Check out our app!

Explore more features on mobile.

Kansas Real Estate Investment Guide

A comprehensive resource for investors looking to capitalize on one of America’s most stable and accessible property markets

1. Kansas Market Overview

Market Fundamentals

Kansas offers a compelling real estate investment destination characterized by stability, affordability, and steady growth. The state’s balanced economy, low cost of living, and central location create favorable conditions for property investors seeking reliable returns with lower volatility than coastal markets.

Key economic indicators reflect Kansas’s investment potential:

- Population: 2.9 million with 75% urban concentration

- GDP: $192 billion (2024), relatively stable growth

- Job Growth: 1.8% annually, concentrated in metro areas

- Cost of Living: 15% below national average

- Business Climate: Ranked favorably for business friendliness

The Kansas economy is diversified across agriculture, manufacturing, healthcare, education, and aerospace. This economic diversity provides stability through different market cycles and supports consistent housing demand across varied price points.

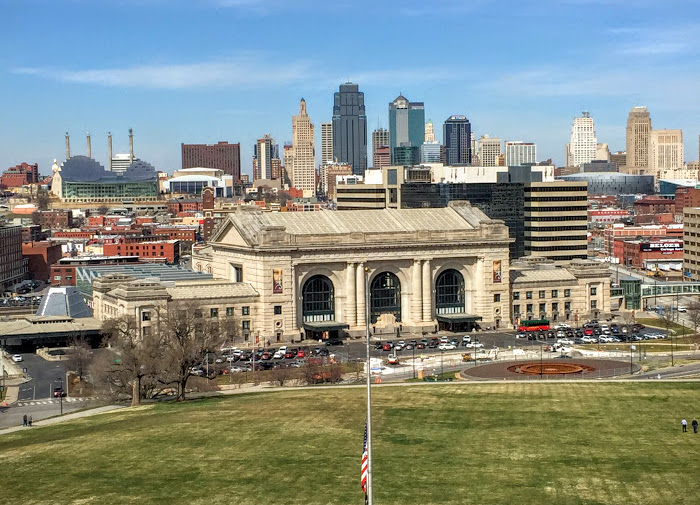

Kansas City’s growing downtown showcases the state’s urban development

Economic Outlook

- Projected GDP growth: 1.5-2.5% annually through 2027

- Stable employment in healthcare and education sectors

- Manufacturing renaissance in certain regions

- Growing tech presence in Kansas City area

- Steady population growth in metropolitan regions

Investment Climate

Kansas provides a favorable environment for real estate investors:

- Property affordability with significantly lower entry points than coastal markets

- Landlord-friendly laws with reasonable protections for property owners

- Moderate property taxes varying by county and municipality

- Lower competition from institutional investors compared to larger markets

- Strong rental demand in university towns and metropolitan areas

- Favorable price-to-rent ratios supporting cash flow investments

The Kansas approach to governance tends toward limited regulation of property markets, creating predictability for investors. While the state doesn’t experience the dramatic growth cycles of some coastal or Sunbelt markets, it offers more consistent returns with less volatility, making it particularly attractive for income-focused investors.

Historical Performance

Kansas real estate has demonstrated solid resilience and steady growth across market cycles:

| Period | Market Characteristics | Average Annual Appreciation |

|---|---|---|

| 2010-2015 | Post-recession recovery, steady growth in metro areas | 2-4% |

| 2016-2019 | Strengthening economy, increasing urban development | 4-6% |

| 2020-2022 | Pandemic impact, remote work migration, low inventory | 8-12% |

| 2023-Present | Market normalization, continued demand in metro areas | 5-7% |

Kansas property markets have shown remarkable stability during national downturns. During the 2008 financial crisis, Kansas home values experienced significantly milder declines than national averages. This resilience is attributed to the state’s more conservative lending practices, diversified economy, and relatively affordable housing stock that wasn’t as susceptible to speculative investment.

The state’s combination of steady economic growth, affordable housing, and strong rental demand has created sustainable appreciation that, while lower than high-growth markets, provides reliable returns with significantly less volatility.

Demographic Trends Driving Demand

Several demographic trends influence Kansas real estate markets:

- Urban Concentration – Increasing population density in Kansas City, Wichita, Lawrence, and other metro areas, creating stronger rental and purchase demand in these regions

- University Influence – Large student populations in Lawrence (University of Kansas), Manhattan (Kansas State), and other college towns driving consistent rental demand

- Healthcare Expansion – Growing healthcare sector attracting medical professionals to major cities and regional medical centers

- Manufacturing Resurgence – New manufacturing investments creating job growth in certain markets, particularly in aerospace and transportation equipment

- Affordable Living Appeal – Increasing interest from remote workers and retirees seeking lower costs of living compared to coastal areas

- Agricultural Technology – Modernization of the agricultural sector creating new economic opportunities in rural and semi-rural communities

These demographic trends vary significantly by region within Kansas, creating distinct investment opportunities across different markets. The eastern urban centers show stronger population growth and appreciation potential, while more rural areas often offer higher cash flow opportunities with more modest appreciation expectations.

2. Legal Framework

Kansas Property Laws and Regulations

Kansas maintains a generally property owner-friendly legal environment:

- Strong property rights protection under state law and constitution

- No statewide rent control with limitations on local rent regulation

- Reasonable eviction processes with defined legal procedures

- Standardized landlord-tenant laws under the Kansas Residential Landlord and Tenant Act

- Clear adverse possession laws with 15-year requirement

- Balanced approach to landlord and tenant rights

Recent legislative changes affecting property owners include:

- Enhanced disclosure requirements for properties in flood zones

- Updated building code regulations in certain jurisdictions

- Property tax assessment transparency improvements

- Clarification of landlord maintenance responsibilities

For investors accustomed to markets with heavy regulation like California or New York, the Kansas legal environment offers significantly greater operational flexibility and less bureaucratic oversight.

Ownership Structures

Kansas recognizes various ownership structures, each with different implications for liability protection, tax treatment, and estate planning:

- Individual Ownership:

- Simplest structure with minimal formation costs

- No liability protection (personal assets at risk)

- Pass-through taxation on personal returns

- Suitable for beginning investors with 1-2 properties

- Limited Liability Company (LLC):

- Most popular structure for real estate investors

- Liability protection separating personal assets

- Pass-through taxation (no double taxation)

- Flexibility in management structure

- Formation cost: $160 filing fee plus legal costs

- Corporation:

- C-Corporations: Separate tax entity with potential double taxation

- S-Corporations: Pass-through taxation with ownership restrictions

- Strong liability protection

- More complex compliance requirements

- Less commonly used for standard rental properties

- Limited Partnership:

- Suitable for properties with multiple investors

- General partner manages property; limited partners are passive

- Tax advantages for certain situations

- More complex formation and compliance

The LLC structure offers the best balance of liability protection, tax efficiency, and operational simplicity for most investors. Kansas has relatively straightforward LLC formation requirements and reasonable annual reporting obligations.

Landlord-Tenant Regulations

Kansas landlord-tenant law, primarily governed by the Kansas Residential Landlord and Tenant Act, establishes clear requirements:

- Lease agreements:

- Written leases recommended but not required

- Month-to-month tenancies permitted

- Lease terms customizable within legal parameters

- Required disclosures including lead paint for pre-1978 construction

- Security deposits:

- Limited to one month’s rent (unfurnished), 1.5 months (furnished)

- Must be returned within 30 days of move-out

- Itemized deductions required for withholding

- No requirement to hold in separate account

- Maintenance responsibilities:

- Landlords must maintain habitability

- Repairs affecting health/safety required within reasonable timeframe

- Tenant responsible for damage beyond normal wear and tear

- Property condition inventory recommended at move-in/move-out

- Entry rights:

- “Reasonable notice” required before entry (typically 24 hours)

- Emergency entry always permitted

- Lease should specify notice procedures

- Tenant cannot unreasonably deny access

- Eviction process:

- 3-day notice for non-payment of rent

- 14/30-day notice for lease violations (depending on type)

- Court filing with service of summons

- Hearing typically scheduled within 14 days

- Writ of possession issued if judgment granted

Kansas law generally maintains a balanced approach between landlord and tenant rights. Professional property management remains advisable for out-of-state investors or those with large portfolios.

Expert Tip

Never attempt “self-help” evictions in Kansas, such as changing locks or shutting off utilities. Despite Kansas’s landlord-friendly reputation, such actions are illegal and can result in significant penalties including damages and attorney fees. Always follow the formal eviction process through the courts, which is relatively efficient in Kansas compared to many other states.

Property Tax Considerations

Property taxes represent a significant ongoing expense for Kansas real estate investors:

| Property Tax Aspect | Details | Investor Implications |

|---|---|---|

| Average Tax Rates | 1.4% to 1.8% of property value annually, varies by location | Moderate compared to national average; significant regional variation |

| Assessment Process | Annual assessments by county appraisers | Values typically assessed at fair market value |

| Protest Rights | 30 days to appeal assessment through county | Formal protest process available with opportunity for hearing |

| Homestead Exemption | Safe Senior property tax refund program for qualifying homeowners | Not available for investment properties; only for primary residences |

| Regional Variation | Johnson County typically highest, rural areas lower | Strategic location selection can significantly impact tax burden |

| Payment Schedule | Due twice yearly (May and December) | Cash flow planning should account for biannual payments |

| Investor Strategies | Regular assessment reviews, documented property condition issues | Budget for annual review and potential appeal of assessments |

Kansas property taxes are set by multiple taxing authorities including counties, municipalities, school districts, and special districts. Tax rates can vary significantly even within the same county, making location-specific research essential. Regular assessment reviews and appeals when appropriate should be considered a standard part of property management in Kansas.

Legal Risks & Mitigations

Common Legal Challenges

- Security deposit disputes with tenants

- Maintenance responsibility disagreements

- Lease violation enforcement

- Local code compliance issues

- Property tax assessment challenges

- Weather-related damage insurance claims

- Contractor performance and mechanics liens

- Property boundary and easement disputes

Risk Mitigation Strategies

- Use Kansas-specific lease forms from professional sources

- Document property condition thoroughly at move-in/move-out

- Conduct regular property inspections with tenant permission

- Establish appropriate entity structures (typically LLC)

- Maintain adequate liability and property insurance

- Develop relationships with local legal counsel

- Implement thorough tenant screening procedures

- Use licensed contractors for all major work

3. Step-by-Step Investment Playbook

This comprehensive guide walks you through the entire Kansas property investment process, from initial market selection to property management and eventual exit strategies.

Market Selection

Kansas offers diverse markets with different investment profiles. Select locations based on your investment goals:

Major Metropolitan Areas

- Kansas City Metro: Largest market, diverse economy, strongest appreciation potential

- Wichita: Aviation industry hub, affordable entry points, solid rental demand

- Lawrence: University town, strong rental demand, higher price points

- Topeka: State capital, government employment base, moderate pricing

Major metros offer more liquidity, professional management options, and diverse tenant pools, but typically feature moderately lower cap rates compared to smaller markets.

Secondary/Tertiary Markets

- College Towns: Manhattan (KSU), Emporia (ESU), Pittsburg (PSU) – student housing potential

- Regional Centers: Salina, Hutchinson, Garden City – service centers for rural areas

- Manufacturing Hubs: Dodge City, Liberal, Junction City – industry-driven demand

- Emerging Areas: Olathe, Lenexa, Gardner – benefiting from Kansas City metro growth

Secondary markets often offer higher cash flow, lower competition, and lower entry price points, but with potentially less liquidity and higher management challenges.

Key Market Analysis Metrics

- Population Growth: Focus on areas with positive growth trends

- Job Growth: Diversified employment sectors, major employers

- Income Trends: Rising incomes support rent and value increases

- Rental Demand: Vacancy rates below 6% indicate strong demand

- Price-to-Rent Ratios: Lower ratios (under 15) support better cash flow

- Development Activity: New construction indicates market confidence

- Infrastructure Projects: Roads, schools, industrial expansion drive growth

- Days on Market: Faster-selling homes indicate strong demand

Successful Kansas investors develop systematic market selection criteria aligned with their investment strategy. Eastern Kansas markets typically offer stronger appreciation potential, while western and central regions often provide higher cash flow opportunities.

Expert Tip: When evaluating Kansas submarkets, pay close attention to school district quality. Properties in highly-rated school districts typically experience stronger appreciation and more stable tenant demand, particularly in family-oriented suburbs around Kansas City, Wichita, and Lawrence. Use the Kansas Department of Education ratings to identify top-performing districts, which often correlate with more resilient property values during market downturns.

Investment Strategy Selection

Different strategies work in various Kansas markets. Choose an approach that matches your goals and resources:

Long-Term Buy and Hold

Best For: Passive investors seeking stable long-term income and moderate appreciation

Target Markets: Established neighborhoods in major metros; growing suburbs

Property Types: Single-family homes, duplexes, small multi-family

Expected Returns: 5-7% cash flow, 3-5% appreciation, 8-12% total return

Minimum Capital: $25,000-$40,000 for down payment and reserves

Time Commitment: 1-2 hours monthly with property management

This strategy focuses on acquiring properties in stable locations with reliable rental demand and holding through market cycles. Kansas’s relatively affordable entry points and favorable price-to-rent ratios make this approach particularly accessible compared to more expensive markets.

BRRRR Strategy (Buy, Rehab, Rent, Refinance, Repeat)

Best For: Investors looking to rapidly build a portfolio with limited capital

Target Markets: Transitional neighborhoods; suburbs with older housing stock

Property Types: Distressed single-family, small multi-family needing renovation

Expected Returns: 8-12% cash flow after refinance, 12-18% total return

Minimum Capital: $40,000-$60,000 initially (potentially recycled)

Time Commitment: 10-20 hours weekly during acquisition/rehab phases

This strategy enables portfolio scaling by recycling capital. Purchase undervalued properties, renovate to increase value, rent to stabilize, refinance to recover capital, then repeat. Kansas’s moderate renovation costs and substantial inventory of older homes in many markets make this strategy viable across multiple regions.

Fix and Flip

Best For: Active investors seeking shorter-term profits

Target Markets: Desirable neighborhoods with high owner-occupant demand

Property Types: Outdated/distressed single-family homes with good bones

Expected Returns: 12-20% profit on total project cost per flip (not annualized)

Minimum Capital: $30,000-$60,000 per project

Time Commitment: 20+ hours weekly during active projects

Kansas markets offer numerous fix and flip opportunities, particularly in areas with aging housing stock and strong buyer demand. Suburban areas around Kansas City and Wichita present the strongest opportunities for this strategy due to higher buyer demand and price points that support renovation costs.

Student Housing

Best For: Investors familiar with higher-management properties seeking strong yields

Target Markets: Lawrence, Manhattan, Emporia, Pittsburg, Hays

Property Types: Multi-bedroom houses, small multi-family near campus

Expected Returns: 8-12% cash flow, location-dependent appreciation

Minimum Capital: $40,000-$80,000

Time Commitment: 5-10 hours weekly or professional management

Kansas’s multiple university towns offer strong student housing opportunities. This strategy typically involves per-bedroom leasing with parent guarantors, providing higher yields than traditional rentals. Success requires understanding academic calendars, student tenant preferences, and typically higher property turnover. Location within walking distance or along direct transit routes to campus commands premium rents.

Team Building

Successful Kansas real estate investing requires assembling a capable team, particularly for out-of-state investors:

Real Estate Agent

Role: Market knowledge, property sourcing, comparable analysis, negotiation

Selection Criteria:

- Experience working specifically with investors

- Investment property ownership themselves

- Deep local market knowledge

- Understanding of investor metrics (cap rate, cash-on-cash, etc.)

- Access to off-market opportunities

Finding Quality Agents:

- Referrals from other successful investors

- Local real estate investment associations

- Kansas-specific investor forums and networks

- Investor-focused brokerages

Look for agents who provide pre-screening analysis of potential properties rather than simply sending listings. The right agent should be able to calculate returns and identify potential issues before you waste time on unsuitable properties.

Property Manager

Role: Tenant screening, rent collection, maintenance, legal compliance

Selection Criteria:

- Experience with your specific property type

- Strong tenant screening processes

- Clear fee structure without hidden charges

- Technology platforms for reporting and communication

- Established vendor relationships

- Professional certifications (NARPM, etc.)

Typical Management Fees in Kansas:

- Single-family homes: 8-10% of monthly rent

- Small multi-family (2-4 units): 7-9% of monthly rent

- Larger multi-family: 5-7% of monthly rent

- Leasing fee: 50-100% of one month’s rent

- Setup/onboarding fees: $150-300 per property

Interview at least three management companies, check references from current clients, and review their lease agreements and processes thoroughly. The right property manager is often the difference between success and failure, particularly for out-of-state investors.

Financing Team

Role: Securing optimal financing, maximizing leverage safely

Key Members:

- Mortgage Broker: Access to multiple loan options and lenders

- Local Banks: Often offer competitive rates for Kansas properties

- Credit Unions: Sometimes provide better terms than traditional banks

- Private/Hard Money Lender: For short-term needs or non-conforming properties

- Insurance Agent: Specialized in investment property coverage

Financing Considerations for Kansas:

- Conventional, FHA, and VA loans widely available

- Local banks often familiar with investment property financing

- Farm Credit Services for rural properties

- Kansas Housing Assistance Program for primary residences

Kansas offers relatively accessible financing with conventional loans being the most common option for investors. Working with local lenders familiar with regional property values can often result in smoother underwriting, particularly for properties in smaller markets.

Support Professionals

Role: Specialized expertise for various investment aspects

Key Members:

- Real Estate Attorney: Entity setup, contract review, dispute resolution

- CPA/Tax Professional: Tax strategy, property tax protests, entity selection

- Home Inspector: Property condition assessment, renovation estimation

- General Contractor: Renovations, repairs, property improvements

- Insurance Agent: Property, liability, and umbrella coverage

The team should scale with your portfolio; beginning investors might rely more on their real estate agent and property manager, while experienced investors with larger portfolios benefit from deeper bench strength with specialists in multiple areas.

Expert Tip: When vetting property managers in Kansas, pay particular attention to their experience with your specific property type and location. Management requirements vary substantially between student housing in Lawrence, luxury rentals in Overland Park, and workforce housing in rural markets. The best property managers typically specialize in certain property types and geographic areas rather than claiming expertise across all segments. Ask for references from current clients with properties similar to yours in the same submarket.

Property Analysis

Disciplined analysis is crucial for successful Kansas investments. Follow these steps for each potential property:

Location Analysis

Neighborhood Factors:

- School district quality and boundaries

- Crime statistics by neighborhood (city-data.com)

- Flood zone and environmental hazards (FEMA maps)

- Property tax rates by exact location (county appraiser website)

- Future development plans (city planning department)

- Proximity to employment centers

- Walkability and amenities

- Demographic trends in immediate area

Common Kansas-Specific Considerations:

- Tornado risk and shelter access

- Basement condition (common in Kansas homes)

- Soil stability in certain regions

- Water table and drainage issues

- HOA restrictions and fees (particularly in newer developments)

- Farm/agricultural influences in semi-rural areas

Kansas real estate varies dramatically by location, even within the same metropolitan area. Research exact property locations thoroughly, as conditions can change significantly even within a few blocks.

Financial Analysis

Income Estimation:

- Research comparable rental rates (Rentometer, Zillow, local listings)

- Verify rates with local property managers

- Factor in seasonal occupancy variations (especially student housing)

- Consider future rent growth potential

- Analyze current lease terms if property is tenant-occupied

Expense Calculation:

- Property Taxes: 1.4-1.8% of value annually (county specific)

- Insurance: 0.4-0.6% of value annually (higher in tornado-prone areas)

- Property Management: 8-10% of rent plus leasing fees

- Maintenance: 5-15% of rent depending on age/condition

- Capital Expenditures: 5-10% of rent for long-term replacements

- Utilities: Any owner-paid utilities (common in multi-family)

- HOA/CID Fees: If applicable

- Vacancy: 5-8% of potential rent (higher in rural areas)

Key Metrics to Calculate:

- Cap Rate: Net Operating Income ÷ Purchase Price (aim for 6-8%+)

- Cash-on-Cash Return: Annual Cash Flow ÷ Total Cash Invested (aim for 8%+)

- Gross Rent Multiplier: Price ÷ Annual Gross Rent (lower is better)

- 1% Rule: Monthly rent should be ≥1% of purchase price (achievable in many Kansas markets)

- 50% Rule: Operating expenses typically ~50% of rent (excluding mortgage)

Kansas investors should be particularly careful with property tax estimates, as they can vary significantly between counties and municipalities. Also pay close attention to insurance costs, which may be higher in areas prone to tornado or hail damage.

Physical Property Evaluation

Critical Systems to Assess:

- Foundation: Look for cracks, settling, water intrusion (particularly in basements)

- Roof: Age, condition, recent hail damage (common in Kansas)

- HVAC: Age, type, seasonal efficiency (crucial for Kansas temperature extremes)

- Plumbing: Type of pipes, evidence of leaks, water pressure

- Electrical: Panel capacity, wiring type, code compliance

- Windows: Energy efficiency, condition, operation

- Drainage: Proper grading, gutters, evidence of water issues

Kansas-Specific Concerns:

- Basement condition and waterproofing (very common in Kansas homes)

- Storm shelter or safe room availability

- Historic hail damage to roofing and siding

- Insulation quality for extreme temperature variations

- Evidence of termite treatment/damage

- Drainage systems for heavy rainfall events

Professional Inspections:

- General home inspection ($300-450)

- Radon testing ($100-150)

- Termite/WDI inspection ($75-125)

- Sewer line scope for older properties ($200-300)

- Foundation assessment if concerns exist ($300-500)

The inspection phase is not the place to economize. Kansas properties face unique challenges from weather extremes, soil conditions, and in many areas, aging housing stock. Thorough professional evaluation prevents costly surprises.

Expert Tip: When analyzing potential investments in Kansas, pay special attention to basement condition and water management. Many Kansas homes have full basements, which can be significant assets if well-maintained or major liabilities if they have moisture issues. Look for proper waterproofing, functioning sump pumps, and exterior grading that directs water away from the foundation. Properties with dry, finished basements often command premium rents in Kansas markets, providing additional livable space that increases rental income potential.

Acquisition Process

The Kansas property acquisition process is relatively straightforward. Be prepared for these steps:

Contract and Negotiation

Kansas-Specific Contract Elements:

- Standard Kansas Association of Realtors (KAR) forms widely used

- Inspection period typically 7-10 days

- Earnest money deposit (1-2% typical) held by title company

- Lead-based paint disclosure for pre-1978 construction

- Specific property disclosure forms required

- Seller’s disclosure requirements (but with limitations)

Negotiation Strategies:

- Focus on inspection contingency length in competitive markets

- Consider as-is purchases with appropriate price adjustments

- Negotiate closing costs coverage by sellers when possible

- Request specific repairs rather than credits when feasible

- Include fixtures and appliances explicitly in contract

- Consider escalation clauses in competitive markets

Kansas uses standardized real estate forms that provide reasonable protection for buyers through contingencies. In most Kansas markets, there’s less pressure for waiving contingencies than in more competitive coastal markets, but the most desirable properties in Johnson County and parts of Lawrence can still see multiple offer situations.

Due Diligence

Property Level Due Diligence:

- Professional home inspection (schedule immediately after contract)

- Specialized inspections as needed (foundation, radon, termite)

- Review of seller’s disclosure (verify all systems functional)

- Utility costs verification (request previous 12 months’ bills)

- Current lease review if tenant-occupied

- Homeowner’s Association documents review (if applicable)

Title and Legal Due Diligence:

- Title commitment review (easements, restrictions, encumbrances)

- Survey review (boundary issues, encroachments)

- Property tax verification (current and post-purchase estimates)

- Permit verification for any recent improvements

- Insurance quote confirmation before closing

- Entity paperwork preparation if using LLC/trust

Neighborhood Due Diligence:

- Visit property at different times of day/week

- Speak with neighbors about area

- Check crime statistics by specific location

- Verify flood zone status (FEMA maps)

- Research planned developments and infrastructure

- Check proximity to unwanted facilities (landfills, etc.)

Kansas due diligence periods are typically 7-10 days, which is adequate for most properties. Begin inspections immediately after contract acceptance to ensure time for any additional specialized inspections that may be needed based on initial findings.

Closing Process

Key Closing Elements:

- Title companies handle closings (attorneys optional but not required)

- Typical closing timeline: 30-45 days from contract

- Final walk-through right before closing

- Both remote and in-person closings available

- Cashier’s check or wire transfer for closing funds

- Buyer and seller typically not present at same time

Closing Costs:

- Title insurance: 0.5-0.7% of purchase price

- Escrow fee: $300-400

- Recording fees: $50-100

- Lender fees: Per lender (if financing)

- Prepaid expenses: Insurance, property taxes, etc.

- Survey: $400-600 if not provided by seller

Post-Closing Steps:

- Transfer utilities immediately

- Change locks/security codes

- Register with HOA if applicable

- Set up property tax notifications

- Schedule property management onboarding

- File homestead exemption if owner-occupied

The Kansas closing process is generally efficient compared to states requiring attorney closings. Title companies handle most documentation, and many can accommodate remote closings for out-of-state investors through mail-away closings or power of attorney arrangements.

Expert Tip: In Kansas markets, consider including a home warranty with your purchase offer, especially for properties with older systems. A basic home warranty typically costs $400-600 annually and can provide valuable protection against unexpected repairs in the first year of ownership. This is particularly valuable for out-of-state investors who need time to establish relationships with reliable contractors. Additionally, offering to cover the cost of a home warranty in your purchase offer can be an attractive incentive to sellers without substantially increasing your acquisition costs.

Property Management

Effective property management is essential for maximizing returns in Kansas markets.

Tenant Screening

Key Screening Elements:

- Income verification (2.5-3x monthly rent minimum)

- Credit check (minimum score typically 600-650)

- Criminal background check (based on conviction history)

- Rental history verification (previous 2-3 landlords)

- Employment verification (length of employment, stability)

- Eviction history search (Kansas and national databases)

Legal Considerations:

- Kansas allows significant screening flexibility

- Must still comply with federal Fair Housing laws

- Consistent application of screening criteria for all applicants

- Careful documentation of reasons for application denials

- Written screening criteria to demonstrate consistency

Thorough tenant screening is the foundation of successful property management. In Kansas, evictions can be completed relatively efficiently compared to many states, but prevention through proper screening is always preferable.

Lease Agreements

Essential Lease Elements:

- Term length (12-month standard, avoid month-to-month initially)

- Rent amount, due date, grace period, late fees

- Security deposit amount and conditions

- Pet policies and deposits/fees

- Maintenance responsibilities clearly defined

- Utility payment responsibilities

- Rules regarding alterations, smoking, noise, etc.

- Entry notification procedures

Kansas-Specific Provisions:

- Security deposit handling procedures (30-day return requirement)

- Tornado/severe weather procedures

- Snow/ice removal responsibilities

- Lead paint disclosure for pre-1978 construction

- Lawn care/landscaping maintenance requirements

- Specific utility transfer requirements

Use professionally prepared, Kansas-specific lease forms such as those from the Kansas Association of Realtors (KAR) or Kansas Apartment Association (KAA). Avoid generic online leases that may not comply with Kansas requirements.

Maintenance Systems

Responsive Maintenance:

- Clear protocol for tenant maintenance requests

- Categorization of emergency vs. non-emergency issues

- Response timeline expectations (24 hours for acknowledgment)

- Documentation of all maintenance activities

- Follow-up verification of completion and quality

Preventative Maintenance:

- Seasonal HVAC maintenance (crucial for Kansas climate extremes)

- Gutter cleaning (particularly after fall leaf drop)

- Roof inspections (especially after severe weather)

- Water heater maintenance and inspection

- Pest control treatments (quarterly recommended)

- Seasonal weatherization (window seals, etc.)

Vendor Management:

- Pre-qualified vendor list for each trade

- Pricing agreements with preferred contractors

- Verification of insurance and licensing

- Performance tracking and quality control

- Backup vendors for each category

Kansas’s climate creates specific maintenance challenges, particularly related to HVAC systems, storm damage, and seasonal transitions. Proactive maintenance prevents costly emergency repairs and improves tenant satisfaction.

Financial Management

Income Management:

- Online rent collection options

- Clear late fee policies and enforcement

- Security deposit handling in separate account

- Documentation of all financial transactions

- Rent increase strategies and market analysis

Expense Management:

- Preventative maintenance budget (typically 5-10% of rent annually)

- Capital expenditure reserves (5-10% of rent annually)

- Property tax planning and protest procedures

- Insurance review and competitive bidding

- Utility cost monitoring and management

Accounting and Reporting:

- Monthly owner statements

- Annual financial summaries

- Tax document preparation (1099s, etc.)

- Cash flow analysis and forecasting

- Return on investment calculation and tracking

For out-of-state investors, detailed and transparent financial reporting is critical. Property management software with owner portals showing real-time performance data is increasingly the standard in major Kansas markets.

Expert Tip: Kansas’s seasonal climate extremes can significantly impact property maintenance needs. Consider implementing a bi-annual HVAC service program that includes spring cooling system preparation and fall heating system preparation. These scheduled maintenance visits not only prevent costly emergency repairs during peak demand periods but also extend equipment life and improve energy efficiency. Many HVAC contractors offer annual service agreements at discounted rates that provide priority service during extreme weather events when service calls are otherwise difficult to schedule.

Tax Optimization

Strategic tax planning significantly impacts overall returns on Kansas investments:

Property Tax Management

Understanding Kansas Property Taxes:

- Moderate property tax rates by national standards (1.4-1.8%)

- Significant variation between counties and municipalities

- Set by multiple taxing authorities (county, city, school district, etc.)

- Values reassessed annually by county appraisers

- No statutory caps on increases for non-homestead properties

Protest Strategies:

- Annual protests should be considered for most properties

- Protest deadline typically 30 days after valuation notice

- Evidence-based arguments using comparable sales

- Unequal appraisal arguments comparing to similar properties

- Condition issues documentation and cost estimates

- Professional representation available for more complex cases

Additional Tax Reduction Strategies:

- Separate business personal property from real estate

- Homestead exemption for primary residence (if owner-occupied)

- Damaged property tax relief for storm/disaster affected properties

- Agricultural use valuation for qualifying rural properties

- Historic property tax credits for qualifying properties

Property tax management is important in Kansas where it represents a significant portion of operating expenses. Successful investors budget for regular assessment reviews and appeals as needed.

Federal Income Tax Strategies

Deductible Expenses:

- Mortgage interest (subject to TCJA limitations)

- Property taxes (subject to SALT limitations)

- Insurance premiums

- Property management fees

- Repairs and maintenance

- Utilities paid by owner

- Marketing and advertising costs

- Travel expenses for property management

- Legal and professional services

- Depreciation of building (27.5 years for residential)

Advanced Tax Strategies:

- Cost segregation studies to accelerate depreciation

- Bonus depreciation for qualified improvements

- 1031 exchanges to defer capital gains

- Real estate professional status for active investors

- Self-directed IRAs for certain investments

- Qualified Business Income (QBI) deduction optimization

Kansas has a state income tax, so rental income will be subject to both federal and state taxation unless structured strategically. Consult with tax professionals specializing in real estate investments to develop a comprehensive strategy tailored to your specific situation.

Entity Structuring for Tax Efficiency

Common Entity Options:

- Individual Ownership: Pass-through taxation, simplest structure

- LLC (Disregarded Entity): Pass-through taxation with liability protection

- LLC (S-Corporation Election): Potential self-employment tax savings

- Limited Partnership: Multiple investor structure with tax advantages

Entity Selection Factors:

- Number of properties owned

- Active vs. passive management

- Portfolio growth plans

- Risk profile and liability exposure

- Estate planning concerns

- Self-employment tax considerations

Kansas-Specific Considerations:

- State income tax on all entity types

- Annual report fees for LLCs ($55 online filing)

- No state-level Series LLC statute

- Relatively straightforward LLC formation process

- Property tax treatment generally unaffected by entity type

Entity structure decisions should balance tax considerations with liability protection and operational efficiency. The right structure often evolves as your portfolio grows and investment strategy matures.

Expert Tip: For Kansas investors focused on long-term wealth building, consider implementing a dual-entity strategy. Form a Wyoming or Delaware LLC to serve as the membership owner of your Kansas LLC, which directly holds the properties. This structure provides enhanced asset protection benefits of the out-of-state LLC while maintaining operational simplicity and favorable tax treatment. This approach is particularly valuable for investors with substantial assets outside real estate that require additional protection, or those with properties in multiple states seeking consolidated management.

Exit Strategies

Planning your eventual exit is an essential component of any investment strategy:

Traditional Sale

Best When:

- Significant appreciation has accrued

- Local market conditions favor sellers

- Major repairs/renovations are approaching

- Investment goals have changed

- Portfolio rebalancing is desired

- 1031 exchange into other property is planned

Preparation Steps:

- Strategic improvements for maximum ROI

- Professional photography and marketing

- Timing based on seasonal market patterns

- Tenant coordination (selling vacant vs. occupied)

- Tax planning to minimize capital gains impact

- 1031 exchange planning if applicable

Cost Considerations:

- Agent commissions (typically 5-6%)

- Closing costs (1-2%)

- Repair negotiations from buyer inspections

- Capital gains taxes if not using 1031 exchange

- Tenant relocation costs if applicable

Kansas residential real estate typically follows seasonal patterns with spring and early summer bringing the most buyers and highest prices. Timing your sale to coincide with these peak periods can significantly impact final sale price and time on market.

1031 Exchange

Best When:

- Significant capital gains have accumulated

- Continuing real estate investment is planned

- Upgrading to larger/higher-quality properties

- Switching property types (residential to commercial)

- Moving investment to different markets

- Consolidating multiple properties into fewer larger assets

Key Requirements:

- Like-kind property (broadly defined for real estate)

- Equal or greater value to defer all gain

- 45-day identification period

- 180-day closing period

- Qualified intermediary to hold proceeds

- Same taxpayer/entity on title

Kansas-Specific Considerations:

- State follows federal treatment of 1031 exchanges

- Several qualified intermediaries available in major markets

- Title companies familiar with 1031 procedures

- Property tax reassessment after purchase

- DST (Delaware Statutory Trust) options available

1031 exchanges are powerful wealth-building tools that allow Kansas investors to preserve equity and defer taxes while strategically improving their portfolios. Advanced planning is essential, ideally beginning 3-6 months before the planned sale.

Cash-out Refinancing

Best When:

- Significant equity has accumulated

- Interest rates are favorable

- Property continues to cash flow after refinance

- Capital needed for additional investments

- Tax-free cash extraction preferred over sale

- Long-term hold still desired

Refinancing Considerations:

- Typically limited to 70-75% LTV for investment properties

- Requires income verification and credit qualification

- Property condition and appraisal critical

- Closing costs typically 2-4% of loan amount

- Impact on cash flow with new loan terms

- Prepayment penalties on some loans

Refinancing allows investors to access equity without triggering tax events, effectively leveraging appreciation while maintaining ownership of appreciating assets. This strategy works best in Kansas markets that have seen substantial appreciation, such as Johnson County and other Kansas City suburbs.

Seller Financing/Owner Financing

Best When:

- Higher sale price is priority over immediate cash

- Steady income stream is desired

- Conventional buyers facing tight credit markets

- Property has challenges for traditional financing

- Tax benefits from installment sale desired

- Higher interest returns compared to other investments

Kansas-Specific Considerations:

- Document as mortgage with promissory note

- Recording with county register of deeds recommended

- Dodd-Frank compliance for multiple transactions

- Foreclosure rights through judicial process

- Title insurance recommended for buyer protection

- Servicing companies available for payment collection

Seller financing can create win-win situations by helping buyers with limited conventional financing options while providing sellers with higher sale prices and potentially favorable tax treatment through installment sales. This exit strategy is often effective in Kansas’s smaller markets where conventional financing may be more challenging to obtain.

Expert Tip: When planning your exit strategy in Kansas markets, consider the seasonal timing of your sale. Kansas real estate markets typically peak in spring and early summer, with significantly slower activity during winter months. For investment properties, aim to list between March and June to capitalize on the largest buyer pool and strongest pricing. If selling a tenant-occupied property, coordinate lease end dates to align with this optimal selling season, potentially offering lease flexibility or incentives to tenants to facilitate timing that maximizes your sale prospects.

4. Regional Hotspots

Major Metropolitan Markets

Detailed Submarket Analysis: Kansas City Metro (Kansas Side)

The Kansas City metropolitan area offers diverse submarkets with distinct investment characteristics:

| Submarket | Price Range | Cap Rate | Growth Drivers | Investment Strategy |

|---|---|---|---|---|

| Overland Park | $350K-600K | 4.5-5.5% | Corporate headquarters, top schools, retail/entertainment | Long-term appreciation play, newer properties, family rentals |

| Olathe | $275K-450K | 5-6% | Affordability, family-friendly, good schools, new development | Balanced cash flow and appreciation, strong rental demand |

| Lenexa | $300K-500K | 5-6% | City Center development, business parks, central location | Mixed-use development opportunities, newer suburban properties |

| Shawnee | $250K-400K | 5.5-6.5% | Affordability, family-oriented, good accessibility | Value-add opportunities, strong cash flow potential |

| Kansas City, KS (Wyandotte) | $100K-250K | 7-9% | Affordability, revitalization efforts, medical district | High cash flow, multifamily, workforce housing |

| Gardner/Edgerton | $225K-350K | 6-7% | Logistics hub, warehouse development, affordability | Emerging growth area, workforce housing, new construction |

| Spring Hill/DeSoto | $250K-375K | 5.5-6.5% | Rural-suburban transition, new development, schools | Growth corridor play, newer single-family homes |

Detailed Submarket Analysis: Wichita Metro

Wichita offers diverse investment opportunities across various neighborhoods and suburbs:

| Submarket | Price Range | Cap Rate | Growth Drivers | Investment Strategy |

|---|---|---|---|---|

| East Wichita | $200K-350K | 5.5-6.5% | Higher-end neighborhoods, best schools, retail centers | Long-term appreciation, stable family rentals |

| Northeast Wichita | $150K-250K | 6-7.5% | Moderately priced, mixed neighborhoods, accessibility | Balanced returns, workforce housing, value-add potential |

| Derby | $175K-300K | 6-7% | Family-oriented suburb, good schools, McConnell AFB | Military housing rentals, family homes, stable suburb |

| Andover | $225K-375K | 5.5-6.5% | Premier school district, growth corridor, newer homes | Higher-end rentals, family properties, potential appreciation |

| West Wichita | $175K-275K | 6-7% | Established neighborhoods, mixed demographics, accessibility | Balanced returns, mid-range rentals, stable demand |

| South Wichita | $90K-175K | 7-9% | Affordability, industrial employment, workforce housing | High cash flow, multifamily, higher management intensity |

| Haysville | $125K-225K | 6.5-8% | Affordable suburb, working-class area, good accessibility | Strong cash flow, workforce housing, entry-level investing |

Up-and-Coming Areas for Investment

Growth Corridor Markets

These areas are experiencing development and infrastructure investment:

- Gardner/Edgerton (Johnson County) – Benefiting from massive logistics hub development and transportation infrastructure

- Western Shawnee/Lenexa – Continued westward expansion of Kansas City suburbs with new development

- Northwest Wichita/Maize – Growing suburb with strong school district and new housing development

- West Lawrence – Expansion area with newer housing stock and continued development

- Junction City – Benefiting from Fort Riley expansion and growing regional importance

- Goddard (West of Wichita) – Growing suburb with excellent schools and new development

These markets typically offer better appreciation potential with moderate cash flow. They’re ideal for investors with a medium to long-term time horizon seeking balanced returns from both income and appreciation.

Revitalization Areas

Neighborhoods experiencing renewal and demographic shifts:

- East Lawrence – Historic district with growing artistic community and renovation activity

- North Topeka – NOTO Arts District driving neighborhood revitalization

- Delano District (Wichita) – Historic neighborhood near downtown seeing renewed interest

- Argentine/Strawberry Hill (KCK) – Historic neighborhoods with affordable properties and renewal efforts

- College Hill (Wichita) – Established near-downtown neighborhood with character homes

- Downtown Manhattan – Urban core revitalization near Kansas State University

These areas typically involve higher management intensity but offer potential for strong appreciation through property improvements aligned with neighborhood trends. They require more market knowledge but can deliver above-average returns through both cash flow and appreciation when properly executed.

Expert Insight: “Kansas investors should pay particular attention to infrastructure development when identifying emerging markets. The state’s significant transportation projects, such as highway expansions and interchanges, often precede major development activity by 2-3 years. Areas around the Johnson County Gateway interchange, South Lawrence Trafficway expansion, and Northwest Wichita bypass are all primed for growth. Additionally, locations near major distribution centers and logistics hubs, like those in Edgerton and Gardner, continue to drive housing demand as these facilities expand their workforce. Identifying these catalysts early allows investors to acquire properties before appreciation accelerates.” – Mark Richardson, Principal, Kansas Investment Properties

5. Cost Analysis

Initial Investment Costs

Understanding the full acquisition costs is essential for accurate return projections:

Acquisition Cost Breakdown

| Expense Item | Typical Cost | Example ($200,000 Property) |

Notes |

|---|---|---|---|

| Down Payment | 20-25% of purchase price | $40,000-$50,000 | Investor loans typically require higher down payments than owner-occupied |

| Closing Costs | 2-3% of purchase price | $4,000-$6,000 | Title insurance, escrow fees, recording, lender costs |

| Inspections | $350-600+ | $450 | General inspection plus specialized if needed |

| Initial Repairs | 0-5%+ of purchase price | $0-$10,000+ | Varies greatly by property condition |

| Furnishing (if applicable) | $3,000-$10,000+ | $0 | For furnished or partially furnished rentals |

| Reserves | 6 months expenses | $3,600-$5,400 | Emergency fund for vacancies and unexpected repairs |

| Entity Setup (if used) | $300-$800 | $500 | LLC formation, operating agreement, initial filings |

| TOTAL INITIAL INVESTMENT | 25-35% of property value | $48,550-$72,350 | Varies based on financing, condition, and strategy |

Note: Costs shown are typical ranges for Kansas residential investment properties as of May 2025.

Comparing Costs by Market

Property acquisition costs vary across Kansas markets:

| Market | Median SFH Price | Typical Down Payment (25%) | Closing Costs | Initial Investment |

|---|---|---|---|---|

| Johnson County (KC Metro) | $350,000 | $87,500 | $8,750 | $96,250+ |

| Lawrence | $275,000 | $68,750 | $6,875 | $75,625+ |

| Wichita | $225,000 | $56,250 | $5,625 | $61,875+ |

| Topeka | $175,000 | $43,750 | $4,375 | $48,125+ |

| Manhattan | $250,000 | $62,500 | $6,250 | $68,750+ |

| Smaller Markets (Salina, Hutchinson, etc.) |

$150,000 | $37,500 | $3,750 | $41,250+ |

Initial investment requirements vary significantly across Kansas markets, with Johnson County requiring more than twice the capital of smaller markets for comparable property types. When analyzing potential returns, consider both your available capital and desired investment strategy – higher-priced markets typically offer stronger appreciation but lower cash flow, while more affordable markets provide better current income but potentially slower growth.

Ongoing Costs

Accurate expense estimation is critical for realistic cash flow projections:

Annual Operating Expenses

| Expense Item | Typical Percentage | Example Cost ($200,000 Property) |

Notes |

|---|---|---|---|

| Property Taxes | 1.4-1.8% of value annually | $2,800-$3,600 | Varies by city/county; regional variation |

| Insurance | 0.4-0.6% of value annually | $800-$1,200 | Higher in tornado-prone areas |

| Property Management | 8-10% of rental income | $1,152-$1,440 | Based on $1,200/mo rent; plus leasing fees |

| Maintenance | 5-15% of rental income | $720-$2,160 | Higher for older properties |

| Capital Expenditures | 5-10% of rental income | $720-$1,440 | Reserves for roof, HVAC, etc. |

| Vacancy | 5-8% of potential income | $720-$1,152 | Lower in high-demand areas |

| HOA Fees (if applicable) | $0-300 monthly | $0-$3,600 | Very property-specific |

| Utilities (if owner-paid) | Varies | $0-$1,800 | Usually tenant-paid for SFH |

| TOTAL OPERATING EXPENSES | 40-50% of rent (excluding mortgage) | $6,912-$15,392 | Wide range based on property age, location, and type |

Note: The “50% Rule” (estimating expenses at 50% of rent excluding mortgage) is often a good starting point for Kansas properties, though actual expenses may be lower in well-maintained properties in stable areas.

Sample Cash Flow Analysis

Single-family investment property in suburban Wichita:

| Item | Monthly (USD) | Annual (USD) | Notes |

|---|---|---|---|

| Gross Rental Income | $1,300 | $15,600 | Market rate for comparable properties |

| Less Vacancy (6%) | -$78 | -$936 | Approximately 3 weeks per year |

| Effective Rental Income | $1,222 | $14,664 | |

| Expenses: | |||

| Property Taxes | -$263 | -$3,150 | 1.5% of $210,000 value |

| Insurance | -$88 | -$1,050 | 0.5% of value |

| Property Management | -$104 | -$1,248 | 8% of collected rent |

| Maintenance | -$91 | -$1,095 | 7% of rent (moderate age) |

| Capital Expenditures | -$104 | -$1,248 | Reserves for major replacements |

| HOA Fees | -$0 | -$0 | No HOA in this example |

| Total Expenses | -$650 | -$7,791 | 53% of gross rent |

| NET OPERATING INCOME | $572 | $6,873 | Before mortgage payment |

| Mortgage Payment (20% down, 30yr, 6.5%) |

-$1,058 | -$12,701 | Principal and interest only |

| CASH FLOW | -$486 | -$5,828 | Negative cash flow with financing |

| Cash-on-Cash Return (with financing) |

-11.1% | Based on $52,500 cash invested | |

| Cap Rate | 3.3% | NOI ÷ Property Value | |

| Total Return (with 5% appreciation) | 8.9% | Including equity growth and appreciation |

This example illustrates how current market conditions with higher interest rates can create negative cash flow with conventional financing, even in a relatively affordable market like Wichita. To create positive cash flow, investors might need to:

- Increase down payment to reduce mortgage costs (25-30%)

- Look for below-market purchases through off-market deals

- Consider smaller markets with better price-to-rent ratios

- Focus on value-add opportunities to increase rent potential

- Consider alternative financing with lower rates/payments

Return on Investment Projections

5-Year ROI Analysis

Projected returns for a $200,000 single-family rental property with 20% down:

| Return Type | Year 1 | Year 3 | Year 5 | 5-Year Total |

|---|---|---|---|---|

| Cash Flow | -$5,828 | -$5,410 | -$4,965 | -$26,598 |

| Principal Paydown | $3,005 | $3,413 | $3,878 | $17,148 |

| Appreciation (5% annual) | $10,000 | $11,025 | $12,155 | $55,256 |

| Tax Benefits (25% tax bracket) |

$2,450 | $2,250 | $2,050 | $11,250 |

| TOTAL RETURNS | $9,627 | $11,278 | $13,118 | $57,056 |

| ROI on Initial Investment ($52,500) |

18.3% | 21.5% | 25.0% | 108.7% |

| Annualized ROI | 18.3% | 7.2% | 5.0% | 15.8% |

This example demonstrates why many Kansas investors accept negative cash flow in the current interest rate environment – the total return can remain attractive due to appreciation potential, equity building through mortgage paydown, and tax benefits. However, this strategy involves significant risk if appreciation fails to materialize or if extended vacancies occur.

Cash Flow Focus Strategy

For investors prioritizing positive cash flow, consider these approaches in Kansas markets:

- Target Secondary Markets: Focus on Salina, Hutchinson, Garden City and similar cities with lower property values and favorable rent-to-price ratios

- Higher Down Payments: 30-40% down to reduce monthly mortgage obligations

- Multifamily Properties: 2-4 unit properties often provide better cash flow metrics than single-family homes

- Value-Add Opportunities: Properties requiring cosmetic updates where rents can be significantly increased after improvements

- Seller Financing: Often offers better terms than conventional loans

- Less Competitive Areas: Focus on neighborhoods overlooked by larger investors

- House Hacking: Owner-occupying one unit of a multi-unit property to qualify for better financing

Cash flow-focused strategies typically involve more management intensity and potentially slower appreciation but provide immediate positive returns and reduced reliance on market appreciation.

Appreciation Focus Strategy

For investors prioritizing long-term wealth building through appreciation:

- High-Growth Corridors: Focus on Johnson County, western Wichita suburbs, and Lawrence

- New Construction: Partner with builders in developing areas

- Higher-End Properties: Target properties in premium school districts and established neighborhoods

- Path of Progress: Identify areas with planned infrastructure improvements

- College-Adjacent: Properties in stable neighborhoods near expanding universities

- Corporate Relocation Areas: Target markets with announced major employers

- Employment Centers: Focus on areas with concentrated job growth

Appreciation-focused strategies generally require stronger financial positions to weather negative or break-even cash flow periods, but can produce substantial wealth through equity growth in Kansas’s faster-developing markets.

Expert Insight: “Kansas investors should adapt their strategy based on their specific market within the state. The current environment has created a significant divide between cash flow and appreciation opportunities. In Johnson County and Lawrence, appreciation potential remains strong, but achieving positive cash flow requires substantial down payments or creative financing. Meanwhile, in many secondary and tertiary markets, the 1% rule (monthly rent at 1% of purchase price) is still achievable, creating excellent cash flow opportunities with more modest appreciation expectations. The most successful Kansas investors often maintain a balanced portfolio with properties in both types of markets, allowing appreciation assets to build wealth while cash flow properties provide current income and liquidity.” – Jennifer Collins, Kansas Investment Properties Association

6. Property Types

Residential Investment Options

Commercial Investment Options

Beyond residential, Kansas offers attractive commercial property opportunities:

| Property Type | Typical Cap Rate | Typical Entry Point | Pros | Cons |

|---|---|---|---|---|

| Retail Strip Centers | 7-9% | $500K-$2M | Triple-net leases, diverse tenant mix, lower management | E-commerce disruption, tenant turnover, higher vacancy risk |

| Self-Storage | 6-8% | $750K-$3M | Recession resistant, low maintenance, expandable | Increasing competition, seasonal fluctuations |

| Office Buildings | 8-10% | $750K-$5M+ | Long-term leases, higher-quality tenants | Remote work impacts, high tenant improvement costs |

| Industrial/Warehouse | 6-8% | $1M-$7M+ | E-commerce growth, lower maintenance, stable tenants | Higher entry costs, specialized knowledge required |

| Mixed-Use Properties | 7-9% | $800K-$5M+ | Diversified income streams, urban growth areas | Complex management, varying lease structures |

| Medical Office | 6.5-8.5% | $1M-$5M+ | Recession resistant, stable tenants, aging population | Specialized buildouts, complex regulations |

| Mobile Home Parks | 8-11% | $750K-$3M | Affordable housing demand, tenant-owned units | Management intensity, aging infrastructure |

Cap rates and investment points reflective of 2025 Kansas commercial real estate market.

Commercial properties generally involve larger investments, longer closing timelines, more complex due diligence, and specialized financing. However, they can offer stronger returns and lower management intensity than residential properties of equivalent value.

Alternative Investment Options

Agricultural Land

Kansas offers extensive agricultural land investment opportunities:

- Farmland: Crop production land with rental income potential

- Ranchland: Grazing land for livestock operations

- Recreational Land: Hunting leases, conservation, outdoor recreation

- Development Land: Agricultural land in path of growth for future development

- Water Rights: Increasingly valuable in certain regions

Pros: Stable appreciation, potential income streams, tax advantages through agricultural exemptions, tangible asset, limited supply

Cons: High entry costs, weather/crop price risks, lower liquidity, specialized management needed, seasonal income patterns

Best Markets: Western Kansas for larger farms/ranches, outskirts of growing urban areas for future development, central Kansas for balanced operations

Real Estate Syndications/Crowdfunding

Participate in larger Kansas real estate deals with lower capital requirements:

- Private Equity Real Estate Funds: Professional management of diversified properties

- Project-Specific Syndications: Investment in specific developments

- Real Estate Crowdfunding: Fractional ownership through online platforms

- Real Estate Investment Trusts (REITs): Publicly traded shares in property portfolios

- Delaware Statutory Trusts (DSTs): Fractional ownership with 1031 exchange eligibility

Pros: Lower minimum investments, professional management, access to larger assets, geographic diversity, passive involvement

Cons: Limited control, typically illiquid investments, fee structures can impact returns, reliance on sponsors/managers

Best Opportunities: Multifamily developments in Johnson County, medical office properties near major hospitals, industrial projects in logistics corridors

Strategy Selection Guidance

Matching Property Type to Investment Goals

| Investment Goal | Recommended Property Types | Recommended Markets | Investment Structure |

|---|---|---|---|

| Maximum Cash Flow Focus on immediate income |

Small multifamily, student housing, single-family in affordable areas | Secondary markets (Salina, Hutchinson, Garden City), workforce areas of major cities | Higher down payments, value-add opportunities, seller financing when possible |

| Long-term Appreciation Wealth building focus |

Single-family homes, townhomes in premium locations | Johnson County, Lawrence, western Wichita suburbs | Conventional financing, focus on location quality, accept lower initial returns |

| Balanced Approach Cash flow and growth |

Duplexes, small multifamily, single-family in growing areas | Lenexa, Olathe, east Wichita, Topeka | Moderate leverage, some value-add component, location with growth potential |

| Minimal Management Hands-off investment |

Newer single-family, townhomes, triple-net commercial, syndications | Johnson County, newer subdivisions, commercial corridors | Professional management, newer properties, higher-quality tenants, REITs |

| Portfolio Diversification Spread risk across assets |

Mix of residential, commercial, and alternative investments | Multiple Kansas markets with different economic drivers | Combination of direct ownership and passive investments, various financing structures |

| Student Housing Focus Higher yields, niche strategy |

Multi-bedroom houses, small apartment buildings near campus | Lawrence, Manhattan, Emporia, Pittsburg | Value-add renovations, per-room leasing, parent guarantors, specialized management |

Expert Insight: “Kansas offers a unique advantage for investors willing to look beyond conventional property types. In our experience, mixed-use properties in revitalizing areas of Kansas City, Topeka, and Lawrence have consistently outperformed single-purpose investments. These properties—typically with retail/commercial on the ground floor and residential above—benefit from income diversification and tend to appreciate faster as urban cores continue to strengthen. While they require more sophisticated management, the premium in returns typically ranges from 2-4% annually compared to similar-quality single-purpose properties. For investors with the capability to handle slightly more complex operations, these mixed-use opportunities represent one of Kansas’s most overlooked niches.” – Michael Thurman, Kansas Commercial Property Association

7. Financing Options

Conventional Financing

Traditional mortgage options available for Kansas property investments:

Conventional Investment Property Loans

| Loan Aspect | Details | Requirements | Best For | ||

|---|---|---|---|---|---|

| Down Payment | 20-25% minimum for single-family 25-30% for 2-4 units 30-35% for 5+ units |

Liquid funds or documented gifts Reserves of 6+ months required |

Investors with substantial capital Long-term buy-and-hold strategy |

||

| Interest Rates | 0.5-0.75% higher than owner-occupied Typically 6.5-7.5% (May 2025) Fixed and ARM options |

Credit score 680+ for best rates Lower scores = higher rates/points |

Investors prioritizing predictable payments Those expecting to hold through rate cycles |

||

| Terms | 15, 20, or 30-year terms 5/1, 7/1, 10/1 ARMs available Interest-only options limited |

Debt-to-income ratio under 45% Including all properties owned |

Those seeking longest amortization Maximizing cash flow over equity build |

||

| Qualification | Based on income and credit Some rental income considered Multiple property limitations |

2 years employment history Credit score 620+ minimum No recent foreclosures/bankruptcies |

W-2 employees with strong income Those with limited property portfolios |

||

| Limits | Conforming limits apply Maximum of 10 financed properties Declining terms after 4-6 properties |

Each property must qualify Increased reserve requirements with multiple properties |

Beginning to intermediate investors Those building initial portfolios |

||

| Property Types | 1-4 unit residential properties Warrantable condos Some planned communities |

Property must be in good condition Non-warrantable condos excluded No mixed-use typically |

1-4 unit residential properties Warrantable condos Some planned communities |

Property must be in good condition Non-warrantable condos excluded No mixed-use typically |

Standard investment properties Traditional residential units |

Conventional financing remains the most common approach for Kansas investors, particularly for beginning and intermediate investors with strong personal finances. These loans offer the best combination of low interest rates, long terms, and minimal ongoing compliance requirements.

Government-Backed Loan Programs

Several government programs can assist with Kansas investment properties under specific circumstances:

- FHA (203k) Loans:

- Primary residence requirement (owner-occupied)

- 1-4 unit properties allowed (can rent other units)

- Low down payment (3.5% with 580+ credit score)

- Renovation financing included

- Cannot be used for pure investment properties

- Strategy: “House hacking” – live in one unit while renting others

- VA Loans:

- For qualifying veterans and service members

- Primary residence requirement

- Zero down payment option

- 1-4 unit properties (owner occupies one unit)

- Competitive interest rates

- Strategy: Military members using VA benefits for multi-unit properties

- USDA Loans:

- Rural property requirement (many Kansas areas qualify)

- Primary residence only

- Zero down payment option

- Income limitations apply

- Strategy: First investment in rural/suburban areas while living in property

- Kansas Housing Assistance Programs:

- First-time homebuyer programs

- Down payment assistance

- Primary residence requirement

- Income and purchase price limitations

- Strategy: First rental property purchase while living in it

These programs require owner occupancy but can be stepping stones to building an investment portfolio through house hacking or eventual conversion to rental properties after meeting occupancy requirements (typically 1 year).

Alternative Financing Options

Beyond conventional mortgages, Kansas investors have access to several specialized financing options:

Portfolio Loans

Loans from local banks and lenders that keep loans on their own books rather than selling to secondary market.

Key Features:

- More flexible qualification criteria

- Often based on property performance rather than borrower income

- Can exceed conventional loan limits

- No limit on number of financed properties

- Can finance non-warrantable condos, mixed-use, etc.

Typical Terms:

- 20-25% down payment

- Rates 1-2% higher than conventional

- Shorter terms (often 5-10 years with balloon)

- May have prepayment penalties

Best For: Investors with multiple properties, those with debt-to-income challenges, unique property types

Private/Hard Money Loans

Short-term financing from private individuals or lending companies.

Key Features:

- Asset-based lending (property is primary consideration)

- Quick closing (often 1-2 weeks)

- Minimal documentation compared to conventional

- Credit and income less important

- Can finance properties needing renovation

Typical Terms:

- 10-25% down payment

- 8-12% interest rates

- 2-4 points (upfront fees)

- 6-24 month terms

- Interest-only payments common

Best For: Fix-and-flip investors, properties needing significant renovation, buyers needing quick closings

Commercial Loans

Traditional financing for properties with 5+ units or non-residential use.

Key Features:

- Based primarily on property’s net operating income

- Debt service coverage ratio (DSCR) typically 1.25+

- Personal guarantees often required

- More extensive documentation than residential

- Suitable for larger multifamily, mixed-use, retail, office, etc.

Typical Terms:

- 25-35% down payment

- 5-7% interest rates (varies by property type)

- 5-10 year terms with 20-25 year amortization

- Balloon payments common

- Recourse and non-recourse options

Best For: Larger multifamily properties, commercial real estate, experienced investors

Seller Financing

Property seller acts as the lender, holding a note for part of the purchase price.

Key Features:

- Highly negotiable terms based on seller motivation

- No traditional lender qualification process

- Faster closings without conventional underwriting

- Can finance properties difficult to finance conventionally

- Creative structures possible

Typical Terms:

- 10-30% down payment (highly variable)

- Interest rates from 4-8% (negotiable)

- Term lengths vary widely (often 3-10 years with balloon)

- May require additional security beyond property

Best For: Buyers with credit challenges, unique properties, situations where conventional financing is unavailable

Creative Financing Strategies

Experienced Kansas investors employ various creative approaches to maximize returns and portfolio growth:

BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat)

A systematic approach to building a portfolio while recycling capital:

- Buy: Purchase undervalued property (often with hard money or cash)

- Rehab: Improve property to increase value and rental potential

- Rent: Place qualified tenants to establish cash flow

- Refinance: Obtain long-term financing based on new, higher value

- Repeat: Use extracted capital for next property

Kansas Advantages:

- Affordable entry points in many markets

- Significant inventory of older homes suitable for value-add

- Moderate renovation costs compared to coastal markets

- Strong rental demand in most markets

- Local lenders familiar with refinancing investment properties

Key Considerations:

- Refinance typically limited to 70-75% of appraised value

- 6-month seasoning period often required before cash-out refinance

- Requires accurate rehab budgeting and ARV (After Repair Value) estimation

- Initial capital needs higher than conventional purchases

Best Markets: Older neighborhoods in Kansas City, Wichita, Topeka, and Lawrence with renovation potential and strong rental demand

House Hacking

Living in a property while renting portions to offset costs:

- Multi-Unit Approach: Purchase 2-4 unit property, live in one unit, rent others

- Single-Family Approach: Rent individual rooms in larger home

- Basement Apartment: Many Kansas homes have basements convertible to separate units

Financing Advantages:

- Can use owner-occupied financing (FHA, VA, conventional with 3-5% down)

- Better interest rates than investment loans

- Lower down payment requirements

- Rental income can help qualify for mortgage

Kansas Considerations:

- Most effective in higher-cost areas (Johnson County, Lawrence)

- Verify zoning and occupancy regulations regarding unrelated roommates

- Many older Kansas homes offer ideal layouts for house hacking

- Must live in property for minimum time period (typically 1 year)

Best Markets: College towns, urban centers, areas with strong rental demand and higher housing costs

Master Leasing/Rent-to-Rent

Leasing a property from an owner and then subletting it for profit:

- Lease a property from landlord with subletting permission

- Make improvements to increase rental value

- Rent to tenants at a higher rate than the master lease

- Profit from the spread between master lease and sublease

- May involve converting single-family to roommate/shared housing

Key Considerations:

- Explicit written permission for subletting required

- May need to form a property management company

- Insurance considerations for subletting

- Local regulations regarding subletting and occupancy

- Clear agreements with both owner and sub-tenants

Kansas Advantages:

- Many landlords open to this arrangement in college towns

- Lower barrier to entry than property ownership

- Minimal capital requirements

- Scalable business model

Best For: Investors with limited capital, entrepreneurial mindset, strong tenant management skills, and markets with significant spread potential

Financing Strategy Comparison

Selecting the Right Financing Approach

| Financing Type | Best For | Avoid If | Important Considerations |

|---|---|---|---|

| Conventional Traditional bank financing |

Long-term buy-and-hold strategy Strong credit and income Stable properties in good condition |

You have credit challenges The property needs significant work You already have multiple financed properties |

Lowest interest rates Longest terms Most stable option Strictest qualification requirements |

| Portfolio Loans Bank-held financing |

Experienced investors Multiple property portfolios Non-standard property types |

You want the absolute lowest rate You need 30-year fixed terms You’re looking for maximum leverage |