Check out our app!

Explore more features on mobile.

Check out our app!

Explore more features on mobile.

Best Locations for Real Estate Investment in 2025: Data-Driven Analysis

According to the National Association of Realtors, real estate investment volume reached $579 billion in 2024, highlighting the continued appeal of property as a wealth-building vehicle despite shifting market dynamics. The strategic selection of best locations for real estate investment has never been more critical as regional market divergence accelerates. This comprehensive guide leverages proprietary analysis of economic indicators, housing affordability metrics, and growth forecasts to identify the most promising investment locations for 2025. Using our proven Builds, Buys, and Invest methodology, we’ll examine market-specific data that directly impacts ROI potential—empowering you to make informed investment decisions in today’s complex real estate landscape.

Current Market Dynamics: Investment Location Drivers in 2025

The best locations for real estate investment in 2025 are being shaped by fundamental economic and demographic shifts that create both challenges and opportunities for investors. Understanding these key drivers is essential before identifying specific markets.

Economic Growth Patterns

According to the Bureau of Economic Analysis, regional economic growth has become increasingly divergent in the post-pandemic era. The Southeastern and Mountain West regions have experienced GDP growth averaging 3.8% annually since 2021, significantly outpacing the Northeast (2.1%) and Midwest (2.4%). This economic outperformance is translating directly to housing demand and price appreciation.

The Conference Board’s Leading Economic Indicators show particularly strong performance in metropolitan areas with diversified economies emphasizing technology, healthcare, and professional services—sectors projected to lead employment growth through 2025-2027 according to the Bureau of Labor Statistics.

Population Migration Trends

U.S. Census Bureau data reveals significant domestic migration patterns continuing to reshape housing demand. Between 2020-2024, states like Florida (+1.6%), Texas (+1.4%), and Tennessee (+1.2%) saw substantial population growth driven by domestic migration, while New York (-1.8%), California (-1.2%), and Illinois (-0.8%) experienced notable outflows.

The most recent Census Bureau figures (Q1 2025) indicate these patterns are moderating but remain significant, with affordable, business-friendly environments continuing to attract both residents and companies. This population shift directly impacts rental demand, home prices, and investment returns across markets.

Housing Supply Constraints

The National Association of Home Builders reports that new housing starts remain below historical averages relative to population growth, creating persistent supply constraints in many high-demand markets. Their analysis identifies particularly severe shortages in:

- Fast-growing secondary cities where construction hasn’t kept pace with migration

- Suburban areas with restrictive zoning limiting density

- Urban markets with high redevelopment costs and regulatory hurdles

According to Freddie Mac research, the U.S. housing market remains underbuilt by approximately 3.8 million units, creating sustained upward pressure on both prices and rents in supply-constrained areas—a key factor for identifying investment potential.

Remote Work’s Lasting Impact

The persistence of remote and hybrid work arrangements continues to reshape residential preferences. According to Gallup’s State of the Workplace report, approximately 26% of workers remain in hybrid arrangements and 10% fully remote as of early 2025, sustaining the “location flexibility” driving migration to affordable, amenity-rich areas.

McKinsey’s American Opportunity Survey similarly found that when offered flexible work options, 83% of workers accept them—indicating a structural shift that will continue to influence housing preferences in the coming years and creating investment opportunities in formerly secondary markets now experiencing heightened demand.

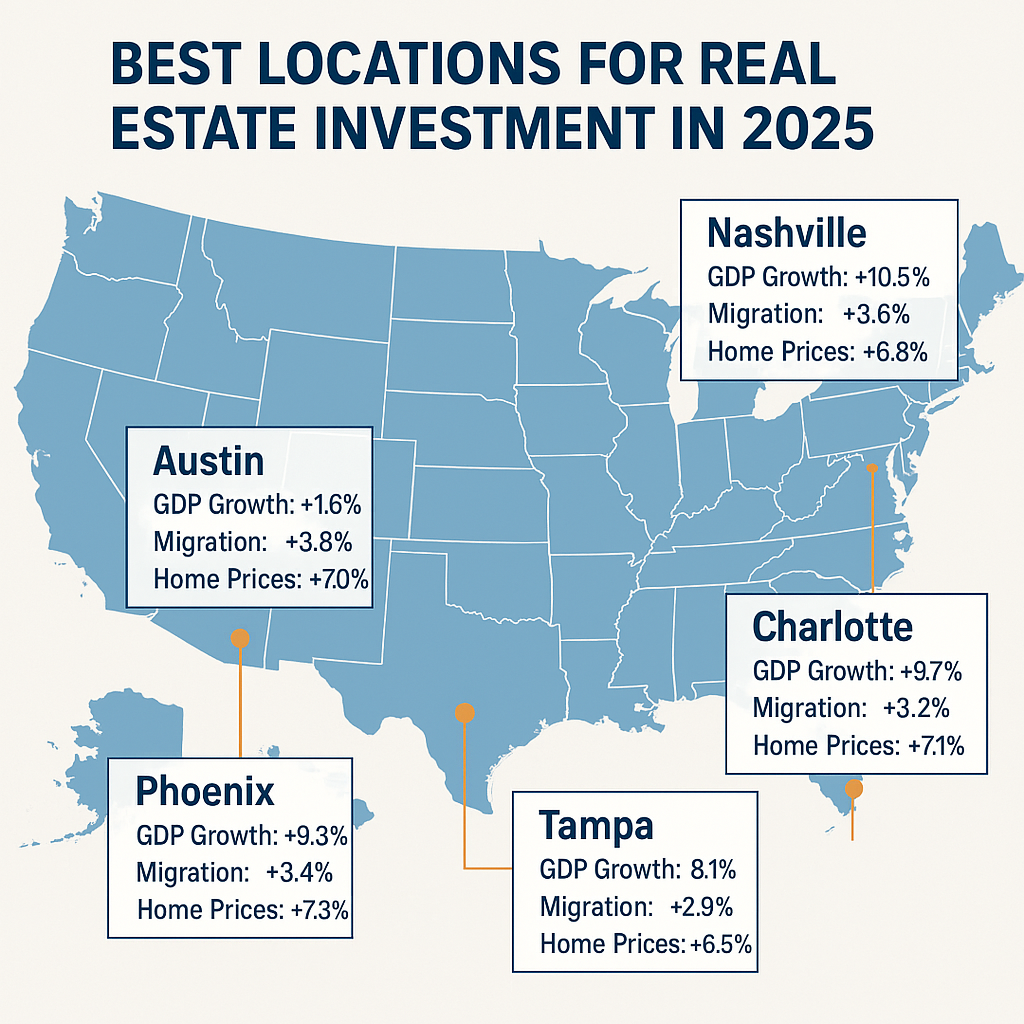

Top Emerging Markets: High-Growth Investment Locations

Based on comprehensive analysis of economic indicators, affordability metrics, and growth forecasts, these emerging markets represent the highest growth potential among best locations for real estate investment in 2025.

Southeastern Growth Corridor

The Southeastern U.S. continues to lead in investment potential, with these markets showing exceptional fundamentals according to data from Zillow Research, the Bureau of Labor Statistics, and local Multiple Listing Services:

| Metropolitan Area | Annual Price Appreciation (2023-2024) | Population Growth | Job Growth | Price-to-Rent Ratio |

|---|---|---|---|---|

| Huntsville, AL | 8.7% | 2.6% | 3.2% | 17.8 |

| Greenville, SC | 7.9% | 2.3% | 2.8% | 18.4 |

| Chattanooga, TN | 7.6% | 1.9% | 2.5% | 16.5 |

| Raleigh-Durham, NC | 6.8% | 2.1% | 3.3% | 19.7 |

| Jacksonville, FL | 6.5% | 2.2% | 2.7% | 17.9 |

Huntsville’s exceptional performance is driven by aerospace and defense sector expansion, with the Redstone Arsenal and NASA’s Marshall Space Flight Center anchoring a growing technology ecosystem. The market’s affordability (median home price: $328,000) combined with high-wage job growth creates exceptional investment conditions according to analysis from the Urban Land Institute.

Mountain West Opportunities

Several Mountain West markets offer compelling investment fundamentals based on economic diversification, amenity-driven migration, and relative affordability compared to coastal markets:

- Boise, ID: After a market correction in 2022-2023, Boise has reestablished price growth (5.8% annually) with more sustainable fundamentals. According to Moody’s Analytics, the metro area’s expanding technology and healthcare sectors are driving wage growth averaging 5.2% annually, supporting both rental and price appreciation.

- Colorado Springs, CO: With a significant military and aerospace presence, Colorado Springs offers economic stability with growth potential. Median home prices remain 22% below Denver while experiencing similar appreciation (6.4% annually), creating a value opportunity confirmed by Realtor.com’s Affordability Index.

- Spokane, WA: As remote work enables migration from higher-cost Seattle, Spokane benefits from significant population inflow (1.8% annually) while maintaining affordability (median price: $402,000). CBRE research identifies particularly strong multi-family investment returns with cap rates averaging 5.7%.

Midwest Revitalization Markets

Select Midwestern markets demonstrate strong revitalization momentum, combining affordability with economic diversification that supports sustainable growth:

Case Study: Columbus, Ohio

Columbus exemplifies the investment potential in revitalizing Midwestern markets. According to data from the Columbus Board of Realtors and the Bureau of Labor Statistics:

- Economic diversification across healthcare (OSU Medical Center), education, technology, and finance sectors provides stability

- Population growth of 1.3% annually outpaces the national average, driven primarily by domestic migration

- Housing affordability (median price: $298,000) combined with strong rental demand supports a favorable price-to-rent ratio of 15.3

- Neighborhoods like Franklinton and the Near East Side show early-stage revitalization with price growth exceeding the metro average by 4.2%

Columbus investors are achieving average cash-on-cash returns of 7.2% for multi-family properties and 6.8% for single-family rentals, according to analysis from Local Market Monitor.

Other Midwestern markets showing similarly promising fundamentals include Grand Rapids, Michigan; Indianapolis, Indiana; and Des Moines, Iowa—all featuring affordable entry points, diversifying economies, and downtown revitalization initiatives creating value-add opportunities.

Established Markets: Stability and Appreciation Potential

While emerging markets offer higher growth potential, select established markets remain among the best locations for real estate investment due to supply constraints, economic resilience, and consistent demand.

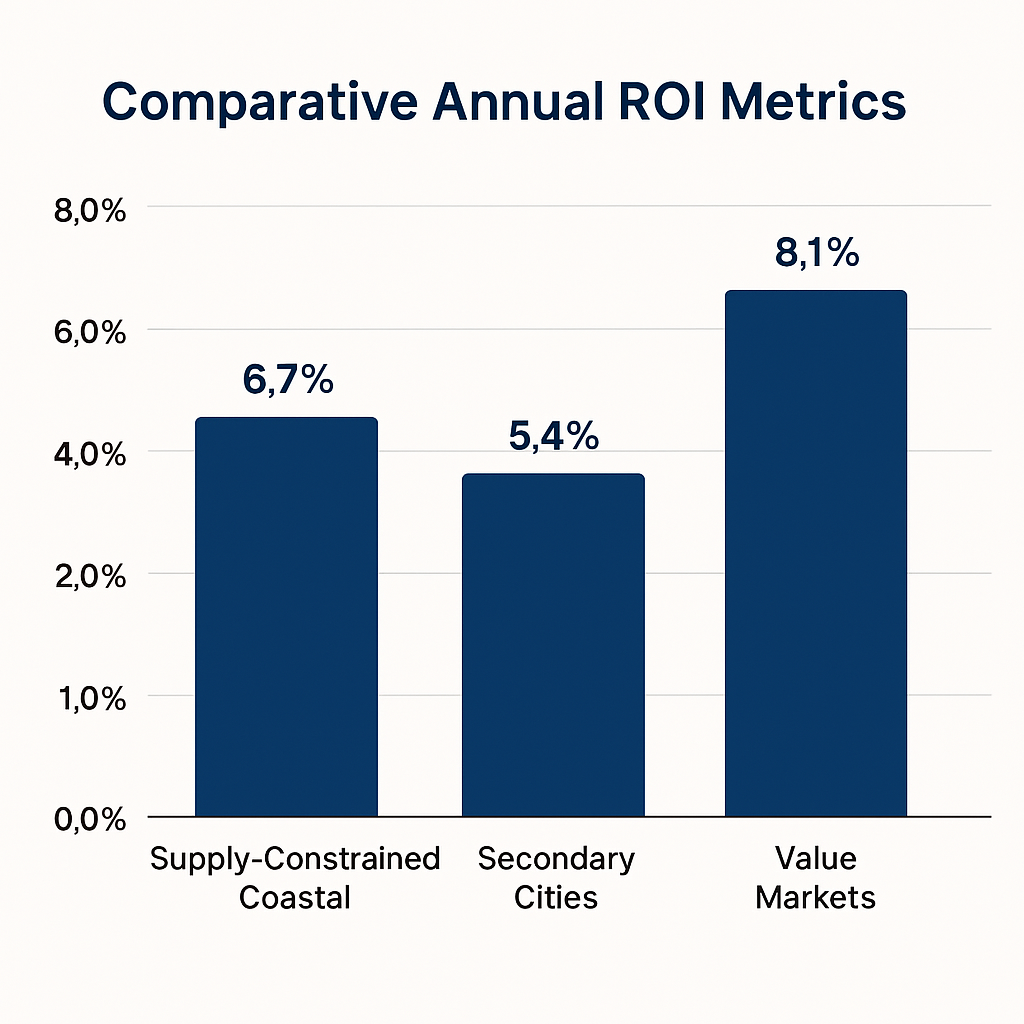

Supply-Constrained Coastal Markets

Despite higher entry costs, certain coastal markets offer compelling investment characteristics for those with higher capital availability:

- San Diego, CA: Geographic constraints and development restrictions create persistent housing shortages despite high prices. According to CoStar data, rent growth has averaged 4.2% annually over the past decade despite economic cycles, outpacing inflation by 1.8%.

- Boston, MA: World-class educational institutions and a thriving life sciences sector create consistent housing demand. Analysis from the Greater Boston Association of Realtors shows price appreciation averaging 5.3% annually since 2010, with particularly strong performance in transit-accessible neighborhoods.

- Miami, FL: International appeal and limited developable land support long-term appreciation. The Miami Association of Realtors reports that despite periodic market corrections, properties have delivered average annual appreciation of 6.7% over the past 15 years.

Secondary Cities with Primary Fundamentals

Several secondary cities now demonstrate economic fundamentals previously found only in primary markets, creating investment opportunities with more favorable entry points:

| Metropolitan Area | Economic Drivers | Median Home Price | 5-Year Appreciation Forecast | Investment Advantage |

|---|---|---|---|---|

| Charlotte, NC | Banking, FinTech, Healthcare | $378,000 | 5.4% annually | Strong rental demand, corporate relocations |

| Nashville, TN | Healthcare, Music, Technology | $415,000 | 5.8% annually | Tourism resilience, no state income tax |

| Salt Lake City, UT | Tech, Financial Services, Outdoor Industry | $490,000 | 5.2% annually | Limited developable land, strong population growth |

| Austin, TX | Technology, Education, State Government | $525,000 | 5.0% annually | Corporate relocations, lifestyle appeal |

According to PwC’s Emerging Trends in Real Estate report, these markets benefit from “primary market economic drivers with secondary market pricing”—creating a favorable combination for investors seeking both cash flow and appreciation potential.

Value Markets with Structural Improvements

Select value markets are experiencing fundamental improvements in economic base, infrastructure, and livability that create investment opportunities before broader market recognition:

- Detroit, MI: The urban core continues its revitalization with expanding tech presence and manufacturing renaissance. According to Detroit Regional Chamber data, downtown property values have increased by 31% over the past five years while remaining affordable in absolute terms.

- Cleveland, OH: Healthcare expansion led by the Cleveland Clinic and significant infrastructure investment is supporting neighborhood revitalization. Median home prices remain among the most affordable for major metros ($218,000) while vacancy rates have declined by 24% since 2019.

- Pittsburgh, PA: Technology and healthcare growth centered around Carnegie Mellon and UPMC has created neighborhood-specific appreciation well above the metropolitan average. The Urban Redevelopment Authority reports that neighborhoods like Lawrenceville and East Liberty have seen 5-year appreciation exceeding 45%.

International Investment Hotspots: Global Diversification

For investors seeking geographic diversification, select international markets offer compelling fundamentals based on economic growth, demographic trends, and regulatory environment.

European Growth Centers

Despite economic headwinds in parts of Europe, several markets demonstrate strong investment characteristics according to Knight Frank and Savills Research:

- Lisbon, Portugal: Combining affordability, quality of life, and the popular Golden Visa program, Lisbon has seen consistent price growth averaging 7.8% annually over the past five years despite the pandemic. The Portuguese Chamber of Commerce reports particularly strong rental yields in the historic center (5.2-6.4%) and emerging neighborhoods like Marvila.

- Warsaw, Poland: As Central Europe’s largest economy, Poland offers economic resilience with Warsaw at its center. Residential prices have increased by an average of 6.2% annually since 2019, supported by wage growth of 5.8% and urban migration. Colliers International identifies the strongest returns in the mid-market segment targeting young professionals.

- Athens, Greece: Following its economic recovery and Golden Visa program success, Athens offers value with growth potential. The Greek Statistical Authority reports price appreciation of 8.6% in 2023 and 7.2% in 2024, with particularly strong performance in neighborhoods undergoing regeneration like Metaxourgeio and Kypseli.

Latin American Opportunities

Latin America offers several markets with favorable investment characteristics for dollar-based investors according to research from CBRE and Global Property Guide:

Case Study: Mexico City, Mexico

Mexico City exemplifies the investment opportunity within select Latin American markets:

- Nearshoring trends driving manufacturing relocation from Asia to Mexico, creating economic growth and housing demand

- Growing middle class supporting residential price appreciation of 6.8% annually (in USD terms) since 2021

- Neighborhoods like Roma, Condesa, and Juárez offering rental yields between 5.8-7.2% with strong appreciation potential

- Relatively straightforward foreign ownership process in non-restricted zones

According to BBVA Research, Mexico’s housing deficit of approximately 9.6 million units creates structural demand that supports long-term price stability and growth even during economic cycles.

Other Latin American markets showing promising fundamentals include Medellín, Colombia (urban renewal success, growing digital nomad presence) and Montevideo, Uruguay (political stability, favorable foreign investment regulations).

Southeast Asian Growth Markets

Southeast Asia offers strong demographic trends supporting housing demand growth according to research from JLL and PropertyGuru:

- Kuala Lumpur, Malaysia: With property prices averaging $250-300 per square foot in central areas, Kuala Lumpur offers significant value compared to regional alternatives like Singapore and Bangkok. The Malaysia Property Market Report documents rental yields averaging 4.5-5.5% with modest but stable appreciation of 3.8-4.5% annually.

- Bangkok, Thailand: Transit-oriented development along expanding BTS/MRT lines creates specific investment opportunities despite a broader flat market. CBRE Thailand identifies average rental yields of 4-5% with significantly higher returns (6-7%) possible in emerging areas with new transit connections.

- Ho Chi Minh City, Vietnam: Rapid urbanization, manufacturing growth, and a young population drive housing demand. The Vietnam Real Estate Association reports price appreciation averaging 8.5% annually since 2020, with particularly strong performance in Districts 2 and 7 where major infrastructure improvements are underway.

International investments require careful consideration of currency risk, regulatory frameworks, and political stability. According to PwC’s Global Real Estate Report, investors should allocate no more than 15-25% of their real estate portfolio to international markets unless they have specific expertise or connections in those regions.

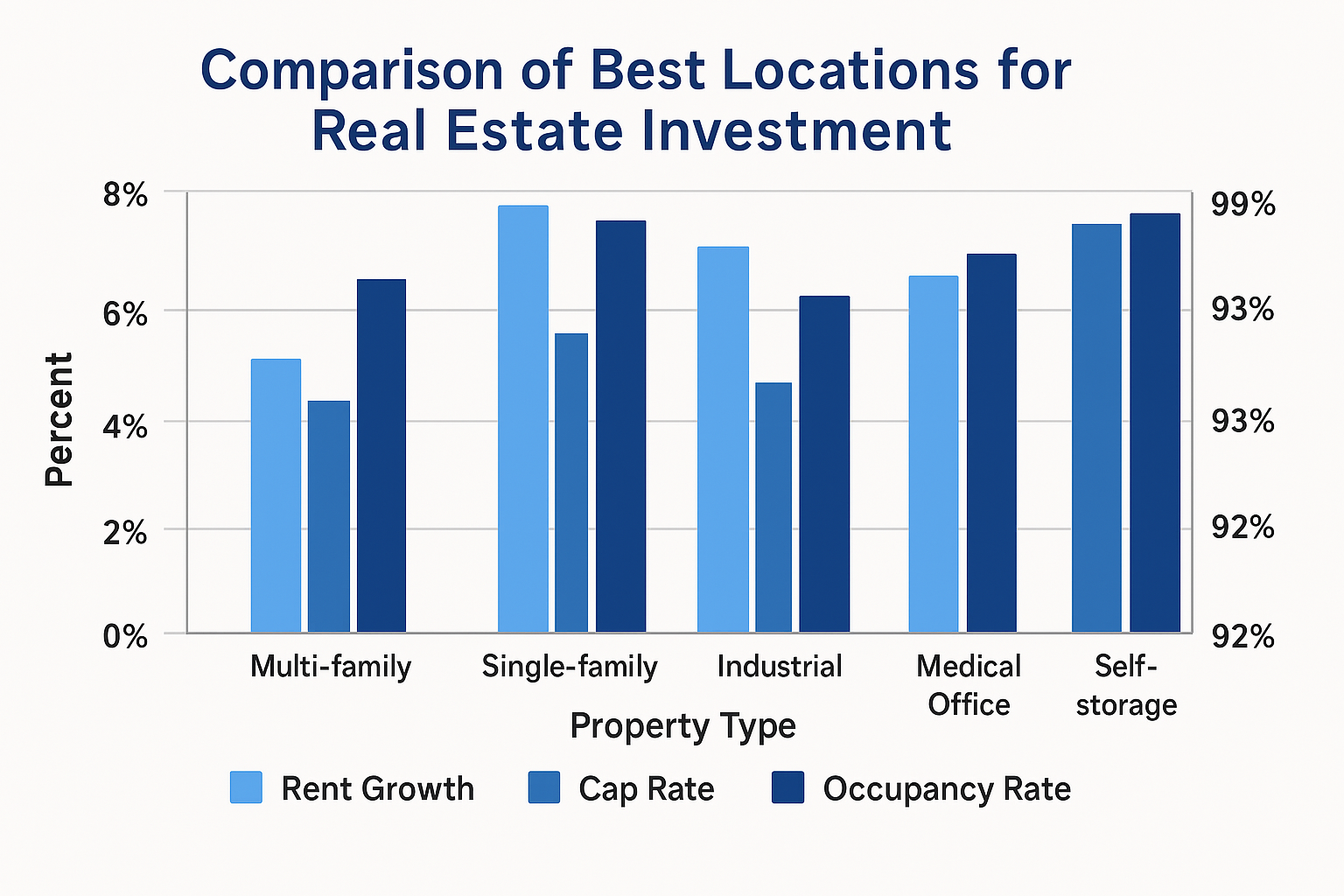

Investment Property Types: Market-Specific Opportunities

The optimal property type varies significantly across the best locations for real estate investment, requiring market-specific analysis to maximize returns.

Multi-Family Investment Opportunities

Multi-family properties offer scale advantages and resilience during economic uncertainty. According to CBRE’s Multi-Family Market Outlook, these markets present the strongest fundamentals for 2025:

| Market | Average Cap Rate | Rent Growth Forecast | Occupancy Rate | Optimal Property Size |

|---|---|---|---|---|

| Phoenix, AZ | 5.3% | 4.8% | 95.2% | 20-50 units |

| Tampa, FL | 5.1% | 5.2% | 96.1% | 50-100 units |

| San Antonio, TX | 5.5% | 4.3% | 94.8% | 10-30 units |

| Indianapolis, IN | 5.8% | 3.9% | 95.3% | 10-50 units |

| Columbus, OH | 5.7% | 4.1% | 96.0% | 20-60 units |

According to Marcus & Millichap’s Multifamily Investment Forecast, smaller secondary and tertiary markets often offer higher cap rates than primary markets, creating superior cash flow potential for investors seeking immediate returns rather than long-term appreciation.

Value-add opportunities—properties requiring moderate renovation to increase rents—show particularly strong performance in growing markets. CBRE analysis indicates that well-executed value-add strategies typically deliver 15-25% higher returns over a 5-year hold period compared to turnkey properties in the same submarkets.

Single-Family Rental Strategies

The single-family rental (SFR) sector has evolved from individual investors to institutional capital, though opportunities remain for both. According to John Burns Real Estate Consulting and CoreLogic data:

- Suburban Growth Markets: Single-family rentals in growing suburban markets with strong schools show the highest rent growth potential. Markets like Frisco (TX), Alpharetta (GA), and Henderson (NV) demonstrate rent increases averaging 5.7-6.9% annually according to CBRE’s 2024 SFR Market Report.

- Mid-Price/Mid-Age Sweet Spot: Properties built between 1990-2010 in the median price range for their market typically offer the optimal balance of maintenance costs and rental rates. CoreLogic data shows these properties averaging 7.2% net yields compared to 5.8% for newer properties and 6.1% for older homes requiring more maintenance.

- Build-to-Rent Communities: Purpose-built rental home communities represent a growing investment channel. According to the National Rental Home Council, these developments deliver operational efficiencies similar to multi-family while offering the privacy and space of single-family homes, with particularly strong performance in Phoenix, Dallas, and Charlotte markets.

Commercial Real Estate Opportunities

While residential property remains the primary focus for most individual investors, select commercial property types offer complementary opportunities according to research from CBRE, Colliers, and JLL:

Emerging Industrial Investment Opportunities

Last-mile distribution facilities represent a particularly strong investment opportunity driven by e-commerce growth and supply chain restructuring:

- Small-format warehouses (20,000-50,000 sq. ft.) in urban infill locations command premium rents

- Top-performing markets include Dallas-Fort Worth, Atlanta, and Indianapolis based on logistics network positioning

- Average cap rates of 5.8-6.5% exceed office and retail while offering stronger tenant stability

- Limited new construction due to land constraints creates favorable supply-demand dynamics

According to Prologis Research, these facilities are seeing rent growth averaging 7.3% annually compared to 5.4% for larger regional distribution centers.

Other commercial property types showing resilience include medical office buildings (aging demographics, healthcare growth), self-storage facilities (urbanization, smaller living spaces), and select retail formats focused on necessity goods and services rather than discretionary spending.

Risk Assessment Framework: Identifying Sustainable Growth

Even within the best locations for real estate investment, varying risk profiles exist that must be evaluated based on investor objectives and risk tolerance.

Economic Diversification Analysis

According to research from Moody’s Analytics and the Federal Reserve Bank of Atlanta, markets with diverse economic drivers demonstrate significantly greater resilience during economic downturns:

| Economic Diversification Level | Example Markets | Average Price Decline (2008-2010) | Recovery Period |

|---|---|---|---|

| High Diversification | Dallas, Atlanta, Charlotte | 12-18% | 2-3 years |

| Moderate Diversification | Denver, Minneapolis, Nashville | 18-25% | 3-4 years |

| Limited Diversification | Las Vegas, Orlando, Phoenix | 35-50% | 5-8 years |

| Single Industry Dominant | Detroit, Atlantic City, Oil-dependent markets | 40-65% | 8+ years/Incomplete |

For risk-conscious investors, the Bureau of Labor Statistics’ employment distribution data provides a useful metric: markets where no single economic sector accounts for more than 22-25% of total employment typically demonstrate the greatest stability during economic downturns.

Population Growth Sustainability

While population growth drives housing demand, assessing the sustainability of this growth is critical for long-term investment performance. According to research from the Urban Land Institute and Moody’s Analytics:

- Organic vs. Migration-Driven Growth: Markets with balanced growth from both natural increase (births minus deaths) and net migration demonstrate more sustainable long-term trends than those relying exclusively on migration, which can reverse during economic downturns.

- Age Demographics: Markets attracting a diverse age mix, including both young professionals and retirees, show more resilient housing demand than those dependent on a single demographic segment.

- Housing Affordability Ratio: When median home prices exceed 5-6 times median household income, affordability constraints typically begin to limit further appreciation unless supported by exceptional economic growth.

Climate Risk Evaluation

Climate-related risks are becoming increasingly material to real estate investment decisions. According to research from First Street Foundation and insurance industry data:

- Flood Risk Expansion: FEMA flood maps significantly underestimate actual flood risk in many communities. First Street Foundation data indicates approximately 14.6 million properties face substantial flood risk—far exceeding the 8.7 million properties in FEMA’s Special Flood Hazard Areas.

- Insurance Availability: Insurance challenges in high-risk coastal and wildfire-prone regions are creating secondary investment effects. Markets like Florida, California, and Louisiana have seen insurance premium increases of 30-150% since 2020, impacting affordability and potentially limiting future appreciation.

- Resilient Infrastructure Investment: Markets making significant investments in climate adaptation (improved drainage, sea walls, building code enhancements) typically demonstrate better long-term value preservation. Cities like Norfolk (VA), Miami Beach (FL), and Charleston (SC) have implemented comprehensive resilience strategies that may mitigate future risk-based discount.

Risk-conscious investors should incorporate climate data into location decisions, with particular attention to a property’s elevation, proximity to water bodies, and local infrastructure quality. The ClimateCheck and Moody’s ESG Solutions platforms provide property-specific risk assessments that supplement traditional location analysis.

Political and Regulatory Environment

Local regulatory conditions significantly impact real estate returns through tax policies, zoning regulations, and tenant/landlord laws. According to analysis from the National Apartment Association and the National Association of Realtors:

Regulatory Impact Analysis

The regulatory environment can significantly impact investment returns. Key factors to evaluate include:

- Rent Control Policies: Markets with strict rent control typically show 12-18% lower investment returns over 10-year periods compared to non-regulated markets according to data from the National Multifamily Housing Council.

- Eviction Procedures: The average eviction in tenant-friendly jurisdictions takes 3-4 months longer and costs $3,500-5,000 more than in landlord-friendly markets according to the American Apartment Owners Association.

- Development Restrictions: Markets with severe development constraints often show stronger price appreciation but lower rental yields, creating a tradeoff between growth and income.

- Property Tax Trends: Municipalities facing fiscal challenges often increase property taxes at rates exceeding inflation, compressing returns over time.

Investors should evaluate not just current policies but also political trends that might lead to future regulatory changes affecting investment performance.

Step-by-Step Guide: Builds, Buys & Invest Approach

At Builds and Buys, we provide a structured approach to identifying and capitalizing on the best locations for real estate investment using our proprietary methodology:

Step-by-Step Builds for Location Selection

- Investment Goal Definition: Begin by clearly defining your investment objectives—income generation, capital appreciation, or a balanced approach—as this significantly influences optimal location selection.

- Capital Allocation Framework: Determine your total investment capital and preferred leverage approach to identify the property tier and markets accessible within your financial parameters.

- Risk Tolerance Assessment: Honestly evaluate your risk tolerance to determine whether emerging, established, or value markets align with your comfort level and investment horizon.

- Geographic Familiarity Analysis: Consider your knowledge of specific markets, as investors typically achieve better returns in regions where they have local knowledge or existing connections.

- Management Capability Evaluation: Assess your property management capabilities and willingness to be actively involved, as this impacts suitable property types and proximity requirements.

Step-by-Step Buys for Market Evaluation

- Comprehensive Market Research: Gather data on population growth, job creation, income trends, and housing supply for your target markets using resources like the U.S. Census Bureau, Bureau of Labor Statistics, and local Multiple Listing Services.

- Economic Diversification Analysis: Evaluate the employment distribution across sectors using Bureau of Labor Statistics data to identify markets with resilient, diversified economies.

- Price-to-Rent Ratio Calculation: Calculate and compare price-to-rent ratios across potential markets to identify those offering the best balance between appreciation potential and cash flow.

- Neighborhood-Level Evaluation: Within promising metropolitan areas, identify specific neighborhoods showing positive indicators like decreasing days-on-market, rising rental rates, and improvement initiatives.

- Regulatory Environment Assessment: Research local landlord-tenant laws, property tax trends, zoning regulations, and development activity to identify potential opportunities or challenges.

Step-by-Step Invest for Implementation

- Strategic Network Development: Build relationships with local real estate agents, property managers, contractors, and lenders in your target market before making investments.

- Property Type Selection: Choose property types aligned with both market fundamentals and your management capabilities—single-family, multi-family, or commercial.

- Acquisition Strategy Refinement: Develop market-specific criteria for evaluating properties, including acceptable price ranges, minimum cash flow requirements, and condition parameters.

- Due Diligence Framework: Create a comprehensive checklist covering physical inspection, title research, rental history verification, expense validation, and regulatory compliance.

- Value-Add Identification: Assess specific opportunities to increase property value through strategic improvements, operational efficiencies, or repositioning to capture unmet market demand.

Market Evaluation Checklist

Use this checklist to systematically evaluate potential investment locations:

- ☐ Population growth rate exceeding national average for 3+ consecutive years

- ☐ Job growth diversified across minimum of 4-5 major sectors

- ☐ Median home price-to-income ratio below 4.5 (for maximum affordability)

- ☐ Price-to-rent ratio below 20 (for balanced cash flow and appreciation)

- ☐ Rental vacancy rates below 7% (indicating strong demand)

- ☐ Average days-on-market declining year-over-year (improving liquidity)

- ☐ Building permits showing responsible growth without oversupply

- ☐ Infrastructure investments planned or underway (transportation, education)

- ☐ Property tax rates stable or growing slower than appreciation

- ☐ Climate risk assessment showing manageable exposure to natural hazards

Conclusion: Strategic Location Selection for Optimal Returns

Identifying the best locations for real estate investment in 2025 requires a data-driven approach that balances immediate returns with long-term appreciation potential. The comprehensive analysis presented in this guide highlights several key takeaways:

- Regional Divergence: Market performance continues to diverge based on economic fundamentals, population migration, and housing supply constraints—creating both challenges and opportunities for strategic investors.

- Secondary Market Renaissance: Many secondary markets now offer the economic drivers previously limited to primary markets, but with more favorable pricing and yield potential.

- Risk-Return Calibration: The optimal markets for individual investors vary based on investment objectives, risk tolerance, and management capabilities—requiring personalized analysis rather than a universal prescription.

- Hyperlocal Focus: Even within promising metropolitan areas, neighborhood-level analysis is essential as performance increasingly varies at the submarket level due to targeted development and demographic shifts.

By applying our Builds, Buys, and Invest methodology, investors can systematically evaluate potential markets against their specific objectives, resources, and constraints. This structured approach helps navigate the complex real estate landscape while minimizing emotional decision-making that often undermines investment performance.

Remember that while location selection is critical, successful real estate investment ultimately depends on disciplined execution across the entire investment lifecycle—from acquisition and financing to management and eventual disposition. The locations identified in this analysis provide promising starting points, but must be complemented by sound operational practices and strategic decision-making.

For more comprehensive guidance on real estate investment strategy, explore our detailed guides on Construction Site Preparation for Investors, Why Real Estate Remains the Best Investment Vehicle, and House Flipping ROI: Maximizing Profits.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.