Check out our app!

Explore more features on mobile.

Transnistria Real Estate Investment Guide

A comprehensive resource for North Americans exploring investment opportunities in an internationally unrecognized territory with unique geopolitical considerations

1. Transnistria Overview

Geopolitical Status

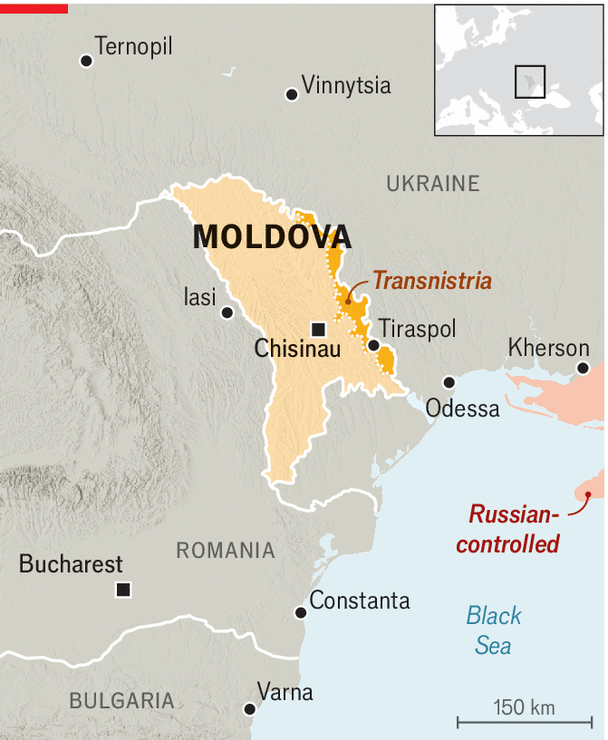

Transnistria (officially the Pridnestrovian Moldavian Republic) is a breakaway state that declared independence from Moldova in 1990. Despite functioning as a de facto independent entity with its own government, military, currency, and postal system, it remains internationally unrecognized, with no UN member states acknowledging its sovereignty.

Key geopolitical factors to understand:

- International Recognition: Considered legally part of Moldova by the international community

- Russian Influence: Significant economic, political, and military support from Russia

- Military Presence: Russian peacekeeping forces stationed in the territory since the 1992 conflict

- Border Status: Shares borders with Moldova and Ukraine

- Population: Approximately 470,000 residents (declining)

This unique geopolitical position creates both extraordinary risks and potential opportunities for investors who understand the complex dynamics at play. Most importantly, property rights and investments are not protected by international law in the same way as in recognized countries.

Transnistria is a narrow strip of land between the Dniester River and Ukraine

Economic Indicators

- GDP: Approximately $1 billion USD (2021)

- Currency: Transnistrian Ruble (not recognized internationally)

- Main Industries: Heavy industry, textile manufacturing, electricity generation

- Major Economic Players: Sheriff conglomerate (dominates local economy)

- Dependence: Heavily reliant on Russian subsidies, particularly gas

Economic System & Challenges

Transnistria’s economy represents a hybrid model combining remnants of Soviet-era command structures with elements of market economy. It faces several fundamental challenges:

- Limited international recognition resulting in isolation from global financial systems

- Heavy dependence on Russian subsidies, particularly subsidized natural gas

- Monopolistic business environment dominated by the Sheriff conglomerate

- Restricted banking system disconnected from global financial infrastructure

- Currency limitations with the Transnistrian ruble only usable within the territory

- Demographic decline with ongoing emigration (especially younger residents)

- Infrastructure challenges including aging Soviet-era systems and limited modernization

Despite these challenges, Transnistria has maintained economic stability largely through Russian support and several major industrial enterprises. In recent years, there has been increased economic integration with the EU through Moldova due to the Deep and Comprehensive Free Trade Area (DCFTA) agreement, which has allowed Transnistrian companies to access EU markets by registering in Moldova.

Foreign Investment Climate

The investment climate in Transnistria presents significant complexities:

| Aspect | Situation in Transnistria | Investment Implications |

|---|---|---|

| Legal Protection | Limited to local Transnistrian laws with no international recognition or recourse | High risk of property disputes with minimal legal protection |

| Banking System | Isolated financial system disconnected from international networks | Difficulty transferring funds in/out of Transnistria |

| Property Rights | Limited recognition of private property; restrictions on land ownership | Only housing property rights fully recognized; land acquisition problematic |

| Market Access | Access to EU markets through Moldova-based registration | Business registration in Moldova may be necessary for export activities |

| Political Risk | High dependence on Russian support; uncertain geopolitical future | Investments vulnerable to geopolitical shifts and policy changes |

| Bureaucracy | Complex administrative procedures with limited transparency | Business establishment requires extensive local knowledge and connections |

| Currency | Non-convertible Transnistrian ruble with limited exchange options | Currency risk and difficulty repatriating profits |

Due to these constraints, foreign investment in Transnistria remains limited, with most activity coming from Russian entities or individuals with connections to the Sheriff conglomerate. Western investors are rare, typically operating through Moldovan-registered entities when they do participate in the market.

Key Urban Areas

Important Note: The Transnistrian real estate market operates in near-complete isolation from global property markets. Price discovery, property valuation, and market analysis are all complicated by the limited data availability and absence of international real estate firms. Any investment should be approached with extraordinary caution and thorough on-the-ground research.

2. Legal Framework

Property Rights in an Unrecognized State

Investing in Transnistrian real estate involves navigating a complex legal landscape with limited international protections:

- International Status: Property rights established under Transnistrian law are not recognized by the international community or Moldova

- Dual Legal Systems: Property could potentially be subject to both Transnistrian and Moldovan legal claims

- Limited Recourse: No access to international courts or arbitration for property disputes

- Enforcement Mechanisms: Property rights enforcement depends entirely on local Transnistrian authorities

- Documentation Issues: Property documents issued by Transnistrian authorities not recognized internationally

Unlike investments in internationally recognized states, property purchases in Transnistria exist in a legal gray area. While the Transnistrian government maintains its own property registration system, these registrations have no standing outside the breakaway territory and could be challenged if the territory’s status changes.

High-Risk Warning: Foreign buyers have no meaningful legal recourse outside Transnistria if property rights are violated. The Transnistrian legal system offers limited transparency and due process protections. Investors should consider only capital they can afford to lose entirely.

Foreign Ownership Restrictions

Transnistria maintains significant restrictions on property ownership, particularly for foreigners:

- Housing Property: Full private property rights only recognized for residential housing

- Land Ownership: Severely restricted with limitations on foreign ownership

- Commercial Property: Subject to special regulations and possible government intervention

- Agricultural Land: Generally not available for foreign ownership or investment

- Strategic Assets: Prohibited from foreign ownership entirely

The Transnistrian authorities maintain tight control over land and property, with permissions for foreign acquisition granted selectively and often requiring special approvals. This creates a system where political connections and relationships with local power structures are often more important than formal legal procedures.

Additionally, the absence of transparent property registries makes conducting proper due diligence extremely challenging for foreign investors.

Investment Structure Options

For those determined to invest despite the risks, several structures may be considered:

- Direct Personal Ownership:

- Simplest approach but highest risk

- Limited to residential property in most cases

- Requires local address and presence

- Documentation only valid within Transnistria

- Transnistrian Legal Entity:

- Establishing a local company for property holding

- Subject to opaque local regulations

- Requires local partners in most cases

- May provide slightly better legal standing

- Moldovan-Registered Entity:

- Potentially providing dual legal protection

- More internationally recognized structure

- Complicates rather than eliminates legal risks

- May facilitate business operations outside Transnistria

Each approach carries distinct risks, and none fully mitigates the fundamental issue of investing in an unrecognized territory with limited rule of law guarantees.

Legal Documentation Process

The property acquisition process in Transnistria involves several Transnistrian-specific procedures:

Required Documentation

- Passport and Identification: Foreign buyers must provide passport and potentially additional identification documents

- Local Registration: Registration with local authorities may be required

- Property Documents: Previous ownership documents and technical passport for the property

- Purchase Agreement: Drafted according to Transnistrian legal requirements

- Notarization: Documents must be notarized by local Transnistrian notaries

- Registration Certificate: Final property registration with Transnistrian authorities

All official documentation will be in Russian or occasionally in the Moldovan language using Cyrillic script. Professional translation is essential as nuances in legal terminology can have significant implications.

Common Legal Pitfalls

- Unclear Title: Property ownership history may be poorly documented, especially for properties dating to the Soviet era

- Multiple Claims: Risk of competing claims from previous owners or their descendants

- Unauthorized Construction: Many properties have unauthorized modifications without proper permits

- Infrastructure Issues: Unclear responsibility for infrastructure maintenance and utilities

- Restricted Uses: Hidden restrictions on property use or development

- Exit Barriers: Difficulty selling property if political or economic conditions deteriorate

- Document Validity: Documentation not recognized for international transactions or financing

Due to these challenges, thorough legal due diligence is essential but extremely difficult to conduct effectively. Local legal assistance is mandatory, though finding truly independent legal advisors can be challenging in Transnistria’s small and interconnected business environment.

Visa & Residency Status

Entry Requirements

- Transnistria has its own border controls but doesn’t issue internationally recognized visas

- Entry typically requires registration with local authorities within 24 hours

- Visitors may need to enter through Moldova or Ukraine first

- Registration allows short stays (typically up to 45 days)

- Documentation issued at Transnistrian borders not recognized internationally

- Potential complications when exiting through international borders

Residency Options

- No internationally recognized residency program exists

- Local residency permits available but only valid within Transnistria

- Property ownership does not automatically grant residency rights

- Business investment may facilitate longer-term stay permits

- Many residents hold Moldovan, Russian, or Ukrainian citizenship

- Some residents have obtained second passports from these countries

Travel Advisory: Several countries, including the United States and Canada, have travel advisories concerning Transnistria due to its unrecognized status, limited consular access, and potential security concerns. Foreign travelers should check their home country’s latest travel advice before visiting and understand that consular assistance may be severely limited or unavailable within Transnistria.

3. Step-by-Step Investment Playbook

This section details the process for those considering Transnistrian property investment, with special emphasis on the unique challenges and risk mitigation strategies essential in this market.

Pre-Investment Risk Assessment

Before considering Transnistrian real estate, conduct a comprehensive risk assessment:

Geopolitical Risk Evaluation

- Status Analysis: Understand the current political situation between Transnistria, Moldova, Russia, and Ukraine

- Sovereignty Implications: Assess the potential for changes in Transnistria’s status that could affect property rights

- Diplomatic Developments: Monitor negotiations regarding Transnistria’s future within Moldova

- Regional Tensions: Evaluate the impact of broader geopolitical tensions on Transnistria

- Russian Support: Assess the stability of Russian political, economic, and military backing

- International Relations: Understand how your home country’s stance on Transnistria could affect your investment

- Exit Strategy: Determine realistic options for divesting if political conditions deteriorate

Financial Risk Assessment

- Currency Exposure: Understand risks associated with the non-convertible Transnistrian ruble

- Banking Limitations: Assess difficulties in transferring funds to and from Transnistria

- Capital Recovery: Evaluate potential challenges in extracting investment value

- Market Liquidity: Understand the extremely limited buyer pool for eventual resale

- Valuation Challenges: Recognize the absence of reliable property valuation mechanisms

- Tax Implications: Determine tax consequences in both Transnistria and your home country

- Insurance Availability: Investigate if any property insurance options exist

Legal and Personal Safety Risks

- Property Rights Enforceability: Assess the practical enforceability of property rights

- Judicial Independence: Understand limitations of the Transnistrian judicial system

- Local Connections: Evaluate need for relationships with local power structures

- Personal Travel Risks: Review travel advisories for Transnistria

- Consular Support: Confirm availability (or likely absence) of consular assistance

- Communications: Assess reliability of communications with the territory

- Property Access: Evaluate future ability to physically access your property

Critical Risk Consideration: Unlike conventional real estate investments, property in Transnistria should be viewed as a high-risk speculative investment. The potential for complete loss of capital is substantial due to the territory’s unrecognized status, limited rule of law, and geopolitical uncertainty. Only proceed if you fully understand these exceptional risks and can afford to lose your entire investment.

Local Network Development

Success in Transnistria’s real estate market depends heavily on establishing reliable local connections:

Essential Local Contacts

- Local Attorney: Find someone with experience in Transnistrian property law who can navigate the local system

- Translator/Interpreter: Secure reliable Russian language assistance as English is rarely used in official settings

- Property Agent: Identify someone with knowledge of available properties and local market conditions

- Banking Contact: Establish relationship with someone who can assist with local financial transactions

- Local Business Partner: Consider partnership with established local entrepreneurs

- Government Connections: Develop relationships with relevant administrative officials

Vetting Local Partners

- Multiple References: Seek references from multiple sources for any potential partner

- Track Record: Verify previous experience with foreign investors specifically

- Transparency: Assess willingness to explain local processes and challenges honestly

- Local Reputation: Investigate standing within the local business community

- Conflict of Interest: Identify any potential conflicts or hidden agendas

- Political Connections: Understand their relationships with local power structures

- Communication: Evaluate reliability of communication and responsiveness

Due to Transnistria’s small, closed society, finding truly independent advisors can be challenging. Many professionals may have connections to the dominant business groups or government structures, creating potential conflicts of interest.

Networking Approach: Consider spending significant time in Transnistria before making investment commitments. Building relationships and understanding local power dynamics is essential. If possible, connect with other foreign businesses operating in the region (though these are few) to gain insights from their experience.

Financial Preparation & Banking

Navigating Transnistria’s isolated financial system requires special preparation:

Currency Considerations

- Transnistrian Ruble: Only usable within Transnistria and not convertible internationally

- Limited Exchange: Currency exchange options typically limited to cash transactions

- Valuation Challenges: Official exchange rates may not reflect actual value

- Preferred Currencies: US dollars, euros, and Russian rubles widely accepted for property transactions

- Cash Economy: Many transactions conducted in cash due to banking limitations

- Exchange Documentation: Keep detailed records of all currency exchanges

The Transnistrian Republican Bank issues the local currency, but it has limited international connections and no access to global financial networks like SWIFT. This creates significant barriers for international money transfers.

Banking Options

Banking in Transnistria presents significant challenges for foreign investors:

- Local Banks: Several Transnistrian banks exist but have no international recognition

- Russian Banks: Some Russian financial institutions have limited operations in the territory

- No Western Banks: No Western banking institutions operate within Transnistria

- No International Transfers: Standard international transfers to Transnistrian banks not possible

- Alternative Payment Routes: Funds typically routed through Moldova, Russia, or occasionally Ukraine

- Documentation Limitations: Banking records from Transnistrian institutions not recognized internationally

- AML Concerns: Transactions may raise anti-money laundering red flags in your home country

Due to these limitations, many investors maintain accounts in Moldova, which can facilitate some financial operations related to Transnistria. However, this adds additional complexity and potential points of failure to any transaction.

Financial Caution: Be extremely wary of transferring significant funds without having a clear, legally verified path for both completing the desired transaction and potentially extracting your capital if needed. Many investors find themselves unable to recover funds once they’ve entered Transnistria’s financial system.

Property Search Process

Finding suitable properties in Transnistria requires specialized approaches:

Property Search Challenges

- Limited Online Listings: Few modern online property platforms operate in Transnistria

- No International Agencies: Absence of international real estate companies

- Informal Markets: Many properties advertised through informal channels

- Language Barriers: Property information typically only available in Russian

- Data Limitations: Lack of reliable market data for comparison and valuation

- Access Restrictions: Potential limitations on property viewing for foreigners

- Transparency Issues: Unclear ownership history and potential hidden claims

Search Resources

- Local Agents: Small-scale property agents operating in major cities

- Personal Networks: Word-of-mouth remains a primary source of property information

- Local Newspapers: Print classified advertisements still common for property listings

- Social Media Groups: Some property listings appear in local social media communities

- Direct Inquiry: Direct contact with property owners in targeted areas

- Government Contacts: Some properties may be available through government channels

Due to the informal nature of much of the market, personal presence and local connections are typically essential for finding suitable investment properties.

Property Types to Consider

- Residential Apartments: The most accessible option for foreign buyers, primarily in urban areas

- Single-Family Homes: Available with varying qualities and conditions

- Commercial Spaces: Limited availability with complex ownership structures

- Land: Highly restricted and generally not recommended for foreign investors

- Soviet-Era Buildings: Often more affordable but with significant maintenance challenges

- New Construction: Limited but growing, typically higher quality

Most foreign investors focus on residential properties due to their relatively simpler ownership structures and fewer restrictions compared to commercial or land investments. Location factors are similar to other markets (proximity to centers, infrastructure, etc.) but with heightened emphasis on security considerations.

Search Strategy: Plan for multiple visits to Transnistria, ideally staying for extended periods. The property market moves slowly, and hurried transactions increase risk substantially. Building relationships with local residents and spending time in different neighborhoods will yield more opportunities than relying solely on formal property listings.

Enhanced Due Diligence

Due diligence in Transnistria must be extraordinarily thorough:

Legal Due Diligence

-

✓

Ownership Verification: Verify current ownership through multiple sources including local registry

-

✓

Historical Claims Research: Investigate potential historical claims from Soviet era or 1990s transition

-

✓

Restriction Identification: Identify any use restrictions or government claims

-

✓

Permit Verification: Check for all required permits and authorizations

-

✓

Debt Encumbrances: Verify no outstanding debts or liens attached to property

-

✓

Boundary Verification: Confirm property boundaries and any easements

-

✓

Local Law Compliance: Verify compliance with all Transnistrian property laws

Physical Due Diligence

-

✓

Structural Inspection: Assess building condition, noting Soviet-era construction issues

-

✓

Utility Systems: Verify electrical, water, heating, and sewage systems

-

✓

Infrastructure Access: Confirm reliability of local infrastructure

-

✓

Environmental Assessment: Check for contamination or environmental hazards

-

✓

Renovation Assessment: Evaluate renovation needs and local material availability

-

✓

Neighborhood Conditions: Assess safety, stability, and future development plans

Stakeholder Verification

-

✓

Seller Verification: Confirm seller’s identity and legal right to sell

-

✓

Family Claims: Check for potential family member claims on the property

-

✓

Local Authority Approval: Verify local authorities have no objections to the sale

-

✓

Neighbor Relations: Assess any disputes with neighboring properties

-

✓

Political Connections: Understand if property has connections to political figures

-

✓

Business Interests: Identify if major local businesses have interests in the property

Due Diligence Warning: Due diligence is exceptionally challenging in Transnistria due to limited transparency, inconsistent record-keeping, and the absence of international oversight. Standard due diligence procedures that work in recognized states may be insufficient. Consider hiring multiple independent experts to verify critical information, and be prepared for significant undisclosed issues even after thorough research.

Transaction Process

The property transaction process in Transnistria differs significantly from international standards:

Purchase Agreement Considerations

- Contract Format: Must conform to Transnistrian legal requirements

- Language: Typically drafted in Russian, with translations having no legal standing

- Payment Terms: Often requires significant cash payments due to banking limitations

- Currency Specification: Clear specification of payment currency (USD, EUR often preferred)

- Legal Jurisdiction: Limited to Transnistrian courts with no international recourse

- Timeline: Usually longer than international transactions due to bureaucratic procedures

- Contingencies: Limited protection through contingency clauses

Purchase agreements in Transnistria provide significantly less protection than contracts in recognized jurisdictions. Having contracts reviewed by multiple legal experts is strongly recommended.

Payment Mechanisms

- Cash Payments: Common for property transactions due to banking limitations

- Local Bank Transfers: Possible within Transnistria but with limited documentation

- Escrow Services: Generally unavailable or unregulated

- Staged Payments: Consider structuring in stages to reduce risk

- Security Deposits: May offer limited protection if properly structured

- Third-Party Verification: Consider involving neutral third parties to witness transactions

The lack of secure payment mechanisms creates significant transaction risk. Cash transactions bring additional security concerns and make documentation of the exchange difficult.

Registration Process

- Notarization: Purchase agreement must be notarized by a Transnistrian notary

- Tax Clearance: Verification of tax payments related to the property

- Registration Application: Submission to the Transnistrian property registry

- Document Review: Official examination of submitted documentation

- Registration Approval: Official registration of ownership transfer

- Certificate Issuance: Issuance of new ownership documents

Property registration is managed by Transnistrian authorities and is only recognized within Transnistria. Registration does not provide any internationally recognized title to the property.

Transaction Strategy: Consider a phased approach to property acquisition, with smaller initial commitments and increasing investment as confidence in the local system grows. Document every step of the transaction process with photographs, videos, and written records, as this documentation may be your only recourse in case of disputes.

Property Management Challenges

Managing property in Transnistria presents unique challenges:

Management Options

- Self-Management: Requires physical presence or frequent visits to Transnistria

- Local Property Managers: Limited professional services available

- Family/Personal Contacts: Often relied upon by diaspora property owners

- Tenant Direct Management: Higher risk but sometimes the only practical option

- Building Administration: Soviet-era collective management for apartment buildings

Professional property management services common in developed markets are largely absent in Transnistria. Management typically relies heavily on informal arrangements and personal relationships.

Tenant Relations

- Tenant Rights: Tenant protections under local law may be strong and difficult to enforce

- Rental Agreements: Should follow Transnistrian legal requirements to be enforceable

- Tenant Screening: Limited formal screening mechanisms available

- Rent Collection: Often cash-based with associated documentation challenges

- Dispute Resolution: Limited to local courts with potential bias against foreign owners

- Cultural Expectations: Different landlord-tenant relationship expectations than Western norms

Securing reliable, responsible tenants is challenging due to limited screening options and the relatively small pool of potential renters with sufficient income in the local economy.

Maintenance Considerations

- Materials Availability: Limited selection of construction and repair materials

- Skilled Labor: Variable quality of available tradespeople

- Infrastructure Issues: Frequent infrastructure problems affecting properties

- Utility Reliability: Intermittent utility services requiring backup solutions

- Winter Challenges: Significant heating concerns during cold winters

- Remote Management: Difficulty overseeing repairs and improvements from abroad

- Building Systems: Soviet-era systems requiring specialized knowledge

Property maintenance in Transnistria is complicated by aging infrastructure, limited supply chains for modern materials, and the absence of professional management companies. Budget generously for maintenance and expect significant unexpected issues, particularly in older properties.

Management Strategy: If possible, identify a trustworthy local contact to serve as your on-the-ground representative. Establish clear communication protocols and reporting requirements. Consider investing in property monitoring technology (security cameras, smart locks) if internet connectivity is sufficient to provide some remote oversight capability.

Tax & Regulatory Compliance

Navigating the tax and regulatory landscape in Transnistria:

Transnistrian Tax Obligations

- Property Tax: Annual tax on property ownership

- Income Tax: Tax on rental income generated within Transnistria

- Transaction Tax: Various fees and taxes during property purchase

- Capital Gains: Potential taxes on property value appreciation

- Utilities Tax: Various charges related to utility connections

- Documentation Fees: Charges for official property documentation

The Transnistrian tax system is not well-documented in English and tends to change frequently. Working with a local tax advisor is essential for compliance and to avoid unexpected penalties.

Home Country Tax Implications

- Foreign Asset Reporting: Many countries require reporting of foreign real estate

- Worldwide Income: Most countries tax citizens on worldwide income including Transnistrian rental income

- Tax Treaty Limitations: No tax treaties with Transnistria as an unrecognized entity

- Double Taxation: Risk of taxation in both Transnistria and home country without credit

- Documentation Challenges: Difficulty providing required proof of taxes paid in Transnistria

- Compliance Complexity: Explaining investments in an unrecognized territory to tax authorities

Consult with tax professionals in your home country who have experience with investments in non-recognized territories. Standard international tax planning strategies may not apply to Transnistrian investments.

Regulatory Requirements

- Foreign Investor Registration: Possible requirement to register as foreign investor

- Residential Registration: Registration of occupants with local authorities

- Utility Regulations: Compliance with local utility connection requirements

- Building Codes: Local construction and renovation regulations

- Rental Licensing: Potential permits required for renting property

- Business Activity: Restrictions on commercial use of residential property

- Reporting Requirements: Periodic reporting to local authorities

Regulatory requirements in Transnistria can be opaque and inconsistently enforced. Developing relationships with relevant local officials can help navigate regulatory challenges, but also creates risks of corruption and unofficial payments.

Regulatory Warning: Transnistria’s unrecognized status creates unique compliance challenges both locally and in your home country. Home country authorities may have concerns about investments in regions with limited international oversight, potentially triggering enhanced scrutiny under anti-money laundering regulations. Maintain meticulous documentation of all transactions to demonstrate legitimate investment activity.

Exit Strategy Planning

Developing realistic exit strategies is critical when investing in Transnistria:

Exit Challenges

- Limited Buyer Pool: Extremely restricted market of potential buyers

- Liquidity Concerns: Properties may take years to sell even at reduced prices

- Valuation Difficulties: Lack of comparable sales and formal appraisal methods

- Currency Extraction: Challenges converting sale proceeds to international currency

- Political Uncertainty: Future political changes may impact property rights and values

- Documentation Limitations: Transnistrian property documents not recognized internationally

- Changing Regulations: Potential for new restrictions on foreign sales or capital extraction

Potential Exit Options

- Local Sale: Finding a local buyer with sufficient resources

- Diaspora Sale: Marketing to Transnistrian diaspora abroad

- Russian Investors: Targeting Russian investors with business interests in the region

- Long-term Rental: Converting to a rental property if unable to sell

- Property Exchange: Trading for other assets within or outside Transnistria

- Family Transfer: Transferring ownership to family members or trustworthy locals

- Abandonment: In worst-case scenarios, accepting the loss of investment

The exit process from Transnistrian real estate is typically much more difficult than entry. Investors should be prepared for the possibility of substantial time delays, significant price discounts, or even inability to liquidate their investment.

Strategic Exit Planning

- Timeline Flexibility: Avoid investments with rigid exit timelines

- Network Development: Continuously build network of potential future buyers

- Value Maintenance: Invest in property upkeep to preserve value

- Documentation Collection: Maintain comprehensive property documentation

- Political Monitoring: Watch for political changes that might affect property markets

- Relationship Preservation: Maintain positive relationships with local authorities

- Incremental Testing: Test market liquidity with partial sale offerings

The most successful investors in Transnistria approach exit planning as an ongoing process that begins the moment the investment is made, rather than a future event to be considered later.

Exit Reality Check: There is a significant possibility that property investments in Transnistria may become effectively illiquid during periods of political tension or economic distress. Only invest capital that you can afford to leave indefinitely in the territory, as forced sales during adverse conditions may result in near-total loss of investment value.

Risk Mitigation Strategies

Implementing comprehensive risk management for Transnistrian investments:

Political Risk Management

- Diversification: Limit exposure to Transnistria as a percentage of total investment portfolio

- Information Network: Develop sources of political intelligence within the region

- Contingency Planning: Create detailed plans for various political scenarios

- Multiple Registrations: When possible, register property claims in both Transnistria and Moldova

- Neutral Structures: Consider ownership structures viewed favorably by all political factions

- Diplomatic Awareness: Stay informed about your home country’s position on Transnistria

Financial Risk Mitigation

- Capital Limitation: Only commit funds you can afford to lose entirely

- Staged Investment: Invest incrementally rather than all at once

- Currency Hedging: Maintain assets in multiple currencies

- Banking Diversification: Use multiple financial institutions across different jurisdictions

- Cash Flow Planning: Ensure property generates sufficient income to cover all local expenses

- Transaction Documentation: Maintain comprehensive records of all financial transactions

- Insurance Investigation: Explore any available insurance options, though likely limited

Operational Risk Management

- Local Representatives: Develop relationships with trustworthy local representatives

- Multiple Partners: Avoid dependence on a single local partner or advisor

- Regular Visits: Maintain physical presence in Transnistria when possible

- Communication Protocols: Establish reliable communication channels with local contacts

- Property Security: Implement appropriate physical security measures

- Documentation Storage: Maintain copies of all important documents outside Transnistria

- Network Development: Build relationships across different segments of local society

Final Investment Perspective: Real estate investment in Transnistria represents an extremely high-risk, potentially high-reward proposition. Successful investors approach it with exceptional caution, thorough research, and modest capital commitments. Understanding the unique geopolitical, legal, and economic landscape is essential, as traditional real estate investment principles may not apply. For most investors, especially those without strong local connections or specific knowledge of the region, the risks generally outweigh potential returns.

4. Market Opportunities

Property Types & Characteristics

Price Ranges by Location

| City/Area | Neighborhood/District | Property Type | Price Range (USD) | Price per m² |

|---|---|---|---|---|

| Tiraspol | City Center | 2-bedroom Soviet apartment | $20,000-$35,000 | $300-$500 |

| Kirov District | New construction apartment | $40,000-$60,000 | $600-$800 | |

| Residential Outskirts | Single-family home | $30,000-$50,000 | $250-$400 | |

| Bender | Fortress District | Historic property | $40,000-$80,000 | $400-$600 |

| Central District | Soviet apartment | $15,000-$30,000 | $250-$450 | |

| Southern Residential | Single-family home | $25,000-$45,000 | $200-$350 | |

| Rîbnița | City Center | Soviet apartment | $10,000-$25,000 | $150-$300 |

| Residential District | Single-family home | $15,000-$35,000 | $120-$250 | |

| Smaller Towns | Urban Areas | Soviet apartment | $5,000-$15,000 | $100-$200 |

| Rural Villages | Village house with land | $3,000-$12,000 | $50-$150 |

Note: Prices as of April 2025. Market conditions in Transnistria are highly variable and prices may fluctuate significantly based on political and economic factors.

Potential Yield Assessments

Rental Yield Potential

- Tiraspol City Center Apartments: 5-7% gross yield

- Bender Residential Properties: 6-8% gross yield

- New Construction Units: 4-6% gross yield

- Soviet Apartments in Secondary Cities: 7-10% gross yield

- Single-Family Homes: 5-7% gross yield

- Commercial Spaces: 8-12% gross yield (high risk)

These yields appear attractive compared to international standards but come with significantly higher risk profiles. Yields can be misleading as they don’t account for potential capital loss, currency risk, and extreme difficulties in extracting rental income from Transnistria.

Appreciation Outlook

- Short-Term (1-2 years): Highly unpredictable, subject to political events

- Medium-Term (3-5 years): Stagnant to moderate growth in Tiraspol center

- Long-Term (5+ years): Entirely dependent on geopolitical resolution

- Best Prospects: New construction in central Tiraspol

- Highest Risk: Rural properties and outlying areas

- Price Volatility: Extreme, with potential for rapid depreciation during crises

Traditional appreciation models have limited applicability in Transnistria due to the territory’s uncertain status and isolation from global real estate trends. Any capital appreciation should be viewed as speculative rather than predictable.

Investment Scenarios

| Investment Scenario | Initial Investment | Monthly Rental Income | Annual Yield | Risk Assessment |

|---|---|---|---|---|

| City Center Apartment 2-bedroom in Tiraspol |

$25,000 | $150-200 | 7-10% | High: Political risk, currency extraction issues, maintenance concerns |

| New Construction Unit Modern amenities in Tiraspol |

$45,000 | $250-300 | 6-8% | Very High: Premium segment sensitivity, potential construction quality issues |

| Secondary City Apartment Soviet-era in Rîbnița |

$12,000 | $80-120 | 8-12% | Extreme: Economic dependency on single industries, demographic decline, infrastructure issues |

| Urban Single-Family Home Residential area of Bender |

$35,000 | $200-250 | 7-9% | Very High: Land ownership restrictions, family tenant management challenges |

| Commercial Space Small retail unit in Tiraspol |

$40,000 | $300-400 | 9-12% | Extreme: Foreign ownership restrictions, business climate uncertainty, political interference |

Note: Yields represent gross figures before expenses, taxes, and management costs. Actual net yields likely significantly lower.

Risk-Opportunity Assessment

Potential Opportunity Factors

- Low Entry Price: Significantly lower property costs than in recognized countries

- High Nominal Yields: Potential for attractive gross rental yields

- Limited Competition: Few international investors in the market

- Resolution Upside: Potential for significant appreciation if political status resolves positively

- Diversification: Extremely uncorrelated market to global real estate trends

- Increasing EU Ties: Growing economic integration with EU through Moldova

- Skilled Labor: Relatively low-cost skilled construction and renovation labor

Critical Risk Factors

- Unrecognized Territory: No international legal protection for property rights

- Political Uncertainty: Potential for destabilizing political developments

- Economic Fragility: Heavy dependence on Russian subsidies and few industries

- Currency Issues: Non-convertible local currency and difficulties transferring funds

- Property Right Limitations: Restricted ownership rights, especially for land

- Demographic Decline: Ongoing population decrease affecting demand

- Limited Exit Options: Extremely limited pool of potential buyers for resale

- Infrastructure Challenges: Aging Soviet-era infrastructure with limited maintenance

- Legal System Concerns: Limited judicial independence and rule of law

Risk-Reward Reality: Transnistria represents one of the highest-risk real estate markets globally. While nominal yields may appear attractive, investors must recognize that standard risk assessment models are inadequate for capturing the unique risks of investing in an unrecognized territory with limited rule of law. The potential for complete capital loss is substantial and should be the primary consideration in any investment decision. These investments should be approached as speculative ventures rather than traditional real estate investments.

5. Cost Analysis

Transaction Costs

Understanding the full cost of property acquisition in Transnistria:

Purchase Transaction Costs

| Expense Item | Typical Percentage/Cost | Example Cost (For $25,000 Property) |

Notes |

|---|---|---|---|

| Property Registration Tax | 0.5-1.5% | $125-$375 | Paid to Transnistrian authorities |

| Notary Fees | 1-2% | $250-$500 | Higher for foreign buyers |

| Legal Fees | 2-5% | $500-$1,250 | Higher for foreign buyers requiring special expertise |

| Property Evaluation | Fixed fee | $100-$300 | Technical assessment of property |

| Agent Commission | 3-5% | $750-$1,250 | If using a local agent |

| Translation Services | Fixed fee | $200-$500 | Document translation and in-person interpretation |

| Property Inspection | Fixed fee | $150-$400 | Independent structural assessment |

| Currency Exchange Costs | 2-5% | $500-$1,250 | Exchange rate spreads and fees |

| TOTAL TRANSACTION COSTS | 10-20% | $2,575-$5,825 | Significantly higher than in recognized markets |

Note: Costs are estimates as of April 2025 and can vary significantly based on specific circumstances and changing local requirements.

Additional Initial Expenses

Beyond transaction costs, budget for these initial expenses:

- Property Repairs/Renovation: $1,000-$15,000 depending on condition (often substantial for Soviet-era properties)

- Utility Connections/Transfers: $100-$500 for documentation and possible unofficial payments

- Essential Appliances: $800-$2,000 if property unfurnished (limited local selection)

- Security Improvements: $300-$1,000 for enhanced locks, security doors, window reinforcement

- Initial Furnishings: $1,000-$5,000 for rental property setup

- Local Registration Fees: $50-$200 for foreign owner registration

- Travel Expenses: $1,500-$3,000 for property inspection visits

Many Soviet-era properties require significant renovation before becoming suitable for rental or personal use. These renovation costs can sometimes exceed the purchase price for properties at the lower end of the market. Availability of quality construction materials is limited, and importing materials adds substantial cost.

Ongoing Costs

Regular expenses associated with Transnistrian property ownership:

Annual Ownership Expenses

| Expense Item | Typical Annual Cost (USD) | Notes |

|---|---|---|

| Property Tax | $50-$200 | Relatively low compared to international standards |

| Building Maintenance Fee | $100-$300 | For apartments in multi-unit buildings |

| Utilities (if unoccupied) | $300-$800 | Electricity, water, heating, minimal usage |

| Property Management | $500-$1,200 | Informal arrangements with local contacts (professional services limited) |

| Insurance | $100-$300 | Limited coverage available through local insurers only |

| Annual Registration Fees | $50-$150 | Foreign owner registration renewal |

| Maintenance Reserve | $500-$1,500 | Recommended allocation for repairs (higher for older properties) |

| Travel Costs | $1,500-$3,000 | For periodic property visits (recommended at least annually) |

| Legal/Accounting | $200-$500 | Annual tax filings and legal consultations |

Rental Property Cash Flow Example

Sample analysis for a $25,000 two-bedroom apartment in central Tiraspol:

| Item | Monthly (USD) | Annual (USD) | Notes |

|---|---|---|---|

| Gross Rental Income | $180 | $2,160 | Based on market rates for the area |

| Less Vacancy (10%) | -$18 | -$216 | Higher than global standards due to market conditions |

| Effective Rental Income | $162 | $1,944 | |

| Expenses: | |||

| Property Management | -$45 | -$540 | Local contact for management (25% of rent) |

| Property Tax | -$8 | -$100 | Annual property tax payment |

| Building Maintenance Fee | -$12 | -$150 | Common area maintenance in apartment building |

| Insurance | -$12 | -$150 | Limited local coverage |

| Repairs & Maintenance | -$30 | -$360 | Higher for Soviet-era buildings |

| Accounting/Legal Fees | -$20 | -$240 | Local tax filings and legal consultations |

| Utilities During Vacancies | -$8 | -$100 | Based on 10% vacancy rate |

| Total Expenses | -$135 | -$1,640 | 84% of effective rental income |

| NET OPERATING INCOME | $27 | $304 | Before income taxes and currency conversion costs |

| Local Income Tax (15%) | -$4 | -$46 | Transnistrian income tax on rental profit |

| AFTER-TAX CASH FLOW | $23 | $258 | Before currency conversion and extraction |

| Cash-on-Cash Return | 0.9% | Based on $28,000 total investment (purchase + costs) | |

| ROI with Potential Appreciation | Unknown | Impossible to project with confidence |

Note: This analysis is simplified and does not include costs of fund transfers, currency exchange for profit repatriation, or home country tax obligations. Actual net returns may be significantly lower or negative when all factors are considered.

Comparison with North American Markets

Investment Comparison

Comparing a $25,000 investment in Transnistria versus alternative North American options:

| Factor | Transnistria Property ($25,000) |

Small US REIT Investment ($25,000) |

Partial US/Canadian Property ($25,000 Down Payment) |

|---|---|---|---|

| What You Get | 2-bedroom apartment in Tiraspol (full ownership) | Fractional ownership in diversified property portfolio | 10-20% equity in property in secondary/tertiary market |

| Cash Flow | $20-25/month ($250-300/year) | $100-125/month ($1,200-1,500/year) | Typically negative after mortgage payments |

| Legal Protection | Minimal, limited to unrecognized territory | Strong regulatory oversight and investor protection | Strong legal framework and property rights |

| Liquidity | Extremely low, potentially years to sell | Very high, can sell within days | Moderate, typically months to sell equity position |

| Management Effort | High, requires significant attention | None, professionally managed | Moderate to high, depending on property manager |

| Risk Level | Extreme political, economic, and legal risk | Moderate market risk, diversified exposure | Moderate property-specific risk, leverage risk |

| Transaction Costs | 10-20% of investment | Minimal, typically under 1% | 3-5% of total property value |

| Tax Complexity | Very high, challenging international issues | Low, standard investment income treatment | Moderate, property tax and rental income issues |

Relative Advantages of Transnistria

- Full Ownership: Complete property ownership for a relatively small investment

- Low Entry Price: Access to real estate ownership with minimal capital

- No Leverage Risk: No mortgage debt or financing risk

- Low Operating Costs: Inexpensive utilities and maintenance labor

- Unique Diversification: Exposure to a market uncorrelated with global trends

- Potential Upside: Possible significant appreciation if political situation resolves favorably

- Personal Use Option: Possibility of occasional personal use of the property

Significant Disadvantages

- Unrecognized Territory: No international legal protection for property rights

- Extreme Risk: Possibility of complete loss of investment

- Limited Financing: No mortgage financing available from international lenders

- Currency Issues: Challenges with currency exchange and profit repatriation

- Management Challenges: Difficult remote management in an opaque market

- Exit Limitations: Highly constrained exit options and buyer pool

- Political Uncertainty: Exposure to unstable geopolitical situation

- Practical Difficulties: Language barriers, travel challenges, limited infrastructure

Investment Perspective: For most North American investors, the extremely high risks of Transnistrian real estate investment outweigh the potential benefits. The same capital could be deployed in recognized markets with substantially lower risk, better legal protection, and more predictable returns. Alternative property investments in emerging but recognized markets, fractional ownership through REITs, or even higher-leverage investments in domestic markets typically offer better risk-adjusted returns than direct Transnistrian property ownership.

6. Local Expert Profile

Professional Background

Alexei Voronin has spent over a decade navigating Transnistria’s unique property market, helping the small number of foreign investors who venture into this challenging territory. With dual education in both Transnistria and Moldova, he brings essential cross-border knowledge to real estate transactions.

His expertise includes:

- Deep understanding of Transnistria’s property registration system

- Strong connections with local authorities and business community

- Expertise in property valuation in an opaque market

- Experience with cross-border property documentation

- Knowledge of the practical realities of property management in Transnistria

- Ability to navigate both Transnistrian and Moldovan legal systems

As one of the few property consultants in Transnistria with international experience, Alexei brings essential local knowledge while understanding the expectations and concerns of foreign investors.

Services Offered

- Property search and acquisition

- Legal document preparation

- Transaction management

- Due diligence coordination

- Property valuation services

- Renovation project supervision

- Property management

- Tenant sourcing and screening

- Administrative issue resolution

- Exit strategy implementation

Service Packages:

- Initial Consultation: Market overview and risk assessment

- Property Acquisition: Full-service support from search to purchase

- Management Services: Ongoing property management and tenant relations

- Documentation Assistance: Support with property documentation and registration

- Exit Implementation: Support in selling or otherwise divesting property

Note: Service fees are higher than in standard markets due to the complex nature of Transnistrian real estate transactions.

Client Testimonials

Consultation Recommendation: Given the unique challenges of the Transnistrian market, a thorough consultation with multiple experts is strongly advised before proceeding with any investment. Consider seeking additional perspectives from experts in Moldovan law, international property rights, and cross-border taxation to supplement local expertise.

7. Resources

Complete Transnistria Investment Guide

What You’ll Get:

- Risk Assessment Checklist – Comprehensive property investment risk guide

- Due Diligence Template – Essential verification steps for Transnistrian property

- Legal Documentation Guide – Understanding Transnistrian property documents

- Contact Directory – Verified local service providers and officials

- Exit Strategy Planner – Planning for investment liquidity

Essential information and tools for navigating this high-risk property market. Specifically developed for North American investors considering Transnistrian real estate.

Information Resources

-

Transnistrian State Registry Office

-

Moldovan Agency for Public Services (ASP)

-

Transnistrian Republican Bank

-

US State Department Travel Advisory

-

OSCE Mission Reports on Transnistria

Note: Most Transnistrian resources are only available in Russian language with limited online presence. Many local government services lack functional websites or reliable digital information.

Local Service Providers

Legal Services

- Transnistria Law Consultants – Tiraspol-based property law specialists

- Chisinau-Tiraspol Legal Partners – Dual-jurisdiction expertise

- Transdniestrian Notary Services – Document certification and registration

Property Management

- Dniester Property Services – Local property management and maintenance

- Tiraspol Rental Management – Tenant placement and rent collection

- Cross-Border Property Care – Management for foreign owners

Financial Services

- Transnistrian Republican Bank – Local currency operations

- Moldova-Transnistria Financial Advisors – Cross-border transactions

- Currency Exchange Specialists – Cash exchange and transfer services

Educational Resources

Other Articles on Builds and Buys

- First-Time Homebuyer’s Blueprint: 8 Critical Steps That Experts Don’t Tell You

- Foreign Real Estate Investment for Americans and Canadians: Top Countries for 2025

- Hire a Licensed Contractor or Lose Thousands of Dollars on Shoddy Repairs

- Homeowner Expenses: The Complete Guide to Budgeting Beyond Your Mortgage

Recommended Books

- Real Estate Investment in Eastern Europe by Michael Krasner

- Managing Political Risk in Frontier Market Real Estate by Andrea Ruskin

- Cross-Border Property Investment: Legal and Tax Strategies by Elena Barkova

- Unrecognized States: Property Rights in Gray Zones by Julian Morgan

8. Frequently Asked Questions

Risk Assessment Summary

Transnistria represents one of the highest-risk real estate investment environments globally. While low entry prices and potential yields may appear attractive, the territory’s unrecognized status creates fundamental legal, political, economic, and practical challenges that most investors will find prohibitive.

Critical Risk Factors

- Unrecognized Territory Status: No international legal protection for property rights

- Political Uncertainty: Future status subject to geopolitical developments beyond investor control

- Banking & Currency Issues: Isolated financial system and non-convertible currency

- Limited Exit Options: Extremely constrained buyer pool and difficult fund extraction

- Legal System Concerns: Limited judicial independence and rule of law protections

- Documentation Limitations: Property documents not recognized internationally

- Practical Challenges: Remote management difficulties and limited professional services

For most North American investors, these risks outweigh the potential rewards. Those determined to proceed should approach any investment in Transnistria as highly speculative, committing only capital they can afford to lose entirely, and with thorough on-the-ground research and strong local partnerships.

For further guidance on real estate investment strategies, explore our comprehensive Step-by-Step Invest guide or browse our collection of expert real estate articles.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.