Check out our app!

Explore more features on mobile.

Can You Invest $100 in Real Estate? 5 Legitimate Ways (2025 Verified)

Published on 2025/04/04

Yes, $100 is enough to start investing in real estate—if you use the right strategies. While you won’t buy a rental property outright, modern platforms and creative techniques let you enter the market with minimal capital. Here are 5 proven methods backed by current data and real-world results.

1. Fractional Real Estate Investing

Platforms like Fundrise and Arrived Homes let you invest in shares of rental properties:

- Minimum investment: $10-$100

- How it works: Your money gets pooled with other investors to purchase properties

- Returns: Typically 8-12% annually from rental income and appreciation

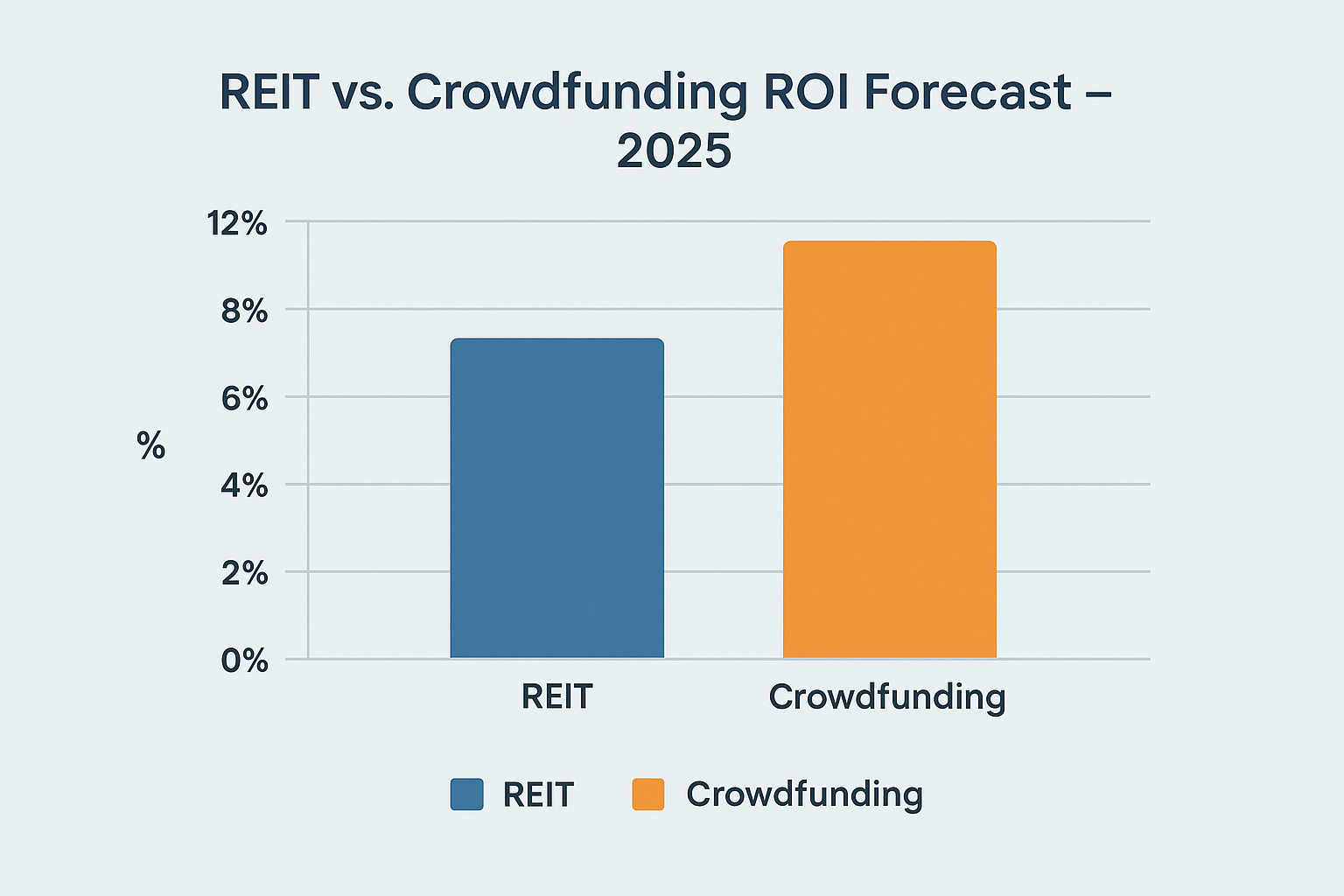

2. REITs (Real Estate Investment Trusts)

REITs are companies that own income-producing real estate. You can buy shares through any brokerage:

- Top REITs to consider: VNQ (ETF), O (Realty Income), AMT (American Tower)

- Minimum investment: $1-$100 (depending on share price)

- Dividend yields: Typically 3-6% annually

3. Real Estate Crowdfunding

Platforms like Groundfloor allow small investments in fix-and-flip projects:

- Minimum investment: $100

- Typical returns: 8-15% for 6-12 month loans

- Risk level: Higher than REITs – diversify across multiple projects

4. Wholesaling (Active Strategy)

With $100, you can start marketing to find off-market deals:

- What to spend on: Bandit signs ($50), Facebook ads ($50)

- Potential earnings: $2,000-$10,000 per deal (no ownership required)

- Learning resources: Pros and Cons of Real Estate Investing

5. Real Estate Education

Invest in knowledge first:

- Books: “The Book on Rental Property Investing” ($15 used)

- Courses: Builds and Buys’ free Real Estate Fundamentals Guide

- Tools: MLS access (some markets offer $50/month)

How to Scale Your $100 Investment

- Start small with REITs or fractional investing

- Reinvest profits every quarter

- Add active strategies like wholesaling once you have $500+

- Diversify across 3-5 different investments

Key Risks to Understand

- Liquidity: Some platforms lock up funds for 5+ years

- Fees: Fractional platforms may charge 1-2% annually

- Market risk: REIT prices fluctuate with stock market

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.

Leave a Comment