections.

The Solution

- Maintain a minimum Debt Service Coverage Ratio (DSCR) of 1.25 or higher

- Keep overall portfolio Loan-to-Value (LTV) ratios below 70%

- Build liquidity reserves equal to at least 6 months of debt service for each property

- Stress-test investments against 2% higher interest rates and 10% lower rents

- Consider fixed-rate financing for at least a portion of your portfolio

4. Poor Risk Management

The Pitfall

Many investors fail to adequately protect themselves from predictable risks including liability claims, property damage, tenant issues, economic downturns, and regulatory changes.

The Solution

- Implement proper entity structures with guidance from an attorney experienced in real estate investing

- Maintain comprehensive insurance including general liability, property, umbrella policies, and rent loss coverage

- Develop robust tenant screening procedures and legally compliant lease agreements

- Diversify across multiple markets and property types when portfolio size permits

- Stay informed about regulatory changes affecting landlords in your investment jurisdictions

5. Ineffective Property Management

The Pitfall

Poor property management can transform otherwise good investments into financial drains through higher vacancy, excessive maintenance costs, tenant issues, and legal problems.

The Solution

- For self-management: develop systems for tenant screening, maintenance, rent collection, and legal compliance

- For professional management: thoroughly vet companies through references, track record, technology usage, and fee structures

- Establish clear key performance indicators (KPIs) and review them monthly

- Implement regular property inspections regardless of management approach

- Stay informed on landlord-tenant law and fair housing requirements

6. Emotional Decision-Making

The Pitfall

Real estate investing decisions are often influenced by emotional factors including FOMO (fear of missing out), overconfidence, personal preferences, and confirmation bias, leading to poor investment choices.

The Solution

- Develop a written investment strategy with specific criteria before beginning property search

- Create standardized analysis tools that provide consistent evaluation metrics

- Establish non-negotiable minimum return requirements

- Seek objective third-party perspectives on potential investments

- Allow cooling-off periods before making major investment decisions

- Focus on data rather than anecdotes or market hype

7. Insufficient Due Diligence

The Pitfall

Inadequate investigation before purchase can result in unexpected issues ranging from structural problems and environmental contamination to title defects and zoning violations.

The Solution

Implement a comprehensive due diligence checklist including:

- Professional property inspections with specialized assessments as needed (foundation, roof, HVAC, environmental)

- Thorough title examination with appropriate title insurance

- Verification of all financial information with original source documents

- Comprehensive zoning and permit research

- Review of all existing contracts, leases, and service agreements

- Verification of utility costs, property tax assessments, and insurance quotes

8. Tax Strategy Oversights

The Pitfall

Failing to implement proper tax strategies can significantly reduce real estate investment returns. Many investors miss legitimate deductions, depreciation benefits, and tax-deferral opportunities.

The Solution

- Work with a tax professional specializing in real estate investing

- Consider cost segregation studies to accelerate depreciation benefits

- Maintain meticulous records of all expenses and improvements

- Understand and properly implement 1031 exchange strategies for disposition

- Evaluate the potential benefits of real estate professional status

- Review entity structure regularly to ensure optimal tax treatment

Common Pitfalls by Investor Type

| Investor Type | Most Common Pitfalls | Risk Mitigation Strategies |

|---|---|---|

| First-Time Investors | Underestimating expenses, inadequate cash reserves, poor property selection, DIY management problems | Start with house hacking or turnkey properties, join local investor groups, build significant cash reserves, consider professional management |

| Scaling Investors (5-15 properties) |

Overleveraging, inefficient operations, inconsistent systems, inadequate entity structure | Develop portfolio management systems, right-size leverage, build professional team, implement technology solutions |

| Portfolio Investors (15+ properties) |

Asset concentration risk, management complexity, succession planning gaps, tax inefficiencies | Geographic diversification, professional asset management, comprehensive estate planning, sophisticated tax strategies |

| Fix-and-Flip Investors | Budget overruns, schedule delays, overimprovement, market timing risks | Conservative underwriting with 20%+ contingencies, reliable contractor relationships, data-driven improvement decisions |

| Syndication Investors | Inadequate sponsor due diligence, fee misalignment, unrealistic projections, liquidity constraints | Focus on sponsor track record across market cycles, verify alignment of interests, stress-test investment projections |

The Red Flag Checklist

Be particularly cautious when encountering these warning signs:

- Projected returns significantly higher than market averages without clear value-add components

- Pressure to make quick decisions without adequate time for due diligence

- Inability to verify key financial or property condition information with original source documents

- Excessive fees or unusual compensation structures in investment partnerships

- Properties with deferred maintenance being sold as “turnkey” or “hands-off”

- Investments requiring 90%+ leverage to deliver projected returns

- Markets with significant overbuilding relative to population and job growth

- Investment strategies based primarily on anticipated regulatory changes or speculative market timing

While real estate investing offers tremendous wealth-building potential, successful investors distinguish themselves not just by identifying opportunities but by systematically avoiding these common pitfalls. By implementing the protective strategies outlined above, investors can significantly improve their probability of success across market cycles.

Conclusion: Building Wealth Through Strategic Real Estate Investment

CopyReal estate remains a powerful vehicle for building wealth in 2025, but successful investing requires more nuance, research, and strategic planning than in previous decades. The current market environment presents both exciting opportunities and meaningful challenges that reward informed, disciplined investors while potentially punishing those who fail to adapt to evolving conditions.

As this comprehensive analysis has demonstrated, the most profitable real estate investments share several characteristics: they are located in markets with strong economic fundamentals, offer opportunities for operational or physical improvements, benefit from favorable supply-demand dynamics, and are structured to maximize both tax and leverage advantages.

Whether you’re a first-time investor considering your initial property purchase or an experienced investor scaling your portfolio, focusing on these fundamentals while avoiding the common pitfalls we’ve outlined will significantly improve your probability of success. By approaching real estate investment as a business—with clear systems, disciplined analysis, and strategic planning—you can harness its unparalleled potential for building long-term wealth and financial freedom.

Start Your Real Estate Investment Journey

Ready to build your real estate investment portfolio? Builds and Buys offers comprehensive resources, market analysis, and investment tools to help you succeed. Visit BuildsAndBuys.com for free investment calculators, market reports, and educational resources.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.