Check out our app!

Explore more features on mobile.

How to Accurately Calculate ROI on Real Estate Investments

Published on 2025/03/29

Accurately calculating Return on Investment (ROI) is crucial to successful real estate investing. Without a precise ROI analysis, investors risk poor decisions leading to significant financial losses. In this guide, we’ll show you step-by-step how to determine your real estate investment ROI effectively, leveraging insights from Builds and Buys’ strategic investment methods.

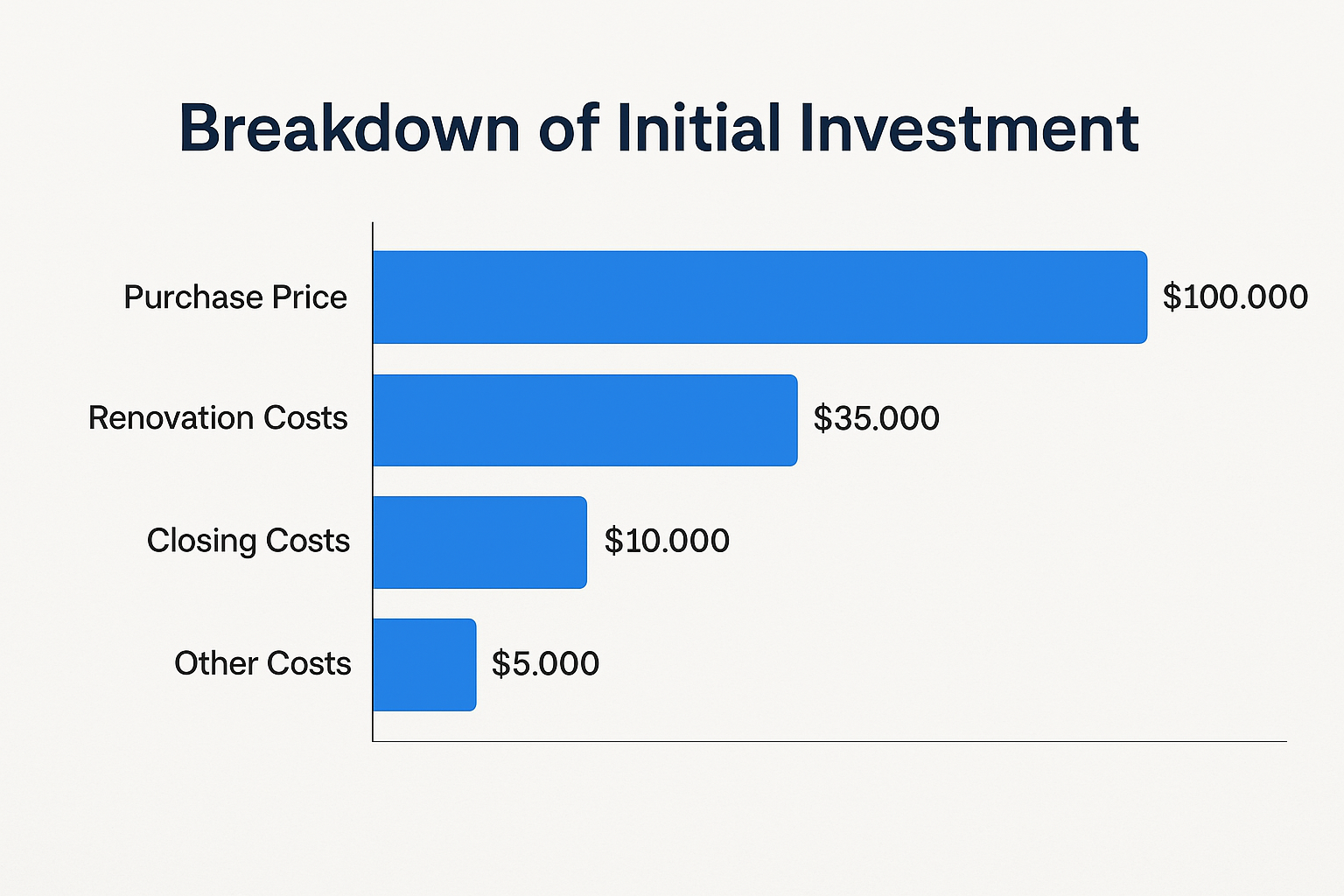

Step 1: Calculate Your Initial Investment

Your initial investment includes the property’s purchase price, closing costs, renovation expenses, and other upfront expenditures. Accurate calculations here set the foundation for precise ROI analysis.

Step 2: Determine Annual Cash Flow

Annual cash flow is calculated by subtracting yearly expenses (mortgage, taxes, insurance, maintenance) from annual rental income. Positive cash flow indicates profitability and sustainability of your investment.

Step 3: Factor in Appreciation and Equity Gains

Real estate appreciation can significantly affect ROI. Historically, residential real estate appreciates at an average of 3-5% annually. Factor this conservatively into your projections to maintain realistic expectations.

Step 4: Account for Loan Paydown (Principal Reduction)

If financed, each mortgage payment increases your equity by reducing the loan balance. Calculate annual principal payments separately to fully capture ROI.

Step 5: Putting It All Together—ROI Calculation

The simplified ROI formula is: ((Annual Cash Flow + Annual Appreciation + Annual Loan Paydown) ÷ Initial Investment) × 100 = ROI %.

Let’s illustrate with an example:

- Initial Investment: $100,000

- Annual Cash Flow: $5,000

- Annual Appreciation (4%): $4,000

- Annual Loan Paydown: $2,000

ROI = (($5,000 + $4,000 + $2,000) ÷ $100,000) × 100 = 11% ROI annually.

Step 6: Continuous Re-evaluation

Real estate markets are dynamic. Regularly re-evaluate your ROI using current market data and adjust your investment strategies as necessary to maintain optimal profitability.

Leverage Builds and Buys’ Step-by-Step Resources

Enhance your real estate investment accuracy by utilizing Builds and Buys’ comprehensive step-by-step guides. Navigate the complexities of real estate investing, from building properties to strategic purchasing and informed investing.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.

Leave a Comment