Check out our app!

Explore more features on mobile.

Foreign Real Estate Investment for Americans and Canadians: Top Countries for 2025

For North American investors seeking to diversify their portfolios beyond domestic markets, foreign real estate investment presents compelling opportunities with potentially superior returns and unique lifestyle benefits. According to the National Association of Realtors’ 2024 Profile of International Transactions, Americans invested over $68 billion in foreign real estate last year—a 14% increase from the previous year. This surge reflects growing recognition of international property’s advantages: currency diversification, rental income in foreign currencies, geographical portfolio dispersion, and access to markets with stronger growth trajectories than North America. This comprehensive analysis examines the most advantageous countries for Americans and Canadians looking to invest abroad in 2025, with special focus on emerging South American opportunities and Dubai’s revolutionary developments.

Why Invest in Foreign Real Estate Markets?

The case for foreign real estate investment has strengthened considerably in recent years, driven by several macroeconomic factors and investment advantages that North American investors increasingly recognize.

Portfolio Diversification Beyond Domestic Markets

According to a 2024 study by JP Morgan Asset Management, portfolios including 15-25% international real estate exposure demonstrated 22% lower volatility over a 20-year period compared to domestic-only real estate holdings. This diversification benefit stems from reduced correlation with North American economic cycles and exposure to markets in different growth phases.

Foreign property investments can serve as effective hedges against domestic market downturns. The Emerging Property Markets Index (EPMI) shows that during the 2008-2009 U.S. housing crisis, select Latin American markets maintained stability or experienced only minor corrections, while North American markets saw declines exceeding 30%.

Currency Diversification Benefits

Investing in foreign real estate provides a tangible asset denominated in alternate currencies—a strategic advantage in periods of dollar weakness. The Federal Reserve’s monetary policy and U.S. deficit spending create long-term pressure on the dollar, making foreign-denominated assets increasingly attractive.

For Canadian investors, whose domestic currency fluctuates with commodity prices, international property offers stabilization against resource market volatility. Analysis from BMO Capital Markets indicates that Canadians with real estate investments in select international markets saw effective returns increase by 8-12% from 2020-2024 due solely to favorable currency movements.

Access to Higher-Growth Markets

Many international markets offer stronger growth fundamentals than mature North American markets. The IMF World Economic Outlook projects that emerging economies in Latin America will grow at 3.8% annually through 2030, compared to 2.1% for the U.S. and 1.8% for Canada.

This growth differential translates directly to real estate performance. Knight Frank’s Global House Price Index shows average annual price growth of 6.2% in emerging markets versus 4.1% in developed markets over the past decade. Select markets like Panama City, Medellín, and Dubai have consistently outperformed North American averages while maintaining favorable affordability metrics.

Comparative Investment Returns

When analyzing risk-adjusted returns across major investment markets, several international destinations demonstrate superior performance metrics:

| Market | Average Annual Appreciation (5-Year) | Typical Rental Yield | Price-to-Income Ratio |

|---|---|---|---|

| Medellín, Colombia | 7.8% | 7.5-9.2% | 5.4 |

| Panama City, Panama | 6.3% | 6.4-8.1% | 6.2 |

| San José, Costa Rica | 5.9% | 6.8-8.5% | 6.8 |

| Dubai, UAE | 8.4% | 5.8-7.6% | 7.5 |

| Miami, USA (Comparison) | 5.7% | 3.5-5.2% | 8.9 |

| Toronto, Canada (Comparison) | 4.9% | 3.2-4.8% | 10.5 |

Source: Knight Frank Global Residential Cities Index, Numbeo Property Investment Analysis, 2025

This data illustrates the significant yield advantage and generally stronger appreciation potential in select international markets compared to major North American cities. The lower price-to-income ratios also suggest greater affordability and room for continued growth.

If you’re investigating property investment potential, consider reviewing our analysis of Why Real Estate Remains the Best Investment Vehicle in 2025.

Colombia: Emerging Market with Strong Fundamentals

Colombia has emerged as a premier destination for North American real estate investors, combining macroeconomic stability with high-yield potential and lifestyle appeal.

Market Fundamentals and Growth Drivers

Colombia’s economy has demonstrated remarkable resilience, with the World Bank projecting GDP growth of 3.5-4.0% annually through 2028—substantially outpacing North American economies. The country’s growing middle class, urbanization trends, and infrastructure development create strong underlying demand for quality housing.

The Colombian peso’s historical patterns against the dollar provide strategic entry opportunities for North American investors. Current exchange rates remain favorable, effectively discounting property prices by 15-20% compared to pre-pandemic valuations when measured in USD terms.

Investment Hotspots and Property Types

Medellín, once notorious for crime, has transformed into Latin America’s innovation hub and a prime real estate investment destination. The city’s El Poblado and Laureles districts offer luxury apartments with construction costs 60-70% lower than comparable North American properties. Apartment prices average $1,200-1,800 per square meter for premium locations—a fraction of costs in major U.S. or Canadian cities.

Bogotá’s northern sectors (Usaquén, Chicó, and Rosales) present opportunities in Colombia’s economic and political center. The capital city attracts corporate tenants and diplomatic renters, providing stable rental streams with yields exceeding 7%.

The Caribbean coastal city of Cartagena offers a different value proposition, focusing on vacation rentals and tourism-oriented properties. Historical properties within the walled city command premium values but deliver exceptional short-term rental performance, with occupancy rates averaging 75% during high seasons.

Legal Framework for Foreign Investors

Colombia maintains an investor-friendly legal framework with few restrictions on foreign property ownership. American and Canadian investors receive the same property rights as Colombian citizens, with no limitations on repatriation of rental income or capital gains.

The Foreign Investment Statute (Decree 1068 of 2015) establishes clear legal protections, ensuring equal treatment under the law. Property registration follows a straightforward process through the Public Registry Office (Oficina de Registro de Instrumentos Públicos).

Key legal considerations include:

- Title searches are essential due to Colombia’s complex property history; using a reputable attorney for due diligence is crucial

- Property transfer tax (Impuesto de Registro) equals approximately 1% of the property value

- Notary fees typically range from 0.3% to 0.5% of the transaction value

- Non-residents must obtain a tax ID (NIT) from the Colombian tax authority (DIAN)

Rental Market Performance

Colombia’s rental market presents compelling economics for investors, particularly in major urban centers:

- Long-term residential rentals yield 7-9% annually in Medellín and Bogotá prime areas

- Short-term Airbnb yields can reach 12-15% in tourist destinations like Cartagena and Santa Marta

- Executive rentals targeting corporate clients deliver premium returns with lower vacancy risk

- Property management fees typically range from 8-12% of gross rental income

According to Colombia’s urban development ministry, rental demand has increased by 22% since 2020, driven by internal migration and international interest. This trend has created particularly strong markets for modern, amenity-rich properties that meet international standards.

Investor Profile: Colombia

Ideal for: Value investors seeking strong yields with moderate appreciation potential

Investment range: $100,000-$350,000 for premium urban apartments

Strengths: High yields, affordable luxury, growing economy, minimal restrictions

Considerations: Currency volatility, political transitions, property formalization issues in some areas

Panama: Tax Advantages and Dollar-Based Economy

Panama offers North American investors a unique combination of favorable tax policies, currency stability, and strategic location, making it a premier destination for foreign real estate investment.

Strategic Advantages for North American Investors

Panama’s dollarized economy eliminates currency risk for U.S. investors—a significant advantage in an era of monetary uncertainty. Canadian investors benefit from a stable USD/CAD conversion point rather than managing exposure to volatile emerging market currencies.

The country’s territorial tax system represents one of its strongest attractions for foreign investors. Panama only taxes income generated within its borders, meaning:

- Foreign-source income remains untaxed for residents and non-residents alike

- Capital gains tax on real estate is a flat 10%, substantially lower than North American rates

- No inheritance or estate taxes affect property transfers to heirs

- Property taxes are minimal, with exemptions for new properties

Panama’s geographic position as a global trade hub creates strong rental demand, particularly in Panama City. The Panama Canal expansion, completed in 2016, continues to drive economic growth, with the logistics sector expanding at 7.2% annually according to the Panama Maritime Authority.

Prime Investment Locations

Panama City offers diverse investment options across several distinct markets:

Panama City – Banking District (Calle 50, Obarrio, Punta Pacifica): Luxury high-rises targeting executive tenants command premium prices ($2,500-3,000/sqm) but deliver strong rental performance with yields of 5.5-7%. Occupancy rates exceed 90% for well-managed properties due to strong corporate demand.

Casco Viejo: Panama’s historic district offers colonial properties with strong tourism potential. Fully renovated properties average $3,000-3,800/sqm but can achieve short-term rental yields of 8-10% through platforms like Airbnb, with high-season occupancy rates approaching 85%.

Costa del Este: This planned community attracts affluent locals and expatriates with family-friendly amenities. Property values average $2,200-2,700/sqm with rental yields of 5.5-6.5% and strong appreciation potential as infrastructure development continues.

Beyond Panama City, emerging investment destinations include:

- Coronado: Beach community popular with retirees, offering single-family homes from $200,000-400,000

- Boquete: Mountain retreat with cooler climate, attracting premium rentals with yields of 6-8%

- Bocas del Toro: Caribbean archipelago with eco-tourism potential and vacation rental opportunities

Residency Through Investment

Panama offers some of Latin America’s most accessible residency-through-investment programs, creating additional value for real estate investors. These include:

Friendly Nations Visa: Americans and Canadians can obtain permanent residency by establishing a Panamanian company and purchasing real estate valued at $200,000 or more. This pathway leads to citizenship eligibility after five years.

Retiree (Pensionado) Program: Investors with guaranteed income of $1,000+ monthly receive substantial benefits:

- One-time import tax exemption for household goods

- Property tax exemptions on primary residence

- Discounts on utility bills, medical services, and transportation

- Expedited residency processing

According to Panama’s National Migration Service, North Americans constitute approximately 35% of residency applicants through investment programs, with record numbers reported in 2023-2024.

Ownership Structures and Legal Considerations

Panama allows unrestricted foreign ownership of real estate with identical rights to local citizens. However, strategic ownership structures can optimize tax efficiency and asset protection:

- Private Interest Foundation: Offers similar benefits to trusts with enhanced privacy and asset protection

- Panamanian Corporation: Separates personal assets from investment property, creating liability barriers

- Direct Ownership: Simplest approach, appropriate for single properties with straightforward usage plans

Property registration involves a straightforward process through Panama’s Public Registry, with transfer taxes of approximately 2% of the property value plus notary and legal fees averaging 1-1.5%.

Investor Profile: Panama

Ideal for: Tax-conscious investors seeking dollar stability with strong asset protection

Investment range: $200,000-$500,000 for premium urban apartments, $150,000-$350,000 for coastal properties

Strengths: Dollarized economy, territorial tax system, residency pathways, strong rental markets

Considerations: New supply in Panama City creating localized oversupply in some segments, higher entry costs than Colombia

Costa Rica: Eco-Tourism and Retirement Haven

Costa Rica has established itself as a premier destination for North American investors seeking stable returns, environmental sustainability, and exceptional quality of life in their foreign real estate investment portfolio.

Market Overview and Investment Climate

Costa Rica’s political stability distinguishes it within Central America, with 70+ years of democratic governance providing a secure investment environment. The country consistently ranks among the highest in Latin America on property rights protection indices, scoring 72.4/100 on the International Property Rights Index.

The Costa Rican economy has maintained steady growth, averaging 3.2% annually over the past decade according to the Central Bank of Costa Rica. Tourism continues as a principal economic driver, with visitor numbers reaching record highs of 3.2 million in 2023—approximately 60% from North America.

The real estate market demonstrates distinct segmentation between the local housing market and the international/investment sector. Properties targeting North American buyers typically feature North American construction standards, amenities, and pricing structures that diverge significantly from local markets.

High-Performing Investment Regions

Costa Rica offers diverse investment opportunities across several microclimates and lifestyle categories:

Guanacaste Province (Pacific Coast): This northwestern region features premier beach communities including Tamarindo, Flamingo, and Nosara. Property values average $2,000-3,000/sqm for ocean-view condominiums and $300-800/sqm for development land. Short-term vacation rental yields range from 8-12% with high-season occupancy rates of 80-90%.

Central Valley (San José, Escazú, Santa Ana): The metropolitan area offers both primary residence options and strong long-term rental markets. Luxury condominiums in Escazú and Santa Ana range from $1,800-2,500/sqm with rental yields of 6-8% from expatriate corporate tenants and diplomatic personnel.

Central Pacific (Jacó, Manuel Antonio): These established tourism destinations provide proven vacation rental performance with strong appreciation history. Beachfront and ocean-view condominiums range from $2,200-3,500/sqm with short-term rental yields of 7-10% and occupancy rates averaging 70-75% annually.

Southern Zone (Dominical, Uvita, Ojochal): This emerging region offers value opportunities with substantial appreciation potential. Ocean-view properties range from $1,500-2,500/sqm with development land available at $100-400/sqm. The region has seen average annual appreciation of 8-12% as infrastructure improvements enhance accessibility.

Legal Framework for Foreign Investors

Costa Rica permits unrestricted foreign ownership of property with identical rights to citizens, with one notable exception: maritime zone restrictions. Properties within 200 meters of the high tide line (Maritime Zone) fall under concession regulations rather than full ownership.

The Maritime Zone is divided into two sections:

- The first 50 meters from high tide is public land with no development permitted

- The next 150 meters can be developed through concessions granted by local municipalities

- Concessions typically run for 20 years with renewal options

- Some areas are exempt through grandfather clauses or special legislation

For non-concession properties, ownership structures include:

- Direct personal ownership: Simplest approach but exposes investors to personal liability

- Costa Rican corporation (S.A. or S.R.L.): Provides liability protection and simplifies eventual resale

- Foreign entity ownership: Possible but creates additional tax complexity

The property registration process involves:

- Title verification through the National Registry (Registro Nacional)

- Transfer tax of 1.5% of the registered property value

- Legal fees typically ranging from 1-2% of the transaction value

- Property registration through the property section of the National Registry

Rental Market Dynamics

Costa Rica offers dual rental strategies depending on property location and investor objectives:

Vacation Rental Market: Properties in tourist destinations generate significantly higher yields through short-term rentals. According to AirDNA market data, average vacation rental revenue for well-managed properties exceeds $45,000 annually for two-bedroom units in prime locations, with Guanacaste and Manuel Antonio achieving the highest performance metrics.

Key success factors for vacation rentals include:

- Professional property management (typically 20-30% of gross revenue)

- Strategic digital marketing across multiple booking platforms

- High-quality furnishings and amenities meeting North American expectations

- Reliable high-speed internet and modern entertainment systems

Long-Term Rental Market: Properties in the Central Valley and select urban areas perform well with extended leases to expatriates, diplomatic staff, and multinational corporate employees. These rentals typically yield 6-8% annually with minimal vacancy and lower management requirements.

The Costa Rican government has implemented a streamlined digital tax registration system for rental income, requiring quarterly reporting and a progressive tax rate between 15-25% on net rental income after deductions.

Investor Profile: Costa Rica

Ideal for: Lifestyle investors seeking natural beauty, environmental sustainability, and vacation rental income

Investment range: $200,000-$600,000 for coastal condominiums, $300,000-$800,000 for single-family homes with views

Strengths: Political stability, established tourism industry, strong rental yields, environmental protection

Considerations: Maritime zone restrictions, higher purchase costs, developing infrastructure in some regions

Dubai & UAE: Ultra-Modern Investment Opportunities

The United Arab Emirates, particularly Dubai, has emerged as a premier global destination for foreign real estate investment, offering North Americans a combination of tax efficiency, luxury lifestyle, and exposure to one of the world’s most dynamic property markets.

Market Dynamics and Investment Climate

Dubai’s real estate market has matured significantly since the 2008-2009 global financial crisis, developing robust regulatory frameworks and more sustainable growth patterns. The Dubai Land Department (DLD) reports that foreign investments exceeded $30 billion in 2024, with North Americans representing approximately 12% of international buyers.

Key market drivers include:

- Complete tax exemption on property income and capital gains

- No restrictions on capital repatriation or currency controls

- Strategic location connecting Europe, Asia, and Africa

- World-class infrastructure and amenities

- Strong rental demand from the expatriate population (approximately 85% of residents)

Recent regulatory developments have enhanced market transparency and investor protection. The Dubai Real Estate Regulatory Agency (RERA) has implemented escrow account requirements for off-plan developments, mandatory property registration, and standardized contracts that significantly reduce investor risk compared to the pre-2008 environment.

Prime Investment Areas

Dubai’s property market features distinct segments targeting different investor objectives:

Downtown Dubai & Dubai Marina: Ultra-luxury apartment market with prices ranging from $5,500-8,000/sqm. These central districts deliver prestige addresses with rental yields of 5-6.5% and strong liquidity for eventual exit. Burj Khalifa apartments and waterfront properties command premium valuations but maintain consistent demand from high-net-worth renters.

Palm Jumeirah: Iconic man-made island featuring both apartments ($6,000-9,000/sqm) and villas ($10,000-25,000/sqm). The limited inventory and prestigious address support strong appreciation while delivering rental yields of 4.5-6%. Vacation rental performance is exceptional, with premium rates during peak tourist seasons.

Business Bay & Jumeirah Lake Towers: Business-oriented districts offering stronger yields (6-7.5%) and lower entry points ($3,800-5,200/sqm). These areas attract professional expatriate tenants seeking proximity to commercial centers and transportation links.

Emerging Communities: Newer developments including Dubai Hills Estate, Dubai South, and Mohammed Bin Rashid City offer entry-level luxury with prices from $3,000-4,800/sqm and rental yields typically exceeding 6.5%. These master-planned communities feature comprehensive amenities and investment potential tied to proximity to key infrastructure developments.

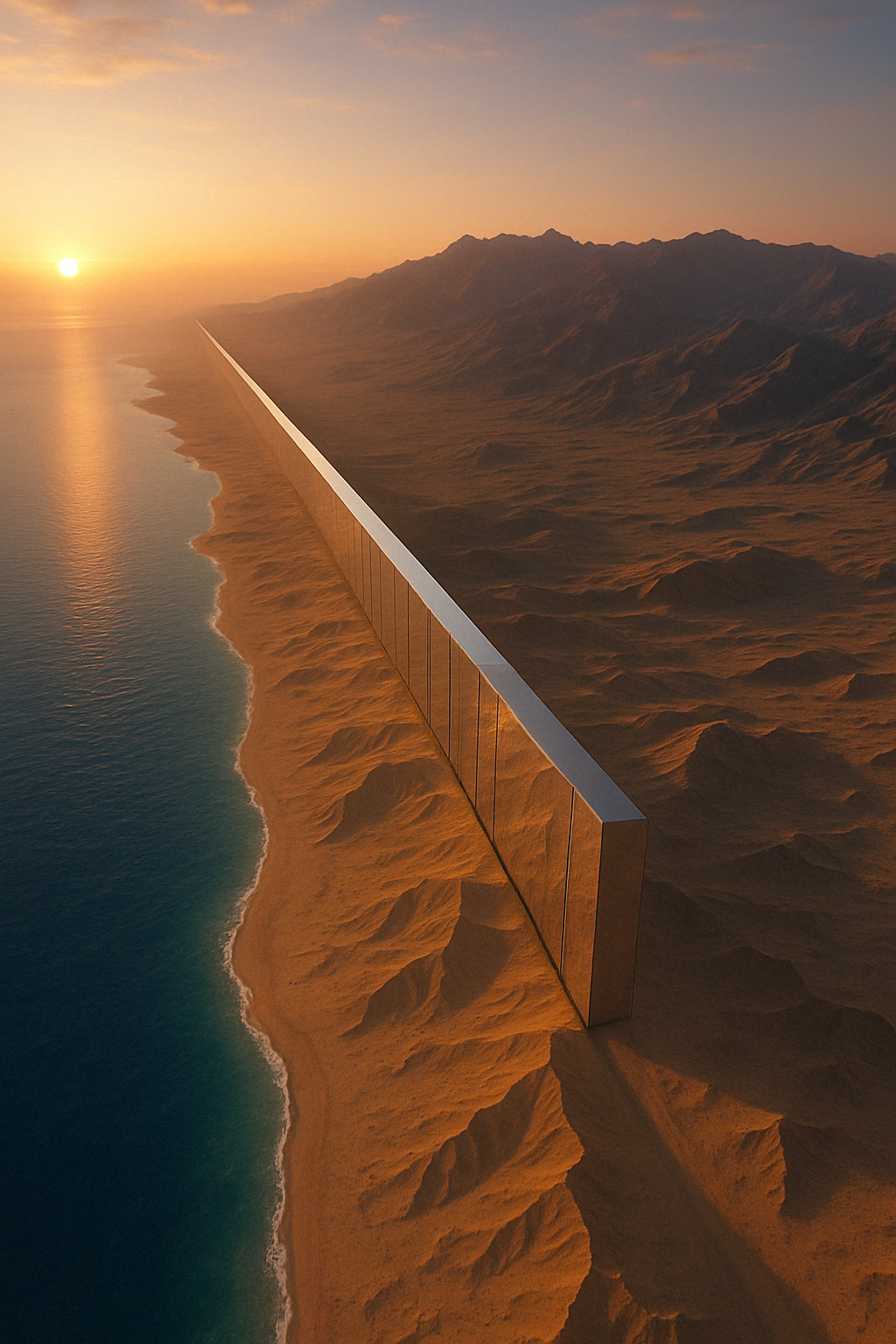

The Line and Saudi Arabia’s NEOM Project

While not in the UAE, Saudi Arabia’s nearby NEOM development—particularly its centerpiece project “The Line”—represents one of the most ambitious real estate ventures in modern history and warrants consideration by forward-thinking investors.

The Line is a revolutionary linear city designed to eventually house 9 million residents across a 170km linear development with zero cars, zero streets, and zero carbon emissions. This futuristic development features:

- Vertical layering of urban functions within a 200-meter wide structure

- High-speed transportation system enabling end-to-end transit in 20 minutes

- 100% renewable energy and comprehensive climate control

- AI-integrated urban management systems

- Development costs estimated at $500 billion

Investment opportunities in The Line currently focus on pre-construction reservations through strategic development partners, with North American participation facilitated through:

- Accredited investor participation in development funds

- Priority access programs for future residential and commercial units

- Strategic partnerships with design, technology, and service providers

The Saudi government has established special regulatory frameworks for foreign investment in NEOM, including:

- Autonomous legal system based on Western commercial principles

- Streamlined visa processes for property owners

- Exemption from standard Saudi property ownership restrictions

- Tax incentives for early investors and business operators

While The Line represents a higher-risk, longer-term investment proposition than established Dubai markets, it offers potentially exceptional returns for investors comfortable with development-stage opportunities and willing to align with Saudi Arabia’s Vision 2030 transformation agenda.

Ownership Structures and Regulations

Dubai permits foreign freehold ownership in designated zones covering approximately 70% of developable areas. These freehold zones include most prime residential and commercial districts, with clear title registration through the Dubai Land Department.

The property acquisition process involves:

- Property selection and negotiation (often facilitated by RERA-registered brokers)

- Memorandum of Understanding with 10% deposit

- Due diligence through Dubai Land Department records

- Final purchase agreement and transfer at the DLD

- Payment of registration fee (4% of purchase price plus administrative fees)

For investors purchasing new developments directly from developers, the process includes:

- Reservation agreement with initial deposit (typically 5-10%)

- Sale & Purchase Agreement detailing payment schedule

- Payments made to developer’s escrow account regulated by RERA

- Registration of Oqood (off-plan) contract with the DLD

- Final transfer upon completion

Ownership structures available to North American investors include:

- Direct personal ownership (simplest approach)

- Offshore company ownership (provides privacy and succession planning advantages)

- Dubai-registered company ownership (ideal for commercial properties)

Rental Market Performance

Dubai’s rental market benefits from a predominantly expatriate population with strong premium housing demand. According to CBRE’s 2024 Dubai Market Report, rental rates increased by 14.8% year-on-year, outpacing most global markets.

The rental process typically involves:

- Annual contracts paid in 1-4 cheques (fewer cheques command premium rates)

- Security deposits equal to 5% of annual rent

- Registration with Ejari (government rental system)

- Property management fees averaging 5-8% of gross rental income

Short-term vacation rentals offer an alternative strategy with higher management requirements but potentially superior returns. Dubai Tourism regulations permit licensed holiday homes with typical performance metrics including:

- Premium locations achieving 65-75% average annual occupancy

- Daily rates 2-3x prorated long-term rental values during peak seasons

- Management costs averaging 20-25% of gross revenue

- Net yields typically 1.5-2% higher than long-term rentals

Investor Profile: Dubai

Ideal for: Tax-conscious investors seeking luxury assets with strong appreciation potential

Investment range: $400,000-$1,000,000 for premium apartments, $1,000,000+ for villas

Strengths: Zero taxation, world-class infrastructure, regulatory improvements, strong rental demand

Considerations: Higher entry costs, market cyclicality, regional geopolitical factors

Legal Frameworks and Ownership Structures

Successful foreign real estate investment requires careful navigation of legal systems that differ significantly from North American frameworks. Understanding these differences proves essential for protecting assets and optimizing investment outcomes.

Comparative Legal Protections

Property rights protection varies significantly across international markets. The International Property Rights Index provides a standardized measure of property rights enforcement:

| Country | Property Rights Index Score (0-100) | Global Ranking | Key Legal Characteristics |

|---|---|---|---|

| United States (Reference) | 87.6 | 4 | Strong enforcement, transparent title |

| Canada (Reference) | 85.2 | 7 | Strong enforcement, transparent title |

| Panama | 68.4 | 38 | Strong for registered property, unrestricted foreign ownership |

| Costa Rica | 67.8 | 42 | Reliable registry, maritime zone restrictions |

| United Arab Emirates | 72.1 | 32 | Designated foreign ownership zones, modern legal system |

| Colombia | 58.3 | 68 | Improving registration system, informal title issues in some areas |

Source: International Property Rights Index 2024, Property Rights Alliance

These variations necessitate specific risk mitigation strategies for each market:

- Colombia: Requires thorough title search (estudio de títulos) extending back 20+ years

- Panama: Title insurance available and recommended for larger investments

- Costa Rica: Special due diligence required for properties near maritime zone

- Dubai: Focus on verification of developer’s escrow compliance for off-plan purchases

Optimal Ownership Structures

Strategic selection of ownership structure significantly impacts tax efficiency, liability protection, and succession planning:

| Ownership Structure | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Direct Personal Ownership | Simplicity, lower setup costs, direct control | Personal liability exposure, probate complexity, higher taxes | Primary residences, smaller investments, short-term holds |

| Local Corporation (SA, SRL, LLC) | Liability protection, local banking access, simplified local tax compliance | Annual maintenance costs, potential for local corporate taxation | Multiple properties, commercial real estate, development projects |

| Foreign Corporation | Privacy, liability protection, potential tax benefits, familiar jurisdiction | Higher setup and maintenance costs, complex cross-border tax filing | High-value assets, investors requiring maximum privacy and control |

| Trust/Foundation | Succession planning, asset protection, potential tax benefits | Complex structure, higher professional costs, jurisdictional limitations | Estate planning, long-term multigenerational investments |

Market-specific ownership considerations include:

- Colombia: Sociedad por Acciones Simplificadas (SAS) provides an efficient structure with simplified incorporation and operation

- Panama: Private Interest Foundations offer unique benefits for estate planning while providing asset protection

- Costa Rica: Sociedad Anónima (S.A.) remains the most common structure for foreign investors

- Dubai: Offshore structures are widely accepted, with JAFZA and RAK options providing optimal tax efficiency

Due Diligence Essentials

Comprehensive due diligence before acquisition proves essential for risk mitigation in international markets:

- Title Verification: Thorough research of property records through official registries

- Encumbrance Check: Verification of liens, mortgages, easements, and restrictions

- Permit Compliance: Confirmation that structures comply with local building codes and zoning

- Tax Compliance: Verification of property tax payment status and applicable rates

- Utility Infrastructure: Assessment of water, electrical, and sewage connections

- Environmental Assessment: Investigation of potential contamination or environmental restrictions

- Developer Background: For new projects, verification of developer’s track record and financial stability

Professional support requirements vary by market complexity:

- Real Estate Attorney: Essential in all markets, with local expertise and language skills

- Notary Public: Required for document authentication in Latin American countries

- Accountant: Advisable for tax planning and compliance guidance

- Property Inspector: Critical for technical assessment of physical condition

- Translator: Necessary for documents and negotiations in non-English jurisdictions

If you’re considering international property investment, understanding the unique challenges of real estate transactions is essential. You might want to review our article on First-Time Homebuyer’s Blueprint: 8 Critical Steps That Experts Don’t Tell You for foundational principles that apply to all real estate transactions.

Financial Considerations for International Buyers

Financial planning for foreign real estate investment requires navigation of cross-border banking, taxation, and currency management. Strategic approaches to these elements can significantly enhance investment returns.

International Financing Options

While cash purchases represent the simplest approach to international acquisition, financing options exist with varying structures:

- Local Bank Financing: Available to foreigners in select markets with country-specific requirements

- Developer Financing: Common for new developments, particularly in Panama and Dubai

- International Mortgage Specialists: Banks focused on expatriate lending across multiple jurisdictions

- Home Equity Leveraging: Using North American property equity to fund international purchases

- Self-Directed IRA (U.S. Investors): Qualified retirement account investment in international real estate

Market-specific financing conditions include:

| Country | Foreign Buyer Financing Availability | Typical Terms | Documentation Requirements |

|---|---|---|---|

| Colombia | Limited (select banks only) | 50% LTV, 10-15 year terms, 8-11% interest | High – income verification, credit history, local tax ID (NIT) |

| Panama | Moderate (established programs) | 60-70% LTV, 15-20 year terms, 6.5-8% interest | Moderate – income verification, financial statements, reference letters |

| Costa Rica | Limited (except for residency applicants) | 50-60% LTV, 15 year terms, 7.5-9.5% interest | High – income verification, extensive financial disclosure |

| Dubai | Good (established programs) | 60-75% LTV, 20-25 year terms, 4.5-6.5% interest | Moderate – income verification, proof of funds, reference letters |

Tax Implications for North American Investors

International real estate investors face multi-jurisdictional tax considerations:

U.S. Citizens and Permanent Residents: Subject to worldwide income reporting requirements through:

- Annual reporting of foreign rental income on Form 1040 Schedule E

- Foreign property holdings exceeding thresholds reported on FinCEN Form 114 (FBAR)

- Foreign corporation ownership reported on Form 5471

- Potential Foreign Tax Credit utilization to offset domestic tax liability

Canadian Citizens and Permanent Residents: Subject to similar worldwide reporting with different mechanisms:

- Foreign property holdings exceeding CAD $100,000 must be reported on Form T1135

- Foreign rental income reported on Form T776

- Foreign tax credits available to offset Canadian tax liability

- Foreign corporation ownership may trigger controlled foreign corporation rules

Local tax considerations vary significantly by jurisdiction:

- Colombia: Progressive rental income tax (5-35%), annual property tax (0.5-1.6%), capital gains tax (10%)

- Panama: No tax on foreign-source income, property tax exemptions for new construction, 10% capital gains tax

- Costa Rica: Progressive rental income tax (15-25% after deductions), annual property tax (0.25%), capital gains exemption for non-habitual property transactions

- Dubai: Zero income tax, zero capital gains tax, minimal property registration fees (4% one-time)

Strategic tax planning approaches include:

- Utilizing available tax treaties to avoid double taxation

- Structuring ownership to optimize for both home country and local tax efficiency

- Timing property disposition to maximize capital gains planning opportunities

- Capturing all available deductions including depreciation, maintenance, and management fees

- Considering timing of income recognition across tax jurisdictions

Currency Management Strategies

Currency fluctuations significantly impact international real estate returns. The 2024 MSCI International Property Currency Risk Report indicates that currency movements accounted for 12-18% of total return variance for cross-border real estate investors over the past decade.

Strategic approaches for managing currency risk include:

- Forward Contracts: Locking in future exchange rates for predictable cash flows

- Multi-Currency Banking: Maintaining accounts in both home and investment currencies

- Natural Hedging: Matching rental income currency with local liabilities where financing is used

- Currency Diversification: Spreading investments across multiple currency zones

- Specialized Remittance Services: Using fintech platforms optimized for international transfers

Currency considerations by market include:

- Colombia (Colombian Peso): Higher volatility currency requiring active management; consider maintaining minimal peso balances

- Panama (U.S. Dollar): No currency risk for U.S. investors; minimal management required for Canadians

- Costa Rica (Costa Rican Colón): Moderate volatility with active central bank management; dual-currency economy permits dollar transactions

- Dubai (UAE Dirham): Stable peg to U.S. dollar (3.67 AED = 1 USD) minimizes currency risk; minimal management required

Transaction Costs Comparison

Acquisition and disposition costs vary significantly across international markets and must be factored into total return calculations:

| Country | Total Acquisition Costs | Key Components | Disposition Costs |

|---|---|---|---|

| Colombia | 7-9% of purchase price | Notary fees (0.9%), registration tax (1%), legal fees (1-1.5%), VAT on new construction (19%) | 3-5% plus 10% capital gains tax |

| Panama | 5-7% of purchase price | Transfer tax (2%), notary fees (0.25%), legal fees (1-2%), registration fees (0.5%) | 3-4% plus 10% capital gains tax |

| Costa Rica | 6-8% of purchase price | Transfer tax (1.5%), legal fees (1-2%), registration fees (0.5%), stamp duties (0.6%) | 3-5% plus 15% capital gains (if applicable) |

| Dubai | 6-8% of purchase price | Registration fee (4%), agent commission (2%), legal fees (0.5-1%), mortgage fees if applicable | 2-3% with no capital gains tax |

Source: Global Property Guide Transaction Costs Analysis, 2025

Expert Insight: Financial Preparation

According to Ricardo Serrano, Head of International Real Estate at Deloitte: “The most successful North American investors in foreign markets establish their financial infrastructure before acquisition. This includes opening local bank accounts, establishing efficient fund transfer mechanisms, understanding tax reporting requirements in both jurisdictions, and creating a comprehensive financial model that incorporates all cross-border costs. This preparation provides both operational efficiency and competitive advantage when negotiating transactions.”

For additional insights on managing real estate investments, consider reviewing our article on Why Real Estate Remains the Best Investment Vehicle in 2025.

Step-by-Step Investment Process

Successful foreign real estate investment follows a systematic process that minimizes risk and maximizes return potential. This framework applies across markets with market-specific adaptations.

1. Pre-Investment Research and Planning (3-6 Months)

Comprehensive preparation establishes the foundation for successful international investment:

- Market Selection: Evaluate multiple markets against investment objectives (yield, appreciation, lifestyle)

- Financial Preparation: Assess investment budget, financing options, and currency management strategy

- Tax Consultation: Engage cross-border tax experts to optimize ownership structure

- Legal Framework Review: Understand foreign ownership regulations, restrictions, and protections

- Team Assembly: Identify reputable local attorney, property agent, and financial institution

According to a survey by the Association of International Property Professionals, investors who dedicate 3+ months to research before acquisition report 42% higher satisfaction with their investment outcomes and 68% fewer unexpected complications.

Essential research resources include:

- Global Property Guide country profiles

- PwC Emerging Trends in Real Estate (Global Edition)

- Knight Frank Global Residential Cities Index

- U.S. State Department Country Commercial Guides

- Local real estate association market reports

- Specialized international property investment forums

2. Market Exploration and Property Selection (1-3 Months)

On-ground research provides critical insights impossible to gather remotely:

- Market Familiarization Trip: Visit target locations to establish area knowledge and local contacts

- Agent Selection: Interview multiple licensed real estate professionals with international client experience

- Property Viewing: Examine 10+ properties to establish comparative market knowledge

- Infrastructure Assessment: Evaluate transportation, utilities, amenities, and services

- Local Economic Research: Identify growth drivers, employment trends, and development patterns

- Rental Market Analysis: Meet property managers to understand tenant profiles, vacancy rates, and rental procedures

Data collected during this phase should be organized into a standardized evaluation matrix with weighted criteria aligned to investment objectives. This systematic approach prevents emotionally-driven decision-making—a common pitfall in lifestyle-oriented investment destinations.

3. Transaction Execution (1-3 Months)

The acquisition process varies by jurisdiction but follows similar fundamental steps:

Property Selection and Negotiation:

- Due diligence verification of property documentation

- Comparative market analysis to establish fair value

- Professional inspection of physical condition

- Title search through official property registry

- Verification of permits, licenses, and property tax status

- Offer preparation and negotiation strategy

Contract and Closing:

- Purchase agreement review by legal counsel

- Escrow account establishment for secure funds transfer

- Execution of preliminary purchase agreement with deposit

- Finalization of financing arrangements (if applicable)

- Completion of closing documentation

- Property registration with official registry

- Utility and service transfers to new ownership

Post-Acquisition Setup:

- Property management arrangement implementation

- Insurance coverage procurement

- Banking and payment systems establishment

- Tax registration with local authorities

- Property improvement plan execution (if applicable)

- Rental marketing implementation (for investment properties)

4. Ongoing Management and Optimization

Active management significantly impacts long-term investment performance:

Property Management Approaches:

- Professional Property Management: Full-service handling of tenant relations, maintenance, and accounting

- Hybrid Management: Professional tenant placement with owner-directed maintenance

- Self-Management: Direct owner control, practical only with local presence or limited usage properties

Performance Monitoring:

- Quarterly financial performance review

- Annual physical inspection and condition assessment

- Regular market positioning evaluation

- Tax compliance verification

- Periodic property improvement planning

Exit Strategy Development:

- Establish performance benchmarks that would trigger disposition consideration

- Monitor market cycle positioning for optimal timing

- Maintain property condition to maximize eventual sale value

- Develop tax-efficient disposition plan

- Consider 1031 exchange options (for U.S. investors) or reinvestment strategies

Investor Implementation Checklist

Use this checklist to ensure you’ve covered critical elements of the international investment process:

- ☐ Consult with cross-border tax specialist regarding optimal ownership structure

- ☐ Establish banking relationships in target country

- ☐ Engage local attorney with international client experience

- ☐ Conduct personal visit to target market before purchase commitment

- ☐ Verify property title through official registry search

- ☐ Complete professional property inspection

- ☐ Confirm property tax and utility status

- ☐ Establish currency transfer mechanism that minimizes fees

- ☐ Secure appropriate property insurance coverage

- ☐ Register ownership with required government entities

- ☐ Develop written property management plan

- ☐ Create tax compliance calendar for both domestic and foreign obligations

Conclusion: Building Your International Real Estate Portfolio

Foreign real estate investment offers North Americans diversification, yield enhancement, and lifestyle benefits unavailable in domestic markets. The profiled countries—Colombia, Panama, Costa Rica, and Dubai—represent distinct value propositions aligned with varied investor objectives.

Colombia provides emerging market opportunity with strong yields in an increasingly stable environment. Panama offers tax efficiency with dollarized simplicity. Costa Rica balances natural beauty with established expat infrastructure. Dubai delivers tax-free luxury with world-class amenities and future-focused vision exemplified by its proximity to Saudi Arabia’s revolutionary Line project.

Successful international real estate investors share common characteristics:

- Thorough pre-acquisition research and planning

- Assembling experienced professional support teams

- Committing to personal market visits before purchase

- Implementing systematic property evaluation methods

- Creating tax-efficient ownership structures

- Developing active management systems

- Maintaining long-term perspective despite short-term market fluctuations

While international real estate investment entails additional complexity compared to domestic acquisitions, the potential benefits—superior yields, stronger appreciation, currency diversification, and lifestyle enhancement—provide compelling motivation to navigate these challenges. With strategic planning, proper professional guidance, and disciplined execution, North American investors can successfully build global real estate portfolios that deliver both financial returns and lifestyle enrichment.

For more comprehensive guidance on real estate investment strategy, explore our detailed guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

To learn more about optimizing your real estate investments, read our articles on Why Real Estate Remains the Best Investment Vehicle in 2025 and Best Locations for Real Estate Investment in 2025.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.