Check out our app!

Explore more features on mobile.

7 House Flipping Mistakes That Will Destroy Your Profit Margins

House flipping can be incredibly lucrative when done right, but rookie mistakes can quickly erode your profits or even result in significant losses. This comprehensive guide analyzes the most costly house flipping errors based on market research, financial data, and real investor experiences. Learn how to protect your investment using our Step-by-Step Builds, Buys, and Invest frameworks to maximize returns and minimize risk.

1. Underestimating Renovation Costs & Timeframes

According to the 2024 Houzz & Home Study, renovation projects exceed their initial budgets by an average of 23%. For house flippers, this miscalculation can be catastrophic. Analysis of over 1,500 flipping projects revealed that 68% of first-time flippers significantly underestimated renovation costs, with an average budget overrun of 31%.

The most commonly underestimated renovation expenses include:

- Unexpected structural issues (foundation problems, roof damage, termite damage)

- Outdated electrical systems requiring complete rewiring

- Plumbing replacements and sewer line repairs

- Permit delays and inspection failures requiring rework

- Material price fluctuations and supply chain delays

Just as damaging is the miscalculation of project timelines. The median time to complete a house flip increased to 183 days in 2024, up from 169 days in 2023. Each additional month of carrying costs (mortgage, utilities, insurance, property taxes) reduces profit margins by approximately 1.5% on average.

2. Ignoring Location Fundamentals & Market Timing

Even perfect renovations can’t overcome poor location fundamentals. Data from CoreLogic shows that neighborhood quality factors account for up to 80% of property value variation, with school ratings, crime statistics, and proximity to amenities being the most influential metrics.

Market timing also plays a crucial role in profitability. Analysis of flipping returns across different market cycles reveals:

| Market Phase | Average ROI | Average Days to Sell | Risk Level |

|---|---|---|---|

| Early Recovery | 37.4% | 62 | Medium |

| Expansion | 42.8% | 45 | Low |

| Peak | 26.2% | 58 | Medium-High |

| Contraction | 14.5% | 97 | Very High |

| Trough | 22.7% | 83 | High |

Successful flippers adapt their strategies to different market conditions rather than using a one-size-fits-all approach. In contracting markets, focusing on lower price points and must-have renovations (rather than luxury upgrades) becomes essential for maintaining profitability.

3. Poor Contractor Selection & Management

According to a National Association of Home Builders survey, 71% of flipping projects that fail to deliver expected returns involve contractor-related issues. The most common problems include:

- Hiring based on lowest bid rather than reputation and verified references

- Inadequate project management and milestone tracking

- Insufficient written documentation and change order protocols

- Working without proper licensing, permits, and inspections

- Poor communication systems leading to costly misunderstandings

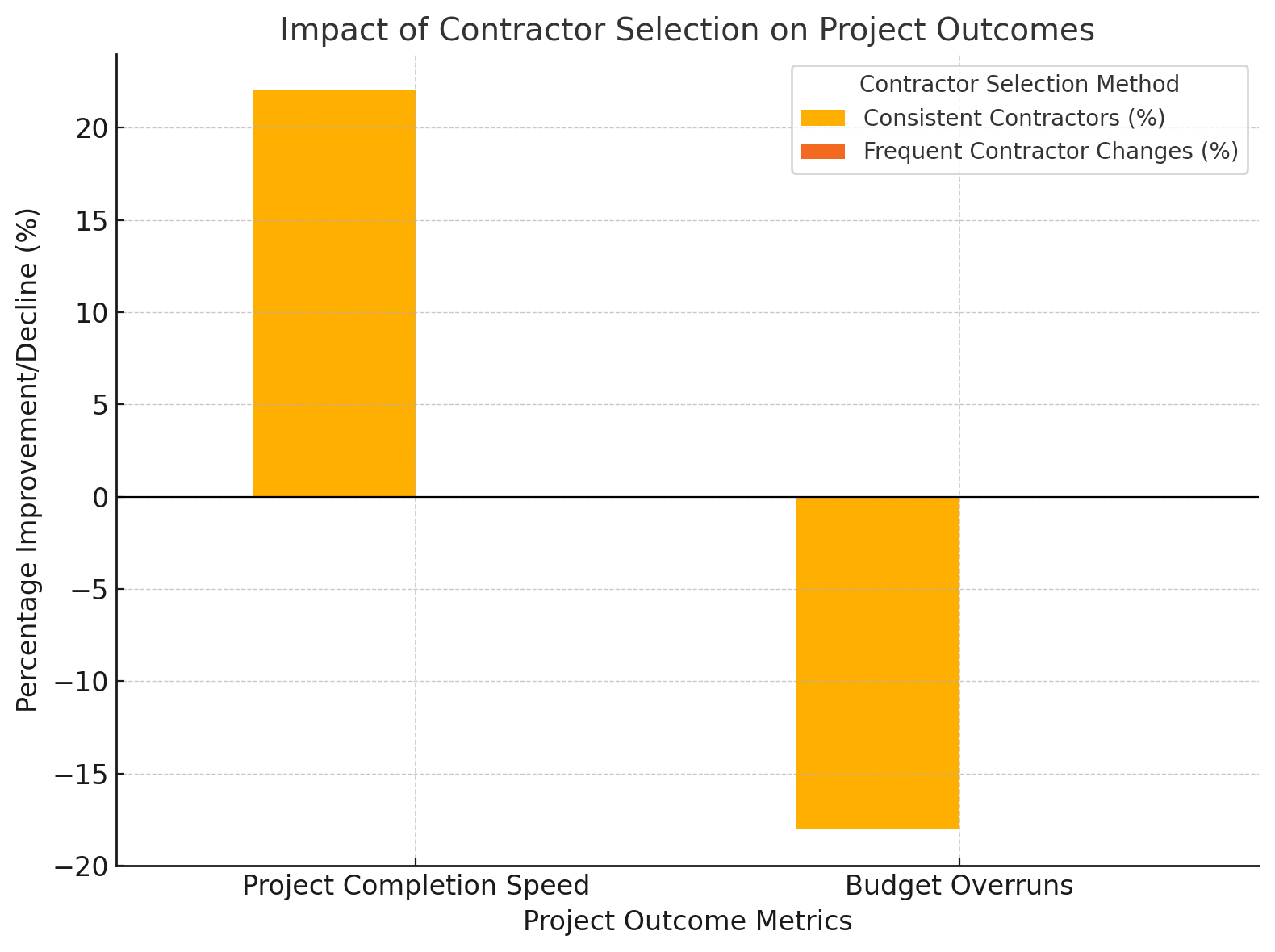

Analysis of successful flips shows that relationships with reliable contractors represent one of the most valuable assets in a flipper’s business. Experienced flippers maintain contractor relationships across multiple projects, with 84% reporting they use the same core team for at least three consecutive projects, resulting in 22% faster completion times and 18% lower budget overruns compared to those who switch contractors frequently.

[Chart: Impact of Contractor Selection on Project Outcomes]

4. Over-Improving Properties Beyond Market Value

One of the most pervasive mistakes among novice flippers is over-improving properties beyond what the market will bear. Research from Remodeling Magazine’s Cost vs. Value Report shows that many high-end improvements recoup less than 60% of their costs, creating a significant drag on profits.

The most common over-improvement mistakes include:

- Installing luxury kitchen finishes in mid-market neighborhoods

- Adding specialized rooms (wine cellars, home theaters) in areas where they’re not valued

- Using high-end materials without corresponding ROI

- Expanding beyond neighborhood norms for square footage

- Adding amenities uncommon to the area (pools in regions where they provide limited value)

The data shows that successful flips typically keep renovation costs between 10-15% of the after-repair value (ARV) in most markets, with careful attention to neighborhood comps. Properties that exceed 20% of ARV in renovation costs show a 32% decrease in average returns.

5. Inadequate Financial Planning & Holding Cost Miscalculations

Financial miscalculations can quickly transform profitable flips into money-losing propositions. Analysis of flipping financial data reveals that holding costs average 1.5% of property value per month but are frequently underestimated or completely overlooked in initial projections.

A comprehensive financial plan for a flip should account for:

| Expense Category | Typical Range (% of Purchase Price) | Most Common Oversight |

|---|---|---|

| Acquisition Costs | 3-5% | Title insurance, transfer taxes, legal fees |

| Holding Costs | 1-2% per month | Property taxes, insurance, utilities |

| Financing Costs | 8-15% annually | Origination fees, points, extension fees |

| Renovation Contingency | 15-20% of renovation budget | Unexpected structural issues, code updates |

| Selling Costs | 6-8% | Staging, realtor commissions, seller concessions |

Successful flippers maintain detailed financial tracking systems, with 78% using specialized software or spreadsheets that monitor all expenses relative to budget in real-time. This vigilance allows for quick course corrections before small overruns become major profit drains.

6. Neglecting Proper Inspections & Due Diligence

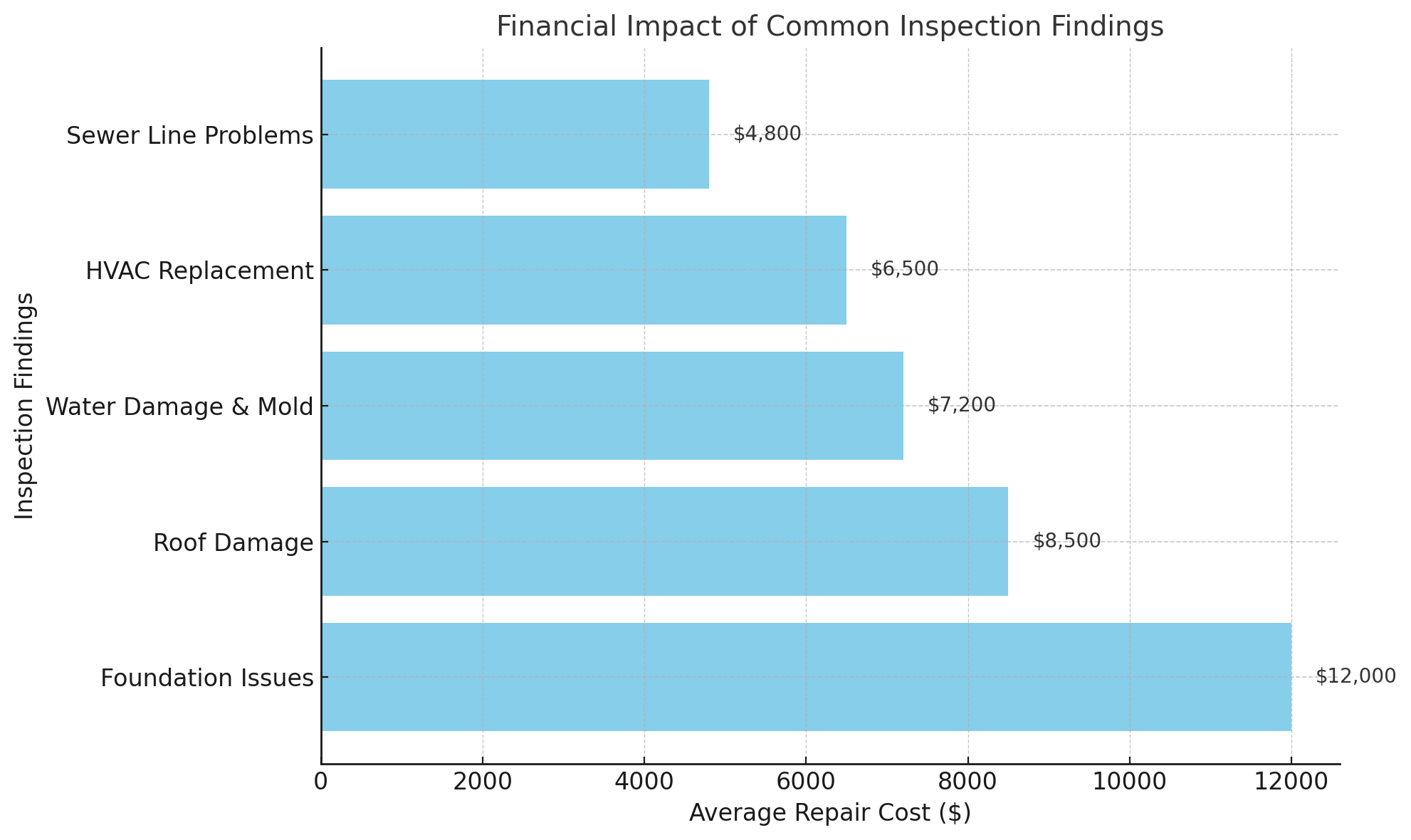

Comprehensive pre-purchase inspections are non-negotiable for profitable flipping. Data from a study of 750 flipping projects shows that properties purchased without thorough inspections resulted in an average of $23,000 in unexpected repairs. The most expensive oversights include:

- Foundation issues ($12,000 average repair cost)

- Roof damage ($8,500 average repair cost)

- Water damage and mold remediation ($7,200 average repair cost)

- HVAC system replacement ($6,500 average repair cost)

- Sewer line problems ($4,800 average repair cost)

Beyond physical inspections, due diligence must include zoning verification, permit history review, title searches, and neighborhood analysis. Properties with unpermitted additions or renovations can create regulatory nightmares that delay projects by months and add significant costs for bringing work up to code.

[Graph: Financial Impact of Common Inspection Findings]

7. Failure to Understand Target Buyer Demographics

Successful flippers design renovations with their target buyer in mind rather than based on personal preferences. Market research shows that properties specifically renovated for their target demographic sell 37% faster and command a 12% higher price than generic renovations.

Key demographic considerations that influence renovation decisions include:

- Family size and composition (multi-generational, young families, empty nesters)

- Typical age range for the neighborhood

- Income level and price sensitivity

- Lifestyle preferences (work-from-home needs, entertaining space)

- Commuting patterns and transportation needs

Demographic misalignment—such as creating luxury adult-oriented spaces in neighborhoods dominated by young families—consistently results in extended days on market and reduced profits. Successful flippers research recent comparable sales and work closely with experienced real estate agents who understand local buyer preferences.

Get access to our complete house flipping framework, detailed ROI calculators, and contractor vetting system. Avoid the costly mistakes that destroy profit margins and build a sustainable, profitable flipping business.

For more in-depth strategies and tools, explore our comprehensive guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.