Check out our app!

Explore more features on mobile.

The Financial Devastation of Going Without Home Insurance: Why 1 in 7 Homeowners Are Taking Dangerous Risks

Skyrocketing premiums have led to an alarming trend: over 11 million American homeowners now live without home insurance protection. This comprehensive analysis examines why 1 in 7 homes across the country are uninsured, the devastating financial consequences of this decision, and expert strategies to protect your most valuable asset without breaking the bank. Our unique step-by-step approach for Builds, Buys, and Invest will provide practical solutions to this growing crisis.

[Image: Uninsured Home After Disaster]

1. The Uninsured Crisis: Market Trends & Risk Analysis

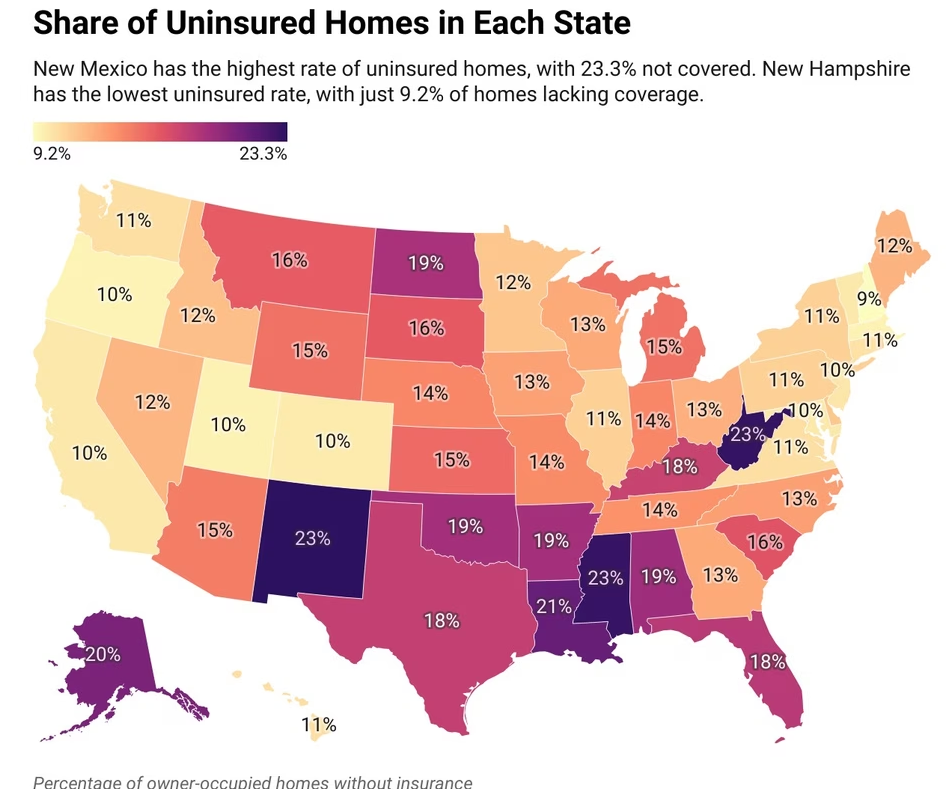

Recent data from LendingTree has revealed a concerning trend: 13.6% of owner-occupied homes in the United States—approximately 11.3 million residences—are completely uninsured. This alarming statistic comes after a dramatic 33% increase in home insurance premiums between 2020 and 2023, pushing the national average to $2,530 annually.

The geographic distribution of uninsured homes reveals crucial patterns. New Mexico leads with 23.3% of homes lacking coverage, followed closely by West Virginia and Mississippi. Among major metropolitan areas, McAllen, Texas shows a staggering 43.3% uninsured rate, while El Paso (23%) and Miami (21%) follow as distant second and third.

These statistics highlight a growing affordability crisis in the insurance market, creating a dangerous vulnerability for millions of homeowners who now face catastrophic financial risk should disaster strike. Insurance expert Rob Bhatt warns that this trend is “putting people just one disaster away from losing the physical and financial security their home provides.”

2. The True Cost of Going Uninsured: Financial Impact Breakdown

While foregoing insurance may seem like a necessary financial decision in the short term, the long-term consequences can be financially devastating. The average homeowner without insurance faces potentially catastrophic costs that far exceed annual premium savings.

| Disaster Type | Average Repair Cost | Insurance Premium Equivalent | Years of Premiums |

|---|---|---|---|

| House Fire (Total Loss) | $352,000 | $2,530 | 139 years |

| Major Hurricane Damage | $78,000 | $2,530 | 31 years |

| Flood Damage | $52,000 | $2,530 | 21 years |

| Tornado Damage | $47,000 | $2,530 | 19 years |

| Major Roof Damage | $18,000 | $2,530 | 7 years |

| Water Damage (Internal) | $12,000 | $2,530 | 5 years |

| Liability Claim | $115,000 | $2,530 | 45 years |

Beyond these direct repair costs, uninsured homeowners face additional financial consequences including:

- Loss of emergency living expenses coverage during repairs

- No personal property replacement coverage

- Full liability exposure for accidents on your property

- Potential bankruptcy following a major disaster

- Difficulty securing future insurance coverage

- Reduced property resale value due to unrepaired damage

3. High-Risk Areas: Why Areas Most in Need Have Lowest Coverage

Paradoxically, areas facing the highest natural disaster risks often have the lowest insurance coverage rates. Among the 25 counties deemed most vulnerable by the National Risk Index, Florida’s Miami-Dade County has the highest uninsured rate at 23.5%, followed by Broward County (22.7%) and Lee County (17.9%)—all in hurricane-prone Florida.

This dangerous inverse relationship between risk and coverage stems from several factors:

- Premium costs in high-risk areas can be prohibitively expensive, with 20% of Florida homeowners paying over $4,000 annually

- Insurance company withdrawals from high-risk markets have reduced competition and availability

- Repeated disaster exposure has depleted financial reserves of many homeowners

- Property values in some high-risk areas have declined, leading to negative equity situations where insurance seems less economically justified

Real estate economist Hannah Jones notes that “markets with high insurance premiums, such as Florida, could see buyer demand continue to dwindle as buyers and homeowners look elsewhere rather than take on either the expense of home insurance or the risk of being uninsured.”

[Map: High-Risk Disaster Areas and Uninsured Home Rates]

4. Case Studies: Real-World Consequences of Being Uninsured

The abstract risk of being uninsured becomes devastatingly concrete when disasters occur. These real-world case studies illustrate the financial aftermath faced by uninsured homeowners:

Hurricane Ian: Southwest Florida, 2022

When Hurricane Ian made landfall in 2022, an estimated 18% of affected homeowners in Lee County, Florida had no insurance coverage. The Martinez family had dropped their policy after premiums increased by 340% over five years. Their uninsured losses totaled $237,000 for structural damage and $65,000 for contents. With no insurance recovery, they were forced to liquidate retirement accounts, incurring additional tax penalties, and ultimately sold their damaged property at a 60% loss from its pre-hurricane value.

Residential Fire: Albuquerque, New Mexico, 2024

In New Mexico, where 23.3% of homes lack insurance, the Castillo family experienced a total loss house fire caused by faulty electrical wiring. Without insurance, they faced $285,000 in rebuilding costs and $120,000 in personal property losses. Unable to afford reconstruction, they were forced to declare bankruptcy and relocated to a rental property half the size of their previous home while still owing mortgage payments on the destroyed property.

Liability Lawsuit: McAllen, Texas, 2023

In McAllen, Texas—where a shocking 43.3% of homes are uninsured—a homeowner faced a $175,000 judgment after a visitor was injured falling on improperly maintained stairs. Without liability coverage that would have been included in a standard homeowners policy, the judgment resulted in a lien against the property, forced refinancing at unfavorable terms, and ultimately led to foreclosure proceedings when the payments couldn’t be maintained.

5. Mortgage Implications & Property Value Impact

The decision to forego insurance creates significant complexities for mortgaged properties and impacts long-term property values:

- Mortgage Requirement Violations: Most mortgage lenders require continuous insurance coverage. When homeowners allow policies to lapse, they trigger force-placed insurance—where lenders impose their own high-cost, limited-coverage policies and add premiums to mortgage payments. These policies typically cost 2-3 times more than standard coverage while protecting only the lender’s interest, not the homeowner’s personal property or liability.

- Loan Default Risk: Uninsured disaster damage can create a financial trap where homeowners must continue paying mortgages on uninhabitable or severely damaged properties while also covering alternative living expenses. This dual financial burden leads to significantly higher default and foreclosure rates.

- Property Value Depreciation: Research shows that properties without insurance coverage sell for 12-18% less than comparable insured properties, as buyers factor in the additional risk and potential repair needs.

- Refinancing Obstacles: Homeowners without insurance face limited or no refinancing options, as lenders universally require proof of adequate coverage before approving new loan terms.

6. Step-by-Step Guidance: Insurance Strategies for Builds, Buys & Invest

At Builds and Buys, our unique approach provides practical solutions tailored to your specific situation.

Step-by-Step Builds: Maximizing Insurance Coverage During Construction

For those building a new home or undertaking significant renovations, insurance considerations are critical at every phase:

- Pre-Construction: Secure builder’s risk insurance to protect materials and work-in-progress from theft, fire, and weather damage.

- During Construction: Require all contractors to provide proof of liability and workers’ compensation coverage before beginning work.

- Post-Construction: Convert to a comprehensive homeowners policy with replacement cost coverage before occupancy, ensuring all custom features and high-value improvements are documented.

- Annual Review: Schedule yearly insurance reviews as property values increase to prevent underinsurance situations.

Step-by-Step Buys: Insurance Optimization for Property Purchases

When buying an existing property, follow these steps to secure proper insurance coverage:

- Pre-Offer Research: Request CLUE (Comprehensive Loss Underwriting Exchange) reports on properties to identify past insurance claims that could affect future insurability and premiums.

- Inspection Focus: Have home inspectors specifically evaluate factors that impact insurance costs, including roof condition, electrical systems, plumbing, and foundation integrity.

- Multiple Quotes: Obtain at least three insurance quotes before closing, using inspection reports to inform coverage needs.

- Negotiation Leverage: Use high insurance quotes as negotiation points for price reductions or seller concessions on necessary improvements.

Step-by-Step Invest: Strategic Insurance Planning for Investment Properties

Investment property owners require specialized insurance approaches:

- Coverage Structuring: Create a tiered insurance approach with separate policies for property damage, liability, loss of income, and umbrella coverage.

- Entity Protection: Consider holding properties in LLCs with proper commercial insurance policies to create liability firewalls between assets.

- Tenant Requirements: Mandate renter’s insurance for all tenants, with a minimum liability coverage of $300,000 and proof of renewal provided annually.

- Premium Reduction Strategies: Systematically implement security enhancements, disaster mitigation improvements, and insurance bundling to maximize coverage while minimizing costs.

7. Alternative Solutions: Affordable Insurance Options

While traditional insurance has become prohibitively expensive for many homeowners, several alternative approaches can provide critical protection:

| Alternative Option | Best For | Average Cost | Coverage Limitations |

|---|---|---|---|

| State FAIR Plans | High-risk areas with limited private options | $1,800-$3,500/year | Basic coverage only; often requires supplemental policies |

| Named Peril Policies | Budget-conscious homeowners | $1,200-$2,000/year | Covers only specifically listed events; no liability protection |

| Parametric Insurance | Disaster-prone regions | $800-$1,500/year | Payout based on event triggers, not actual damage assessment |

| Home Warranty Plans | Protecting systems and appliances | $400-$800/year | No structural or liability coverage; high service fees |

| Community-Based Insurance | Neighborhood collective coverage | $1,500-$2,800/year | Limited availability; requires significant community participation |

| High-Deductible Policies | Catastrophic coverage only | $1,000-$2,200/year | Deductibles of $5,000-$25,000; smaller claims not covered |

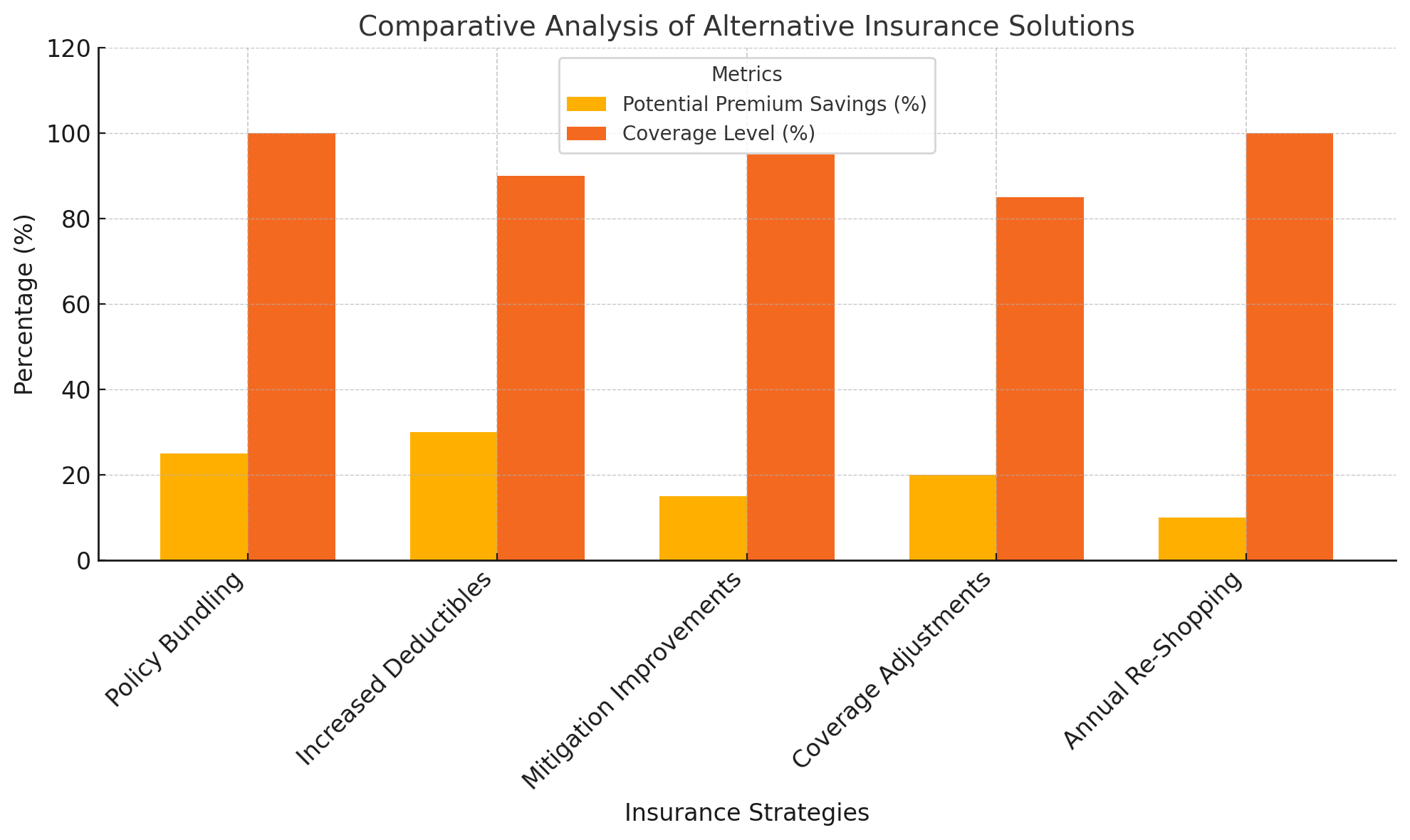

Beyond these alternatives, homeowners can implement several strategies to reduce insurance costs while maintaining essential coverage:

- Policy Bundling: Combining home, auto, and other insurance policies with one carrier can yield discounts of 15-25%.

- Increased Deductibles: Raising deductibles from $500 to $2,500 can reduce premiums by up to 30% while still protecting against catastrophic losses.

- Mitigation Improvements: Installing storm shutters, impact-resistant roofing, and certified security systems can qualify for premium reductions of 5-15% per enhancement.

- Strategic Coverage Adjustments: Focusing coverage on replacement cost rather than cash value for the structure while reducing contents coverage can optimize protection for the most significant assets.

- Annual Re-Shopping: Insurance markets vary significantly by region and over time; systematically requesting competitive quotes annually can identify substantial savings opportunities.

[Chart: Comparative Analysis of Alternative Insurance Solutions]

Conclusion: Balancing Affordability and Protection

The rising trend of uninsured homes represents a significant financial risk for millions of American homeowners. While premium increases have created genuine affordability challenges, the potential financial devastation of going without coverage far outweighs the short-term savings. By implementing strategic coverage decisions, pursuing alternative insurance solutions, and following our step-by-step guidance for your specific situation—whether building, buying, or investing—you can find the optimal balance between cost management and essential protection.

Remember that even partial coverage is substantially better than no coverage at all. The key is to prioritize protection for catastrophic risks that could lead to complete financial ruin, while potentially accepting more manageable levels of risk for smaller, more affordable losses. With thoughtful planning and the right expertise, you can navigate today’s challenging insurance landscape while keeping your most valuable asset—and your financial future—secure.

Our team can help you navigate the complex insurance landscape and find affordable coverage solutions tailored to your specific needs.

For more actionable real estate advice, explore our comprehensive guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.

Your Tools

Access your tools to manage tasks, update your profile, and track your progress.

Collaboration Feed

Engage with others, share ideas, and find inspiration in the Collaboration Feed.