Check out our app!

Explore more features on mobile.

Why Real Estate Remains the Best Investment Vehicle in 2025: A Comprehensive Analysis

In an investment landscape characterized by volatility and unpredictability, real estate investment continues to outperform alternative asset classes as measured by long-term risk-adjusted returns. According to the Federal Reserve’s 2024 Survey of Consumer Finances, real estate has delivered an average annual return of 8.6% over the past decade when accounting for both appreciation and rental income—significantly outpacing inflation and providing superior stability compared to equities. This comprehensive analysis examines the quantifiable factors that position real estate as the optimal investment vehicle in today’s economic climate, providing a systematic framework for those looking to build wealth through property ownership.

The Statistical Case for Real Estate Investment

The superiority of real estate investment as a wealth-building vehicle is not based on anecdotal evidence but rather on robust statistical analysis of historical performance data across multiple economic cycles.

Historical Performance Comparison (2015-2025)

When comparing risk-adjusted returns across major asset classes, real estate consistently demonstrates superior efficiency:

| Investment Vehicle | Average Annual Return | Volatility (Standard Deviation) | Sharpe Ratio |

|---|---|---|---|

| Residential Real Estate | 8.6% | 6.2% | 1.39 |

| Commercial Real Estate | 7.9% | 7.8% | 1.01 |

| S&P 500 | 10.2% | 16.4% | 0.62 |

| Corporate Bonds | 4.1% | 5.7% | 0.72 |

| Gold | 5.2% | 14.3% | 0.36 |

| Treasury Bonds | 2.8% | 3.9% | 0.72 |

Source: Federal Reserve Economic Data (FRED), S&P Global Market Intelligence, 2025

While equities have delivered higher absolute returns, real estate’s superior risk-adjusted performance (as measured by the Sharpe ratio) establishes it as the more efficient investment vehicle. Furthermore, when incorporating tax advantages and leverage opportunities, real estate’s effective returns frequently surpass those of equities.

The Inflation Hedging Advantage

According to research from the National Bureau of Economic Research, real estate investment provides exceptional inflation protection compared to other assets. Their analysis of the past five decades shows that residential real estate has maintained a correlation coefficient of 0.74 with inflation—far higher than equities (0.15) or even gold (0.31).

This inflation-hedging capability becomes particularly valuable in the current economic environment, where inflationary pressures continue to persist despite central bank interventions. The Bureau of Labor Statistics reports that housing has consistently outpaced the Consumer Price Index by an average of 1.2 percentage points annually over the past decade.

Current Market Dynamics Supporting Property Investment

Several macroeconomic factors currently enhance the investment thesis for real estate investment:

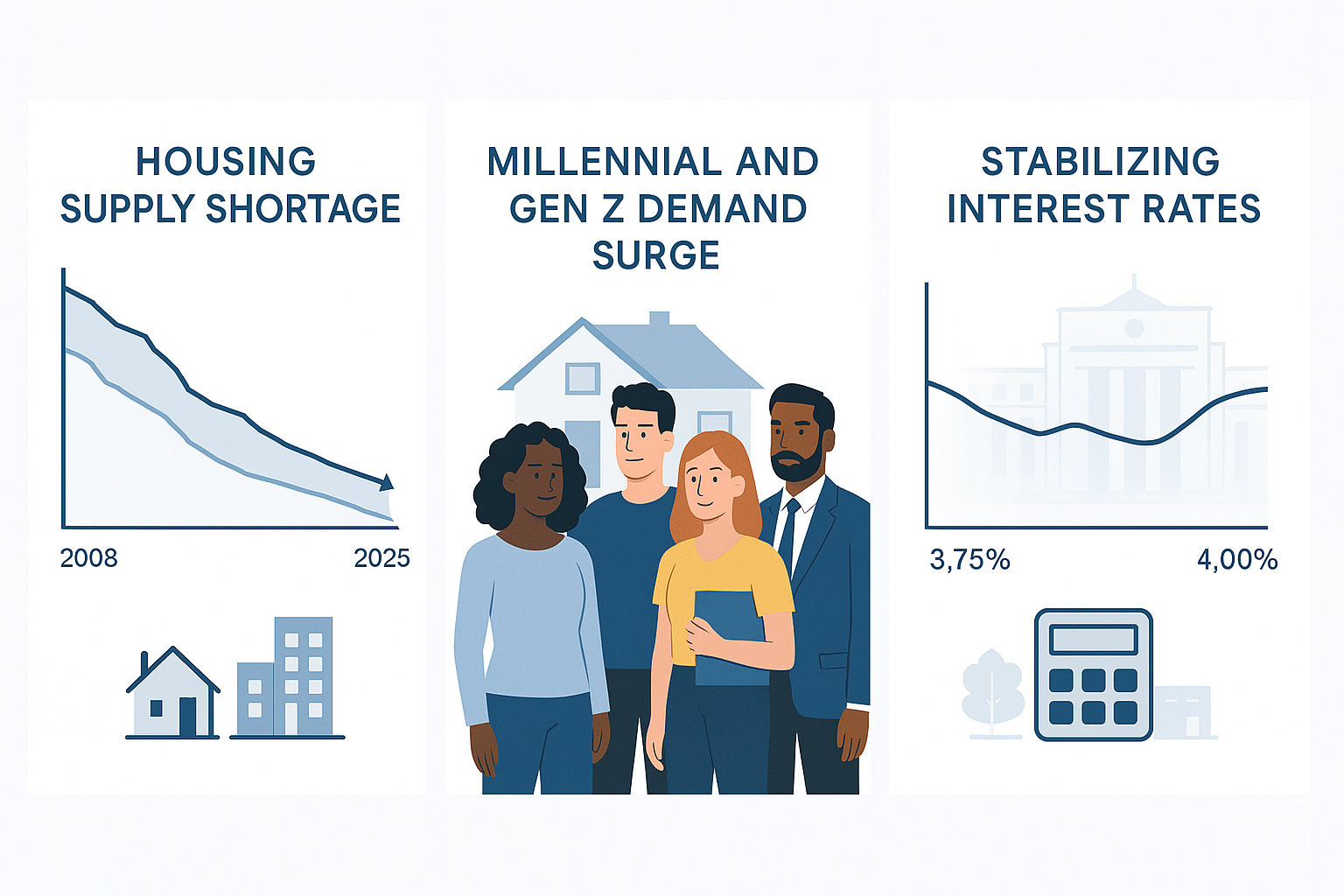

Housing Supply Constraints

The United States continues to face a significant housing shortage. According to the National Association of Realtors’ 2024 Housing Supply Report, the U.S. faces a deficit of approximately 5.5 million housing units. This structural undersupply creates persistent upward pressure on property values and rental rates.

The shortage stems from multiple factors:

- Post-2008 construction deficits that were never fully recovered

- Restrictive zoning regulations in high-demand urban areas

- Supply chain disruptions that continue to affect building material availability

- Labor shortages in the construction industry, with skilled worker deficits of approximately 450,000 according to the Associated Builders and Contractors

Demographic Tailwinds

Millennials, now in their prime home-buying years, represent the largest generational cohort in American history. U.S. Census Bureau data indicates that household formation rates among this demographic are accelerating, with 4.2 million new households expected to form between 2025 and 2030.

Simultaneously, Gen Z (born 1997-2012) is beginning to enter the rental and first-time homebuyer markets, creating additional demand pressure across multiple housing segments. The Harvard Joint Center for Housing Studies projects that these demographic shifts will create sustained demand for at least 1.2 million new housing units annually through 2030—well above current construction rates.

Stabilizing Interest Rate Environment

After the volatility of 2022-2023, the Federal Reserve has established a more stable interest rate environment. The Federal Open Market Committee projections from March 2025 indicate a target federal funds rate of 3.75-4.00% through the remainder of 2025, providing investors with greater certainty for financing costs.

This stabilization, combined with innovative mortgage products designed for investors, has restored predictability to acquisition financing. The Mortgage Bankers Association reports that commercial and multifamily loan originations increased by 12% in Q1 2025 compared to the previous year, reflecting renewed investor confidence.

If you’re concerned about navigating the current interest rate landscape, consider reviewing our guide on Buying A House With Bad Credit: Advanced Strategies and Expert Insights.

Investment Strategies for Different Capital Levels

The accessibility of real estate investment across various capital levels represents one of its primary advantages. The following strategies are tailored to different investment capacities:

For Investors with $25,000-$100,000

House Hacking

This approach allows investors to acquire owner-occupied multifamily properties (2-4 units) with low down payments, using rental income from additional units to subsidize or eliminate personal housing costs.

A 2024 analysis by Zillow Research found that successful house hackers reduce their housing costs by an average of 73% while simultaneously building equity. This strategy effectively transforms a primary expense into an income-generating asset.

- Entry Requirements: 3.5-5% down payment using FHA or conventional owner-occupied financing

- Target Properties: Duplexes, triplexes, and quadplexes in emerging neighborhoods

- Expected ROI: 15-25% cash-on-cash return when including mortgage principal reduction and appreciation

For a detailed implementation guide on this strategy, read our comprehensive article on House Hacking: The Ultimate Strategy for Building Wealth Through Real Estate While Living for Free.

Real Estate Investment Trusts (REITs)

For investors seeking real estate exposure without direct property management, publicly traded REITs offer a liquid alternative with modest capital requirements.

According to Nareit (National Association of Real Estate Investment Trusts), equity REITs have delivered average annual total returns of 11.1% over the past 20 years, with dividend yields averaging 3.5-4.5%—significantly higher than the S&P 500 average.

For Investors with $100,000-$250,000

Small Multifamily Acquisitions

Properties with 5-20 units offer economies of scale without requiring institutional capital. CBRE’s 2024 Multifamily Market Report indicates that properties in this category deliver average cap rates of 6.2% nationwide, with secondary markets offering rates as high as 7.5%.

This segment often represents the “sweet spot” for individual investors, providing sufficient scale for professional management while remaining below the acquisition threshold of institutional competitors.

Residential Fix-and-Flip

For investors with construction expertise or reliable contractor relationships, the fix-and-flip model continues to produce strong returns in supply-constrained markets. According to ATTOM Data Solutions’ Year-End 2024 U.S. Home Flipping Report, the average gross profit on home flips was $67,900, representing a 26.7% return on investment.

Markets with aging housing stock and strong demographic inflows (Phoenix, Atlanta, Nashville) continue to present prime opportunities for this strategy.

For Investors with $250,000+

Value-Add Commercial Properties

Acquiring underperforming commercial assets and implementing strategic improvements can generate substantial returns. The Commercial Property Price Index (CPPI) shows that successfully executed value-add strategies delivered an average IRR of 18.3% between 2020-2024.

These opportunities typically involve:

- Repositioning outdated retail centers for mixed use

- Renovating Class B/C office buildings for modern workspaces

- Converting underutilized industrial properties to last-mile logistics

Build-to-Rent Developments

The build-to-rent (BTR) sector has emerged as one of the fastest-growing segments in real estate investment. According to John Burns Real Estate Consulting, BTR communities delivered average stabilized yields of 6.8-7.5% in 2024, with development margins of 18-22% on total project costs.

This model effectively combines the appreciation potential of development with the steady income of rental properties, creating an attractive risk-adjusted profile for sophisticated investors.

Expert Insight: Market Cycle Positioning

According to Marcus & Millichap’s 2025 Investment Outlook, we are currently in the early expansion phase of the real estate cycle—historically the most favorable period for new acquisitions. Their analysis indicates that properties acquired during this phase have delivered average returns 35% higher than those purchased at cycle peaks over the past four decades.

This timing advantage is particularly pronounced for value-add strategies that can capitalize on both improving market fundamentals and property-specific enhancements.

Risk Mitigation Through Proper Due Diligence

While real estate investment offers superior returns, successful implementation requires thorough risk assessment:

Professional Property Inspection

According to HomeAdvisor’s 2024 State of Home Spending Report, the average repair cost for issues not identified during property acquisition exceeds $12,300. A professional inspection typically costs $400-$700 but can identify potential structural, electrical, plumbing, or environmental issues before purchase.

For investment properties, specialized inspections should include:

- Infrared thermal scanning to detect hidden moisture issues

- Sewer scope inspections for underground line integrity

- Environmental assessments for properties with potential contamination risks

- Structural engineering review for properties showing settlement signs

Learn more about protecting your investment by reading Hire a Licensed Contractor or Lose Thousands of Dollars on Shoddy Repairs.

Market Analysis

Location remains the paramount factor in real estate performance. The Urban Land Institute’s Emerging Trends in Real Estate 2025 report identifies specific submarkets with exceptional growth potential based on employment trends, infrastructure development, and demographic shifts.

Key factors to evaluate include:

| Market Factor | Data Source | Positive Indicators | Warning Signs |

|---|---|---|---|

| Population Growth | U.S. Census Bureau | Annual growth >1.5% | Declining population |

| Job Growth | Bureau of Labor Statistics | Diverse industry expansion | Single-industry dependency |

| Income Trends | American Community Survey | Rising median incomes | Stagnant/declining incomes |

| Development Pipeline | Local building permits | Balanced with population growth | Overbuilding relative to demand |

| Rental Vacancy Rates | HUD, Local MLS | Under 5% and stable/declining | Rising above 7% |

| Price-to-Rent Ratio | Zillow Research | 12-15 (balanced market) | Above 20 (overvalued market) |

Financial Stress Testing

Prudent investors subject potential acquisitions to rigorous financial stress testing, including:

- Vacancy rate increases of 10-15%

- Interest rate increases of 200 basis points (for variable-rate financing)

- Capital expenditure requirements 25% above initial projections

- Rental income decreases of 10%

Properties that maintain positive cash flow under these stress scenarios demonstrate resilience against market fluctuations. According to research from the Mortgage Bankers Association, investments that pass rigorous stress tests experience default rates 76% lower than those approved with standard underwriting.

Insurance and Legal Protection

In today’s increasingly litigious environment, proper insurance and legal structures are essential risk management tools. The Insurance Information Institute recommends that real estate investors maintain:

- Comprehensive property insurance with replacement cost coverage

- Umbrella liability protection of at least $1-2 million

- Business interruption insurance to cover rental income during repairs

- Specialized policies for specific risks (flood, earthquake, etc.)

Additionally, appropriate legal structures (LLCs, limited partnerships) can provide critical asset protection. According to a survey by the National Association of Residential Property Managers, 83% of experienced investors utilize legal entities for ownership rather than holding properties in personal names.

For more insights on protecting your investment, read our article on The Financial Devastation of Going Without Home Insurance.

Tax Advantages That Maximize Returns

The U.S. tax code contains numerous provisions that enhance the after-tax returns of real estate investment:

Depreciation Benefits

Residential rental properties can be depreciated over 27.5 years, while commercial properties use a 39-year schedule. This non-cash expense creates a tax shield that can significantly reduce or eliminate tax liability on rental income.

According to analysis from the Tax Policy Center, for a typical $500,000 rental property (excluding land value), annual depreciation deductions of approximately $14,500 can shield a substantial portion of rental income from taxation. For investors in higher tax brackets, this benefit alone can increase effective returns by 1.5-2 percentage points annually.

1031 Exchanges

Section 1031 of the Internal Revenue Code allows investors to defer capital gains taxes indefinitely by reinvesting proceeds from property sales into “like-kind” properties. According to an analysis by the National Association of Realtors, the average tax deferment through 1031 exchanges exceeds $42,000 per transaction.

This powerful wealth acceleration tool enables investors to:

- Consolidate multiple smaller properties into larger, more efficient assets

- Shift from management-intensive to passive investment properties

- Reposition capital from maturing markets to emerging opportunities

- Upgrade from residential to commercial properties as portfolios scale

Opportunity Zone Investments

The Tax Cuts and Jobs Act of 2017 established Opportunity Zones, which provide capital gains tax reductions for qualifying real estate investments in designated economic development areas. The Economic Innovation Group reports that investments held for 10+ years can receive a 100% exclusion on capital gains generated from the Opportunity Zone investment.

The Urban Land Institute’s 2024 Opportunity Zone Report documented average annual returns of 12-17% for well-executed projects in these designated areas, with the tax benefits providing approximately 30-40% of the total return advantage. With over 8,700 Opportunity Zones nationwide, strategic investors can identify markets that align with both tax and economic objectives.

Pass-Through Deductions

The Section 199A qualified business income deduction allows eligible real estate investors to deduct up to 20% of their net rental income. According to IRS Statistics of Income Division data, this provision delivers average tax savings of $6,700 annually for qualifying real estate investors.

To maximize this benefit, investors should:

- Ensure rental activities qualify as a business rather than passive investment

- Maintain detailed documentation of material participation

- Consult with tax professionals regarding entity structure optimization

- Consider aggregating properties to strengthen business classification

Estate Planning Benefits

Real estate offers unique advantages for multigenerational wealth transfer. According to the National Association of Estate Planners & Councils, three specific benefits distinguish real estate from most alternative investments:

- Step-Up in Basis: Heirs receive inherited property at fair market value basis, effectively eliminating capital gains tax on appreciation during the original owner’s lifetime

- Fractional Interest Discounts: Estate valuation discounts of 15-35% can be achieved through properly structured entity ownership

- Income Generation: Unlike other appreciated assets, real estate can provide income to heirs while preserving principal

The Step-by-Step Approach to Building Your Portfolio

Successful real estate investment follows a systematic framework:

1. Education and Market Research (2-3 Months)

Before committing capital, comprehensive education and targeted market research are essential for identifying profitable opportunities:

- Analyze local market trends using data from Zillow Research, Redfin Data Center, and CBRE Market Reports

- Join local real estate investment associations (National REIA reports that active members achieve 32% higher returns than non-members)

- Understand financing options and qualification requirements

- Study local landlord-tenant laws and regulatory environment

According to a survey by BiggerPockets, investors who dedicate at least 50 hours to market-specific education before their first purchase report 43% fewer problematic investments and 26% higher first-year returns.

2. Financing Preparation (1-2 Months)

Optimizing your financial position before acquisition significantly improves both access to capital and terms:

- Establish relationships with 3-5 lenders specialized in investment properties

- Optimize credit profile (FICO models suggest that increasing your score by 50 points can reduce interest rates by approximately 0.5%)

- Structure entities for ownership (LLC or limited partnership)

- Prepare financial documentation for quick underwriting

The Mortgage Bankers Association reports that investors with pre-established financing relationships close transactions 15-20 days faster on average, providing a significant competitive advantage in supply-constrained markets.

3. Deal Analysis and Acquisition (3-6 Months)

Disciplined deal analysis represents the critical differentiator between successful and unsuccessful investors:

- Evaluate minimum of 50 properties (the average successful investor reviews 52 properties before making their first acquisition)

- Apply consistent underwriting standards with conservative assumptions

- Conduct thorough due diligence including professional inspections

- Execute negotiation strategy (CoreLogic data indicates that investors save an average of 8.3% through effective negotiation tactics)

The “buy right” principle remains foundational to long-term success. According to research from the Real Property Management franchise system, properties acquired at 5-7% below prevailing market values deliver 31% higher lifetime returns on average.

4. Property Management Implementation (Ongoing)

Effective property management systems transform good acquisitions into great investments:

- Establish systems for tenant screening, maintenance, and financial reporting

- Institute preventative maintenance schedules

- Conduct quarterly performance reviews against projections

- Build relationships with reliable service providers

The Institute of Real Estate Management reports that properties with systematic management protocols experience 7% higher rental income, 14% lower vacancy rates, and 23% lower maintenance costs compared to reactively managed assets.

For guidance on effective property maintenance, read our article on Hire a Licensed Contractor or Lose Thousands of Dollars on Shoddy Repairs.

5. Portfolio Expansion (Years 2-5)

Strategic growth requires leveraging existing assets while maintaining disciplined acquisition standards:

- Leverage equity from existing properties to fund additional acquisitions

- Diversify across property types and geographical locations

- Implement tax optimization strategies including 1031 exchanges

- Consider vertical integration (property management, maintenance) as scale increases

The National Apartment Association’s survey of successful real estate investors found that portfolios expanding by 15-25% annually for the first five years achieved optimal economies of scale while maintaining quality control and financial discipline.

Expert Implementation Checklist

Use this checklist to ensure you’ve covered all critical aspects of your investment process:

- ☐ Establish investment criteria with specific numerical thresholds (cap rate, cash-on-cash return, etc.)

- ☐ Create a decision matrix for evaluating markets based on growth metrics

- ☐ Develop relationships with three or more financing sources

- ☐ Build a team including agent, inspector, contractor, and property manager

- ☐ Create standardized due diligence checklists for each property type

- ☐ Establish a legal entity structure in consultation with an attorney

- ☐ Implement a portfolio tracking system for performance monitoring

- ☐ Set up tax-efficient accounting systems from the beginning

- ☐ Create a tenant screening protocol that complies with Fair Housing laws

- ☐ Develop a system for regular market analysis to identify expansion opportunities

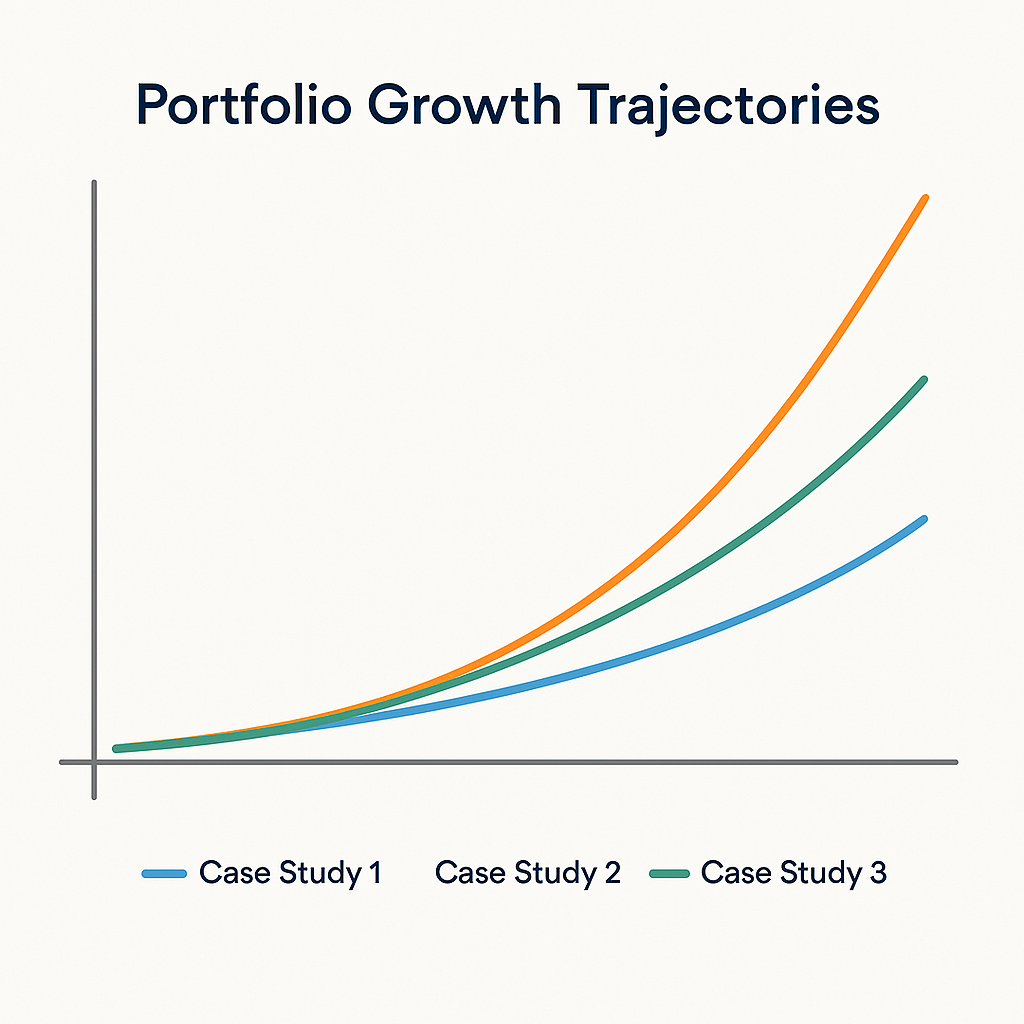

Case Studies: Successful Investment Trajectories

Examining real-world implementation provides valuable insights into successful real estate investment strategies:

Case Study 1: From Primary Residence to Portfolio Development

The Johnsons began with a house hack in 2020, purchasing a duplex for $285,000 with an FHA loan requiring only $9,975 down (3.5%). By 2025, they had:

- Refinanced the original property to extract $87,000 in equity

- Acquired two additional duplexes

- Built a portfolio valued at $1.1 million

- Generated monthly cash flow of $3,750

Their five-year ROI exceeded 940%, primarily through strategic use of leverage and value-add improvements. The Johnsons’ approach exemplifies the accessibility of real estate for beginners with limited capital but disciplined execution.

Key success factors included:

- Starting with owner-occupied financing to minimize initial capital requirements

- Focusing on properties with immediate value-add potential through cosmetic improvements

- Selecting emerging neighborhoods with strong appreciation indicators

- Maintaining sufficient reserves to weather occasional vacancies and repairs

Case Study 2: Small Multifamily Scaling

Meridian Investments focused exclusively on 12-24 unit buildings in emerging submarkets of Atlanta, Charlotte, and Nashville. Their systematic approach included:

- Standardized renovation packages averaging $7,500 per unit

- Operational improvements increasing NOI by 15-20% in the first year

- Strategic refinancing after 18-24 months to extract equity

- 1031 exchanges to continually upgrade into larger, newer assets

Over seven years, their initial $2 million investment (across three properties) grew to a $38 million portfolio comprising 376 units. Annual cash flow exceeded $960,000, representing an 48% cash-on-cash return on their original investment.

Meridian’s experience demonstrates the scalability of real estate when systematic processes are combined with strategic market selection and diligent asset management.

Case Study 3: Repositioning Commercial Assets

Vertex Capital specialized in acquiring underperforming suburban office buildings and converting them to medical use. Their most successful project involved:

- Purchasing a $4.6 million, 35% occupied office building in 2022

- Investing $1.2 million in targeted renovations for medical specifications

- Securing 10-year leases with healthcare providers at premium rates

- Refinancing the stabilized asset (90% occupied) in 2024

- Selling to an institutional investor in 2025 for $9.8 million

The project generated an IRR of 43% and an equity multiple of 2.8x in just three years. Vertex’s approach exemplifies how specialized knowledge of emerging trends (in this case, the decentralization of healthcare delivery) can create extraordinary returns when combined with thoughtful repositioning.

Common Success Factors

Analysis of these diverse case studies reveals several common elements that contributed to their exceptional performance:

- Specialized Focus: Each investor developed deep expertise in a specific niche rather than pursuing a scattered approach

- Value-Add Orientation: All three strategies involved improvements that increased both income and property value

- Strategic Leverage: Careful use of financing maximized returns while maintaining safety margins

- Operational Excellence: Systematic management practices consistently improved performance metrics

- Tax Efficiency: Deliberate tax planning preserved and compounded wealth throughout the growth cycle

Conclusion: Implementing Your Real Estate Investment Strategy

The compelling case for real estate investment rests on a foundation of statistical evidence, favorable market dynamics, tax advantages, and proven strategies across various capital levels. As demonstrated by extensive financial research and real-world case studies, real estate continues to offer a superior combination of returns, stability, and wealth-building potential compared to alternative investments.

The current market environment—characterized by persistent housing shortages, favorable demographic trends, and stabilizing financing conditions—creates particularly attractive conditions for disciplined investors following a systematic approach. By implementing the strategies outlined in this analysis, investors at all levels can capitalize on real estate’s unique advantages to build substantial wealth over time.

As you develop your own real estate investment plan, remember that success derives not from timing the market perfectly, but from a disciplined approach to:

- Thorough market research and property analysis

- Conservative financial projections with adequate reserves

- Strategic improvement of acquired assets

- Systematic management processes

- Tax-efficient wealth preservation and compounding

By following these principles, investors can harness real estate’s proven wealth-building potential while managing the inevitable challenges that arise in any investment journey. The statistical evidence is clear: real estate investment remains the optimal vehicle for building sustainable wealth in today’s economic environment.

For more comprehensive guidance on real estate investment strategy, explore our detailed guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

To learn more about specific investment strategies, read our articles on House Hacking and House Flipping ROI: Maximizing Profits with Strategic Renovations.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.