Check out our app!

Explore more features on mobile.

Your Journey for a Successful Home Purchase: A Strategic Roadmap for Today’s Buyers

Navigating the path to homeownership in today’s complex market requires strategic planning, financial preparation, and market intelligence that goes far beyond traditional home buying advice. Recent data from the National Association of Realtors shows that first-time buyers now spend an average of 10 months searching for homes before making a purchase—nearly double the time compared to a decade ago. This comprehensive guide maps out an evidence-based, step-by-step journey to successful homeownership, addressing the unique challenges of current market conditions while positioning you to build lasting wealth through your most significant investment.

Finding your ideal home requires strategic planning and careful preparation

Financial Foundation: Pre-Purchase Preparation

Successful homeownership begins long before property viewings. The financial groundwork you establish 12-24 months before purchase significantly impacts your purchasing power, interest rates, and long-term wealth-building potential.

Credit Optimization Strategy

According to the Consumer Financial Protection Bureau’s 2023 report, mortgage applicants with FICO scores above 760 receive interest rates averaging 0.8 percentage points lower than those with scores between 660-699. On a $400,000 mortgage, this difference equates to approximately $68,000 in interest savings over a 30-year term.

Strategic credit optimization should focus on:

- Credit utilization management: Maintaining ratios below 20% across all revolving accounts (reducing from 30% to 10% can increase scores by 30-50 points)

- Account age preservation: Keeping older credit cards active with minimal usage

- Strategic debt paydown: Prioritizing revolving debts over installment loans for maximum score impact

- Dispute resolution: Addressing inaccuracies found in approximately 34% of consumer credit reports according to the Federal Trade Commission

Liquidity Development Framework

Beyond the down payment, proper liquidity reserves prevent overleveraging and provide competitive advantages in negotiations. Freddie Mac research indicates that homebuyers with cash reserves exceeding six months of housing expenses are 52% less likely to experience mortgage delinquency within the first three years of homeownership.

A strategic liquidity framework should include:

| Reserve Category | Recommended Amount | Allocation Strategy |

|---|---|---|

| Down Payment | 10-20% of purchase price | High-yield savings account or money market fund |

| Closing Costs | 3-5% of purchase price | High-yield savings account |

| Moving & Initial Furnishing | $5,000-$15,000 | Cash or low-interest credit options |

| Emergency Reserves | 6 months of housing expenses | High-yield savings account |

| Major Repair Fund | 1-2% of home value | Separate savings account or CD ladder |

Debt-to-Income Optimization

Your debt-to-income (DTI) ratio significantly impacts both loan approval and interest rates. According to the Urban Institute’s Housing Finance Policy Center, borrowers with DTI ratios below 36% receive interest rates averaging 0.25 percentage points lower than those with ratios between 43-45%.

Effective DTI optimization strategies include:

- Strategic debt consolidation: Consolidating high-interest consumer debt without closing accounts

- Income documentation enhancement: Documenting all legitimate income sources (side gigs, investment income, etc.)

- Vehicle financing restructuring: Refinancing auto loans to reduce monthly obligations

- Student loan repayment optimization: Utilizing income-based repayment plans to reduce DTI impacts

Expert Insight: Financial Timeline Planning

According to mortgage underwriting expert Sarah Crawford, “The most successful homebuyers begin their financial preparation at least 12 months before applying for financing. This timeline allows for two complete cycles of credit reporting, sufficient time to establish reserves without large, suspicious deposits, and the opportunity to demonstrate consistent income history—all critical factors in securing optimal loan terms.”

Market Analysis: Identifying Value Opportunities

Beyond basic location considerations, sophisticated homebuyers leverage data-driven market analysis to identify emerging value opportunities and avoid overvalued submarkets.

Market Cycle Positioning

Real estate markets move in predictable cycles, though with significant local variations. According to research from the Joint Center for Housing Studies at Harvard University, properties purchased during the early recovery and expansion phases of the market cycle appreciate 37% more on average over the following five years compared to properties purchased during late expansion or peak phases.

Key indicators to assess local market cycle positioning include:

- Months of housing inventory: 4-6 months indicates a balanced market; below 3 months suggests a seller’s market approaching peak pricing

- Days on market trends: Increasing DOM indicates shifting market dynamics

- Price reduction percentage: When more than 20% of listings have price reductions, the market may be transitioning

- Absorption rate changes: Declining rates may signal market softening before price adjustments become apparent

Submarket Opportunity Analysis

Broad market trends often mask significant variations between submarkets within the same metropolitan area. Research from Zillow Economic Research shows that price growth can vary by as much as 15 percentage points between submarkets in the same city.

High-opportunity submarkets typically exhibit:

- Infrastructure investment: Areas with recent or planned public transit, road improvements, or utility upgrades

- Commercial development signals: New retail, dining, or workplace construction indicating economic growth

- School improvement trajectories: Districts with rising test scores and decreasing student-to-teacher ratios

- Decreasing crime statistics: Areas with 3+ years of declining crime rates often precede property value increases

Price-to-Rent Ratio Evaluation

The price-to-rent ratio (calculated as median home price divided by annual rent) provides valuable insights into market valuation and potential appreciation. According to the Federal Reserve Bank of Cleveland’s housing research, markets with price-to-rent ratios between 15-20 offer the optimal balance of current value and appreciation potential.

Interpretation guidelines:

| Price-to-Rent Ratio | Market Interpretation | Buyer Strategy |

|---|---|---|

| Below 15 | Undervalued market; strong buying opportunity | Purchase with confidence; consider investment properties |

| 15-20 | Balanced market; fair valuations | Buy with standard contingencies; normal negotiating position |

| 21-25 | Moderately overvalued; caution warranted | Focus on properties with value-add potential; negotiate aggressively |

| Above 25 | Significantly overvalued; potential bubble | Consider renting; if buying, focus on properties with substantial discount to market |

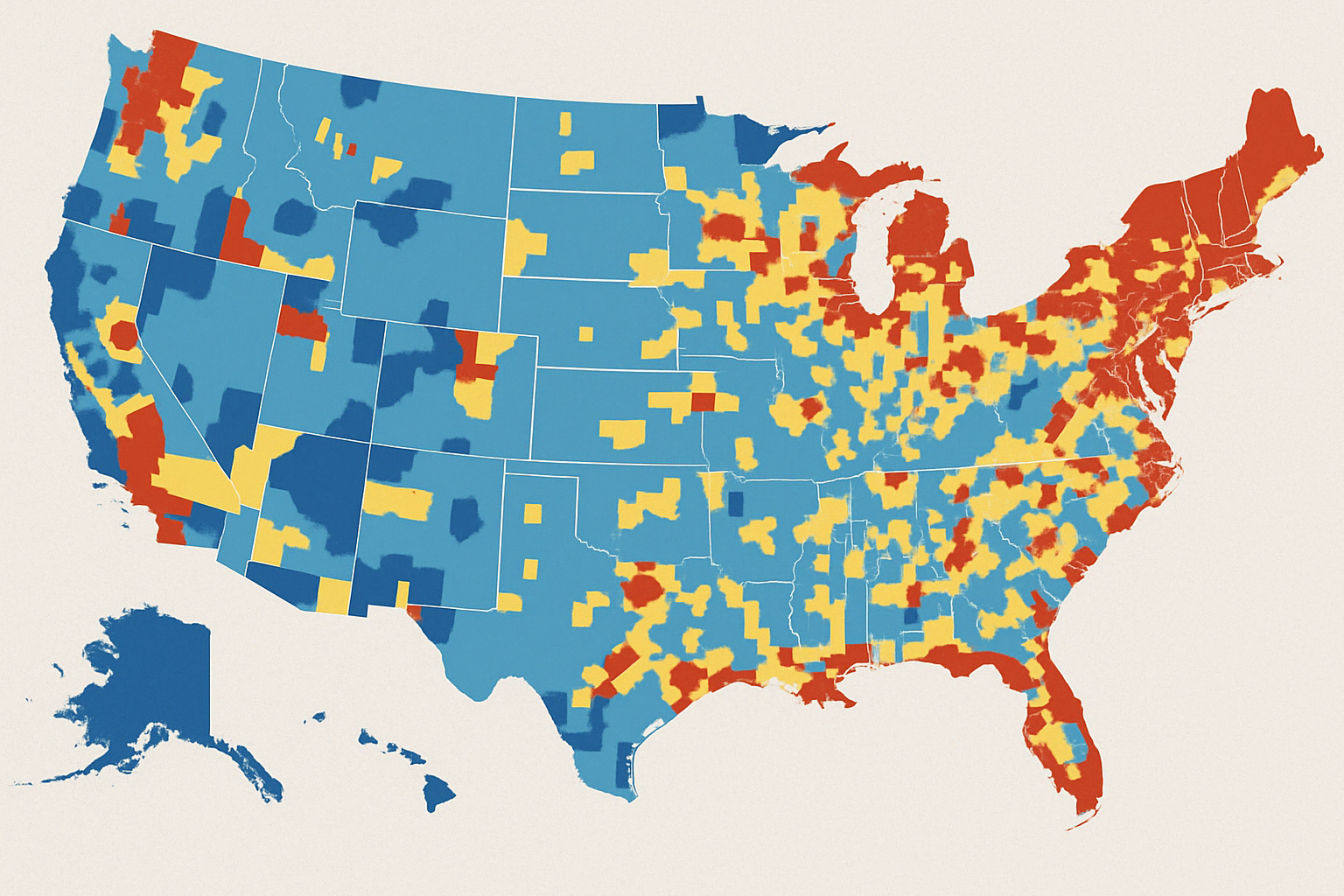

Price-to-rent ratio map showing valuation variations across metro area neighborhoods

Affordability Index Tracking

The Housing Affordability Index (HAI) measures whether a typical family earns enough to qualify for a mortgage on a typical home. Research from the National Association of Realtors demonstrates that markets with HAI readings between 120-150 typically provide the best balance of accessibility and appreciation potential.

Markets with extremely high affordability (HAI above 180) often indicate economic challenges that may limit appreciation, while markets with very low affordability (HAI below 100) may be approaching cyclical peaks.

For a deeper understanding of market trends in 2025, check out our analysis of The 10 Hottest Housing Markets for 2025.

Financing Strategy: Beyond Basic Mortgage Shopping

Sophisticated financing strategy extends far beyond rate shopping, incorporating loan structure optimization, strategic down payment sizing, and closing cost management to maximize both short-term affordability and long-term wealth building.

Loan Product Optimization

The mortgage industry offers over 25 distinct loan programs, each with unique advantages for specific buyer situations. According to the Mortgage Bankers Association, over 37% of borrowers select suboptimal loan products, resulting in an average lifetime overpayment of $43,000.

Strategic loan selection matrix:

| Buyer Profile | Optimal Loan Products | Key Advantages |

|---|---|---|

| First-time buyer with limited savings | FHA, HomeReady, Home Possible | 3-3.5% down payment; flexible DTI requirements; reduced MI options |

| Strong credit, moderate savings | Conventional 97, 80-10-10 piggyback | Lower MI costs; potential to eliminate MI; better pricing tiers |

| High-income, high-cost area | Jumbo, Super Conforming | Higher loan limits; competitive rates for excellent credit; flexible terms |

| Self-employed, complex income | Bank Statement, Asset Depletion | Alternative income documentation; asset utilization for qualification |

| Military service (active/veteran) | VA Loan | Zero down payment; no MI; competitive rates; flexible qualification |

| Rural area homebuyer | USDA Rural Development | Zero down payment; reduced MI costs; competitive fixed rates |

Strategic Down Payment Sizing

Contrary to conventional wisdom, maximizing down payment isn’t always optimal. Research from the Federal Reserve Bank of Boston found that homeowners who maintain liquid reserves rather than making larger down payments experience 28% lower default rates during economic disruptions.

Down payment optimization should consider:

- Interest rate tier thresholds: Identifying the specific down payment percentage where rate improvements occur

- MI removal strategies: Calculating the equity building timeline for automatic MI removal vs. upfront MI payment

- Opportunity cost analysis: Comparing mortgage interest savings against potential returns on invested capital

- Reserve requirements: Maintaining sufficient post-closing liquidity for financial security

Rate Buydown Analysis

Mortgage rate buydowns allow borrowers to pay additional points at closing to secure lower interest rates. According to a Freddie Mac study, the optimal buydown strategy varies significantly based on anticipated loan retention period and available cash resources.

The break-even timeline for rate buydowns can be calculated as:

Break-even months = (Cost of points) ÷ (Monthly payment savings)

Buydown strategy recommendations:

- Planned ownership under 5 years: Minimize points paid; focus on lower closing costs

- Planned ownership 5-10 years: Consider moderate buydown of 0.5-1 point if break-even occurs within 48 months

- Planned ownership over 10 years: More aggressive buydown may be optimal; evaluate up to 2 points based on break-even analysis

- Seller concession opportunity: When sellers offer closing cost credits, directing these toward buydowns often provides optimal long-term benefit

Closing Cost Minimization Strategies

Closing costs typically range from 2-5% of the loan amount, with significant variation based on location, lender, and negotiation strategy. Research from Closing Corp shows that proactive borrowers can reduce closing costs by an average of $1,850 through strategic planning.

Effective closing cost management includes:

- Lender credit optimization: Evaluating slightly higher rates in exchange for substantial lender credits toward closing costs

- Title service shopping: Comparing title insurance and settlement service providers (average savings: $500-900)

- Closing timing strategy: Scheduling closing at month-end to minimize per diem interest charges

- Property tax proration negotiation: Negotiating favorable tax prorations based on payment cycles

Advanced Strategy: The 80-10-10 Approach

For buyers with good credit but limited down payment funds, the 80-10-10 strategy combines an 80% first mortgage, a 10% second mortgage or HELOC, and a 10% down payment. This approach eliminates mortgage insurance while reducing cash required at closing. According to lending analytics firm Optimal Blue, borrowers using this strategy save an average of $187 per month compared to conventional 90% LTV loans with mortgage insurance, creating over $67,000 in saved costs over a full 30-year term.

If you’re facing credit challenges, explore our guide on Buying A House With Bad Credit: Advanced Strategies and Expert Insights.

Property Selection: Data-Driven Decision Framework

Moving beyond emotional reactions to properties, sophisticated buyers implement structured evaluation frameworks that incorporate both lifestyle alignment and investment performance.

Resale Value Optimization

According to a Zillow Research study of 10-year home price appreciation patterns, properties with specific characteristics consistently outperform market averages regardless of broader economic conditions.

Top resale value preservers include:

- Lot location within developments: Properties on cul-de-sacs or away from main thoroughfares appreciate 7-12% faster than otherwise comparable homes

- Functional floor plans: Open-concept living areas with distinct bedroom zones maintain broader market appeal across buyer demographics

- Bedroom-to-bathroom ratios: Homes where these elements are balanced (2:2, 3:2, 4:3) sell 31% faster than properties with mismatched ratios

- Storage optimization: Properties with above-average storage space (minimum 10% of living area) command 4-6% price premiums

Future Modification Potential

Forward-thinking buyers evaluate properties not just for current condition but for cost-effective improvement potential. Harvard’s Joint Center for Housing Studies found that homes with economical expansion potential appreciate 22% faster than properties with limited modification options.

Key modification potential factors include:

- Unfinished spaces: Basements, attics, and bonus rooms that can be converted at below-market cost per square foot

- Logical addition locations: Areas where the home’s structural and mechanical systems can easily accommodate expansion

- Lot size and setback compliance: Properties with sufficient space to expand within zoning regulations

- Architectural style adaptability: Designs that can incorporate additions without compromising aesthetic cohesion

Cost-to-Value Improvement Analysis

Identifying properties where high-return improvements can be made provides significant equity-building opportunities. According to Remodeling Magazine’s Cost vs. Value Report, strategic improvements can deliver returns exceeding 80% of invested capital while simultaneously enhancing livability.

Highest ROI improvements by property category:

| Property Type | High-ROI Improvements | Average Return on Investment |

|---|---|---|

| Older homes (pre-1980) | Kitchen modernization, energy efficiency upgrades, bathroom renovations | 75-92% |

| Newer homes (post-2000) | Outdoor living space, home office conversion, primary suite enhancement | 65-78% |

| Townhomes/Condos | Kitchen upgrades, flooring replacement, bathroom modernization | 70-85% |

| Luxury properties | Smart home technology, outdoor entertainment areas, spa bathroom features | 60-75% |

Before/after comparison of kitchen renovation showing 87% ROI based on local market data

Neighborhood Trajectory Analysis

While point-in-time neighborhood quality is important, trajectory provides greater insight into long-term investment performance. Research from the Federal Reserve Bank of Philadelphia demonstrates that properties in improving neighborhoods experience appreciation rates 1.4x higher than metro averages over ten-year periods.

Key neighborhood trajectory indicators include:

- Business investment patterns: New retail, dining, and commercial development signaling economic optimism

- Renovation activity ratio: Percentage of properties undergoing significant improvement within 3-block radius

- Demographic shifts: Changes in household income, education levels, and occupation types among new residents

- Public investment commitments: Scheduled infrastructure, school, and municipal improvements

Total Cost of Ownership Calculation

Beyond purchase price and mortgage payment, comprehensive cost analysis prevents budget surprises. According to Consumer Reports Home Ownership Survey, 27% of homeowners experience significant financial stress from underestimating total ownership costs.

A complete TCO analysis should include:

Total Cost of Ownership Checklist

- ☐ Property taxes with projected annual increases (typically 2-5% annually)

- ☐ Homeowners insurance with flood/hazard supplements if applicable

- ☐ HOA or condo fees with historical increase analysis

- ☐ Utilities based on property size, age, and efficiency (request historical data)

- ☐ Maintenance reserve (minimum 1% of property value annually)

- ☐ Major system replacement schedule (roof, HVAC, water heater, etc.)

- ☐ Landscaping and exterior maintenance requirements

- ☐ Commuting cost differential from current location

- ☐ Furniture and décor requirements for new space

- ☐ Renovation/improvement costs for planned projects

For guidance on selecting properties with strong appreciation potential, check out our research on The 10 Hottest Housing Markets for 2025.

Negotiation Mastery: Securing Optimal Terms

Effective negotiation strategy extends beyond price haggling to include contingencies, timing, and seller motivations that can significantly impact overall transaction value.

Market-Calibrated Offer Positioning

According to an analysis of 250,000 transactions by real estate data firm CoreLogic, successful negotiations begin with strategically positioned initial offers based on current market conditions.

Optimal initial offer positioning by market type:

| Market Condition | Optimal Initial Offer | Strategic Approach |

|---|---|---|

| Strong Seller’s Market (<3 months inventory) | 100-103% of asking price | Focus on non-price terms; offer escalation clauses; minimize contingencies |

| Moderate Seller’s Market (3-4 months inventory) | 97-100% of asking price | Offer at asking with seller concessions; maintain key contingencies |

| Balanced Market (4-6 months inventory) | 94-97% of asking price | Start below asking with room to negotiate; include all standard contingencies |

| Buyer’s Market (>6 months inventory) | 88-94% of asking price | Aggressive initial offers; extensive contingencies; seller concessions |

Contingency Strategy Optimization

Effective contingency structure balances protection with competitiveness. The National Association of Realtors reports that buyers who strategically customize contingencies improve acceptance rates by 37% while maintaining appropriate safeguards.

Strategic contingency framework:

- Financing contingency: Tighten to 14-21 days with pre-approval in strong markets; maintain standard 30 days in balanced/buyer’s markets

- Inspection contingency: Consider “pass/fail” inspections in competitive situations; maintain traditional detailed contingencies with repair requests in balanced/buyer’s markets

- Appraisal contingency: Consider appraisal gaps in strong markets ($5,000-15,000 typical); maintain full protection in balanced/buyer’s markets

- Sale contingency: Generally avoid in seller’s markets; include with strong proof of marketability in balanced/buyer’s markets

Seller Motivation Analysis

Understanding seller priorities beyond price creates negotiation leverage. According to a survey by Clever Real Estate, 72% of sellers would accept a lower offer price in exchange for terms that address their specific concerns.

Common seller motivations and strategic responses:

- Timeline pressure: Offer flexible closing dates, rent-back options, or extended possession for sellers seeking specific move timing

- Certainty concerns: Provide strong earnest money deposits, shortened contingency periods, and proof of solid financing

- Convenience needs: Offer as-is purchase with right to inspect or waive minor repair requests below threshold amounts

- Future home concerns: Propose lease-back arrangements at market rate to allow sellers time to find replacement properties

Concession Targeting Strategy

Strategic targeting of seller concessions can provide greater financial benefit than equivalent price reductions. Mortgage analytics firm Black Knight found that structuring offers with seller concessions can improve buyer cash flow and reduce closing costs while maintaining seller net proceeds.

High-value concession targets include:

- Closing cost credits: Particularly valuable for cash-constrained buyers, reducing out-of-pocket expenses while maintaining loan amount

- Rate buydowns: Seller-funded permanent or temporary buydowns that reduce monthly payments for the loan term or initial years

- Home warranty coverage: Protection against major system/appliance failures in the critical first year of ownership

- Repair credits: Particularly for issues identified during inspection that don’t affect financing approval

Advanced Negotiation Tactic: The Closing Timeline Lever

According to real estate negotiation expert Michael Maher, “The closing timeline is often the most underutilized negotiation lever available to buyers. By identifying the seller’s ideal moving timeframe and structuring your offer to accommodate it—whether expedited for sellers who need quick proceeds or extended for those still searching for their next home—you can often secure price concessions of 1-3% while creating a win-win scenario. This approach is particularly effective in balanced markets where sellers weigh multiple factors beyond simply maximizing price.”

For homeowners juggling both buying and selling simultaneously, see our guide on How to Buy a Home Before Selling Yours: The Ultimate Guide.

Due Diligence: Protecting Your Investment

Thorough due diligence prevents costly surprises and ensures informed decision-making. According to a study by the American Society of Home Inspectors, proper inspection and investigation prevent an average of $14,000 in unexpected first-year repair costs.

Comprehensive Inspection Strategy

Beyond standard home inspections, strategic buyers conduct specialized evaluations based on property characteristics and risk factors. Data from HomeAdvisor shows that 78% of major post-purchase issues could have been identified through proper specialized inspections.

Recommended inspection protocol by property type:

| Property Type | Standard Inspections | Specialized Inspections to Consider |

|---|---|---|

| Older Homes (30+ years) | General home inspection, radon test | Sewer scope, electrical system review, chimney inspection, lead paint testing |

| Newer Homes (<10 years) | General home inspection, radon test | Builder warranty review, energy efficiency assessment, drainage evaluation |

| Rural Properties | General home inspection, radon test | Well water quality test, septic system inspection, soil stability assessment |

| Properties with Basements | General home inspection, radon test | Foundation specialist assessment, moisture monitoring, mold inspection |

| Condos/Townhomes | Unit inspection, radon test | HOA document review, reserve study analysis, noise transmission testing |

Property Document Analysis

Thorough document review reveals potential issues beyond physical inspection. According to the American Land Title Association, approximately 25% of properties have title issues that could create future ownership problems.

Critical documents to review include:

- Title reports: Identifying easements, encroachments, liens, or other ownership limitations

- Property surveys: Verifying boundary lines, improvements, and encroachments

- HOA/Condo documents: Evaluating financial health, reserve adequacy, and rules/restrictions

- Permit history: Confirming additions/renovations were properly permitted and inspected

- Disclosure statements: Reviewing seller-provided information about known property issues

Critical property documents that should be thoroughly reviewed during due diligence

Environmental Hazard Assessment

Environmental issues can significantly impact property value and occupant health. The Environmental Protection Agency estimates that 1 in 15 U.S. homes has elevated radon levels, and millions of properties have other environmental concerns.

Key environmental factors to evaluate:

- Radon levels: Testing for this odorless radioactive gas that causes lung cancer

- Lead paint presence: Particularly in homes built before 1978

- Asbestos materials: Common in homes built between 1930-1980 in insulation, flooring, and other materials

- Mold assessment: Particularly in properties with previous water damage or humidity issues

- Local contamination: Researching nearby industrial sites, gas stations, or dry cleaners with potential soil/water impacts

Future Expense Assessment

Anticipating major expenses allows for proper budgeting and negotiation strategy. According to Consumer Reports, 62% of homebuyers underestimate replacement costs for major systems, creating financial stress when failures occur.

Strategic future expense analysis includes:

Future Expense Planning Checklist

- ☐ Roof age and remaining lifespan (typical replacement: $8,000-20,000)

- ☐ HVAC system age and maintenance history (typical replacement: $5,000-12,000)

- ☐ Water heater age and type (typical replacement: $1,000-3,000)

- ☐ Appliance age and warranty status (typical replacement: $3,000-8,000 for full suite)

- ☐ Window condition and efficiency (typical replacement: $10,000-30,000 for whole home)

- ☐ Exterior siding condition and maintenance needs (typical replacement: $7,000-25,000)

- ☐ Foundation stability and drainage issues (remediation costs: $5,000-40,000+)

- ☐ Electrical system capacity and safety (upgrades typically: $2,500-9,000)

- ☐ Plumbing system type and condition (replumbing costs: $4,000-15,000)

- ☐ Driveway/hardscape condition (replacement costs: $3,000-12,000)

For insights on the critical importance of professional repairs, see our article Hire a Licensed Contractor or Lose Thousands of Dollars on Shoddy Repairs.

Closing Process: Navigating the Final Steps

The closing process represents a critical phase where attention to detail prevents costly errors and ensures a smooth transition to ownership.

Closing Documentation Review

Thorough review of closing documents prevents costly errors and ensures terms match original agreements. According to the Consumer Financial Protection Bureau, over 35% of closings contain documentation errors that could result in unexpected costs or legal issues.

Critical closing document review checklist:

- Loan disclosure verification: Comparing final closing disclosure against loan estimate for rate, term, and fee accuracy

- Title documentation: Reviewing final title policy for proper coverage and exception limitations

- Deed verification: Ensuring correct property description, ownership vesting, and transfer terms

- Prorations accuracy: Verifying property tax, HOA dues, and utility payment allocations

- Escrow account setup: Confirming proper initial funding and ongoing payment calculations

Final Inspection Strategy

The final walkthrough represents your last opportunity to verify property condition before closing. According to a survey by the National Association of Exclusive Buyer Agents, 12% of buyers discover significant issues during final walkthroughs that require closing adjustments.

Effective final inspection protocol:

| Inspection Category | Verification Steps | Common Issues to Address |

|---|---|---|

| Agreed Repairs | Review repair documentation; test repaired systems; inspect workmanship | Incomplete repairs; substandard workmanship; substituted materials |

| Property Condition | Compare to initial viewing condition; document new damage; test all systems | Moving damage; non-working systems; missing fixtures/items |

| Included Items | Verify all contractually included items remain; check appliance function | Removed appliances; substituted fixtures; missing window treatments |

| Systems Operation | Test HVAC, plumbing, electrical systems; check all light fixtures | Non-functioning outlets; plumbing leaks; HVAC performance issues |

| Exterior Condition | Inspect yard, driveway, and exterior features; check for new damage | Moving truck damage; landscape issues; exterior fixtures removed |

Funds Transfer Optimization

Proper coordination of closing funds prevents delays and ensures financial security. The American Land Title Association reports that wire fraud attempts increased by 480% between 2016-2023, making secure fund transfer critical.

Secure closing funds protocol:

- Verification procedures: Confirming wire instructions via phone using known, verified numbers before sending funds

- Timing optimization: Initiating wire transfers 1-2 business days before closing to allow for processing time

- Transfer method selection: Understanding the pros/cons of wire transfers vs. cashier’s checks for closing funds

- Security protocols: Using secure communication channels for financial information; verifying any changed instructions

- Alternative planning: Having backup funding methods available in case of transfer delays

Post-Closing Optimization

Strategic post-closing actions protect your investment and establish proper ownership records. Data from CoreLogic indicates that 14% of new homeowners experience documentation issues that could have been prevented through proper post-closing procedures.

Essential post-closing checklist:

Post-Closing Action Items

- ☐ Verify deed recording and obtain recording information

- ☐ Secure all closing documents in fireproof storage and digital backup

- ☐ File for homestead exemption and other tax benefits (deadlines vary by location)

- ☐ Transfer utilities and establish new service accounts

- ☐ Change locks and security codes

- ☐ Configure mortgage autopayments and establish payment verification system

- ☐ Update address with post office, DMV, voter registration, etc.

- ☐ Schedule property tax payment reminders if not escrowed

- ☐ Obtain/review home warranty documentation and procedures

- ☐ Create home maintenance schedule based on inspection findings

Expert Insight: Closing Day Preparation

According to real estate attorney Jennifer Barrister, “The most overlooked aspect of closing preparation is creating a contingency buffer for both timing and funds. I advise clients to schedule closings at least 7-10 days before their desired move date and to have access to an additional 2% of the purchase price in liquid funds beyond the expected closing costs. These buffers accommodate the unexpected delays and last-minute adjustments that occur in approximately 40% of transactions, preventing cascading problems with moving schedules, rate locks, and other time-sensitive arrangements.”

For insights on protecting your investment after purchase, see our article on The Financial Devastation of Going Without Home Insurance.

Post-Purchase Wealth Building Strategies

Strategic management of your property after purchase maximizes both lifestyle enjoyment and long-term financial returns. According to data from the Federal Reserve’s Survey of Consumer Finances, homeowners who implement proactive wealth-building strategies accumulate net worth 40x greater than renters over a 30-year period.

Mortgage Optimization Strategy

Post-purchase mortgage management significantly impacts long-term financial outcomes. Analysis from the Mortgage Bankers Association shows that strategic mortgage management can reduce total interest paid by 25-42% while cutting years off the loan term.

Effective mortgage optimization includes:

- Bi-weekly payment structure: Making half payments every two weeks instead of monthly payments (results in 13 “months” of payments annually)

- Strategic principal reduction: Adding modest additional principal to regular payments (even $100/month can save $30,000+ over the loan term)

- Refinance monitoring: Tracking interest rate movements and refinance opportunities for rate reductions

- Mortgage recasting: Applying lump-sum principal payments to reduce monthly payments while maintaining term

Strategic Home Improvement Planning

Targeted improvements enhance both living experience and property value. According to Remodeling Magazine’s Cost vs. Value Report, strategically planned improvements deliver an average of 70% return on investment while enhancing owner enjoyment.

Value-optimized improvement framework:

| Timeframe | Improvement Focus | Strategic Approach |

|---|---|---|

| First Year | Deferred maintenance; energy efficiency; cosmetic updates | Address inspector-identified issues; implement low-cost/high-impact cosmetic improvements |

| Years 2-3 | Focused functional improvements; targeted upgrades | Upgrade highest-use areas (kitchen, primary bath); improve functional layouts |

| Years 4-7 | Major value-adding improvements; space optimization | Add usable space through finishing or expansion; implement major systems upgrades |

| Pre-Sale (1-2 years before) | Market-aligned updates; curb appeal enhancement | Focus on high-visibility features; address market-specific buyer preferences |

Strategic home improvement timeline maximizing both enjoyment and value appreciation

Equity Leverage Strategies

Home equity represents a powerful financial resource when strategically managed. According to Federal Reserve research, homeowners who implement disciplined equity leverage strategies build wealth 2.5x faster than those who leave equity untapped.

Responsible equity utilization options include:

- Strategic investment properties: Using home equity to acquire cash-flowing rental properties (average ROI: 12-18% annually)

- Education financing: Funding career advancement or education with lower-cost equity alternatives to student loans

- Business capitalization: Providing startup or expansion capital for entrepreneurial ventures

- Debt consolidation: Replacing high-interest debt with lower-cost, potentially tax-deductible financing

Important: Equity leverage should only be considered for investments or expenditures with tangible return potential or significant cost-saving advantages. Using home equity for consumption represents a significant wealth-building error.

Tax Optimization Planning

Strategic tax planning significantly enhances the financial benefits of homeownership. IRS data indicates that homeowners who implement comprehensive tax strategies reduce their effective tax burden by an average of 15-23% compared to those who claim only standard deductions.

Key homeownership tax strategies include:

- Property tax planning: Appealing assessments when appropriate; timing payments for optimal deduction

- Home office deductions: Properly documenting and claiming eligible workspace expenses

- Energy efficiency credits: Leveraging federal and state incentives for qualifying improvements

- Capital improvement tracking: Maintaining comprehensive records of improvements that increase cost basis

- Primary residence exclusion planning: Strategic timing of sales to maximize capital gains exclusion benefits

Wealth Building Insight: The Property Ladder Strategy

Financial planner Melissa Rodriguez explains, “One of the most successful wealth-building approaches I’ve observed is the ‘property ladder’ strategy, where homeowners strategically upgrade properties every 5-7 years. By combining the primary residence capital gains exclusion ($500,000 for married couples) with disciplined property selection and improvement, this approach has generated average wealth increases of $85,000-120,000 per cycle. The key is maintaining a long-term perspective where each home represents not just a residence but a strategic step toward building substantial real estate equity.”

For additional strategies to maximize your real estate investment, see our analysis on Why Real Estate Remains the Best Investment Vehicle in 2025.

Conclusion: Your Personalized Path to Homeownership Success

Successful home purchasing in today’s market requires a comprehensive, strategic approach that extends far beyond traditional advice. By implementing the evidence-based strategies outlined in this guide—from financial preparation and market analysis to negotiation tactics and post-purchase wealth building—you position yourself for both immediate success and long-term prosperity through homeownership.

The journey to successful homeownership represents not just the acquisition of a place to live but the establishment of a powerful financial foundation that can generate wealth for decades to come. By approaching this process with careful planning, strategic execution, and continuous optimization, you transform what many experience as a stressful transaction into a rewarding step toward financial independence.

Remember that real estate remains one of the few investment vehicles that combines practical utility with appreciation potential, tax advantages, and leverage opportunities. By mastering each stage of the home purchase journey, you unlock the full spectrum of benefits that homeownership offers.

As you move forward on your path to homeownership, consider these final recommendations:

- Begin your financial preparation at least 12 months before your target purchase date

- Develop relationships with knowledgeable professionals who understand your specific goals

- Stay committed to your established criteria rather than making emotional compromises

- View your purchase as both a home and an investment, balancing lifestyle and financial considerations

- Implement post-purchase strategies from day one to maximize both enjoyment and wealth-building

By following this comprehensive approach, you’ll not only secure an optimal property on favorable terms but also establish the foundation for long-term financial success through strategic homeownership.

Explore More Home Buying Resources

Deepen your home buying knowledge with these comprehensive guides from Builds and Buys:

- First-Time Homebuyer’s Blueprint: 8 Critical Steps That Experts Don’t Tell You

- Buying A House With Bad Credit: Advanced Strategies and Expert Insights

- How to Buy a Home Before Selling Yours: The Ultimate Guide

- The Financial Devastation of Going Without Home Insurance

- Renting versus Buying a Property in 2025: A Comprehensive Analysis for Today’s Market

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.