Homeowner Expenses: The Complete Guide to Budgeting Beyond Your Mortgage

Making the transition from renting to homeownership involves more than just switching a rent payment for a mortgage. With median asking rents across major metropolitan areas at $1,703 as of January 2025, many renters are contemplating homeownership—yet 62% worry they’ll never afford it. The down payment is just the beginning; understanding the full financial picture is crucial before making this significant investment. This comprehensive guide breaks down all the expenses you need to budget for as a homeowner that you didn’t face as a renter.

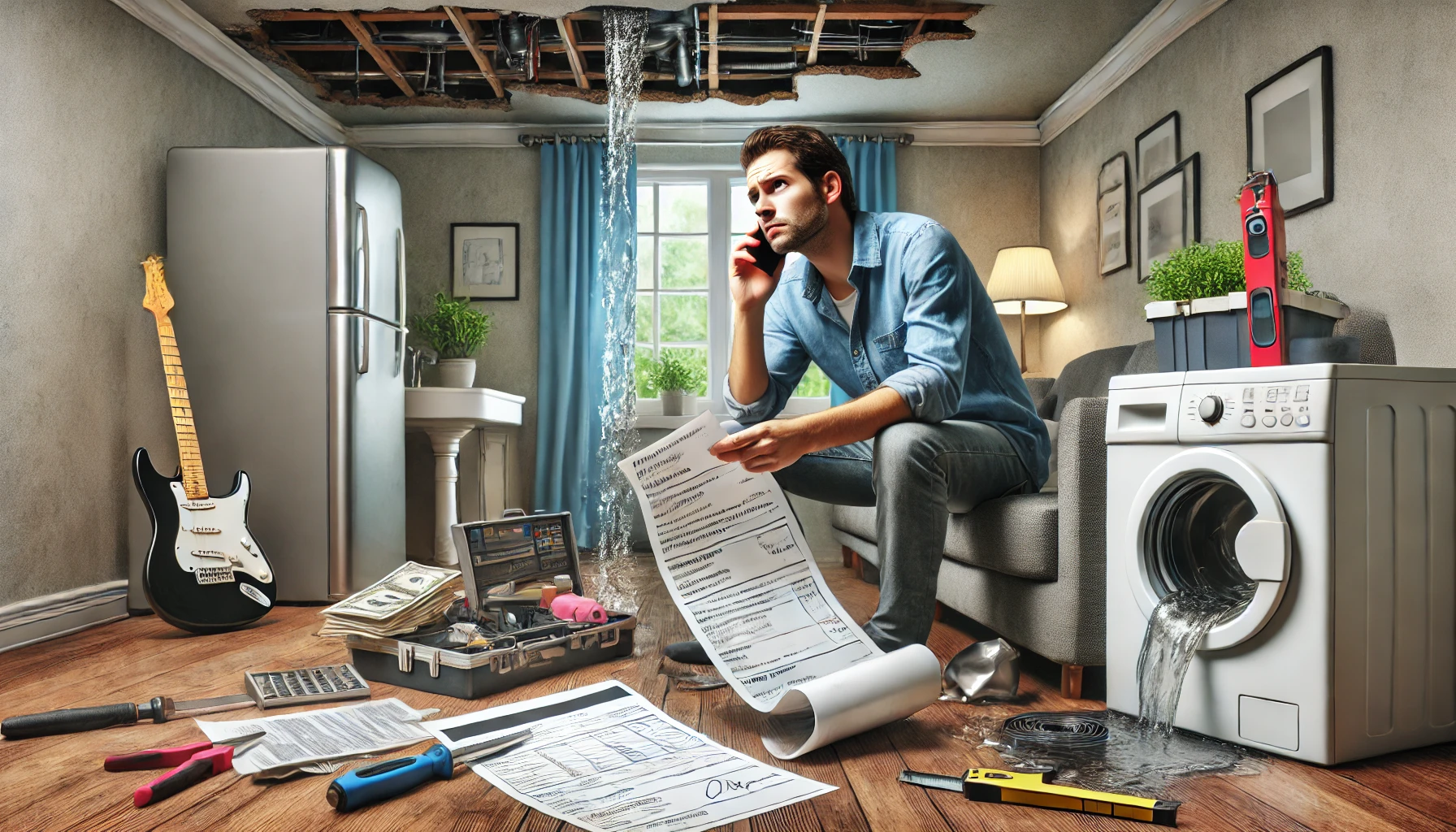

[Image: Planning your comprehensive homeowner budget]

1. Rent vs. Mortgage: Understanding the Fundamental Differences

While both rent and mortgage payments secure you a place to live, they function very differently from a financial perspective. Understanding these differences is crucial for making an informed housing decision.

Key Differences Between Rent and Mortgage Payments

| Feature | Rent Payment | Mortgage Payment |

|---|---|---|

| What it buys | Temporary right to occupy | Ownership equity in property |

| Tax benefits | None (not tax-deductible) | Mortgage interest, property taxes, and certain home improvements deductible |

| Credit impact | Generally doesn’t affect credit until severely delinquent | Immediately impacts credit score (positive with on-time payments) |

| Price stability | Subject to increases at lease renewal | Fixed-rate mortgages maintain stable payments |

| Long-term value | No equity or asset appreciation | Builds wealth through equity and potential appreciation |

According to the latest market data from January 2025, the median asking rent across the 50 largest U.S. metropolitan areas is $1,703, showing a 0.2% decrease year-over-year. This marks the 18th consecutive month of declining rents in these markets. However, recent Freddie Mac research indicates approximately 30 renter households competing for each available home for sale—a dramatic increase from less than 10 in 2006.

2. Essential Homeowner Expenses to Budget For

Beyond your mortgage payment, homeownership comes with various recurring and one-time expenses that can significantly impact your monthly budget. Understanding and planning for these costs is essential for financial stability.

Recurring Homeowner Expenses

- Mortgage Insurance: “Mortgage insurance is typically required for all loans with less than 20% down payment,” explains Sam Fitz-Simon, a real estate agent with Compass in Danville, CA. This additional monthly cost ranges from 0.5% to 1.5% of your loan amount annually, divided into monthly payments.

- Property Taxes: These vary significantly depending on your location and property value. Unlike rent, property taxes are your responsibility and typically range from 0.5% to 2.5% of your home’s assessed value annually. As Douglas Bendt of Berkshire Hathaway HomeServices notes, “Your Realtor should have the property tax totals for budgeting purposes, and most counties have websites [where] you can look up taxes online.”

- Homeowners Insurance: Essential for protecting your investment, homeowners insurance typically costs between 0.5% to 1% of 80% of your home’s purchase price annually. Costs can rise significantly in areas prone to natural disasters like wildfires or floods.

- HOA Fees: In 2024, 41% of homes listed for sale had HOA fees, with a median monthly cost of $125. These fees cover maintenance of common areas, amenities, and sometimes utilities for community properties.

- Utilities: As a homeowner, you’re responsible for all utilities—water, gas, electricity, garbage, internet, and sometimes sewer fees. These costs vary by location, home size, and season but can add $200-$500+ to your monthly expenses.

[Image: Breakdown of typical monthly homeowner expenses]

Often Overlooked Expenses

- Maintenance and Repairs: Experts recommend budgeting 1-3% of your home’s value annually for maintenance. As Bendt notes, “The cost of home maintenance varies widely depending on the age of the house and how well it was maintained.”

- Mortgage Points: Jeremy Schachter, branch manager of Fairway Independent Mortgage Corp., advises that “A qualified loan officer should show the borrower the break-even point of paying points and their savings.” Each point typically costs 1% of your loan amount and lowers your interest rate by about 0.25%.

- Home Appliance Replacement: Major appliances have a lifespan of 8-15 years, requiring regular budgeting for eventual replacement.

- Landscaping and Outdoor Maintenance: Lawn care, snow removal, tree trimming, and other outdoor expenses can add $100-$300 monthly depending on property size and region.

- Pest Control: Regular pest prevention services can cost $40-$100 monthly depending on your region and property size.

3. Comparative Cost Analysis: Renting vs. Owning

To make an informed decision between renting and buying, it’s crucial to understand the full financial picture beyond the monthly payment. Here’s how the costs typically compare:

| Expense Category | Renting | Owning |

|---|---|---|

| Monthly Payment | $1,703 (median rent, major metros) | $1,800-$2,200 (typical mortgage for median-priced home) |

| Insurance | $15-30/month (renter’s insurance) | $100-250/month (homeowner’s insurance) |

| Property Taxes | $0 (paid by landlord) | $200-500/month (varies by location) |

| Maintenance | $0 (landlord responsibility) | $200-500/month (1-3% of home value annually) |

| Utilities | $100-300/month (varies by lease terms) | $200-500/month (all utilities) |

| HOA Fees | $0 (typically) | $0-400/month (if applicable) |

| Tax Benefits | None | Deductions for mortgage interest and property taxes |

| Equity Building | $0 | $300-500/month (portion of mortgage payment) |

| Total Monthly Cost | $1,818-2,033 | $2,500-3,850 |

| Long-term Wealth Building | None | Equity + Potential Appreciation |

According to current market research, it’s more affordable to rent than to buy a starter home in 48 of the 50 largest U.S. metro areas. However, this calculation often doesn’t factor in the long-term wealth-building aspects of homeownership.

5. Step-by-Step Builds, Buys & Invest: Your Financial Roadmap

At Builds and Buys, our unique process helps you navigate the financial complexities of homeownership through three key components:

- Step-by-Step Builds: Plan for home maintenance and improvements to protect your investment and minimize emergency expenses. We recommend setting aside 1-3% of your home’s value annually in a dedicated maintenance fund.

- Step-by-Step Buys: Navigate the purchasing process with a comprehensive understanding of all costs involved. Our detailed calculators help you determine a realistic budget that accounts for both obvious and hidden expenses.

- Step-by-Step Invest: Understand how homeownership fits into your broader financial strategy. Learn to leverage mortgage interest deductions, property appreciation, and equity building to maximize your home’s role in wealth creation.

The 50/30/20 Homeowner Budget Framework

Following this budgeting framework can help new homeowners maintain financial stability:

- 50% of after-tax income toward needs (mortgage, utilities, insurance, property taxes, groceries)

- 30% toward wants (dining out, entertainment, travel)

- 20% toward savings and debt repayment (beyond mortgage)

Pro Tip: Include a separate home maintenance fund of 1-3% of your home’s value annually within your savings allocation.

[Image: Financial roadmap for homeownership success]

6. Expert Guidance & Next Steps

Whether you’re a current renter contemplating homeownership or a new homeowner adjusting to your budget, understanding the full financial picture is essential for long-term success.

Is Buying Better Than Renting in 2025?

Jeremy Schachter of Fairway Independent Mortgage Corp. believes that despite high costs, “Owning a home builds individual wealth. Not only do you have some tax advantages, real estate long term is always a great asset to have in your diversification.”

However, Dylan Calvo emphasizes personal circumstances: “To decide, you must research your market. In my Nashville market, it definitely makes sense because the houses doubled and even tripled in value over the past 10 years. If you can afford it, I’d of course always say to get a home.”

But both experts agree: don’t let social pressure push you into homeownership if renting better suits your current lifestyle and financial situation.

Our comprehensive guides on Step-by-Step Builds, Step-by-Step Buys, and Step-by-Step Invest provide actionable tools to help you navigate the financial aspects of homeownership.

The rent-versus-buy decision remains highly personal, with financial, lifestyle, and market factors all playing crucial roles. While homeownership offers wealth-building potential through equity and appreciation, it also comes with significantly higher expenses and responsibilities. By thoroughly understanding all costs involved, you can make an informed decision that aligns with both your current financial situation and your long-term goals.

Remember: The right housing choice is the one that works for your unique circumstances—not what works for someone else or what social expectations dictate.

Real Estate News And Knowledge

Stay informed with the latest trends, insights, and updates in the real estate world.